Swiss SMI Spread Betting

Where Can I Spread Bet on the Swiss SMI? |

Investors can speculate commission free on the Swiss SMI with an account from the following spread betting firms:

Swiss SMI (Switzerland 20) Trading Updates

|

| 23-Mar-18 |

[8:49am] Switzerland 20 Daily Market Update- The Switzerland 20 is currently trading at 8,565.0.

- In the last session, the market closed down -189.5pts (-2.16%) at 8,565.5.

30 Minute Indicator Analysis

The stock market is currently below the 20 period moving average of 8,610.7 and below the 50 period moving average of 8,696.4. The stock market is currently below the 20 period moving average of 8,610.7 and below the 50 period moving average of 8,696.4.

1 Day Indicator Analysis

The stock market index is below the 20 day moving average of 8,826.8 and below the 50 day moving average of 9,039.6. The stock market index is below the 20 day moving average of 8,826.8 and below the 50 day moving average of 9,039.6.

Update by Gordon Childs, Editor,

|

| 09-Oct-17 |

[12:15pm] Switzerland 20 Daily Analysis- The Switzerland 20 is currently trading at 9,250.7.

- At the end of the last session, the market closed up 5.3pts (0.06%) at 9,258.0.

1 Day Analysis

The index is currently above the 20-day moving average of 9,165.2 and above the 50-day moving average of 9,022.6. The index is currently above the 20-day moving average of 9,165.2 and above the 50-day moving average of 9,022.6.

Update by Gordon Childs, Editor,

|

» For more see Stock Market Trading News & Analysis.

Where Can I Find Live Prices and Charts for the Swiss SMI? |

The following CFDs chart and prices offers a useful guide to the Swiss SMI market.

The above chart is provided by Plus500 and typically tracks the Swiss SMI futures market (not the daily market).

If you would like to access real time spread betting prices and charts for the Swiss SMI, you can use a spread betting account.

A spreads account would also give you access to the shorter-term daily prices. Please note that opening an account is subject to suitability and status checks.

If your application is approved then you can log on to see the live prices/charts. On most platforms, these will be provided for free. The catch? You're likely to get the occasional email or sales call from the financial spread betting provider.

Of course, if you do decide to trade, remember that financial spread trading and contracts for difference do involve a high level of risk to your funds and can result in you losing more than your initial deposit.

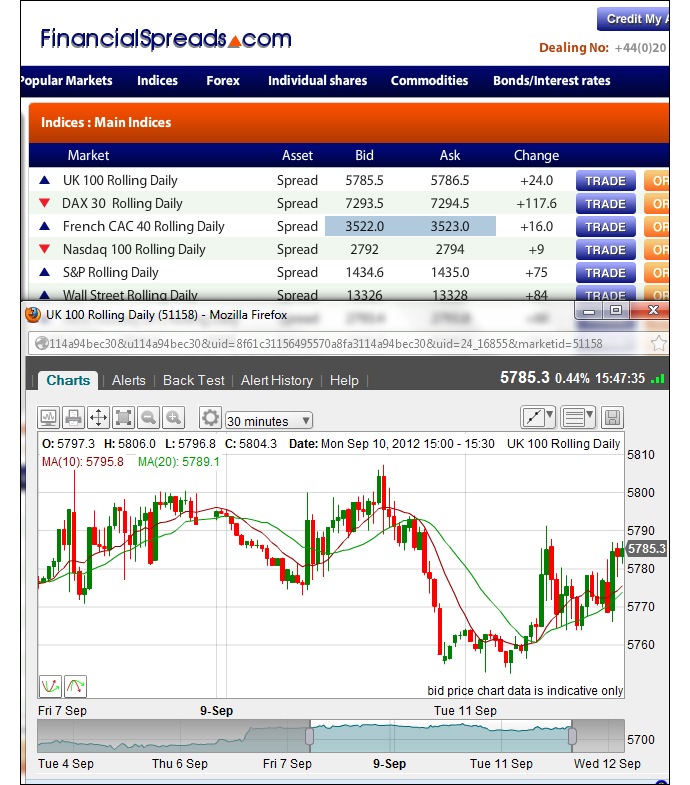

Professional Level Charts for the Swiss SMI |

Even though the specific charting packages tend to differ between firms, in order to aid your technical analysis, they usually have user friendly features that include:

- An array of time periods such as 1 minute, 1 hour, 1 month and so on

- A variety of display styles such as candle charts and line charts

- Tools for adding features such as Trendlines, Fibonacci Time Zones, Fans and Arcs

Charts on Capital Spreads also come with:

- Back Testing and Customisable Indicators

- Numerous overlays such as Moving Averages, Bollinger Bands, Envelopes and so on

- Technical indicators such as MACD, Historical Volatility, Projection Oscillator and so on

- Automated email alerts that trigger when a market hits a pre-determined level

Sample indices chart

The following spread betting firms offer their account holders live trading prices and charts:

How to Spread Bet on the Swiss SMI? |

As with many of the world's financial markets, you can place a spread bet on indices, such as the Swiss SMI, to go up or down.

Logging onto Inter Trader, we can see they are valuing the Swiss SMI December Futures market at 6551 - 6555. This means an investor can spread bet on the Swiss SMI index:

Settling above 6555, or Settling above 6555, or

Settling below 6551 Settling below 6551

On the expiry date for this 'December' market, 20-Dec-12.

When financial spread trading on the Swiss SMI index (Switzerland 20) you trade in £x per point. Therefore, if you choose to risk £2 per point and the Swiss SMI moves 32 points then that would be a difference to your P&L of £64. £2 per point x 32 points = £64.

For short term trading on stock market indices also see Stock Market Indices Rolling Daily Spread Betting.

Swiss SMI Futures - Indices Trading Example |

So, if we consider the above spread of 6551 - 6555 and assume:

- You have analysed the index, and

- Your analysis suggests that the Swiss SMI index will close above 6555 by 20-Dec-12

Then you may decide that you want to buy a spread bet at 6555 and risk, let’s say, £3 per point.

With such a spread bet you make a profit of £3 for every point that the Swiss SMI index increases higher than 6555. On the other hand, you will lose £3 for every point that the Swiss SMI market moves lower than 6555.

Looking at this from another angle, should you ‘Buy’ a spread bet then your profit/loss is worked out by taking the difference between the settlement price of the market and the initial price you bought the market at. You then multiply that difference in price by the stake.

Subsequently, if, on the closing date, the Swiss SMI market settled at 6588, then:

P&L = (Closing Value - Opening Value) x stake

P&L = (6588 - 6555) x £3 per point stake

P&L = 33 x £3 per point stake

P&L = £99 profit

Trading stock market indices, by spread trading or otherwise, may not go to plan. In the above example, you wanted the index to increase. Of course, it might decrease.

If the Switzerland 20 fell and closed at 6517, you would end up making a loss on this trade.

P&L = (Closing Value - Opening Value) x stake

P&L = (6517 - 6555) x £3 per point stake

P&L = -38 x £3 per point stake

P&L = -£114 loss

Note - Swiss SMI December Futures index market accurate as of 26-Sep-12.

Advert:

Swiss SMI Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Swiss SMI with

Financial Spreads.

|

Where Can I Spread Bet on the Swiss SMI for Free? |

By its very nature, speculating isn't risk free, however, if you would like to open a free Test Account, that allows you to trial spread trading and access charts, see below.

When looking at which trading option is right for you, don't forget that in the UK, spread trading is currently tax free*, i.e. there is no capital gains tax, stamp duty or income tax.

If you're trying to find a free spread betting site then note that you can trade the Swiss SMI commission free with providers like:

Should you want to have a look at a Demo Account / Test Account which lets you try online spread betting, including trading markets like the Swiss SMI, then have a look at:

All of the above spread betting firms currently provide a risk free Demo Account that lets investors practice with a host of orders, try out ideas and review professional charts.

Advert:

Swiss SMI Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Swiss SMI with

Financial Spreads.

|

'Swiss SMI Spread Betting' edited by Jacob Wood, updated 23-Mar-18

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

Swiss SMI Spread Betting

Swiss SMI stock market futures spread betting guide with live prices & charts. Also, where to spread bet on the Swiss SMI index commission-free and tax-free* as well as... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|