Losses can exceed deposits

Looking at Financial Spreads…

One option is Financial Spreads, the UK financial spread betting and CFD trading company.

- Financial Spreads Trading Offer

- Financial Spreads Review

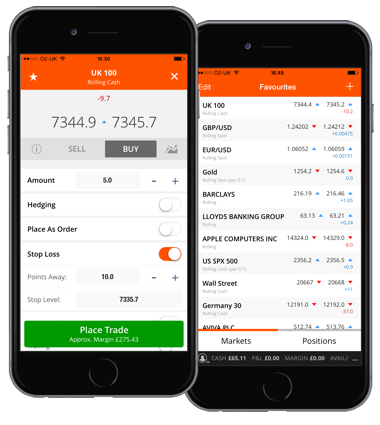

- Mobile Apps

- Financial Spreads Platform

- Advanced Charts

- User Ratings on Financial Spreads

- User Comments on Financial Spreads

- CFD Trading with Financial Spreads

- Financial Spreads Account

- Financial Spreads Markets

- Client Money Protection

- Financial Spreads Stability

- Regulation

Financial Spreads 25% Trading Rebate (New and Old Clients)

25% Trading Rebate: All Spread Betting, CFD and Forex Trades for the Next 30 Days

- APPLY – Apply for a Financial Spreads account

- DEPOSIT – Make a “Qualifying Deposit” in your Financial Spreads account, i.e. deposit £250 ($300, €300) between 1 January 2018 and 31 May 2018

- TRADE – Once you have made a Qualifying Deposit, trade as normal over the next 30 days and then just claim your rebate

Just contact Financial Spreads within 60 days of making your Qualifying Deposit to claim your 25% rebate bonus.

The trading rebate is 25% of the spread of all your trades made during the 30 days after your Qualifying Deposit.

When the rebate bonus has been added to your Financial Spreads account, there are no further release criteria and you can withdraw the rebate.

Multiple Deposits Are OK

Multiple deposits will count towards the £250 ($300, €300300) qualifying deposit.

E.g. if you make a £250 deposit and then a £250 deposit at a later date (but before 31 May 2018), the 30 days will start from when your total 2018 deposits are at least £250.

Accounts are subject to status. See site for full Terms and Conditions.

Losses can exceed deposits

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary

Financial Spreads Review

- Tax free investments, i.e. no stamp duty, no capital gains tax and no income tax

- You can buy or sell indices, shares, forex and commodities

- No commissions

- A wide range of global markets, for more details see Financial Spreads markets.

Financial Spreads Platform Highlights

They highlight the following as key features of their spread betting service:- 25% Rebate – a one off rebate for your first month that is pretty easy to get if you deposit £250 (see details above). The rebate is based on your trading volume so not great for low volume traders but useful for medium-high volume traders.

- Monthly Rebate up to 20% – this is one of the more generous / easy to get monthly rebates and good for higher volume traders – see Financial Spreads for details

- Tight Spreads – e.g. 0.7pts on EUR/USD and 0.8pts on the UK 100 (FTSE 100)

- Trading Apps for the iPhone, iPad and Android based mobiles and tablets

- 24 hour trading – including popular forex and commodity markets (but not all markets)

- More than 1,000 markets

- Spread Betting and CFDs from one account

- Advanced Charts

- Stop Losses automatically added to all trades – you can ask their Customer Support to switch these off

- Free demo accounts

- Small stake sizes e.g. from £0.5/pt

- Low initial margin requirements

- A choice or 1 or 2-click trading

- Daily rolling contracts – spread bets and CFDs

- Guaranteed Stop Loss orders – for most but not all markets

- Trailing Stops – these cannot be Guaranteed Stops

- FinancialSpreads.com – a user-friendly website

And the “could do better” areas:

- No MT4

- If you spread bet on individual shares they cover the FTSE 100 and a lot of US firms and the top 50 eurozone shares… but that’s about it. Few individual shares in any other country

- I’d like to see faster charts on the apps… but I think I complain about slow charts on all brokers’ apps.

Financial Spreads Services |  |

| Average User Rating | 7.6 |

| New Account Offer |  |

| 24 Hour Trading |  |

| Live Charts |  |

| iPhone App |  |

| iPad App |  |

| Android Apps |  |

| Web Platform |  |

| Stop Loss Available |  |

| Automatic Stop Loss |  |

| Credit Account |  |

| Deposit Account |  |

| FCA Authorised and Regulated |  |

Financial Spreads Mobile Trading Apps

- Opening and closing trades

- Checking live prices

- Accessing live charts

- Viewing and amending open positions

- Setting orders-to-open

- Creating new, and updating existing, stop loss and limit orders

- Reviewing your account history, P&L etc.

- You can save your password for easy access

- You can use the app for spread betting and CFDs (switch between the asset classes via the Settings page)

- iPhone and iPad (requires iOS version 7 or later)

- Android mobiles and tablets (requires Android version 4 or later)

User Ratings & Comments on Financial Spreads

Add Your View – feel free to add any questions and/or comments on Financial Spreads here:Readers can leave comments by logging in securely to their Facebook, Twitter or Intense Debate accounts (CleanFinancial does not see, or keep a record of, your login details).

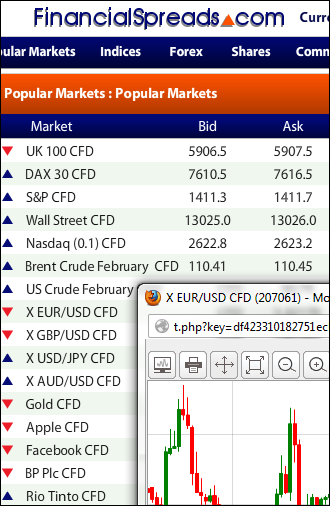

Financial Spreads – Advanced Charts

The charts offer a variety of user friendly features and tools such as:- A variety of time periods e.g. 1 minute, 2 minute, 5 minute, 30 minute, 1 day, 1 week etc.

- Different displays e.g. they default to candlesticks but you can choose bar and line chats

- Drawing tools e.g. pitchfork, Fibonacci time zones, arcs and fans

- Key chart overlays e.g. Ichimoku Clouds, Moving Averages, Bollinger Bands, Linear Regression etc.

- A wide selection of secondary charts e.g. MACD, RSI, Historical Volatility, Chaikin Money Flow, Price Volume Trend etc.

For rolling index markets like UK 100, Wall St and the Germany 30 the data goes as far back as 2012 but that should be enough for most spread bettors.

Sample Financial Spreads Chart

Lower Cost CFD Trading with Financial Spreads

As well as a comprehensive spread betting service, Financial Spreads also lets clients trade CFDs on stock market indices, forex, shares and commodities (more than 1,000 CFD markets).Like spread betting, CFD trading offers an alternative to traditional share trading. With CFDs you do not own the underlying market and you don’t put up the full value of the shares that you are buying or selling.

With normal CFD trading the main costs are the commission and the spread (the difference between the sell and buy price). The higher the commission and wider the spread, the more it costs you to trade.

If you trade CFDs with Financial Spreads note that they do not charge any commissions and they have some of the tightest spreads available. For example, the spread applied to FTSE 100 shares is just 0.05% either side of the underlying market.

With Financial Spreads CFDs you can also benefit from:

- Trading an exact quantity of shares or lot sizes

- Low minimum margin rates

- No stamp duty*

Financial Spreads Account

Why open a spread betting account with Financial Spreads? Here’s what they say:We aim to keep our spreads tight to give traders more room for profit (with tighter spreads, a market does not have to move as far before a trade is profitable).

Investors can trade a wide variety of markets including shares, stock market indices, commodities and forex markets.

Whether you’re an experienced FX or commodities trader, or new to spread betting and want to trade on shares or whole stock markets, we aim to provide competitive pricing on simple user-friendly web and app platforms together with a friendly and efficient service.”

FinancialSpreads Markets

Below, here you will find a sample of the markets offered by FinancialSpreads along with their typical in-hours spread size and the minimum stake for that market. See FinancialSpreads.com for full details.- Other index markets e.g. Euro Stoxx 50

- Futures markets e.g. UK 100 Future, Wall St. Future, DAX Future, US Tech 100 (NASDAQ) Future etc.

- Index Differentials e.g. “Wall St 30/UK 100”, “Germany 30/UK 100” etc.

Typical In-Hours Forex Spread Sizes with Financial Spreads |  |

| EUR / USD Daily | 0.7 |

| GBP / USD Daily | 1 |

| EUR / GBP Daily | 0.8 |

| USD / JPY Daily | 0.8 |

| Forex minimum stake | £1 |

Also see Company Prices – Notes and Comments.

About Financial Spreads – Client Money Protection, Stability & Regulation

Losses can exceed deposits

Financial Spreads was founded in 2007.

Client Money Protection

Financial Spreads is a trading name of Clear Investor Ltd. which is an appointed representative of FINSA Europe Ltd (Finsa).

Finsa is authorised and regulated by the Financial Conduct Authority (FCA) and complies with the FCA’s strict rules on client money.

This means clients can rest assured that their funds are fully segregated and ring fenced.

The result is that it is not only the funds that are deposited with Financial Spreads but the total net available funds that are held completely separately, i.e. the net position on any open trades calculated on a mark-to-market basis plus account balance are ring fenced.

This also means that your funds, up to £50,00, are cover by the Financial Services Compensation Scheme, For more details see FSCS.org.uk.

Registered Address: Office 701, Tower Bridge Business Centre, 46-48 East Smithfield, London E1W 1AW, United Kingdom.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.