CAC 40 Spread Betting

Where Can I Spread Bet on the CAC 40? |

At the moment, investors can spread bet on the CAC 40 with these firms:

French Stock Market Analysis and Trading News

|

| 23-Mar-18 |

[8:49am] French CAC 40 Daily Report- The French CAC 40 is currently trading at 5,092.9.

- In the last session, the market closed down -147.9pts (-2.83%) at 5,074.0.

30 Minute Chart Analysis

The stock market is trading above the 20 period MA of 5,087.9 and below the 50 period MA of 5,129.6. The stock market is trading above the 20 period MA of 5,087.9 and below the 50 period MA of 5,129.6.

1 Day Chart Analysis

The index is trading below the 20 DMA of 5,214.6 and below the 50 DMA of 5,264.5. The index is trading below the 20 DMA of 5,214.6 and below the 50 DMA of 5,264.5.

Update by Gordon Childs, Editor,

|

| 09-Oct-17 |

[12:15pm] French CAC 40 Daily Update- The French CAC 40 is currently trading at 5,356.2.

- In the last session, the market closed up 3.1pts (0.06%) at 5,366.9.

1 Day Indicator Analysis

The stock market is currently higher than the 20-DMA of 5,305.2 and higher than the 50-DMA of 5,194.6. The stock market is currently higher than the 20-DMA of 5,305.2 and higher than the 50-DMA of 5,194.6.

Update by Gordon Childs, Editor,

|

| 16-Jul-13 |

[1:39pm] A quick video update discussing the latest European car sales data:

Update by Alastair McCaig, Market Analyst,

|

| 15-Jul-13 |

[8:42am] A quick video update on the overnight Chinese data and the latest Euro zone problems.

Update by Ishaq Siddiqi, Market Analyst,

|

| 15-May-13 |

[10:00am] Eurozone Q1 GDP: -0.2% (-0.1% expected).

Update by Gordon Childs, Editor,

|

» For more see Stock Market Trading News & Analysis.

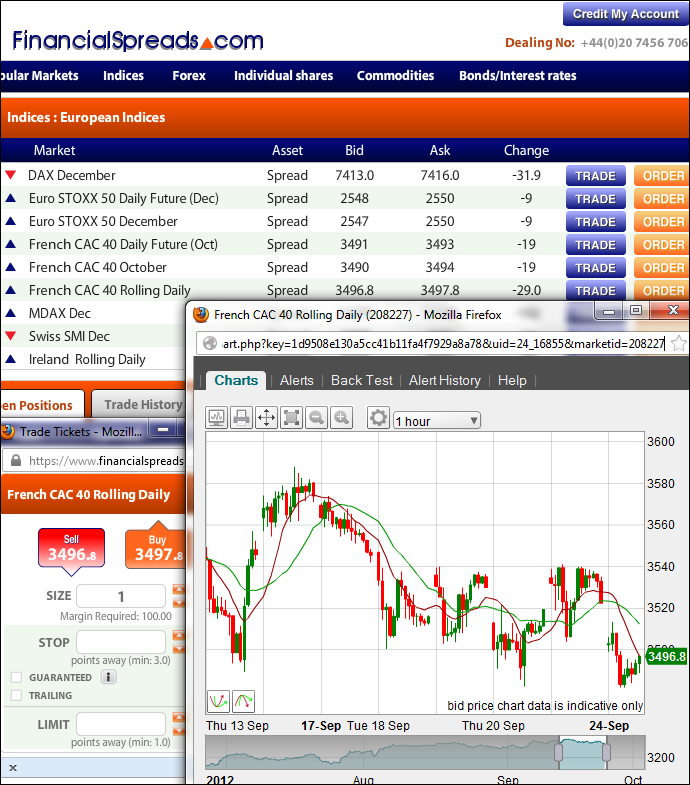

Where Can I Find Live Prices and Charts for the CAC 40? |

We do show reasonably accurate prices above, see CAC 40 prices.

The live CFD chart below also provides readers with a useful insight into the French stock market.

The above chart, provided by Plus500, usually tracks the near-term CAC 40 futures price.

If you want live financial spread betting charts and prices for the CAC 40, you will generally need a financial spread betting account.

Also, a spreads account gives you access to shorter-term/spot CAC markets. Note that accounts are subject to status and suitability checks.

Should your application be approved then, once logged on, you will be able to view the real-time trading charts and prices. On most platforms, these will be free. What's the catch? You might receive the occasional email or sales call from your chosen financial spread betting provider.

If you do decide to trade then, before you start, you should be aware that financial spread betting and contracts for difference involve a high degree of risk to your capital and losses could exceed your initial investment.

Advanced Charting Packages for the CAC 40 |

Though the charting packages tend to vary from firm to firm, to help you with your technical analysis, the majority of charts come with useful tools such as:

- A wide range of time periods such as 1 minute, 3 minutes, 15 minutes, 1 day etc.

- Drawing tools and features such as trendlines, Fibonacci fans, arcs and time zones

- A variety of chart types such as line charts and candlestick charts

Charts offered by FinancialSpreads.com also have more advanced features such as:

- Custom Indicators, Back Testing and Analysis tools

- Custom Alerts for when your chosen market hits a pre-set level

- Key overlays such as EMAs, MAs, Ichimoku Clouds, Wilder's Smoothing etc.

- A wide selection of indicators such as Standard Deviation, Range Indicator, Stochastic, Chaikin Volatility, Forecast Oscillator, Volume Index etc.

French CAC 40 Stock Market Chart

The spread trading firms listed below offer users real-time charts and prices:

Advert:

French Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the CAC 40 with

Financial Spreads.

|

Where Can I Spread Bet on the CAC 40 for Free? |

Trading the stock markets always involves a degree of risk, however, if you'd like to open a Demo Account, that lets you trial spread trading, then see below for more details.

When thinking about which investment option might work for you, also remember that financial spread betting in the UK is free of capital gains tax, stamp duty and income tax*.

If you want to try a free trading platform then note that you can speculate on the CAC 40 without paying any brokers' fees via:

If you want to open a free Test Account to try financial spread betting, including markets like the CAC 40, then have a closer look at:

All of the above spread trading firms offer a risk free Demo Account that lets investors access professional level charts, apply a variety of orders and try out new trading theories.

How to Spread Bet on the CAC 40? |

As with a wide variety of global financial markets, it is possible to spread bet on indices, such as the CAC 40, to either increase or decrease.

If we go to a platform like InterTrader, we can see they are currently valuing the CAC 40 Rolling Daily market at 3531.3 - 3532.3. As a result, you can put a spread bet on the CAC 40 market:

Rising above 3532.3, or Rising above 3532.3, or

Falling below 3531.3 Falling below 3531.3

When spread betting on the CAC 40 index you trade in £x per point. Therefore, if you chose to have a stake of £5 per point and the CAC 40 moves 35 points then that would change your profit/loss by £175. £5 per point x 35 points = £175.

Rolling Daily Index Markets

One important thing to note is that this is a Rolling Daily Market and so there is no closing date for this market. If your position is still open at the end of the day, it will roll over to the next session.

If your spread bet does roll over and you are speculating on the market to:

Go higher - then you will often be charged a small financing fee, or Go higher - then you will often be charged a small financing fee, or

Go lower - then you'll often receive a small payment to your account Go lower - then you'll often receive a small payment to your account

For a more detailed example see Rolling Daily Spread Betting.

Let's take the above spread of 3531.3 - 3532.3 and make the assumptions:

- You have done your analysis of the French stock market, and

- You feel that the CAC 40 index will move above 3532.3

If so, you may decide to buy at 3532.3 for a stake of £3 per point.

With such a spread bet you make a profit of £3 for every point that the CAC 40 index increases higher than 3532.3. Of course, it also means that you will lose £3 for every point that the CAC 40 market decreases below 3532.3.

Looked at another way, if you ‘Buy’ a spread bet then your profit/loss is calculated by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that difference in price by the stake.

As a result, if after a few hours the French index started to move upwards then you could choose to close your spread bet in order to secure your profit.

Therefore, if the French stock market moved up then the spread, set by the spread trading company, might change to 3572.9 - 3573.9. In order to close your position you would sell at 3572.9. Accordingly, with the same £3 stake you would calculate your profit as:

P&L = (Settlement Price - Initial Price) x stake

P&L = (3572.9 - 3532.3) x £3 per point stake

P&L = 40.6 x £3 per point stake

P&L = £121.80 profit

Speculating on stock market indices, whether by spread betting or otherwise, is not simple. In this example, you wanted the index to increase. Nevertheless, it might decrease.

If the CAC 40 index had started to drop then you might decide to settle/close your position in order to restrict your losses.

If the market dropped to 3486.4 - 3487.4 then you would settle your position by selling at 3486.4. Accordingly, your loss would be:

P&L = (Settlement Price - Initial Price) x stake

P&L = (3486.4 - 3532.3) x £3 per point stake

P&L = -45.9 x £3 per point stake

P&L = -£137.70 loss

Note - CAC 40 Rolling Daily spread betting market correct as of 28-Nov-12.

Advert:

French Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the CAC 40 with

Financial Spreads.

|

How to Spread Bet on the France 40 - Example 2 |

Looking at a spread trading site like Capitalspreads, you can see they are offering the France 40 Rolling Daily market at 3442.0 - 3443.0. Therefore, you can put a spread bet on the France 40 index:

Increasing above 3443.0, or Increasing above 3443.0, or

Decreasing below 3442.0 Decreasing below 3442.0

When spread trading on the France 40 index you trade in £x per point. So, if you invest £2 per point and the France 40 moves 31 points then that would be a difference to your bottom line of £62. £2 per point x 31 points = £62.

Now, if we think about the spread of 3442.0 - 3443.0 and assume:

- You've completed your stock market analysis, and

- Your analysis suggests the France 40 index will go above 3443.0

Then you might decide to go long of the market at 3443.0 and risk, let’s say, £2 per point.

With such a spread bet you win £2 for every point that the France 40 index pushes higher than 3443.0. On the other hand, it also means you will lose £2 for every point that the France 40 market moves below 3443.0.

Looked at another way, if you were to buy a spread bet then your profit/loss is found by taking the difference between the closing price of the market and the initial price you bought the market at. You then multiply that difference in price by your stake.

Therefore, if after a few days the French stock market started to increase then you might think about closing your trade in order to guarantee your profit.

Taking this a step further, if the market rose then the spread, set by the spread trading company, might change to 3489.5 - 3490.5. You would settle your position by selling at 3489.5. So, with the same £2 stake your profit would be calculated as:

P&L = (Settlement Level - Initial Level) x stake

P&L = (3489.5 - 3443.0) x £2 per point stake

P&L = 46.5 x £2 per point stake

P&L = £93.00 profit

Trading indices, whether by spread betting or not, is not straightforward. With the above, you wanted the French index to increase. However, the index could fall.

If the France 40 market began to drop then you might choose to close your position to limit your losses.

So if the spread fell to 3389.6 - 3390.6 then this means you would settle your position by selling at 3389.6. If so, your loss would be calculated as:

P&L = (Settlement Level - Initial Level) x stake

P&L = (3389.6 - 3443.0) x £2 per point stake

P&L = -53.4 x £2 per point stake

P&L = -£106.80 loss

Note: France 40 Rolling Daily spread betting market accurate as of 18-Oct-12.

How to Spread Bet on French Shares |

If you want to invest in French shares, e.g. Societe Generale, then you could spread bet on the share price.

Looking at a website like Tradefair, we can see that they are valuing the Societe Generale Rolling Daily market at €32.40 - €32.48. This means that an investor could put a spread bet on the Societe Generale share price:

Increasing above €32.48, or Increasing above €32.48, or

Decreasing below €32.40 Decreasing below €32.40

Whilst spread betting on French shares you trade in £x per cent. Therefore, if you chose to risk £3 per cent and the Societe Generale share price moves €0.36 then that would alter your profit/loss by £108. £3 per cent x €0.36 = £108.

Note that you are also able to spread bet on this market in Dollars or Euros, e.g. €x per cent.

Rolling Daily Shares Markets

Note that this is a Rolling Daily Market and therefore there is no preset closing date for this market. If your position is still open at the end of the day, it will simply roll over to the next trading day.

If your position is rolled over and you are speculating that the market will:

Rise - then you usually pay a small overnight financing fee, or Rise - then you usually pay a small overnight financing fee, or

Fall - then a small payment is normally credited to your account Fall - then a small payment is normally credited to your account

For more information on Rolling Daily Markets, and a fully worked example, please see Rolling Daily Spread Betting.

Societe Generale Rolling Daily - French Shares Trading Example |

So, if we consider the above spread of €32.40 - €32.48 and make the assumptions:

- You have analysed the stock market, and

- Your research suggests that the Societe Generale share price looks like it will move higher than €32.48

Then you could decide that you are going to buy at €32.48 and risk, for example, £3 per cent.

With such a spread bet you make a profit of £3 for every cent that the Societe Generale shares go above €32.48. Nevertheless, it also means that you will lose £3 for every cent that the Societe Generale market falls below €32.48.

Considering this from another angle, should you buy a spread bet then your profits (or losses) are found by taking the difference between the settlement price of the market and the initial price you bought the market at. You then multiply that price difference by your stake.

As a result, if after a few days the stock started to increase then you might think about closing your position in order to lock in your profit.

So if the market moved up then the spread, set by the spread betting company, could change to €32.80 - €32.88. You would settle your position by selling at €32.80. Therefore, with the same £3 stake:

Profit / loss = (Settlement Value - Opening Value) x stake

Profit / loss = (€32.80 - €32.48) x £3 per cent stake

Profit / loss = €0.32 x £3 per cent stake

Profit / loss = 32c x £3 per cent stake

Profit / loss = £96 profit

Financial spread trading can fail to go to plan. In this case, you had bet that the share price would rise. However, it could fall.

If the Societe Generale shares had fallen then you might choose to close your position to limit your losses.

If the market fell to €32.11 - €32.19 then you would sell back your position at €32.11. As a result, your loss would be:

Profit / loss = (Settlement Value - Opening Value) x stake

Profit / loss = (€32.11 - €32.48) x £3 per cent stake

Profit / loss = -€0.37 x £3 per cent stake

Profit / loss = -37c x £3 per cent stake

Profit / loss = -£111 loss

Note - Societe Generale Rolling Daily market taken as of 23-Jan-13.

Spread Betting on French Companies |

Simply click on the company you're interested in spread betting on.

As well as live charts and prices, we talk you through the most popular spread betting questions for that French company:

| Company Name |

Symbol |

French Shares

Spread Betting Guides » |

Charts &

Prices |

Individual Shares Spread Betting Guides |

For more individual equities guides, also see:

Advert:

French Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the CAC 40 with

Financial Spreads.

|

'French Stock Market Spread Betting' edited by Jacob Wood, updated 23-Mar-18

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

French Stock Market Spread Betting

French stock market spread betting guide with daily market updates. Plus live charts & prices for the CAC 40 and French shares as well as where to spread bet on the Paris stock market commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|