Losses can exceed deposits

At Clean Financial we want to you select the spread betting option that fits your trading needs.

One option is Tradefair Spreads, a collaboration between Betfair, the leading betting exchange, and Gain Capital (who also run City Index).

With Tradefair Spreads you get all the normal advantages of spread betting:

- Tax Free Investments*

- No Capital Gains Tax

- No Income Tax

- No Stamp Duty

- No Commissions

- You can buy or sell indices, shares, foreign exchange markets, commodities, interest rates, bonds and more

- Over 2,500 markets and instruments – see below

* Tax law is subject to change or may differ if you pay tax in a jurisdiction other than the UK.

Tradefair Spreads

- The Tradefair Spreads platform – a spread betting site with a variety of trading options

- Fully interactive online dealing

- iPhone Trading – see Tradefair Mobile Trading

- Live prices

- Free charts with advanced functionality

- ‘Daily Rolling’ contracts

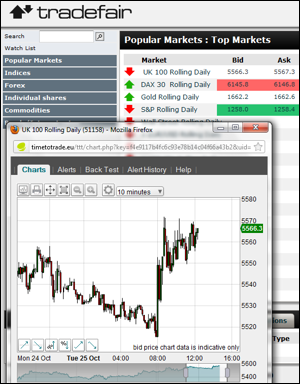

Tradefair Mobile Trading

Investors can also access their Tradefair account via the Tradefair iPhone application.

- Check the latest prices and market movements

- Access spread betting charts

- Open and close spread bets

- Manage trading orders and positions

- Monitor their account balance and P&L

- Review their margin and available trading funds

User Comments & Ratings on Tradefair

Add Your View – if you have any comments or questions on Tradefair, feel free to add them here.Readers can leave comments by logging in securely to their Facebook, Twitter or Intense Debate accounts (CleanFinancial does not see, or keep a record of, your login details).

The Tradefair Account

A quick look at the Tradefair account:Tradefair Services |  |

| Average User Rating | 7.2 |

| New Account Offer |  |

| 24 Hour Trading |  |

| Live Charts |  |

| iPhone App |  |

| iPad App |  |

| Android Apps |  |

| Web Platform |  |

| Stop Loss Available |  |

| Automatic Stop Loss |  |

| Credit Account |  |

| Deposit Account |  |

| FCA Authorised and Regulated |  |

Markets on Tradefair

Below you will find a sample of the markets offered by Tradefair.com along with their typical in-hours spread size and the minimum stake for that market.French CAC 40, the German DAX 30, the US Dow Jones Industrial Average (aka Wall Street) or the Japanese Nikkei 225. The indices tend to comprise the stocks of the particular country’s biggest companies.

silver, Heating Oil, Cotton, OJ, Sugar, Robusta Coffee and more.

Typical In-Hours Forex Spread Sizes with Tradefair |  |

| EUR / USD Daily | 0.6 |

| GBP / USD Daily | 0.8 |

| EUR / GBP Daily | 0.8 |

| USD / JPY Daily | 0.6 |

| Forex minimum stake | £1 |

Typical In-Hours Interest Rate Spread Sizes with Tradefair |  |

| Euribor | 3 |

| Euroswiss | – |

| Short Sterling | 2 |

| Treasuries minimum stake | £1 |

Typical In-Hours Bonds Spread Sizes with Tradefair |  |

| BOBL | 3 |

| Bund | 3 |

| Gilt | 3 |

| Schatz | 2 |

| US T Bond 10 Year | 6 |

| US T Bond 30 Year | 6 |

| Treasuries minimum stake | £1 |

Tradefair Stability and UK Regulation

Losses can exceed deposits

‘Tradefair Financials’ (“Tradefair”) is a trading name of GAIN Capital UK Limited, registered office 16 Finsbury Circus, Park House, 1st Floor, London, EC2M 7EB and is authorised and regulated by the Financial Conduct Authority. FCA No. 113942.

Tradefair® is fully owned by Paddy Power Betfair plc.

Remember: big rewards can mean big risks. The possibility that you could lose more than your initial deposit means Tradefair Spreads isn’t for everyone. Only invest what you can afford to lose and make sure you’re aware of the risks.