Stock Market Trading

Where Can I Open an Stock Market Trading Account? |

There are a good number of spreads firms that offer thousands of international markets including the leading indices like the FTSE 100, Dow and DAX as well as forex, commodities and individual shares.

Some companies, like FinancialSpreads.com, provide the usual benefits of tax free* trading with zero commissions and trading on markets to go up or down two way. They also offer trading on a number of the key indices 24 hours a day, 5 days a week. For more information see 24 hour spread trading.

| FTSE 100 (UK 100) Daily |

0.8 |

1 |

1 |

2 |

| Dow Jones (Wall St) Daily |

1 |

1 |

1 |

1.4 |

| DAX 30 (Germany 30) Daily |

1 |

1 |

1 |

1 |

| S&P 500 (SPX 500) Daily |

3 |

4 |

5 |

5 |

| NASDAQ 100 (US Tech 100) Daily |

5 |

4-10 |

3 |

1 |

| CAC 40 (France 40) Daily |

0.8 |

1 |

1 |

1 |

| ASX 200 (Australia 200) Daily |

1 |

5 |

3 |

1 |

| Japan 225 Daily |

8 |

8 |

13 |

5 |

| Hong Kong Daily |

8 |

10 |

20 |

7 |

| Stock Indices - Minimum Stake |

£1 |

£1 |

£0.5 |

£1 |

Comparison Notes.

Advantages of Index Spread Trading |

Stock Market Trading has several important advantages over more traditional investment options:

- Spread trading is tax free*, that is to say, you don’t pay capital gains tax, income tax or stamp duty on your trades.

- With spread trading, you deal directly with a spread trading firm. This means that trades are typically commission free and there are no broker’s fees. This can help to keep your trading costs down. Although beware that if you are trading ‘rolling daily markets’ and you decide to keep your position open overnight then there is often a small charge (see below).

- A spread trading account offers a lot of freedom and choice. You can typically speculate on huge range of financial markets, not just indices. There are commodities, like gold, crude oil and coffee as well as currencies, shares, interest rates and even bonds.

- With spread trading, you are simply speculating on the future price of a given market. This means that you can speculate on a stock market index to go down as well as up. This is in contrast with traditional investment formats which often only allow investors to profit on rising markets.

Index Spread Trading Example |

As with many of the world's financial markets, an investor can place a spread bet on indices, like the Dow Jones, to go up or down.

Looking at a financial spread betting platform like Capitalspreads, you can see that they are showing the Dow Jones Rolling Daily market at 13866.0 - 13867.0. As a result, an investor can spread trade on the Dow Jones market:

Rising above 13867.0, or Rising above 13867.0, or

Falling below 13866.0 Falling below 13866.0

Whilst financial spread betting on the Dow Jones index you trade in £x per point. Therefore, if you decided to risk £2 per point and the Dow Jones moves 32 points then that would alter your bottom line by £64. £2 per point x 32 points = £64.

Rolling Daily Index Markets |

One thing to note is that this is a Rolling Daily Market which means that there is no closing date for this market. Therefore, if you decide not to close your trade by the end of the day, it will just roll over into the next trading session.

If a position is rolled over and you are spread betting on the market to:

Rise - then you will pay a small overnight financing fee, or Rise - then you will pay a small overnight financing fee, or

Fall - then you will often receive a small payment to your account Fall - then you will often receive a small payment to your account

You can learn more about Rolling Daily Markets in our article Rolling Daily Spread Betting.

Dow Jones Rolling Daily - Indices Spread Trading Example |

If you consider the above spread of 13866.0 - 13867.0 and assume that:

- You've completed your market research, and

- Your analysis suggests the Dow Jones index will move above 13867.0

Then you may decide that you are going to buy at 13867.0 for a stake of, let’s say, £3 per point.

So, you gain £3 for every point that the Dow Jones index pushes higher than 13867.0. Conversely, however, you will make a loss of £3 for every point that the Dow Jones market goes lower than 13867.0.

Put another way, if you ‘Buy’ a spread bet then your P&L is worked out by taking the difference between the final price of the market and the initial price you bought the market at. You then multiply that price difference by the stake.

As a result, if after a few hours the stock market started to rise you might decide to close your spread bet to lock in your profit.

So if the market moved up then the spread might move to 13905.1 - 13906.1. You would settle/close your trade by selling at 13905.1. As a result, with the same £3 stake your profit would be calculated as:

P&L = (Settlement Price - Initial Price) x stake

P&L = (13905.1 - 13867.0) x £3 per point stake

P&L = 38.1 x £3 per point stake

P&L = £114.30 profit

Speculating on indices, whether by spread betting or not, may not go to plan. In this case, you had bet that the index would rise. Naturally, the index can also go down.

If the Dow Jones index had fallen then you could choose to close your trade in order to limit your losses.

So if the spread fell to 13823.3 - 13824.3 then you would settle/close your trade by selling at 13823.3. If so, your loss would be calculated as:

P&L = (Settlement Price - Initial Price) x stake

P&L = (13823.3 - 13867.0) x £3 per point stake

P&L = -43.7 x £3 per point stake

P&L = -£131.10 loss

Note - Dow Jones Rolling Daily index market correct as of 24-Jan-13.

Where Can I Find Stock Market Trading Charts? |

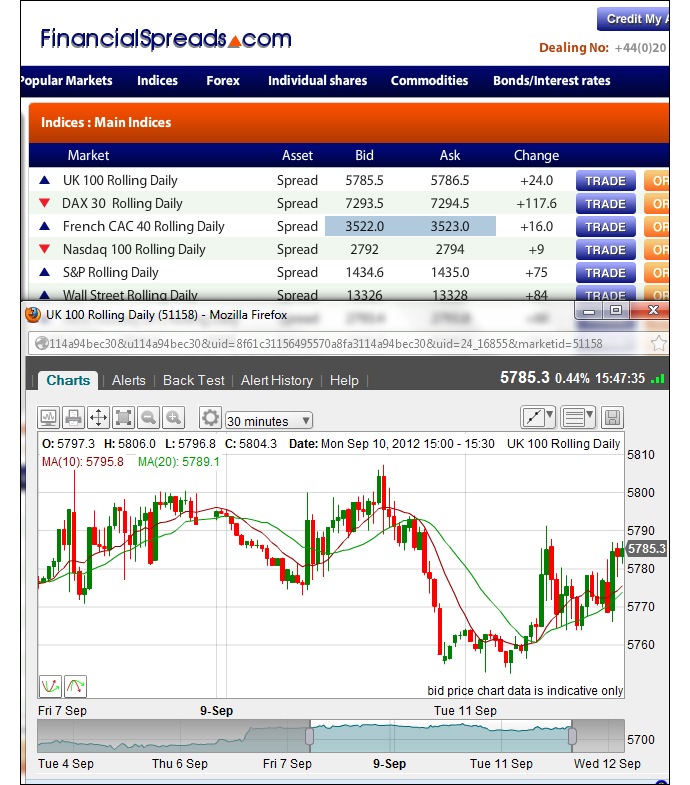

Most spread trading companies offer charts as well as a wide range of historical data and analysis. For example, the indices spreads charts offered by most of the companies on this website let you add a range of Moving Averages and other statistics like Bollinger Bands.

Depending upon your personal investment strategy and how you want to trade the markets, you can easily alter the charts to show the data in a variety of different time scales from week-by-week and day-by-day down to minute-by-minute changes.

Example UK 100 (FTSE 100) Chart

Stock Market Trading Companies – Account Services Comparison |

The firms detailed below all offer clients a range of indices markets as well as all the normal benefits of spread trading mentioned above, ie tax free*, commission free trading, numerous markets and two-way trading.

| User Ratings |

7.6 |

6.6 |

6.7 |

7.1 |

| Web Platform |

|

|

|

|

| iPhone App |

|

|

|

|

| iPad App |

|

|

|

|

| Android Apps |

|

|

|

|

| 24 Hour Trading |

|

|

|

|

| Live Charts |

|

|

|

|

| Stop Loss Available |

|

|

|

|

| Automatic Stop Loss |

|

|

|

|

| Deposit Account |

|

|

|

|

| Credit Account |

|

|

|

|

| FCA Authorised and Regulated |

|

|

|

|

Comparison Notes.

Stock Market Trading and Risk Management |

Whether you trade more traditional stocks and shares or trade via newer products, such as ETFs or CFDs, there are always risks when you invest. With spread trading you need to be careful because you can lose more than your initial investment.

Therefore before you trade, ensure that spread trading matches your investment objectives. Make sure you familiarise yourself with the risks involved. Trades carry a high level of risk to your capital. Seek independent advice where necessary.

Having said this, you can put limits on your positions to reduce your losses but not your profits. You can also employ smaller stake sizes such as £1 per point or $1 per point.

If you only want to gain a little exposure then you could trade European, UK or US stock market indices, ie speculate on whether the FTSE, DAX, S&P 500 etc will go up or down.

You can normally trade any of these markets with stakes of just £1 per point or $1 per point etc. If you speculate on the FTSE to go up, with a £1 per point stake, and it goes up by 140 points then you would make 140 points x £1 per point = £140.

Conversely, if the market went against you, dropping by say 95 points, then with a £1 stake you would lose 95 points x £1 per point = £95.

Of course this would not be a great way to start. However, with a number of companies like Financial Spreads you can add a Guaranteed Stop Loss at let's say, 60 points.

If you were trading the FTSE 100 then your position would be closed if the FTSE 100 moved against you by 40 points. Therefore, instead of losing £95, you'd only lose 60 points x £1 per point = £60.

However, assuming you correctly predicted the direction of the market, your profit would still be £120 if it moved 120 points or £70 if the FTSE 100 moved by 70 points.

Using small stakes and guaranteed stop losses are simple risk management techniques that too many investors overlook.

Financial Spreads » "With FinancialSpreads.com you get all the advantages of

Spread Trading as well as commission free CFD Trading on 2,500+ markets, 24 hour trading, professional level charts and..." read

Financial Spreads review.

|

Stock Market Trading - 11 July 2016 |

For more see our 'latest stock market trading reports'.

'Stock Market Trading' edited by DB, updated 11-Jul-16

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

Stock Market Trading News, updated 29-Jul-13

An index of stock market trading articles covering news, analysis & spread betting on the FTSE, Dow Jones, DAX 30 etc. Plus stock market index charts, comparisons and... » read guide.

About this page:

Stock Market Trading

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|