The CleanFinancial.com guide to Bitcoin trading. Investors can now trade can trade Bitcoins through spread bets, Contracts for Difference (CFDs) and Binary bets.

- Live Bitcoin Prices and Charts

- Bitcoin Market News & Analysis

- Bitcoin CFDs

- Bitcoin Binary Bets

- Bitcoin Spread Betting

- About Bitcoin, Definitions, FAQs & Resources

- Video Guide to Bitcoin

- Bitcoin Ponzi Scheme

- Litecoin Trading Guide

Live Bitcoin Prices and Charts

The live CFD chart and prices below will offer readers a useful look at the Bitcoin market. Also see Bitcoin technical analysis charts below.Bitcoin Market News & Analysis

3 March 2018, 8:37am,

The market is currently lower than the 20 period MA of $8,447.14 and lower than the 50 period MA of $8,559.27.

The market is currently lower than the 20 period MA of $8,447.14 and lower than the 50 period MA of $8,559.27.

1 Day Chart Analysis

The market is trading lower than the 20 day MA of $9,109.67 and lower than the 50 day MA of $9,365.19.

The market is trading lower than the 20 day MA of $9,109.67 and lower than the 50 day MA of $9,365.19.

Bitcoin Futures Trading Report

- Bitcoin is currently trading at $8,442.22.

- At the end of the last session, the market closed -$189.88 (-2.14%) lower at $8,664.88.

1 Day Chart Analysis

3 March 2018, 5:04pm,

The digital currency is below the 20-period MA of $8,665.91 and below the 50-period MA of $8,812.36.

The digital currency is below the 20-period MA of $8,665.91 and below the 50-period MA of $8,812.36.

1 Day Indicator Analysis

The market is currently below the 20-DMA of $9,253.44 and below the 50-DMA of $9,377.43.

The market is currently below the 20-DMA of $9,253.44 and below the 50-DMA of $9,377.43.

Bitcoin Futures Market News

- Bitcoin is currently trading at $8,567.75.

- At the end of the last session, the market closed -$11.56 (-0.13%) lower at $8,854.76.

1 Day Indicator Analysis

7 July 2015, 3:42pm, Trading Bitcoin After Last Year’s Fall

1 January 2015, 6:26pm,

Following a security breach at Europe’s leading Bitcoin exchange, IG ask Garrick Hileman, Founder of MacroDigest, about what challenges the crypto-currency faces in 2015.

The video discusses the likelihood of further adoption of Bitcoin by retailers, financiers and consumers, as well as the regulatory environment and the currency’s fair value.

Will Bitcoin See Further Adoption in 2015?

Following a security breach at Europe’s leading Bitcoin exchange, IG ask Garrick Hileman, Founder of MacroDigest, about what challenges the crypto-currency faces in 2015.

The video discusses the likelihood of further adoption of Bitcoin by retailers, financiers and consumers, as well as the regulatory environment and the currency’s fair value.

11 November 2014, 8:30pm,

With such incrediblely huge volatility in the Bitcoin market, IG talk to Stephen Kinsella, Lecturer of Economics at the University of Limerick, about why the virtual currency may be the perfect bubble market.

Mr Kinsella is concerned that crypto-currencies will see some individuals who do not understand the risks wiped out and inspire some kind of central regulation.

Is Bitcoin the Perfect Bubble?

With such incrediblely huge volatility in the Bitcoin market, IG talk to Stephen Kinsella, Lecturer of Economics at the University of Limerick, about why the virtual currency may be the perfect bubble market.

Mr Kinsella is concerned that crypto-currencies will see some individuals who do not understand the risks wiped out and inspire some kind of central regulation.

2 February 2014, 12:16pm,

Note that Plus500 have moved their Bitcoin market from Mt.Gox to BTC-e.com.

This is not surprising given the well documented problems on the Mt.Gox platform e.g. see some of our updates below.

Although we aren’t always in awe of the Plus500 service, this seems to be a sensible move; both the futures companies and individual investors need reliable underlying markets.

CFD Market Moves from Mt.Gox to BTC-e.com

Note that Plus500 have moved their Bitcoin market from Mt.Gox to BTC-e.com.

This is not surprising given the well documented problems on the Mt.Gox platform e.g. see some of our updates below.

Although we aren’t always in awe of the Plus500 service, this seems to be a sensible move; both the futures companies and individual investors need reliable underlying markets.

2 February 2014, 1:43pm,

BTC was trading at around the $920 level on the Mt.Gox exchange when the withdrawal problems started to be even worse than usual (see the 5, 10 and 11 Feb comments below).

At the moment, the Mt.Gox price is trading at $250.25, its lowest level since 6 Nov 2013.

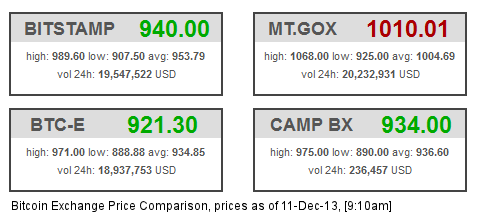

With investors struggling to get out of the currency, we can see the problems are not just related to Mt.Gox. As the table below shows, there is certainly pressure on prices elsewhere.

Given that Mt.Gox has #historically’ traded at a premium to other exchanges, the price fall on the Japanese exchange shows it has been hit far harder than some of the other exchanges.

Problem with the Software?

As reported below on 11 Feb, Mt.Gox said there was a problem with the Bitcoin software.

OK, maybe that’s true.

But if it’s a generic problem with the Bitcoin software why are prices on the other exchanges now trading at a $350 premium?

Bitstamp, the Slovenian exchange, suspended withdrawals on 12 Feb after a denial of service (DDoS) attack.

However, a DDoS attack is often employed by blackmailers and is designed to stop a website from working by flooding it with data requests.

To me, the Bitstamp DDoS attack and the Mt.Gox #software issue’ are two seemingly different problems (or excuses).

Even if they are related, they simply highlight the high risks associated with #Bitcoin investing’.

Some Bitcoin Exchanges Burst More than Others

BTC was trading at around the $920 level on the Mt.Gox exchange when the withdrawal problems started to be even worse than usual (see the 5, 10 and 11 Feb comments below).

At the moment, the Mt.Gox price is trading at $250.25, its lowest level since 6 Nov 2013.

With investors struggling to get out of the currency, we can see the problems are not just related to Mt.Gox. As the table below shows, there is certainly pressure on prices elsewhere.

| Exchange | Current Price | 5-Feb-14 Price (Approximate) | Price Fall (Approximate) |

| Mt.Gox | $250.25 | $920 | $670 |

| Bitstamp | $626.02 | $800 | $174 |

| BTC-e | $599.79 | $795 | $195 |

| Huobi | $632.04 | $815 | $183 |

Given that Mt.Gox has #historically’ traded at a premium to other exchanges, the price fall on the Japanese exchange shows it has been hit far harder than some of the other exchanges.

Problem with the Software?

As reported below on 11 Feb, Mt.Gox said there was a problem with the Bitcoin software.

OK, maybe that’s true.

But if it’s a generic problem with the Bitcoin software why are prices on the other exchanges now trading at a $350 premium?

Bitstamp Suspends Withdrawals

Bitstamp, the Slovenian exchange, suspended withdrawals on 12 Feb after a denial of service (DDoS) attack.

However, a DDoS attack is often employed by blackmailers and is designed to stop a website from working by flooding it with data requests.

To me, the Bitstamp DDoS attack and the Mt.Gox #software issue’ are two seemingly different problems (or excuses).

Even if they are related, they simply highlight the high risks associated with #Bitcoin investing’.

2 February 2014, 9:38pm,

Following on from the comments below on 5 and 10 Feb, Mt.Gox has stopped letting clients withdraw any money.

Serious Technical Flaw

It seems as though there is a serious technical flaw. According to Mt.Gox the non-technical explanation is:

“A bug in the bitcoin software makes it possible for someone to use the Bitcoin network to alter transaction details to make it seem like a sending of bitcoins to a bitcoin wallet did not occur when in fact it did occur.

“Since the transaction appears as if it has not proceeded correctly, the bitcoins may be resent. MtGox is working with the Bitcoin core development team and others to mitigate this issue.”

They may have rushed their press release given the title-case and lower-case spelling of Bitcoin.

Hopefully they do a better job of fixing the code.

Why Mt.Gox Exchange Has Stopped Bitcoin Withdrawals

Following on from the comments below on 5 and 10 Feb, Mt.Gox has stopped letting clients withdraw any money.

Serious Technical Flaw

It seems as though there is a serious technical flaw. According to Mt.Gox the non-technical explanation is:

“A bug in the bitcoin software makes it possible for someone to use the Bitcoin network to alter transaction details to make it seem like a sending of bitcoins to a bitcoin wallet did not occur when in fact it did occur.

“Since the transaction appears as if it has not proceeded correctly, the bitcoins may be resent. MtGox is working with the Bitcoin core development team and others to mitigate this issue.”

They may have rushed their press release given the title-case and lower-case spelling of Bitcoin.

Hopefully they do a better job of fixing the code.

2 February 2014, 11:20am,

MtGox, one of the largest and best known Bitcoin exchanges is reportedly having problems paying out to clients.

There seems to have been a perennial problem for users withdrawing funds from many exchanges and now, according to a new article, MtGox owes $38m in withdrawals that have not been executed.

Note that the author of the article clarifies that he could be biased because he’s waiting for a large amount of money himself.

Having said that, he’s basing his report on MtGox’s own data.

In short, over the last week, clients withdrawing money from MtGox have seen their funds debited from their Bitcoin account but have not actually received the money in their bank accounts.

This means that the exchange has “racked up over $38m in such unfulfilled withdrawals”.

MtGox have issued a statement saying “We’re working on it…[the problem applies] primarily to large transactions”.

$38m in ‘Missing’ Withdrawals from MtGox

MtGox, one of the largest and best known Bitcoin exchanges is reportedly having problems paying out to clients.

There seems to have been a perennial problem for users withdrawing funds from many exchanges and now, according to a new article, MtGox owes $38m in withdrawals that have not been executed.

Note that the author of the article clarifies that he could be biased because he’s waiting for a large amount of money himself.

Having said that, he’s basing his report on MtGox’s own data.

In short, over the last week, clients withdrawing money from MtGox have seen their funds debited from their Bitcoin account but have not actually received the money in their bank accounts.

This means that the exchange has “racked up over $38m in such unfulfilled withdrawals”.

MtGox have issued a statement saying “We’re working on it…[the problem applies] primarily to large transactions”.

1 January 2014, 6:36pm,

Readers should note that eToro, the social trading platform, and Markets.com now offer contracts for difference on Bitcoin.

We haven’t fully tested these offerings yet but the eToro market looks rather strange, see companies that offer Bitcoin CFDs below for more info.

More Brokers Offer Bitcoin CFDs

Readers should note that eToro, the social trading platform, and Markets.com now offer contracts for difference on Bitcoin.

We haven’t fully tested these offerings yet but the eToro market looks rather strange, see companies that offer Bitcoin CFDs below for more info.

1 January 2014, 11:45am,

In Nov 2013 Plus500 really tightened this market and closed positions every night. I.e. investors couldn’t automatically roll positions into the next trading day.

The company has now eased conditions and the market expires monthly like a near-term futures contract, e.g. the current market will be settled on 31 Jan 2014.

Sadly, no sign of a DogeCoin or Coinye market though.

Updated Bitcoin CFD Futures Market

In Nov 2013 Plus500 really tightened this market and closed positions every night. I.e. investors couldn’t automatically roll positions into the next trading day.

The company has now eased conditions and the market expires monthly like a near-term futures contract, e.g. the current market will be settled on 31 Jan 2014.

Sadly, no sign of a DogeCoin or Coinye market though.

1 January 2014, 12:20pm,

After a quiet-ish festive break, BTC volatility is back.

The last two days have seen trading ranges of $116 and $121.

The market is currently hovering below the $1,000 level at $999.4. It won’t be there for long.

Business as Usual for the Volatile Bitcoin Market

After a quiet-ish festive break, BTC volatility is back.

The last two days have seen trading ranges of $116 and $121.

The market is currently hovering below the $1,000 level at $999.4. It won’t be there for long.

1 January 2014, 8:09pm,

Zynga have said that they are testing Bitcoin and that players will be able to pay via the ‘BitPay’ payments service for games like FarmVille 2 and CastleVille.

For more details see Bitcoin Tops $1,000 Again as Zynga Accepts Virtual Money.

Bitcoin Prices Boosted by News that Zynga Will Accept the Currency

Zynga have said that they are testing Bitcoin and that players will be able to pay via the ‘BitPay’ payments service for games like FarmVille 2 and CastleVille.

For more details see Bitcoin Tops $1,000 Again as Zynga Accepts Virtual Money.

1 January 2014, 9:05am,

I know the markets are normally pretty anaemic over the festive period but even Bitcoin has been quite calm.

Whist there has still been some volatility it has not been at the usual Bitcoin standard. After the market closed at $706.88 on 23 Dec, most days have ‘only’ seen a $50 range.

Boxing Day was the exception with a more ‘normal’ $120 range.

BTC is currently trading at $813.25.

Even Bitcoin Took a Break for Christmas

I know the markets are normally pretty anaemic over the festive period but even Bitcoin has been quite calm.

Whist there has still been some volatility it has not been at the usual Bitcoin standard. After the market closed at $706.88 on 23 Dec, most days have ‘only’ seen a $50 range.

Boxing Day was the exception with a more ‘normal’ $120 range.

BTC is currently trading at $813.25.

12 December 2013, 7:49pm,

As reported in the FT, the Reserve Bank of India (RBI) is looking into the legality of Bitcoin, see 24 Dec update below.

Whilst this is only an investigation by the RBI, and not a ban on BTC trading, according to an article on bidnessetc.com, the largest Indian Bitcoin exchange has suspended operations.

BuySellBitCo.in is “suspending buy and sell operations…All pending orders will be cancelled and the deposits refunded.”

BuySellBitCo.in was seeing nearly $200,000 worth of transactions per day.

The Largest Indian Bitcoin Exchange Suspends Itself

As reported in the FT, the Reserve Bank of India (RBI) is looking into the legality of Bitcoin, see 24 Dec update below.

Whilst this is only an investigation by the RBI, and not a ban on BTC trading, according to an article on bidnessetc.com, the largest Indian Bitcoin exchange has suspended operations.

BuySellBitCo.in is “suspending buy and sell operations…All pending orders will be cancelled and the deposits refunded.”

BuySellBitCo.in was seeing nearly $200,000 worth of transactions per day.

12 December 2013, 7:50pm,

Reserve Bank of India (RBI) released a statement today saying the RBI, “has today cautioned the users, holders and traders of Virtual currencies (VCs), including Bitcoins, about the potential financial, operational, legal, customer protection and security related risks that they are exposing themselves to.”

Also see the FT.com article, India’s central bank gets to grip with Bitcoin.

Indian Central Bank Queries Bitcoin

Reserve Bank of India (RBI) released a statement today saying the RBI, “has today cautioned the users, holders and traders of Virtual currencies (VCs), including Bitcoins, about the potential financial, operational, legal, customer protection and security related risks that they are exposing themselves to.”

Also see the FT.com article, India’s central bank gets to grip with Bitcoin.

12 December 2013, 12:55pm,

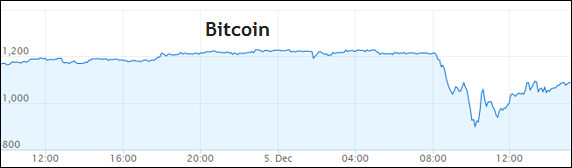

According to the Financial Times, the People’s Bank of China has banned local Bitcoin exchanges from accepting new deposits, see new Chinese Bitcoin ban.

Naturally this means problems for the BTC China exchange, the largest exchange by trading volume, as they can no longer accept Renminbi based deposits.

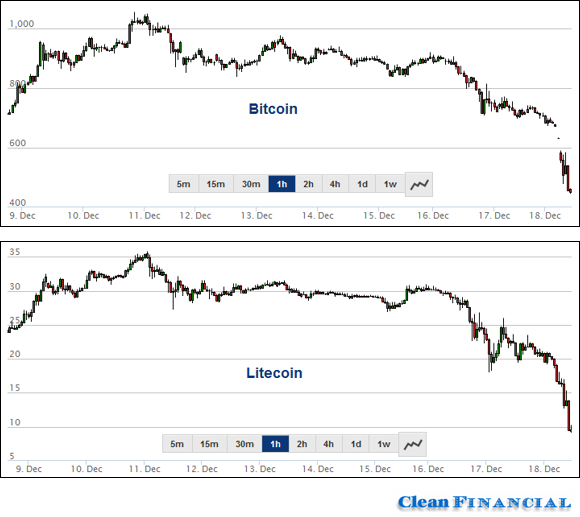

The ban has meant huge falls for both Bitcoin and Litecoin:

Last week, Bitcoin was trading as high as $1232. This morning it hit a low of $446. It’s now trading at $525.

As always, be very very careful if you are trading digital currencies.

China Ban Bitcoin Exchanges from Taking Deposits

According to the Financial Times, the People’s Bank of China has banned local Bitcoin exchanges from accepting new deposits, see new Chinese Bitcoin ban.

Naturally this means problems for the BTC China exchange, the largest exchange by trading volume, as they can no longer accept Renminbi based deposits.

Massive Bitcoin and Litecoin Falls

The ban has meant huge falls for both Bitcoin and Litecoin:

|

Last week, Bitcoin was trading as high as $1232. This morning it hit a low of $446. It’s now trading at $525.

As always, be very very careful if you are trading digital currencies.

12 December 2013, 11:15am,

Bloomberg are running a story, Bitcoins Spark Regulatory Crackdown as Denmark Drafts Rules.

This could be negative for Bitcoin and that’s seems to the be angle in the press.

However, the Scandinavians are well known early-adopters when it comes to the tech world.

The regulation could mean that more people are happy to trade Bitcoin and, more importantly, it could help legitimatise the digital currency.

Denmark Drafting Bitcoin Regulations

Bloomberg are running a story, Bitcoins Spark Regulatory Crackdown as Denmark Drafts Rules.

This could be negative for Bitcoin and that’s seems to the be angle in the press.

However, the Scandinavians are well known early-adopters when it comes to the tech world.

The regulation could mean that more people are happy to trade Bitcoin and, more importantly, it could help legitimatise the digital currency.

12 December 2013, 12:06pm,

For a quick look at how the two markets have moved over the last week see Early Litecoin vs Bitcoin Trends.

Litecoin vs Bitcoin Trend Comparison

For a quick look at how the two markets have moved over the last week see Early Litecoin vs Bitcoin Trends.

12 December 2013, 9:01pm,

If you like Bitcoin, note that Plus500 have opened a Litecoin market.

See our Litecoin trading guide for more details.

New Litecoin Market

If you like Bitcoin, note that Plus500 have opened a Litecoin market.

See our Litecoin trading guide for more details.

12 December 2013, 3:03pm,

A Bank of America strategist has suggested that the maximum fair value of Bitcoin is $1300.

BoA are now issuing guidance on BTC and David Woo, Currency Strategist, stated:

“Is Bitcoin a bubble? Assuming Bitcoin becomes:

(1) A major player in both ecommerce and money transfer, and

(2) A significant store of value with a reputation close to silver

“Then, our fair value analysis implies a maximum market capitalisation of Bitcoin of $15bn, or 1฿ = $1,300.

“This suggests that the 100 fold increase in Bitcoin prices this year is at risk of running ahead of its fundamentals.”

For more details see, BoA starts Bitcoin coverage.

“Max Fair Value of Bitcoin is $1,300”

A Bank of America strategist has suggested that the maximum fair value of Bitcoin is $1300.

BoA are now issuing guidance on BTC and David Woo, Currency Strategist, stated:

“Is Bitcoin a bubble? Assuming Bitcoin becomes:

(1) A major player in both ecommerce and money transfer, and

(2) A significant store of value with a reputation close to silver

“Then, our fair value analysis implies a maximum market capitalisation of Bitcoin of $15bn, or 1฿ = $1,300.

“This suggests that the 100 fold increase in Bitcoin prices this year is at risk of running ahead of its fundamentals.”

For more details see, BoA starts Bitcoin coverage.

12 December 2013, 2:25pm,

Bitcoin took a double hit today:

Investors should note however that the digital currency recouped a good portion of its losses and is trading back up at around $1,068.

The comment from Alan Greenspan carries some weight, but he’s not said anything that a lot of other commentators haven’t already said.

The China ban could have a far bigger impact; it’s surprising the Bitcoin market has been so resistant.

Of course, it is possible that, even though the news has been out for most of the trading day, it hasn’t reached enough people to hurt the market.

We could well see more selling over the next 24 hours, i.e. when China has a full day of trading.

As always, caution is required with this very volatile market.

China Bans Bitcoin ‘Handling’

Bitcoin took a double hit today:

- China has banned financial institutions from ‘handling’ bitcoins

- Former Federal Reserve Chairman, Alan Greenspan, has said that “Bitcoin is a bubble waiting to burst”

Investors should note however that the digital currency recouped a good portion of its losses and is trading back up at around $1,068.

The comment from Alan Greenspan carries some weight, but he’s not said anything that a lot of other commentators haven’t already said.

The China ban could have a far bigger impact; it’s surprising the Bitcoin market has been so resistant.

Of course, it is possible that, even though the news has been out for most of the trading day, it hasn’t reached enough people to hurt the market.

We could well see more selling over the next 24 hours, i.e. when China has a full day of trading.

As always, caution is required with this very volatile market.

|

12 December 2013, 6:27pm,

There is a very interesting story on NewStatesman.com about the recent theft of 96,000 Bitcoin.

‘Sheep Marketplace’ closed down at the weekend and someone has run off with 96,000 Bitcoin (~£60m).

If you steal Bitcoin though you aren’t completely invisible and some grumpy users are chasing the thief around the web.

The article talks about the theft and how the victims are trying to trace the guilty party, or more accurately, tracing the flowing of the stolen coins, read Real-time Bitcoin theft.

£60m Bitcoin Theft

There is a very interesting story on NewStatesman.com about the recent theft of 96,000 Bitcoin.

‘Sheep Marketplace’ closed down at the weekend and someone has run off with 96,000 Bitcoin (~£60m).

If you steal Bitcoin though you aren’t completely invisible and some grumpy users are chasing the thief around the web.

The article talks about the theft and how the victims are trying to trace the guilty party, or more accurately, tracing the flowing of the stolen coins, read Real-time Bitcoin theft.

11 November 2013, 8:39pm,

I have seen a lot of people complaining about how frustrating it is to buy actual Bitcoins.

I’ve also read a few nasty stories about trying to get your funds back.

The following experience on Reddit seems fairly typical of the stories I have read, buying your first Bitcoin is so arduous.

Patience Needed if You Want to Buy Bitcoin

I have seen a lot of people complaining about how frustrating it is to buy actual Bitcoins.

I’ve also read a few nasty stories about trying to get your funds back.

The following experience on Reddit seems fairly typical of the stories I have read, buying your first Bitcoin is so arduous.

11 November 2013, 12:51pm,

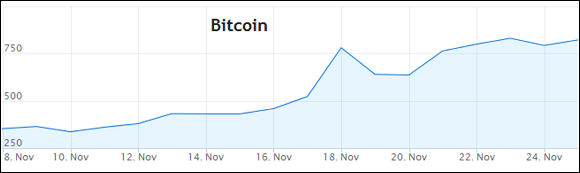

After some very volatile swings last week, the digital currency has regained ‘some’ composure.

Bitcoin is currently trading at $869, still a little off last week’s all-time high of $896.

Whether you are going long or short though, note that the intraday moves are still highly volatile and there are a lot of $20-50 dollar moves over short periods of time (you can see these if you adjust the adjust the live Bitcoin chart above).

For the last four days, the daily range has been in the $80-90 region, i.e. the market is seeing daily 10% swings.

Caution is needed.

Wild Swings in the Bitcoin Market

After some very volatile swings last week, the digital currency has regained ‘some’ composure.

Bitcoin is currently trading at $869, still a little off last week’s all-time high of $896.

Whether you are going long or short though, note that the intraday moves are still highly volatile and there are a lot of $20-50 dollar moves over short periods of time (you can see these if you adjust the adjust the live Bitcoin chart above).

For the last four days, the daily range has been in the $80-90 region, i.e. the market is seeing daily 10% swings.

Caution is needed.

|

11 November 2013, 11:59am, And another $1m goes missing from a Bitcoin bank, this time from bips.me.

Clearly, if you have Bitcoins, you need to be very careful where you store them.

For more details see businessinsider.com.

Clearly, if you have Bitcoins, you need to be very careful where you store them.

For more details see businessinsider.com.

11 November 2013, 12:54pm,

Bitcoin crossed the $600 mark earlier this morning. That’s a gain of more than $100 in one day. This market could come crashing down in a very nasty way.

Another Warning for Investors Trading Bitcoin

Bitcoin crossed the $600 mark earlier this morning. That’s a gain of more than $100 in one day. This market could come crashing down in a very nasty way.

11 November 2013, 12:52pm,

There’s a new story on BusinessInsider.com which discusses the recent theft and loss of the digital currency. It cites recent examples, including:

The Brief History of Bitcoin Theft

There’s a new story on BusinessInsider.com which discusses the recent theft and loss of the digital currency. It cites recent examples, including:

- Nov 2013, China: Bitcoin exchange GBL went offline, taking $4.1m in client accounts with it

- Nov 2013, Australia: a Bitcoin exchange run by an 18-year-old with the username ‘Tradefortress’ claims to have lost $1m of client money

- Nov 2013, Czech Republic: Bitcoin exchange Bitcash.cz declared that hackers stole ‘an undisclosed sum’ which was stored in clients’ wallets

- Oct 2013, USA: Whilst it wasn’t theft, the FBI seized nearly $29m in Bitcoins from Silk Road, an alleged online drugs market place. For more on this Silk Road story, see below.

11 November 2013, 6:29pm,

MoneyWeek.com are running an interesting story on the ‘spectacular rise of Bitcoin’.

It’s a fairly sceptical read, maybe that’s why we like it. However, it does help to point out some of the pitfalls of the e-currency such as:

The Rise and Rise of Bitcoin

MoneyWeek.com are running an interesting story on the ‘spectacular rise of Bitcoin’.

It’s a fairly sceptical read, maybe that’s why we like it. However, it does help to point out some of the pitfalls of the e-currency such as:

- The fact that users seem to be hoarding the currency rather than spending it.

- The bigger it gets, and the more notorious it gets, the greater the likelihood of increased regulation. With regulation, the digital currency quickly loses one of it’s major advantages.

10 October 2013, 2:23pm,

Bitcoins are down around 9% following an FBI raid on ‘Silk Road’, a dark market for drugs where the digital currency was popular.

For more on this see, the Telegraph article Bitcoin Tumbles on Closure of Drugs Black Market.

Bitcoin Tumbles 9%

Bitcoins are down around 9% following an FBI raid on ‘Silk Road’, a dark market for drugs where the digital currency was popular.

For more on this see, the Telegraph article Bitcoin Tumbles on Closure of Drugs Black Market.

7 July 2013, 5:44pm,

Looks like a new first for the SEC, charging someone for a Bitcoin ponzi scheme.

The SEC alleges that Trendon T. Shavers, founder of Bitcoin Savings and Trust (BTCST), raised at least 700,000 Bitcoin in BTCST investments, i.e. more than $4.5m based on the average price of Bitcoin in 2011 and 2012 when the investments were made.

Shavers promised investors up to 7% weekly interest based on BTCST’s Bitcoin arbitrage activity, which supposedly included selling to people who wanted to buy Bitcoin ‘off the radar’.

According to the SEC allegations, “BTCST was a sham and a Ponzi scheme in which Shavers used Bitcoin from new investors to make purported interest payments and cover investor withdrawals…Shavers also diverted Bitcoins for day trading in his account on a Bitcoin currency exchange, and to pay his personal expenses”.

Andrew Calamari, Director of the SEC’s New York Regional Office said “Fraudsters are not beyond the reach of the SEC just because they use Bitcoin or another virtual currency to mislead investors and violate the federal securities laws.”

Full details can be found at SEC.gov BitCoin Ponzi scheme.

Bitcoin Ponzi Scheme

Looks like a new first for the SEC, charging someone for a Bitcoin ponzi scheme.

The SEC alleges that Trendon T. Shavers, founder of Bitcoin Savings and Trust (BTCST), raised at least 700,000 Bitcoin in BTCST investments, i.e. more than $4.5m based on the average price of Bitcoin in 2011 and 2012 when the investments were made.

Shavers promised investors up to 7% weekly interest based on BTCST’s Bitcoin arbitrage activity, which supposedly included selling to people who wanted to buy Bitcoin ‘off the radar’.

According to the SEC allegations, “BTCST was a sham and a Ponzi scheme in which Shavers used Bitcoin from new investors to make purported interest payments and cover investor withdrawals…Shavers also diverted Bitcoins for day trading in his account on a Bitcoin currency exchange, and to pay his personal expenses”.

Andrew Calamari, Director of the SEC’s New York Regional Office said “Fraudsters are not beyond the reach of the SEC just because they use Bitcoin or another virtual currency to mislead investors and violate the federal securities laws.”

Full details can be found at SEC.gov BitCoin Ponzi scheme.

More Bitcoin News

This content is for information purposes only and is not intended as a recommendation to trade. Nothing on this website should be construed as investment advice.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Bitcoin CFDs

You can currently trade Bitcoin CFDs through:- Plus500

Readers should note that Plus500 have put a comment on their charts saying ‘Warning! Bitcoin value is extremely volatile’.

- You can trade this market via the Plus500 web platform and their mobile app

- Note that we use the Plus500 chart further up this page

- This market is based in US dollars

- Spread: about 1.47% either side of the underlying market on the BTC-e exchange

- Initial Margin: 10.00%

- Leverage: 1:10

- Expiry: Monthly (but subject to change)

- AvaTrade

According to AvaTrade, “this is a highly volatile currency”.

- You can trade this market though MetaTrader 4 (MT4) and AvaTrader

- This market is based in US dollars

- Available 5 days a week

- Leverage: Up to 20:1

- eToro (Long-Term Trading only?)

Readers should note that the execution of trades is rather unusual for the eToro BTC market:

- Their trading team executes the trades at 6am, 12pm, 6pm and 12am GMT

- Trades are not executed at weekends or bank holidays, i.e. when BTC markets are normally still open

According to the eToro site, “price changes between those execution times will not affect the order execution price, and therefore we recommend looking at longer term price trends when considering your investment”.

Bitcoin Binary Bets and Binary Options

Like Spreadex (see below), IG closed their BTC markets in 2013.In November 2014 though…IG did a u-turn and re-opened a number of Bitcoin binary betting markets. You can now trade:

- XBT/USD

- XBT/GBP

- XBT/EUR

- XBT/JPY

- XBT/CNH

Bitcoin Spread Betting

Please note that Spreadex have currently suspended their Bitcoin market.It was suspended in mid-November 2013 after the company reached their risk limits.

I am told by one of the Spreadex traders that they may re-open the market but they need clients to start closing their positions first.

So it sounds like a lot of investors are long and happy to wait for the market to go up.

And, whilst I haven’t been told the following, my guess is that this market won’t be available for quite some time. If they have had problems hedging their book, they could easily be nursing a black-eye and won’t be in a hurry to re-open the book.

- You cannot apply a stop loss to this market

- You can go long (buy) and short (sell)

- There is only a daily rolling market – if you roll a trade overnight the interest is charged at 5% + 1Month LIBOR

- Minimum stake: 50p

- Spread: 2.5% either side of the underlying market on the MtGox exchange

- Margin: 50%, a £1 spread bet on Bitcoin price movements at around the £90 level would require a £45 deposit to trade

- They are consistently losing money, and/or

- Clients aren’t trading the market much and the fees set by the relevant exchange get too high

About Bitcoin – Definitions, FAQs and Resources:

- Bitcoin

-

- According to the Wired.com Rise and Fall of Bitcoin article, Satoshi Nakamoto is the pseudonym for the unknown developer(s) who designed the original Bitcoin protocol in 2008

- The Bitcoin network was launched in 2009

- Bitcoin is defined as an “open source peer-to-peer electronic money and payment network”

- Coins are entirely unique

- Bitcoin is sometimes refered to as a ‘cryptocurrency’ because of the way cryptography is used to secure transactions

- Because it is a decentralised digital currency, some internet users and businesses use it as a substitute for government-backed currencies

- There is growing evidence showing that BTC transactions are traceable / not entirely anonymous

- Also see the short video guide to Bitcoin below

- Bitcoin’s Appeal

-

- There is no central bank to control supply

- Governments do not currently apply any tax

- Bitcoin are created at a steady rate. 21m coins will be created in total and then the mining process will stop. This means there should be no monetary easing / quantitative easing of Bitcoin

- In essence, the currency is viewed by some as ‘digital gold’ and, therefore as a potential inflation/devaluation hedge

- Bitcoin Exchanges

-

- MT.GOX – based in Japan, Mt.Gox calls itself “the world’s most established Bitcoin exchange” – a warning, as of early 2014, this exchange seems to be having a lot of problems, see comments above.

- Bitstamp – a European based exchange

- BTC-E – a popular Bulgarian based exchange which a number of spread betting and CFD firms also use for their Litecoin prices

- Camp BX – a US based exchange which allows short selling and (high risk) margin trading

- BTC China – the largest Chinese exchange

If you are interested in the ‘arbs’ between the different exchanges take a quick look at our view of Bitcoin arbitrage.

- Bitcoin Forums, News and Social Media

-

- BitcoinTalk – this is the original forum set up by the Satoshi Nakamoto and is still rather active. It covers ‘Development and Technical’ discussions as well as discussions on Mining and Trading

- We offer some analysis of the Bitcoin market above

- For a quick price update, or to review historic price movements, see the live Bitcoin chart above

- On Twitter, try searching for #BTC and #Bitcoin, both searches yield a lot of tweets

- Google+ is quite active when it comes to digital currencies e.g.

- The Gold and Silver bugs community on Google+ is fairly well managed, it covers digital currencies including BTC

- The Bitcoin community on Google+ is one of a number of Bitcoin communities, try to ignore the spam in there

- Just try a Google+ search for ‘Bitcoin’

- Bitcoin Symbols and Subunits

-

- Both BTC and XBT are commonly used Bitcoin symbols

- ฿ is also used, this is the same symbol as the Thai Baht. If you want to write this Bitcoin symbol in html use ฿

- In the same way a dollar can be subdivided into 100¢, a Bitcoin can be subdivided into 100,000,000 Satoshis

- Bitcoin Technical Analysis

-

- For traders who like their technical analysis, bitcoinwisdom.com has some very useful live charts

- The charts are free and you can quickly add indicators like Moving Averages and MACDs. Naturally you can view the chart across various time periods

- The site is also useful because you can get different charts for different exchanges e.g. Mt.Gox, Bitstamp, BTC-e and Huobi (i.e. BTC/CNY)

- Bitcoin Wallet

- A collection of Bitcoin addresses is known as a wallet

- Blockchain.info

-

This is one of the most useful resources with a lot of data and answers.

- You can get downloads of historic price data

- You can compare prices between 4 of the largest exchanges, i.e. MT.GOX, Bitstamp, BTC-E and Camp BX see markets.blockchain.info

- “How many / how much…” Blockchain.info can answer a large number of these question with live data, charts and data that you can download e.g.

(Ignore the chat though, it’s very low quality, with a lot of spam and abuse)

- How to Buy Bitcoins

-

In practice, this seems to be easier said than done and there are a lot of complaints, also see Patience Needed if You Want to Buy Bitcoin.

- How Much is a Bitcoin Worth / What is the Current Bitcoin Price?

-

- For the latest view of the market see the Bitcoin analysis above

- For real-time data see the live BTC chart and prices above

- The prices on the exchanges can, and do, vary, see Bitcoin Exchanges

- To compare prices between 4 of the largest exchanges, our Blockchain.info review above

- How Many Bitcoins are Currently in circulation?

-

- There are a fixed number of ‘coins’

- A total of approximately 21m coins will be created, and then no more new coins will be made

- As of 17 Dec 2013, 15.05, UK time, there were 12,097,875 coins in circulation

- For more on this see our Blockchain.info review above

- How Many? / How Much?

- Blockchain.info is a good website with a lot of useful data and answers, see our Blockchain.info review above.

- Trading Hours

-

Bitcoin exchanges are typically traded 24 hours a day, 7 days a week.

Note that the exchanges do close fairly regularly for short periods of maintenance.

- Why Are There Bitcoin Arbitrage Opportunities?

-

Well…there are and there aren’t.

The Blockchain.info markets page is useful if you want to compare some of the leading exchanges.

At the moment, it’s not uncommon to see a set of prices like this:

Note that the Mt.Gox price is often the highest.

Of course, with so many Bitcoin transactions, why are the prices so different? You might be saying to yourself, “If the markets are genuine then I should be able to make a profit through arb’ing the market”

In short, it seems as though it is more difficult to get your money out of the Mt.Gox exchange and therefore arbitrage opportunities are not so simple.

This Forbes article explains quite nicely why the Mt.Gox exchange prices are different, Do Bitcoins violate a fundamental economic law?

For more on this topic, also see our guide to arbitrage.

Video Guide to Bitcoin

A short video explaining the basics of Bitcoin:

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.