Stock Market Futures

Notation: In futures trading, spread trading and CFD trading, the FTSE 100 is often referred to as the 'UK 100'. Likewise, the Dow Jones is often referred to as 'Wall Street', the 'US 30' and 'USA 30'.

Indicative Stock Market Prices |

Stock Market Spreads Comparison |

The table below compares the 'spread size' and minimum stakes for the popular stock market indices. Readers should note that we have mostly compared the 'daily' markets rather than the futures markets. This is simply because the short-term markets tend to be more popular with investors.

| FTSE 100 (UK 100) Daily |

0.8 |

1 |

1 |

2 |

| Dow Jones (Wall St) Daily |

1 |

1 |

1 |

1.4 |

| DAX 30 (Germany 30) Daily |

1 |

1 |

1 |

1 |

| S&P 500 (SPX 500) Daily |

3 |

4 |

5 |

5 |

| NASDAQ 100 (US Tech 100) Daily |

5 |

4-10 |

3 |

1 |

| CAC 40 (France 40) Daily |

0.8 |

1 |

1 |

1 |

| ASX 200 (Australia 200) Daily |

1 |

5 |

3 |

1 |

| Japan 225 Daily |

8 |

8 |

13 |

5 |

| Hong Kong Daily |

8 |

10 |

20 |

7 |

| Stock Indices - Minimum Stake |

£1 |

£1 |

£0.5 |

£1 |

Comparison Notes.

- this table is not meant to be inclusive, index trading may be available through other brokers.

Where to Trade Stock Market Futures |

Using a spread trading account, you can trade stock market futures with these companies:

Financial Spreads » "With FinancialSpreads.com you get all the advantages of

Spread Trading as well as commission free CFD Trading on 2,500+ markets, 24 hour trading, professional level charts and..." read

Financial Spreads review.

|

Where to Trade Stock Market Futures for Free? |

Trading stock market futures always involves an element of risk. However, if you'd like to open a Demo Account, that allows you to try out the futures markets, then see below.

If you are based in the UK and trade the futures markets using a spread trading account, your trading will be tax-free*. Financial spread trading is currently exempt from income tax, stamp duty and capital gains tax*.

If you're trying to find a low cost futures platform, keep in mind that you can trade stock market futures commission-free and without any broker's fees with these companies:

If you are interested in a free Test Account where you can practice trading markets like the FTSE futures, Dow futures, S&P 500 futures and DAX futures, then take a closer look at:

All of the above offer a free 'Demo Account' which lets investors gain experience with futures trading.

Where to Find Live Stock Market Futures Prices and Charts |

We feature some pretty accurate 'daily' stock market prices further up this page.

Note that daily markets generally have tighter spreads than the equivalent futures market.

The live futures chart and prices below cover a range of stock markets indices.

You can use the search function to get live charts for the FTSE 100 (UK 100), DAX 30 (Germany 30), Dow Jones (USA 30), S&P 500 (USA 500), NASDAQ 100 (US-TECH 100) etc.

The above CFD chart, from Plus 500, typically follows the near-term futures market (not the spot price).

If you would like spread trading prices and charts you will normally need a spread trading account.

As mentioned above, in the UK, spread trading is tax-free*. Also, a spreads account will give you access to both futures and the shorter-term daily markets. Note that opening an account is subject to credit and status checks.

If you apply, and your application is approved, you will be able to log into the platform and check the live charts and prices. With most brokers, including the ones listed below, these will be provided for free.

If you decide to trade then, before you start, be aware that spread trading and contracts for difference carry a high degree of risk and it's possible to incur losses that exceed your initial investment.

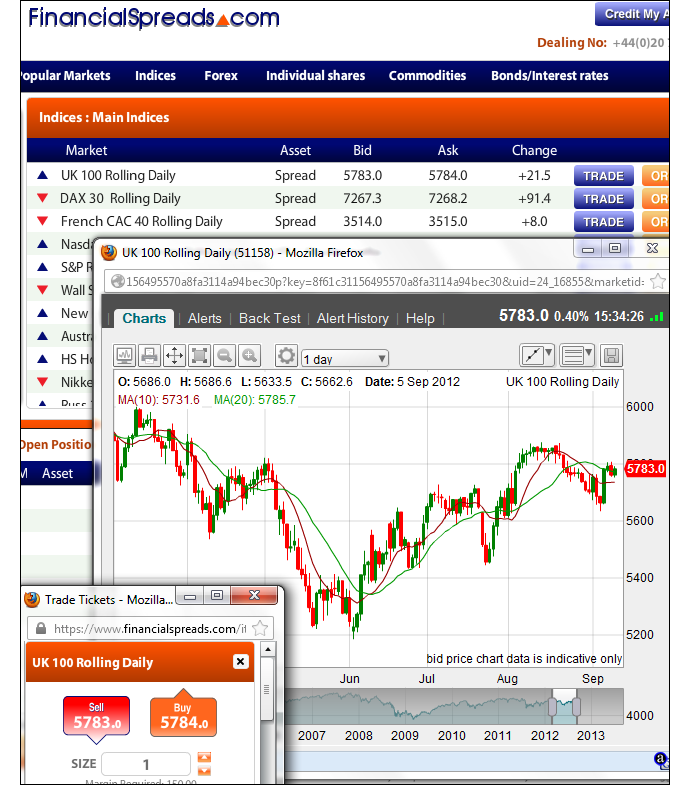

Professional Level Stock Market Futures Charts |

Despite the fact that charts can vary across the industry, in order to aid your futures trading, the charts often have valuable options like:

- A broad variety of time periods e.g. 2 minute, 15 minute, 1 hour, 2 hour, 1 day and so on

- Different chart types e.g. candlestick and line charts

- Tools for drawing/adding features e.g. Trendlines and Fibonacci Retracements

- Chart overlays and indicators e.g. MACD, TSI, Moving Average, Parabolic SAR and so on

The charts offered by Financial Spreads have further options like:

- Back Testing

- Customised alerts for when your chosen market hits a certain price

Example stock market index chart

The following brokers provide their clients with live trading charts:

Stock Market Futures Guides |

For individual guides to the most popular futures markets also see:

How to Trade Stock Market Futures |

Like many futures markets, you can speculate on stock market indices like the FTSE 100, Dow Jones, DAX 30 etc. to rise or fall.

If you go to the Capital Spreads platform, you can see that they have priced the FTSE 100 December Futures market at 5760.3 - 5764.3. This means you can speculate on the FTSE 100:

Closing higher than 5764.3, or Closing higher than 5764.3, or

Closing lower than 5760.3 Closing lower than 5760.3

On the expiry date for this 'December' market, 21-Dec-12.

With spread trading, you trade the FTSE 100 index in £x per point. So, if your stake was £3 per point and the FTSE 100 moves 25 points then that would alter your profit/loss by £75. £3 per point x 25 points = £75.

For short-term trading on the FTSE 100 also see FTSE 100 Rolling Daily Spread Trading.

FTSE 100 Stock Market Futures Example |

So, if you think about the above FTSE spread of 5760.3 - 5764.3, let's assume that:

- You have done your analysis of the UK stock market, and

- Your stock market analysis leads you to think that the FTSE 100 index will settle higher than 5764.3 by 21-Dec-12

If so, you might go long of the market at 5764.3 for a stake of, let's say, £3 per point.

With this contract you make a profit of £3 for every point that the FTSE 100 index increases and moves above 5764.3. On the other hand, you will lose £3 for every point that the FTSE 100 market falls below the 5764.3 level.

Looked at another way, with spread trading, if you 'Buy' a futures market, your profit/loss is found by taking the difference between the closing price of the market and the price you bought the market at. You then multiply that price difference by your stake.

So if, on the expiry date, the FTSE 100 market settled higher at 5809.0, you would make a profit:

Profit / loss = (Closing Price - Opening Price) x stake

Profit / loss = (5809.0 - 5764.3) x £3 per point stake

Profit / loss = 44.7 x £3 per point stake

Profit / loss = £134.10 profit

Trading stock market futures doesn't always work out as you would have liked. In this example, you wanted the UK stock market to rise. Nevertheless, the market could fall.

If the FTSE 100 index had fallen and settled lower at 5715.3, then you would end up making a loss on your contract.

Profit / loss = (Closing Price - Opening Price) x stake

Profit / loss = (5715.3 - 5764.3) x £3 per point stake

Profit / loss = -49.0 x £3 per point stake

Profit / loss = -£147.00 loss

Note: FTSE 100 December Futures price taken as of 27-Sep-12.

Dow Jones Stock Market Futures Example |

Like the FTSE futures example above, you can also speculate on the Dow Jones futures market to rise and fall.

If you log on to the Financial Spreads platform you can see that they have priced the Dow Jones March Futures market at 13342 - 13350. This means you can speculate on the Dow Jones:

Finishing higher than 13350, or Finishing higher than 13350, or

Finishing lower than 13342 Finishing lower than 13342

On the expiry date for this 'March' market, 15-Mar-13.

With spread trading, you trade Dow Jones futures in £x per point, e.g. if you trade £4 per point and the Dow Jones moves 21 points then that would make a difference to your P&L of £84. £4 per point x 21 points = £84.

For short-term trading on the Dow Jones also see Dow Jones Rolling Daily Spread Trading.

If we continue with the Dow 'March' futures spread of 13342 – 13350, let's assume you:

- Have done your analysis of the US stock market, and

- Your analysis suggests the Dow will finish higher than 13350 by 15-Mar-13

If so, you could choose to go long of the Dow Jones futures market at 13350 and risk, for the sake of argument, £3 per point.

Therefore, with this contract, you make a profit of £3 for every point that the Dow Jones index pushes above 13350. Having said that, such a contract also means that you will lose £3 for every point that the futures market falls below 13350.

Thinking of this in a slightly different way, with spread trading, should you buy a futures contract then your profits (or losses) are found by taking the difference between the closing price of the market and the price you bought the market at. You then multiply that price difference by your stake.

So if, on the settlement date the Dow Jones closed at 13388, then:

Profit = (Closing Price - Opening Price) x stake

Profit = (13388 - 13350) x £3 per point stake

Profit = 38 x £3 per point stake

Profit = £114 profit

Trading futures is rarely straight forward. In this example, you had speculated that the US index would rise. Of course, it could also fall.

If the Dow Jones fell and expired at 13317, you would end up making a loss on this contract.

Loss = (Closing Price - Opening Price) x stake

Loss = (13317 - 13350) x £3 per point stake

Loss = -33 x £3 per point stake

Loss = -£99 loss

Note: Dow Jones March Futures price accurate as of 27-Sep-12.

Financial Spreads » "With FinancialSpreads.com you get all the advantages of

Spread Betting as well as commission free CFD Trading on 2,500+ markets, 24 hour trading, professional level charts and..." read

Financial Spreads review.

|

Applying Technical Analysis to Stock Market Futures |

Below, an older but still useful case study on the FTSE futures market by Shai Heffetz, InterTrader, 3-Apr-2011.

If one looks at the price of the FTSE 100 in relation to the Ichimoku Kinko Hyo cloud in the chart below, it clearly shows that the market is currently in a declining phase.

The price is well below the cloud, which indicates that a long position at the present moment cannot be recommended.

The green Chinkou Span line is also well below the price, which supports the signal given by the Ichimoku cloud.

The stock market index started trading below the cloud after the earthquake/tsunami disaster in Japan and closed at a low of 5552.50 on 16 March. Since then it has recovered significantly, but during the last few days it has started drifting sideways with no clear direction being evident.

If the market should recover and break through the upper level Senkou Span A line of the cloud, this could indicate that the previous bull market has been restored and that we can expect further price increases.

A drop below the blue Kijun Sen line will, however, be a signal that the downward movement has gained momentum. In that case traders should look at a short position to cash in on a potentially significant price drop.

'Stock Market Futures' edited by Jenna Cutly, updated 22-Feb-17

For related articles also see:

Stock Market Futures, updated 22-Feb-17

Our stock market futures guide comes with live prices & charts. We also have a stock market futures price comparison and review where to trade commission-free and tax-free*. There are... » read guide.

About this page:

Stock Market Futures

Our stock market futures guide comes with live prices & charts. We also have a stock market futures price comparison and review where to trade commission-free and tax-free*. There are... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|