Life After GFT Markets

Please note that the GFT Markets platform is no longer available.The GFT layout was fairly unique and so there aren’t many similar options that we can suggest.

Looking for a New Spread Betting, CFD and Forex Account?

If you are looking for a new spread betting, CFD and/or forex account, please see our spread betting, cfd and forex offers and spread betting comparison pages.What Happened to GFT Markets?

The owner of GFT Markets, GAIN Capital, bought City Index in 2014. As part of that the acquisition, GAIN Capital merged GFT into the City Index brand.Note that GFT (Global Futures and Forex LTD) information below is no longer accurate, it is maintained purely as part of the CleanFinancial archive.

Review of ‘Global Futures and Forex’

GFT Review

With GFT you get all the normal advantages of spread betting:- Tax-free investments*

- No Stamp Duty

- No Capital Gains Tax

- No Income Tax

- You can buy or sell stock market indices, shares, forex, commodities, interest rates and bonds

- Commission-free trading

- A wide range of markets – see GFT ‘Markets and Prices’

GFT Global Markets

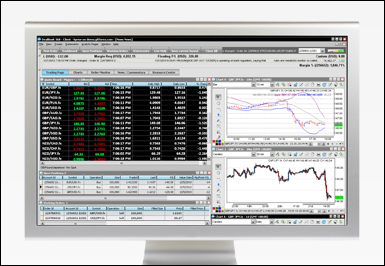

Using a GFT Markets account, investors can access different forms of the award-winning GFT DealBook platform:- DealBook Web – their user-friendly web based platform. It comes with the most popular chart types and indicators as well as live news feeds

- DealBook 360 – their customisable platform which comes with the broadest range of tools and charts. Note, whilst this platform has a lot more features than the typical web-based trading platform, you do need to download it

- DealBook Mobile – their mobile platform which you can use to trade from your iPhone, iPad, Android-based phone and Kindle Fire, see GFT Mobile Trading for details

- Competitive pricing on 3,200+ markets – including spreads from 1 point on key index and forex markets during market hours. Spreads on individual shares are as low as 0.1% of the underlying market

- MT4 – use MetaTrader4, one of the most popular trading systems, see MT4 with GFT for details

- 24 hour trading – trade a selection of popular markets from Sunday evening to Friday evening

- Autochartist Trade Ideas – ‘Premium Accounts’ can use ‘Autochartist Trade Ideas’ to produce live trade setups. The real-time program offers entry, stop and limit prices for trades on 18 currency pairs, the potential ‘points’ profit, the time period and the probability of each trade on a scale from 1 to 10

- Low Margin Requirements – margins on some popular markets are as low as 0.5%

- Price Alerts – users can set price alerts for when the markets hit a certain level. Price alerts can also be set directly on the charts

- Trading directly from the charts – traders who prefer their technical analysis may prefer to add trades directly to the charts rather than through deal tickets

- Single-click orders – useful in fast moving markets

GFT Mobile Trading

Using GFT’s award winning DealBook Mobile platform, investors can trade from their iPhone, iPad, Android based phone or Kindle Fire. Each trading app offers:- Live trading of thousands of markets including forex, stock market indices, commodities, shares and treasuries markets

- Live charts with a full-screen option that shows current positions, orders and alarms (price alerts)

- Further chart options such as key technical indicators and overlays

- The option to add/update/remove trading orders

- Account access including P&L and account history

- Live streaming news

GFT on the Kindle Fire:

GFT Awards

GFT have won a range of awards and accolades in recent years, these include:- Best Customer Service, Investment Trends UK CFD Report, 2012

- Best Mobile Platform, Shares Magazine Awards, 2012

- Best Forex Broker, The Stockies, 2012

- Best Online Trading Platform, UK Shares Awards, 2011

- Best Forex Provider, AFR Smart Investor Blue Ribbon Awards, 2011

- Best Forex Education Provider, IBTimes FX Excellence Awards, 2011

- Best Forex Customer Service, IBTimes FX Excellence Awards, 2011

User Ratings & Comments on GFT Markets

Add Your View – please add any comments, questions and/or feedback on your experience with GFT here:Readers can leave comments by logging in securely to their Facebook, Twitter or Intense Debate accounts (CleanFinancial does not see, or keep a record of, your login details).

MT4 with GFT

Traders can use MetaTrader4 (MT4) with GFT.MetaTrader4 is one of the most popular trading systems, it allows users to place their own trades or set up Expert Advisors (EAs). EA are settings/programs that can automatically place trades when certain market conditions are met.

Whilst they do not come with any guarantees, investors can search 100s of free EAs, each EA can be back-tested and modified.

MT4 is available in multiple languages and there are no hidden charges, GFT absorbs the cost of using MT4.

When using MT4 with GFT, investors can:

- View their win/loss ratios

- Undock charts and create multi-monitor configurations

- Create powerful ‘If-Done’ and other conditional orders

- Use the Autochartist tools

GFT Charts

- Functionality that lets you trade directly from the charts as well as add new orders to the chart (not available on mobile apps)

- Numerous indicators, many of which you can customise

- Functions that help validate patterns and trends

- Features that identify both simple and complex patterns as well as potential entry and exit points for possible trades

- Time frames as small as a tick or as large as a year

GFT Trading Orders

To help simplify trading and risk management, there are a number of trading orders available:- Single-click Orders – to help with fast moving markets (not available on mobile apps)

- Limit Orders and Stop Orders – designed to protect your potential profit and minimise your losses by closing a trade when the market hits a given price

- Automated Trailing Stops – designed to automatically trail the market as the price moves in your favour. When the market moves against you, it then acts like a Stop Loss. These orders therefore help lock in profitable market movements

- Guaranteed Stop Orders – prices in volatile or illiquid markets can occasionally gap through a normal Stop Order level and therefore be executed at a price that is worse than your Stop Order price. As the name suggests, a Guaranteed Stop Order is guaranteed to execute at the price you specified, irrespective of any gaps or slippage. Note that these orders normally come with a small additional cost

- Parent and Contingent Orders – by applying these orders, investors create an entire trade from start to finish, i.e. set the levels for a trade to open and close at

GFT Markets – 24 Hour Service

According to the GFT website, their “knowledgeable market specialists, customer service associates, technical support staff and dealing desk are available to assist you 24 hours a day.“We provide you with the highest levels of personalised service, and promise to respond to your inquiries in a timely manner so you can remain focused on your trading”

GFT Markets Account

A quick look at the typical GFT account.GFT Services |  |

| Average User Rating | 6 |

| New Account Offer |  |

| 24 Hour Trading |  |

| Live Charts |  |

| iPhone App |  |

| iPad App |  |

| Android Apps |  |

| Web Platform |  |

| Stop Loss Available |  |

| Automatic Stop Loss |  |

| Credit Account |  |

| Deposit Account |  |

| FCA Authorised and Regulated |  |

Markets on the GFT Platform

Below you will find a sample of the markets offered by GFT along with their typical in-hours spread size and the minimum stake for that market.GFT also offers spread bets on a range of other Indices including: German Mid-Cap 50, CAC, AEX, Euro Stoxx 50, Australia 200, Belgium 20 and more.

Typical In-Hours Commodities Spread Sizes with GFT |  |

| Gold Daily | – |

| Gold Futures | – |

| Brent Crude Oil Daily | – |

| Brent Crude Oil Futures | – |

| US Crude Oil Daily | – |

| US Crude Oil Futures | – |

| Commodities minimum stake | – |

GFT also offers spread bets on a range of other Commodities markets including: Gas, Silver, High Grade Copper, London Coffee and more.

Typical In-Hours Forex Spread Sizes with GFT |  |

| EUR / USD Daily | – |

| GBP / USD Daily | – |

| EUR / GBP Daily | – |

| USD / JPY Daily | – |

| Forex minimum stake | – |

GFT also offers spread bets on a range of other Forex markets including: GBP/JPY, GBP/CHF, GBP/HUF, EUR/CZK, EUR/PLN, HKD/JPY, USD/MXN and more.

Typical In-Hours Interest Rate Spread Sizes with GFT |  |

| Euribor | – |

| Euroswiss | – |

| Short Sterling | – |

| Treasuries minimum stake | – |

Typical In-Hours Bonds Spread Sizes with GFT |  |

| BOBL | – |

| Bund | – |

| Gilt | – |

| Schatz | – |

| US T Bond 10 Year | – |

| US T Bond 30 Year | – |

| Treasuries minimum stake | – |

Also see our notes and comments on the above.

About GFT Global Markets

GFT Global Markets was founded in 1997. Today they service traders in more than 120 countries from offices in London, Dubai, New Jersey, Grand Rapids, Singapore, Sydney and Tokyo.The company offers financial spread betting, CFD trading, forex trading and binaries.

GFT Global Markets UK Limited is authorised and regulated by the Financial Conduct Authority.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.

Losses can exceed deposits