Stock Market Spread Betting

Indicative Stock Market Prices |

Stock Market Index Spread Comparison |

A spread/price comparison table looking at the 'spread size' and minimum stakes for the most popular stock market indices.

| FTSE 100 (UK 100) Daily |

0.8 |

1 |

1 |

2 |

| Dow Jones (Wall St) Daily |

1 |

1 |

1 |

1.4 |

| DAX 30 (Germany 30) Daily |

1 |

1 |

1 |

1 |

| S&P 500 (SPX 500) Daily |

3 |

4 |

5 |

5 |

| NASDAQ 100 (US Tech 100) Daily |

5 |

4-10 |

3 |

1 |

| CAC 40 (France 40) Daily |

0.8 |

1 |

1 |

1 |

| ASX 200 (Australia 200) Daily |

1 |

5 |

3 |

1 |

| Japan 225 Daily |

8 |

8 |

13 |

5 |

| Hong Kong Daily |

8 |

10 |

20 |

7 |

| Stock Indices - Minimum Stake |

£1 |

£1 |

£0.5 |

£1 |

Comparison Notes.

This table is not meant to be inclusive, index spread betting may be available through other brokers.

Stock Market Spread Betting Analysis & News |

| 20-May-18 |

[12:56pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 13-May-18 |

[8:17pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 07-May-18 |

[1:06pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 29-Apr-18 |

[11:28am] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 09-Apr-18 |

[11:27am] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 03-Apr-18 |

[8:48pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 29-Mar-18 |

[1:53pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 23-Mar-18 |

[8:49am] Stock Market Update:

Compared to the overnight close:

The FTSE 100 is trading up 53.9pts (0.79%) at 6,897.9 The FTSE 100 is trading up 53.9pts (0.79%) at 6,897.9

The Dow Jones is trading up 67pts (0.28%) at 23,848 The Dow Jones is trading up 67pts (0.28%) at 23,848

The S&P 500 is trading up 5.2pts (0.20%) at 2,632.0 The S&P 500 is trading up 5.2pts (0.20%) at 2,632.0

The NASDAQ 100 is trading up 5.0pts (0.08%) at 6,625.5 The NASDAQ 100 is trading up 5.0pts (0.08%) at 6,625.5

The Nikkei 225 is trading down -320pts (-1.53%) at 20,583 The Nikkei 225 is trading down -320pts (-1.53%) at 20,583

The German DAX 30 is trading up 33.0pts (0.28%) at 11,917.3 The German DAX 30 is trading up 33.0pts (0.28%) at 11,917.3

The French CAC 40 is trading up 18.9pts (0.37%) at 5,092.9 The French CAC 40 is trading up 18.9pts (0.37%) at 5,092.9

The Spain 35 is trading down -69pts (-0.73%) at 9,365 The Spain 35 is trading down -69pts (-0.73%) at 9,365

The Euro Stoxx 50 is trading down -13pts (-0.39%) at 3,302 The Euro Stoxx 50 is trading down -13pts (-0.39%) at 3,302

The Switzerland 20 is trading down -0.5pts (-0.01%) at 8,565.0 The Switzerland 20 is trading down -0.5pts (-0.01%) at 8,565.0

For more international stock markets see our Index Price Table.

Pricing notes.

Update by Gordon Childs, Editor,

|

| 23-Mar-18 |

[4:49am] Daily Stock Market Moves:

How the key stock market indices closed compared to the previous session:

The FTSE 100 closed down -168.8pts (-2.41%) at 6,844.0 The FTSE 100 closed down -168.8pts (-2.41%) at 6,844.0

The Dow Jones closed down -933pts (-3.78%) at 23,781 The Dow Jones closed down -933pts (-3.78%) at 23,781

The S&P 500 closed down -88.6pts (-3.26%) at 2,626.8 The S&P 500 closed down -88.6pts (-3.26%) at 2,626.8

The NASDAQ 100 closed down -244.5pts (-3.56%) at 6,620.5 The NASDAQ 100 closed down -244.5pts (-3.56%) at 6,620.5

The Nikkei 225 closed down -440pts (-2.06%) at 20,903 The Nikkei 225 closed down -440pts (-2.06%) at 20,903

The German DAX 30 closed down -374.2pts (-3.05%) at 11,884.3 The German DAX 30 closed down -374.2pts (-3.05%) at 11,884.3

The French CAC 40 closed down -147.9pts (-2.83%) at 5,074.0 The French CAC 40 closed down -147.9pts (-2.83%) at 5,074.0

The Spain 35 closed down -169pts (-1.75%) at 9,434 The Spain 35 closed down -169pts (-1.75%) at 9,434

The Euro Stoxx 50 closed down -73pts (-2.15%) at 3,315 The Euro Stoxx 50 closed down -73pts (-2.15%) at 3,315

The Switzerland 20 closed down -189.5pts (-2.16%) at 8,565.5 The Switzerland 20 closed down -189.5pts (-2.16%) at 8,565.5

For more global indices see our Stock Market Price Table.

Pricing notes.

Update by Gordon Childs, Editor,

|

| 26-Feb-18 |

[2:37pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 17-Feb-18 |

[1:09pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 22-Jan-18 |

[2:46pm] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 27-Oct-17 |

[8:47am] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 20-Mar-17 |

[11:30am] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

| 12-Mar-17 |

[8:43am] New Stock Market COT Reports

The latest Commitments of Traders Report (COT) has been published by the CFTC and so we have produced a new Stock Market COT Summary Report.

We have also updated our individual COT reports for the futures markets listed below. These are easier-to-read than the CFTC version. They also have additional long/short ratios data and give the weekly net positions changes.

Update by Gordon Childs, Editor,

|

|

|

For the stock market commentary archives see Stock Market Trading Archive.

Where Can I Spread Bet on Stock Market Indices? |

At the moment, investors can speculate on stock market indices with:

Live Stock Market Prices and Charts |

We do give readers some fairly accurate prices for the daily index markets, please see stock index prices above.

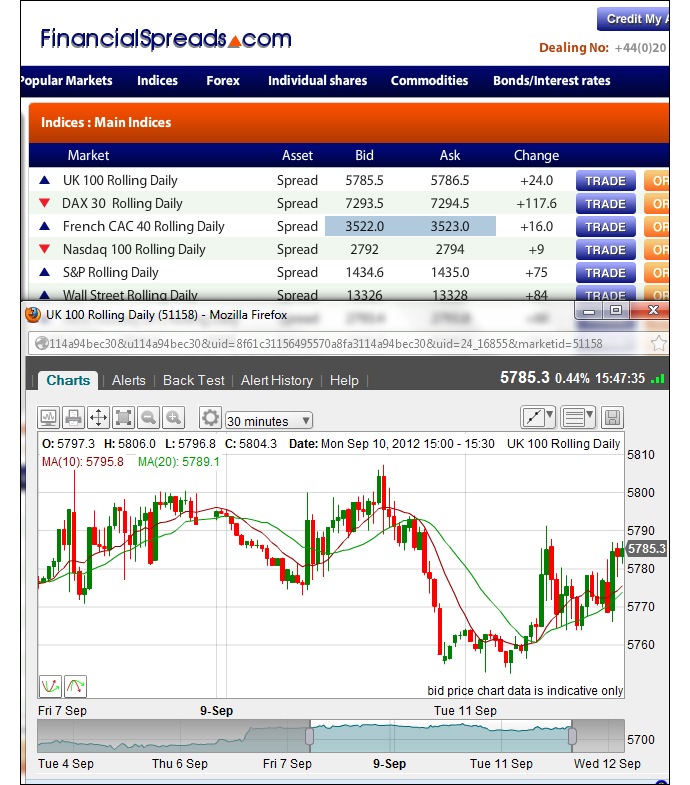

The live CFD chart and prices below will offer readers a useful look at the FTSE 100 (UK 100) stock market index.

You can use the search option on the chart to select other indices like the Dow Jones (USA 30), S&P 500 (USA 500), DAX 30 (Germany 30), etc.

The above chart, provided by Plus 500, usually follows the FTSE 100 futures market (not the spot market).

If you want to study live spread betting prices and charts for the stock market, then naturally, one option is to use a spread betting account.

A spreads account would also give you access to daily markets. Users should note that accounts are subject to credit, suitability and status checks.

If you apply, and your application is approved, you can log on and use the live charts and prices. These are usually provided for free.

Of course, if you decide to trade then, before you start, you should be aware that spread trading and contracts for difference involve a significant level of risk to your capital and it is possible to incur losses that exceed your initial investment.

Advanced Stock Market Charts |

Although charting software and packages can differ across the various firms, in order to assist you with your trading, the majority of charts usually have features such as:

- A variety of time intervals - 1 minute, 2 minute, 10 minute, 1 hour, 2 hour, 1 day, etc

- Indicators - Moving Average, MACD, Momentum, RSI, TSI etc

- Various display styles - bar charts and candlestick charts

- Tools for drawing features - Fibonacci retracements and trendlines

The charts provided by FinancialSpreads.com also come with other benefits such as:

- Custom email alerts when a market reaches a certain level

- Back Testing and Analysis tools

Typical index spread betting chart

The financial spread betting brokers in the following list offer users real-time trading prices and charts:

Where Can I Spread Bet on Stock Market for Free? |

Investing in the stock market always has its risks, but if you want a free Practice Account, which lets you try spread betting, see below for more details.

Also, don't forget that in the UK, spread betting is exempt from capital gains tax, income tax and stamp duty*.

If you're trying to find a low cost stock market/spread betting platform, keep in mind that you can speculate on the indices without having to pay any commissions or brokers’ fees via companies like:

If you are interested in a free Demo Account where you can practice index spread betting, then take a look at:

The above companies provide a Test Account that lets investors try out new trading ideas, review professional charts and practice with an array of trading orders.

Stock Market Trades: Daily vs Futures Markets |

Many investors prefer daily markets to futures markets. In the trading examples below we cover both daily and futures.

A 'Rolling Daily' market is unlike a futures market in that there is no closing date.

If you decide to leave your trade open at the end of the day, it simply rolls over to the next trading day.

If a trade is rolled over and you are spread betting on the market to:

Go up - then you are charged a small overnight financing fee, or Go up - then you are charged a small overnight financing fee, or

Go down - then you will usually receive a small credit to your account Go down - then you will usually receive a small credit to your account

For a more detailed example see Rolling Daily Spread Betting.

Futures Markets

A ‘futures’ market will normally have a wider spread than a ‘daily’ market. However, you do not normally have ‘daily rolling’ costs with a futures market.

Having said that, if you are trading a quarterly futures market, i.e. a market that closes at the end of the quarter, and you want to keep it open past the expiry date then you will often incur a small cost at the end of the quarter.

Importantly, if you plan on doing this, you need to tell your spread betting company in advance, i.e. before the contract expires.

How to Spread Bet on a Stock Market Index? |

An index is a statistical indicator that represents the total value of the stocks that constitute it eg the FTSE and Dow Jones are both indices. It often serves as a barometer for a given market or industry and acts as a benchmark from which financial or economic performance is measured.

As with many global markets, you can spread bet on a stock market index to rise or fall.

FTSE 100 Index - Rolling Daily Example |

If we go onto Financial Spreads, we can see that they are pricing the FTSE 100 Rolling Daily market at 5819.7 - 5820.7. This means you can spread bet on the FTSE 100 index:

Moving higher than 5820.7, or Moving higher than 5820.7, or

Moving lower than 5819.7 Moving lower than 5819.7

Whilst placing a spread bet on the FTSE 100 index you trade in £x per point. Therefore, if you choose to have a stake of £3 per point and the FTSE 100 moves 32 points then that would be a difference to your P&L of £96. £3 per point x 32 points = £96.

So, let’s assume:

- You have done your analysis, and

- Your analysis suggests the FTSE 100 index will move higher than 5820.7

If so, you might want to buy a spread bet at 5820.7 for a stake of, let’s say, £4 per point.

With this trade you make a profit of £4 for every point that the FTSE 100 index moves above 5820.7. Conversely, however, you will lose £4 for every point that the FTSE 100 market drop below the 5820.7 level.

Or, in other words, if you were to buy a spread bet then your profit/loss is worked out by taking the difference between the closing price of the market and the price you bought the market at. You then multiply that difference in price by your stake.

If, after a few hours, the UK stock market rose then you might consider closing your position in order to lock in your profit.

If the FTSE rose then the spread, set by the spread trading firm, might move up to 5849.3 - 5850.3. In order to close your spread bet you would sell at 5849.3. So if you sell with the same £4 stake your profit would be calculated as:

Profit / loss = (Closing Price - Opening Price) x stake

Profit / loss = (5849.3 - 5820.7) x £4 per point stake

Profit / loss = 28.6 x £4 per point stake

Profit / loss = £114.40 profit

Speculating on stock market indices won't always go to plan. In this case, you wanted the UK index to rise. Of course, stock markets can fall.

If the FTSE 100 market began to fall then you could close your trade in order to limit your losses.

If the UK stock market dropped to 5785.8 - 5786.8 you would close your trade by selling at 5785.8. So your loss would be calculated as:

Profit / loss = (Closing Price - Opening Price) x stake

Profit / loss = (5785.8 - 5820.7) x £4 per point stake

Profit / loss = -34.9 x £4 per point stake

Profit / loss = -£139.60 loss

Note: FTSE 100 Rolling Daily market quoted as of 28-Nov-12.

How to Spread Bet on Indices - Selling FTSE 100 Futures Market |

Let's say a firm is offering a FTSE 100 Futures price of 6202 - 6206, i.e. you can 'buy' at 6206 or 'sell' at 6202.

- You think the FTSE is going to go down, so you 'Sell'.

- You decide to risk £10 per point

- The market rises in the afternoon. You decide to cut your losses by closing your bet at the latest current Daily FTSE price

- The new quote is 6210 - 6212

- To close a 'sell' bet you simply 'buy' at the top end of the spread for the same stake

- You buy £10/point at 6212

- Closing price = 6212

- Profit / Loss = (Opening price - Closing price) x stake

- Opening price = 6202

- Profit / Loss = (6202 - 6212) x £10 per point

- -10 point Loss x £10 per point

- Loss = -£100

How to Spread Bet on a Stock Market - Selling US Futures (Wall Street) |

Let's say Wall Street, i.e. the Dow Jones, has been gaining steadily but you feel the current level of 12215 is a medium term high. Therefore you could have a look at Wall Street Mar (March) and see the quote is 12331 - 12345.

Therefore you decide to SELL (go short) at 12331 for a stake of £5 per point.

You have Sold but the even if the price does increase you will still make a profit as long as it doesn't go above 12331 from the current level of 12215.

Let's say you're not quite right and the market continues to go up but only a fraction and in March it settles at 12290.

Your profit is calculated by calculating the difference between the closing level (12290) and the opening price (12331) and multiplying that by your stake.

Profit on day = (12331 - 12290) x £5 per point stake

Profit on day = 41 points x £5 per point = £205 profit

However had Wall Street continued to increase at a greater rate and closed at 12360, you would have lost.

Loss = (12331 - 12360) x £5 per point stake

Loss = -29 points x £5 per point = -£145 loss

Note: Wall Street market as of Jun 2012.

Advert:

Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Stock Market with

Financial Spreads.

|

Individual Stock Market Guides |

Below we have listed guides to the worlds’ major stock markets.

The guides for the more popular stock market indices have real-time prices and charts as well as regular market updates and analysis.

All of the guides below have worked trading examples and answer popular questions such as:

- Where can I spread bet?

- Where can I get live prices / charts?

- Where can I trade commission free?

- Where can I practice trading?

- Etc.

Each spread betting company offers their own specific markets. However, nearly all large spread betting firms offer markets on these popular indices:

The majority of firms will also offer futures and/or daily markets on the following:

Only a handful of firms offer the following markets. Whilst all spread betting is a high risk form of trading, users may want to take extra care when trading the following, these index markets are:

- Less popular and therefore the ‘spreads’ tend to be wider i.e. the underlying market has to move further before you can close your trade for a profit.

- More volatile and more likely to ‘gap’ or ‘slip’ than a liquid index like the FTSE 100 or Dow.

Financial Spreads » "With FinancialSpreads.com you get all the normal

advantages of Spread Betting plus..." » read Financial Spreads review.

|

Commitments of Traders Stock Market Reports |

When studying the CFTC COT reports, investors will often concentrate on the Non-Commercial commitments and the Change in Open Interest. Therefore, every week, we publish the latest data in the following ‘Summary Non-Commercial and Open Interest COT Report’.

For the full COT report for a particular stock market index, and to see how traders are altering their positions, just click on the relevant link in the summary table below.

Also see our Commitments of Traders guide.

Summary Indices Non-Commercial and Open Interest COT Report - 15 May 2018 |

| Indices |

Net Non-Commercial Commitments (i) (Futures Only) |

Open Interest (i) |

Change in Open Interest (i) |

| Long:Short Ratio (i) |

15 May 2018 |

8 May 2018 |

Weekly Change |

| Dow Jones Index |

1.5:1 |

10,124 |

2,669 |

7,455 |

102,222 |

-879 |

| S&P 500 Index |

1.3:1 |

2,424 |

1,186 |

1,238 |

99,871 |

1,255 |

| Nikkei 225 Index (Yen Denom) |

1:1.2 |

-3,045 |

-3,124 |

79 |

61,995 |

-4,935 |

Quick Stock Market Guide: |

- FTSE 100: The index that highlights the performance of the UK's top 100 companies, as ranked by their market capitalisation. The FTSE 100 is normally the most popular spread betting market and a number of firms offer 24 hour trading from Sunday evening to Friday evening. In spread betting, the FTSE 100 is also referred to as the ‘UK 100’.

- FTSE 250: The index of the next 250 UK companies, after the top 100. The FTSE 250 is sometimes referred to as the ‘UK 250’ or ‘FTSE MID 250’.

- FTSE 350: The index of the top 350 UK companies by market capitalisation. It is a combination of the FTSE 100 and FTSE 250 stocks. You cannot normally trade a FTSE 350 market in spread betting.

- Dow Jones: An index of 30 of the most traded US stocks. In financial spread betting and CFD trading this market is also known as the ‘Wall Street’ index. Like the FTSE 100, it is extremely popular with spread bettors.

- S&P 500: Defines the broader US equity market, tracking the performance of the top 500 US companies. Sometimes referred to as the ‘SPX 500’ or ‘US 500’.

- NASDAQ 100: NASDAQ stands for the National Association of Securities Dealers Automated Quotation System. The NASDAQ 100 is an index that reflects the performance of high tech stocks in the US. Sometimes referred to as the ‘US 100’ or ‘US Tech 100’.

- Nikkei 225: The price-weighted average of 225 stocks of the first section of the Tokyo Stock Exchange. Sometimes referred to as the ‘Japan 225’.

For more details on an individual index see our individual stock market guides above.

Case Study: Applying Technical Analysis to a Stock Market Index |

Below, an older but still useful case study on the FTSE 100 by Shai Heffetz, InterTrader, 31-Aug-2011.

Looking at the candlestick chart below, we can see that up to the end of July 2011 the FTSE 100 was trading within a narrow range and staying reasonably close to the Ichimoku cloud.

At the beginning of August, it broke downwards out of this range and the price started to drop sharply. It continued to drop for nearly a week, during which time it went down by nearly a thousand points to well below 4,900.

Following that we saw a relatively strong recovery to just below 5,400 on 16 August and then another downward correction.

The FTSE 100 price is presently trading sideways without any clear direction.

From a pure technical analysis point of view, traders should adopt a wait-and-see approach before taking any positions in the market.

The price is currently trading inside the cloud of the Ichimoku Kinko Hyo, which is a clear indication of market uncertainty.

The FTSE has continued to get closer to the upper border of the Ichimoku cloud. However, whilst the green Chinkou Span line is marginally above the price of 26 periods ago, this is not enough of a reason to enter into a long trade.

Taking into account the recent volatility in the market, if it breaks out of the cloud in an upwards direction a cautious trader would wait for a second, confirming signal before entering a long trade.

This could be when the blue Kijun Sen line also breaks out of the Ichimoku cloud in an upwards direction.

On the other hand, traders who are looking for a short trade should wait for the price to drop below the recent lowest level of 4,846.

Where Can I Find a Stock Market Index Trading Platform/Software? |

Some of the spread betting firms offer software/trading platforms that you have to download and install onto your computer. Most firms however, offer web based platforms that allow easier access from home, the office and most other places with internet access.

The companies listed in our price comparison section all have web-based platforms where you can spread bet on indices and individual shares.

'Stock Market Spread Betting' edited by Jacob Wood, updated 23-Mar-18

For related articles also see:

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

Hang Seng Spread Betting, updated 13-Apr-17

Hang Seng financial spread betting guide with daily updates. Plus live Hang Seng charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

Stock Market Spread Betting

Stock market index spread betting guide with live prices & charts. Plus daily stock market analysis, an indices spread betting price comparison, tips on where to trade commission-free and tax-free* as well as... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|