AEX Index Spread Betting

Where Can I Spread Bet on the AEX Index? |

At the moment, investors are able to speculate with no commissions or brokers' fees on the AEX Index, in addition to a host of other markets, with companies like:

AEX Index (Holland 25) Trading Updates

|

| 20-Jul-15 |

[9:29am] Holland 25 Daily Market Update- The Holland 25 is currently trading at 504.2.

- At the end of the last session, the market closed up 0.2pts (0.04%) at 500.9.

1 Day Chart Analysis

The market is above the 20-DMA of 484.2 and above the 50-DMA of 486.2. The market is above the 20-DMA of 484.2 and above the 50-DMA of 486.2.

Update by Gordon Childs, Editor,

|

» For more see Stock Market Trading News & Analysis.

Where Can I Find Live Prices and Charts for the AEX Index? |

The real-time CFDs chart and prices below will provide you with a good overview of the AEX Index.

The above chart normally uses the underlying AEX Index futures market.

If you'd like to access up-to-the-minute financial spread betting charts and prices for the AEX Index, you can use a spread trading account.

In addition, a spreads account would let you speculate on the shorter-term daily markets. Note that accounts are subject to status.

If your application is accepted then you will be able to log on and access the real-time trading charts/prices. On most platforms, these are free. So what's the catch? You could get the odd sales call and/or email from your chosen financial spread betting broker.

Of course, if you do decide to trade, be aware that financial spread betting and CFDs carry a high degree of risk to your funds and it's possible to lose more than your initial investment.

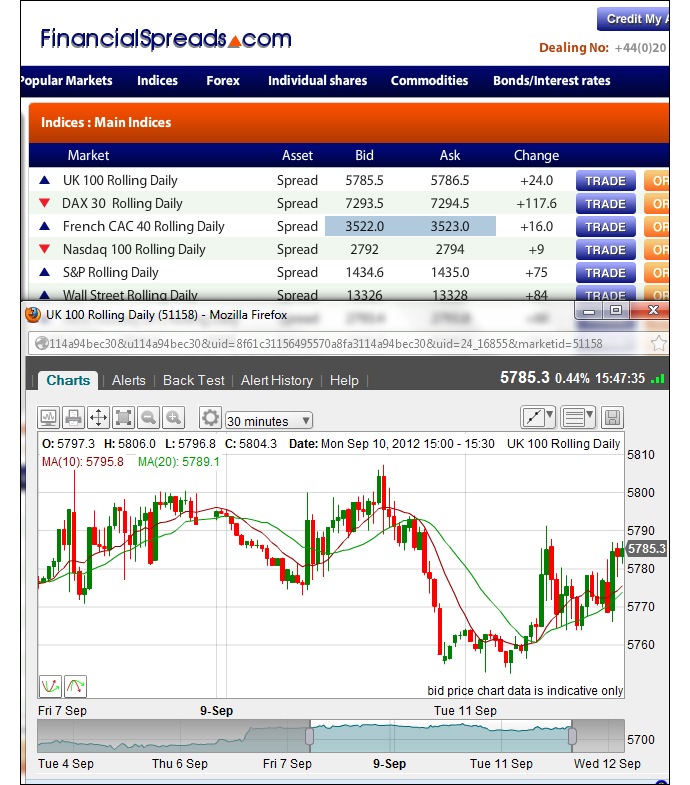

Advanced Charts for the AEX Index |

Whilst charts normally vary from provider to provider, to aid your analysis, most charts come with useful features and tools that include:

- An array of time intervals - 1 minute, 2 hours, 1 month etc

- Different display options - line charts and candlestick charts

- Drawing options - Fibonacci Retracements and Trendlines

The charts with Tradefair Spreads also offer advanced features, including:

- BackTesting, Customisable Indicators and Optimisation functions

- Key chart overlays - Ichimoku Clouds, Moving Average, Price Channels etc

- A selection of secondary charts - Chaikin's Volatility, Relative Strength Index (RSI), Projection Bands etc

- Customised alerts for when the markets hit a specific price

FinancialSpreads stock market index candlestick chart

The financial spread betting brokers in the following list give their users access to real time trading charts/prices:

Advert:

AEX Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the AEX Index with

Financial Spreads.

|

Where Can I Spread Bet on the AEX Index for Free? |

Speculating isn't risk free. Having said that, if you want to open a Demo Account (free), that lets you try spread betting on a host of markets, then see below for further details.

Furthermore, don't forget that in the UK, spread trading is currently free of tax*.

If you're looking for a free spread trading platform then keep in mind that you can speculate on the AEX Index without brokers' fees or commissions with providers such as:

If you want a completely free Demo Account where users are able to try online spread betting, including markets like the AEX Index, then look at:

Each of the firms listed above offer a risk free Test Account that allows users to try out trading theories, practice with an array of trading orders and use charts, including candlestick and bar charts.

How to Spread Bet on the AEX Index? |

As with many markets, investors can speculate on stock market indices, such as the AEX Index, to either rise or fall.

Logging onto CapitalSpreads, we can see that they have put the AEX Index October Futures market at 329.1 - 330.1. As a result, an investor could spread bet on the AEX Index market:

Closing higher than 330.1, or Closing higher than 330.1, or

Closing lower than 329.1 Closing lower than 329.1

On the closing date for this 'October' market, 19-Oct-12.

When financial spread trading on the AEX Index you trade in £x per 0.1 points. Therefore, should you decide to risk £3 per 0.1 points and the AEX Index moves 2.7 points then that would be a difference to your P&L of £81. £3 per 0.1 points x 2.7 points = £81.

For short term trading on indices also see Indices Rolling Daily Spread Betting.

AEX Index Trading Example 1 |

If you consider the above spread of 329.1 - 330.1 and make the assumptions that:

- You have done your market research, and

- Your analysis suggests that the AEX Index will close above 330.1 by 19-Oct-12

Then you might decide that you are going to buy a spread bet at 330.1 for a stake of, for example, £2 per 0.1 points.

This means that you win £2 for every 0.1 points that the AEX Index rises higher than 330.1. On the other hand, such a bet also means you will make a loss of £2 for every 0.1 points that the AEX Index market decreases lower than 330.1.

Thinking of this in a slightly different way, if you ‘Buy’ a spread bet then your profit/loss is found by taking the difference between the final price of the market and the price you bought the market at. You then multiply that price difference by your stake.

So if, on the settlement date the AEX Index market settled at 338.5, then:

P&L = (Closing Price - Opening Price) x stake

P&L = (338.5 - 330.1) x £2 per 0.1 points stake

P&L = 8.4 x £2 per 0.1 points stake

P&L = £168 profit

Trading indices, whether by spread betting or otherwise, is not easy. With the above, you wanted the index to rise. However, the index can also go down.

If the AEX Index had fallen, closing lower at 322.5, then this means you would end up making a loss on this spread bet.

P&L = (Closing Price - Opening Price) x stake

P&L = (322.5 - 330.1) x £2 per 0.1 points stake

P&L = -7.6 x £2 per 0.1 points stake

P&L = -£152 loss

Note - AEX Index October Futures spread correct as of 26-Sep-12.

Advert:

AEX Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the AEX Index with

Financial Spreads.

|

How to Spread Bet on the Dutch 25 - Example 2 |

Logging into Financial Spreads, you can see that they are valuing the Dutch 25 October Futures market at 329.0 - 330.0. As a result, you can spread bet on the Dutch 25 index:

Finishing higher than 330.0, or Finishing higher than 330.0, or

Finishing lower than 329.0 Finishing lower than 329.0

On the expiry date for this 'October' market, 19-Oct-12.

Whilst spread trading on the Dutch 25 index you trade in £x per 0.1 points. Therefore, if you invest £2 per 0.1 points and the Dutch 25 moves 2.8 points then that would change your P&L by £56. £2 per 0.1 points x 2.8 points = £56.

Now, if you take the above spread of 329.0 - 330.0 and make the assumptions:

- You've completed your market research, and

- Your analysis leads you to think the Dutch 25 index will close higher than 330.0 by 19-Oct-12

Then you might buy a spread bet at 330.0 and invest, for example, £2 per 0.1 points.

Therefore, you win £2 for every 0.1 points that the Dutch 25 index moves above 330.0. Conversely, however, you will make a loss of £2 for every 0.1 points that the Dutch 25 market falls below 330.0.

Looked at another way, if you buy a spread bet then your P&L is found by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that difference in price by your stake.

With that in mind, if, on the settlement date, the Dutch 25 market settled at 336.6, then:

Profit = (Settlement Price - Opening Price) x stake

Profit = (336.6 - 330.0) x £2 per 0.1 points stake

Profit = 6.6 x £2 per 0.1 points stake

Profit = £132 profit

Trading stock market indices, whether by spread betting or not, is not always simple. In the above example, you had bet that the index would go up. Nevertheless, the index can also fall.

If the Dutch 25 had fallen, settling lower at 324.2, then you would end up making a loss and losing on this spread bet.

Loss = (Settlement Price - Opening Price) x stake

Loss = (324.2 - 330.0) x £2 per 0.1 points stake

Loss = -5.8 x £2 per 0.1 points stake

Loss = -£116 loss

Note - Dutch 25 October Futures spread betting market taken as of 27-Sep-12.

Advert:

AEX Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the AEX Index with

Financial Spreads.

|

How to Spread Bet on Dutch Shares |

If you want to spread bet on Dutch shares like ING then here is how you could do it.

Looking at a site like Inter Trader, you can see they are currently pricing the ING Rolling Daily market at €7.27 - €7.30. This means that an investor could put a spread bet on the ING shares:

Rising higher than €7.30, or Rising higher than €7.30, or

Falling lower than €7.27 Falling lower than €7.27

When financial spread trading on Dutch shares you trade in £x per cent. As a result, if you invested £4 per cent and the ING share price moves €0.37 then that would alter your P&L by £148. £4 per cent x €0.37 = £148.

Note that you are also able to invest in this market in Euros or Dollars, e.g. €x per cent.

Rolling Daily Equities Markets

Be aware that this is a Rolling Daily Market and so unlike a normal spread betting futures market, there is no settlement date. You do not have to close your trade, should it still be open at the end of the trading day, it simply rolls over to the next trading day.

If your spread bet does roll over and you are speculating on the market to:

Increase - then you would normally pay a small financing fee, or Increase - then you would normally pay a small financing fee, or

Decrease - then you will usually receive a small credit to your account Decrease - then you will usually receive a small credit to your account

You can find more on Rolling Daily Markets, as well as a fully worked example, in our feature Rolling Daily Spread Betting.

ING Rolling Daily - Dutch Equities Trading Example |

So, if we continue with the above spread of €7.27 - €7.30 and make the assumptions:

- You've completed your analysis of the sector, and

- Your analysis leads you to feel that the ING share price is likely to increase and move above €7.30

Then you might decide that you are going to buy a spread bet at €7.30 for a stake of £5 per cent.

With such a bet you make a profit of £5 for every cent that the ING shares increase and go higher than €7.30. Nevertheless, you will lose £5 for every cent that the ING market falls below €7.30.

Looked at another way, if you were to buy a spread bet then your profits (or losses) are found by taking the difference between the settlement price of the market and the initial price you bought the market at. You then multiply that difference in price by the stake.

With this in mind, if after a few trading sessions the shares started to rise you might decide to close your trade to secure your profit.

So if the market increased then the spread might move to €7.54 - €7.57. You would close your trade by selling at €7.54. As a result, with the same £5 stake your profit would come to:

Profit / loss = (Closing Price - Initial Price) x stake

Profit / loss = (€7.54 - €7.30) x £5 per cent stake

Profit / loss = €0.24 x £5 per cent stake

Profit / loss = 24c x £5 per cent stake

Profit / loss = £120 profit

Financial spread trading can go against you. In this example, you had bet that the share price would increase. Of course, the share price can also go down.

If the ING share price weakened, against your expectations, then you might choose to close your spread bet in order to restrict your losses.

So if the market dropped to €7.03 - €7.06 you would close your trade by selling at €7.03. If so, that would mean you would lose:

Profit / loss = (Closing Price - Initial Price) x stake

Profit / loss = (€7.03 - €7.30) x £5 per cent stake

Profit / loss = -€0.27 x £5 per cent stake

Profit / loss = -27c x £5 per cent stake

Profit / loss = -£135 loss

Note - ING Rolling Daily spread correct as of 23-Jan-13.

Spread Betting on Dutch Companies |

Simply click on the company you're interested in spread betting on.

As well as live charts and prices, we talk you through the most popular spread betting questions for that Dutch company:

| Company Name |

Symbol |

Dutch Shares

Spread Betting Guides » |

Charts &

Prices |

'AEX Stock Market Spread Betting' edited by Jacob Wood, updated 13-Apr-17

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

AEX Stock Market Spread Betting

Holland 25 stock market spread betting guide with daily market updates. Plus live charts & prices for the AEX and Dutch shares as well as where to spread bet on the Amsterdam stock market commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|