Dow Jones Spread Betting

Note: Rather than being called the Dow, Dow Jones or Dow 30, in spread betting and CFD trading, the Dow is often called 'Wall Street' or the 'US 30'.

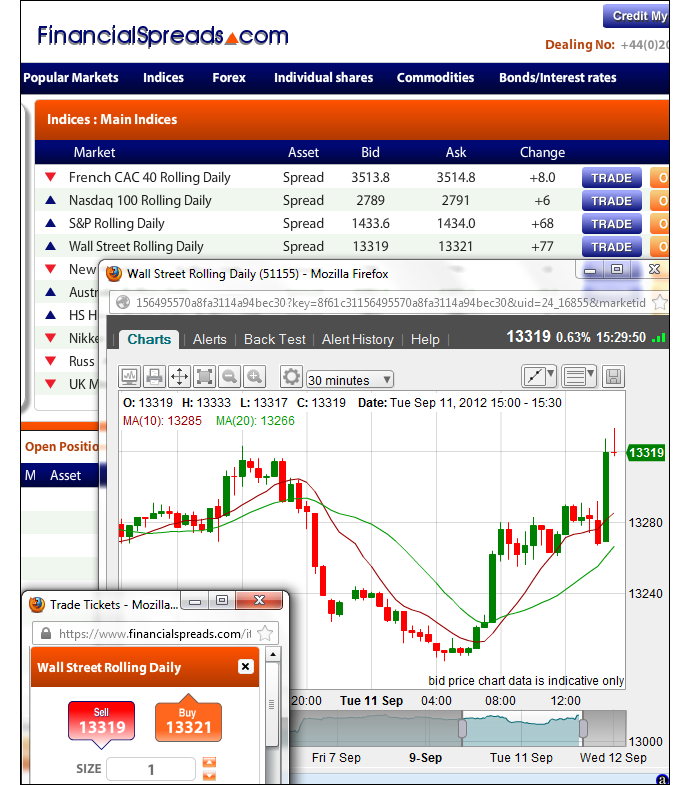

Indicative Dow Jones Prices |

Stock Market Index Comparison |

A stock market index comparison table covering the Dow Jones (Wall St) and other popular markets:

| FTSE 100 (UK 100) Daily |

0.8 |

1 |

1 |

2 |

| Dow Jones (Wall St) Daily |

1 |

1 |

1 |

1.4 |

| DAX 30 (Germany 30) Daily |

1 |

1 |

1 |

1 |

| S&P 500 (SPX 500) Daily |

3 |

4 |

5 |

5 |

| NASDAQ 100 (US Tech 100) Daily |

5 |

4-10 |

3 |

1 |

| CAC 40 (France 40) Daily |

0.8 |

1 |

1 |

1 |

| ASX 200 (Australia 200) Daily |

1 |

5 |

3 |

1 |

| Japan 225 Daily |

8 |

8 |

13 |

5 |

| Hong Kong Daily |

8 |

10 |

20 |

7 |

| Stock Indices - Minimum Stake |

£1 |

£1 |

£0.5 |

£1 |

Comparison Notes.

Where Can I Spread Bet on the Dow Jones? |

You can speculate on the Dow Jones, as well as the FTSE 100 and other stock market indices, with providers like:

US Stock Market Analysis and Trading News

|

| 20-May-18 |

[12:56pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 13-May-18 |

[8:17pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 07-May-18 |

[1:06pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 29-Apr-18 |

[11:28am] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 09-Apr-18 |

[11:27am] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 03-Apr-18 |

[8:48pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 29-Mar-18 |

[1:53pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 23-Mar-18 |

[8:49am] Dow Jones Daily Trading Report- The Dow Jones is currently trading at 23,848.

- Overnight, the market closed down -933pts (-3.78%) at 23,781.

30 Minute Chart Analysis

The stock index is above the 20-period MA of 23,814.9 and below the 50-period MA of 24,135.5. The stock index is above the 20-period MA of 23,814.9 and below the 50-period MA of 24,135.5.

1 Day Chart Analysis

The stock market index is trading below the 20-day MA of 24,747.8 and below the 50-day MA of 25,066.8. The stock market index is trading below the 20-day MA of 24,747.8 and below the 50-day MA of 25,066.8.

Update by Gordon Childs, Editor,

|

| 26-Feb-18 |

[2:37pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 17-Feb-18 |

[1:09pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 22-Jan-18 |

[2:46pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 08-Jan-18 |

[12:09pm] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 02-Jan-18 |

[11:51am] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 28-Dec-17 |

[10:18am] Updated Dow Jones COT Report

The latest COT Report (Commitments of Traders) for the Dow Jones futures market has been released by the CFTC, please see our Dow Jones COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

» For more see Stock Market Trading News & Analysis.

Where Can I Find Live Prices and Charts for the Dow Jones? |

We do show indicative Dow Jones spread betting prices, please see above.

The CFD chart below also offers readers a helpful look at the US stock market index.

The Plus500 chart above is usually based on the Dow Jones futures contract (not the daily market).

If you want to check live spread betting prices and charts for the Dow, you may need a financial spread betting account.

A spreads account would also let you speculate on short-term daily Dow Jones markets. Users should note that accounts are normally subject to suitability, credit and status checks.

Should your application be approved then you can log on and study the charts and the current prices. These are normally free. Having said that, you might get the occasional sales letter or email from the spread trading company.

Of course, if you do trade then, before starting, you should note that CFD trading and financial spread trading carry a high degree of risk to your funds and can result in losses that are greater than your initial investment.

Advanced Charts for the Dow Jones |

Although charting software/packages can vary across the industry, to help your analysis of the Dow Jones, they often come with useful tools like:

- Drawing features and options e.g. Trendlines, Fibonacci Arcs, Fans and Time Zones

- Different display options e.g. candlestick charts and bar charts

- A host of different time periods e.g. 1 minute, 3 minute, 5 minute, 15 minute, 1 hour, 1 day etc.

Charts on the Financial Spreads platform also include advanced features like:

- BackTesting, Custom Indicators and Optimisation functions

- Helpful overlays e.g. Ichimoku Clouds, Parabolic SAR, EMA, Envelopes etc.

- Technical indicators e.g. Williams %R, True Strength (TSI), Chaikin's Volatility, Aroon, Forecast Oscillator, Price and Volume Trend, Linear Regression etc.

- Automatic email notifications that trigger when a market hits a pre-set level

Sample Dow Jones chart from Financial Spreads

The following financial spread betting firms give account holders access to real time trading prices and charts:

Dow Jones Index Commitments of Traders Report - 15 May 2018 (i) |

Futures Only Positions, CBT , Code 124603, (DJIA Index x $5) (i)

| Reporting Firms (i)

|

|

Non-Reportable Positions (i) |

Non-Commercial (i)

|

Commercial (i) |

Total Reportable (i) |

| |

| Commitments (i) |

Open (i) Interest |

Commitments |

| Long (i) |

Short (i) |

Spreads (i) |

Long |

Short |

Long |

Short |

Long |

Short |

| 32,222 |

22,098 |

969 |

51,621 |

65,428 |

84,812 |

88,495 |

102,222 |

17,410 |

13,727 |

| |

| Changes from 8 May 2018 (i) |

Change in (i) Open Interest |

Changes from |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

Long |

Short |

| -1,329 |

-8,784 |

266 |

-1,750 |

7,094 |

-2,813 |

-1,424 |

-879 |

1,934 |

545 |

| |

| Percent of Open Interest for Each Category of Trader (i) |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

Long |

Short |

| 31.5% |

21.6% |

0.9% |

50.5% |

64.0% |

83.0% |

86.6% |

|

17.0% |

13.4% |

| |

| Number of Traders in Each Category (i) |

Total (i) Traders |

|

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

|

| 33 |

17 |

6 |

23 |

27 |

61 |

45 |

91 |

|

|

| |

| Long/Short Commitments Ratios (i) |

|

Long/Short Ratio |

| Ratio |

|

Ratio |

Ratio |

|

Ratio |

| 1.5:1 |

|

1:1.3 |

1:1 |

|

1.3:1 |

| |

| Net Commitment Change (i) |

|

| 7,455 |

|

Also see:

Spread Betting on Individual Dow Jones Companies |

Simply click on the company you're interested in spread betting on. As well as indicative prices and charts, we talk you through the most popular spread betting questions on that Dow 30 company:

- Where can I spread bet?

- How to spread bet on that American company?

- Where can I trade commission free?

- Etc

Individual Shares Spread Betting Guides |

For more individual equities guides, also see:

Financial Spreads » "With FinancialSpreads.com you get all the normal

advantages of Spread Betting plus..." » read Financial Spreads review.

|

The Dow Jones Industrial Average, often referred to as the Dow, Dow 30 or Dow Jones, is one of the world's most well known markets.

The Dow represents a selection of thirty of the biggest American public companies. It's used to measure the performance of these corporations whilst also reflecting the state of the American economy and, to a degree, the world economy.

In spread betting and CFD trading, rather than being called the Dow, Dow Jones or Dow 30 it is often called 'Wall Street' or the 'US 30'.

Dow Jones Spread Betting: Firms with High Share Prices are the Most Important |

If you want to profit from trading the FTSE 100, the biggest corporations are the most important. Because of the way the FTSE 100 index is weighted, movements in the share prices of the largest corporations affect the FTSE 100 index more than price movements in the shares of smaller companies.

However, the Dow Jones Industrial Average is not 'price weighted'. This means that a one point increase or decrease by any share in the index will have the same effect as a one point increase or decrease of any other share.

However, the Dow Jones Industrial Average is not 'price weighted'. This means that a one point increase or decrease by any share in the index will have the same effect as a one point increase or decrease of any other share.

As of April 2012, share prices on the DJIA range from around $8-9 (Bank of America and Alcoa) to almost $210 (IBM).

So, a 10% shift in IBM's share price (around $21) would account for a large movement in the Dow Jones index (around 160 points).

However, a 10% shift in Bank of America's share price (around $0.90) would only lead to a very small change in the Dow Jones (around 7 points). This isn't because IBM is a bigger corporation, it is because IBM's share price is much higher.

The other high value shares to watch out for in the Dow Jones are, as of April 2012, Caterpillar, Chevron and McDonalds.

Dow Jones Stock Market Index: Different Trading Times |

The Dow is based on Wall Street however, not all 30 companies that make up the DJIA are based on America's East coast.

So, when the Dow Jones opens for trading, the value is determined only by the relatively few companies that open first. The opening price on the Dow will therefore always be close to the previous day's closing price.

As a result, the Dow Jones will never accurately reflect the true opening prices of all its companies.

If you are looking to trade on the Dow Jones, you need to be very careful when you open your position. Whilst the FTSE 100 might 'hit the ground running' with all companies opening at the same time, the Dow Jones doesn't work in the same way. Investors should monitor opening and closing prices so they can be confident of opening a position at the right time.

Dow Jones Spread Betting: Know the Shares |

One of the advantages of trading the Dow Jones is that there are only 30 corporations in the index. Therefore it's easier to keep an eye on each of the component companies and what's happening to their share price.

Some traders believe that it is good practice to have a number of shares that you regularly follow. The aim of this is to get to know these shares and become familiar with their price movements.

Keeping tabs on all FTSE 100 companies is tough, it's hard to know exactly what is happening to all the shares at any given time. However, watching 30 Dow Jones stocks is more manageable. You can get to know each company's typical share movements and that can help you forecast where the Dow Jones will head next.

Advert:

Dow Jones Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Dow Jones with

Financial Spreads.

|

Where Can I Spread Bet on the Dow Jones for Free? |

Speculating on the stock market always comes with a degree of risk. However, if you would like to use a Demo Account, that allows you to practice spread betting on a wide range of markets, please see below for further details.

When you think about which investment option is right for you, don't forget that, in the UK, financial spread betting is currently tax free*.

If you are trying to find a low cost financial spread betting website then keep in mind that you can trade the Dow Jones without having to pay any commissions or brokers' fees through companies such as:

If you would like to use a Demo Account where you are able to try out online spread betting, and speculating on markets like GBP/USD, gold, the FTSE 100 and the Dow Jones, then look at:

Each of the spread betting companies listed above offer a Test Account which lets users apply a range of trading orders, test new trading ideas and review stock market charts.

How to Spread Bet on the Dow Jones? |

As with a wide variety of financial markets, investors can spread bet on indices, like the Dow Jones, to either rise or fall.

If you go to the Financial Spreads platform, you can see that they have priced the Dow Jones Rolling Daily market at 13343.0 - 13345.0. This means that an investor could put a spread bet on the Dow Jones index:

Moving above 13345.0, or Moving above 13345.0, or

Moving below 13343.0 Moving below 13343.0

When you spread bet on the Dow Jones index you trade in £x per point, where a point is one point of the index itself. As a result, if you invested £4 per point and the Dow Jones moves 26 points then that would be a difference to your profit/loss of £104. £4 per point x 26 points = £104.

Rolling Daily Indices Markets

This is a Rolling Daily Market which means that there is no set settlement date for this market. You do not have to close your position, should it still be open at the end of the trading day, it simply rolls over to the next trading day.

If you do let your position roll over into the next day and are spread betting on the market to:

Go higher - then you are charged a small overnight financing fee, or Go higher - then you are charged a small overnight financing fee, or

Go lower - then a small payment is normally credited to your account Go lower - then a small payment is normally credited to your account

For more information see Rolling Daily Spread Betting.

Dow Jones Index - Rolling Daily Trading Example |

Now, if you think about the spread of 13343.0 - 13345.0 and assume that:

- You have analysed the indices markets, and

- You think that the Dow Jones index will increase and move above 13345.0

Then you may go long of the market at 13345.0 and invest, for example, £5 per point.

Therefore, with this trade you make a profit of £5 for every point that the Dow Jones index moves higher than 13345.0. However, it also means you will lose £5 for every point that the Dow Jones market moves below 13345.0.

Considering this from another angle, if you were to buy a spread bet then your P&L is worked out by taking the difference between the final price of the market and the initial price you bought the spread at. You then multiply that price difference by the stake.

Therefore, if after a few days the US stock market moved higher then you might think about closing your trade and guaranteeing your profits.

Taking this a step further, if the stock market did go up then the spread might change to 13380.4 - 13382.4. You would close your spread bet by selling at 13380.4. As a result, with the same £5 stake your profit would be calculated as:

P&L = (Closing Price - Initial Price) x stake

P&L = (13380.4 - 13345.0) x £5 per point stake

P&L = 35.4 x £5 per point stake

P&L = £177.00 profit

Trading the American stock market is not simple. In the above example, you had bet that the US index would rise. Of course, the stock market can fall.

If, contrary to your expectations, the Dow Jones fell, then you might decide to close your trade to stop any further losses.

So if the spread pulled back to 13313.1 - 13315.1 you would close your position by selling at 13313.1. This would result in a loss of:

P&L = (Closing Price - Initial Price) x stake

P&L = (13313.1 - 13345.0) x £5 per point stake

P&L = -31.9 x £5 per point stake

P&L = -£159.50 loss

Note - Dow Jones Rolling Daily spread quoted as of 11-Sep-12.

Looking at a site like InterTrader, we can see they are currently offering the Dow Jones December Futures market at 13408 - 13414. This means an investor could speculate on the Dow Jones index:

Closing above 13414, or Closing above 13414, or

Closing below 13408 Closing below 13408

On the expiry date for this 'December' market, 21-Dec-12.

As with the daily market above, you trade the Dow Futures in £x per point. So if your stake is £5 per point and the Dow moves 27 points then that would make a difference to your profits (or losses) of £135. £5 per point x 27 points = £135.

Dow Jones Futures Trading Example |

If we take the above spread of 13408 - 13414 and make the assumptions that:

- You have done your analysis of the American futures market, and

- Your analysis suggests the US index will settle above 13414 by 21-Dec-12

Then you could decide to buy the market at 13414 and risk, for the sake of argument, £2 per point.

With this contract you make a gain of £2 for every point that the US index moves higher than 13414. Nevertheless, you will make a loss of £2 for every point that the Dow Jones market goes lower than 13414.

Put another way, with spread trading, your profits (or losses) are worked out by taking the difference between the closing price of the market and the price you bought the market at. You then multiply that price difference by the stake.

So, if on the expiry date, the Dow Jones closed at 13488, then:

Profit / loss = (Closing Value - Opening Value) x stake

Profit / loss = (13488 - 13414) x £2 per point stake

Profit / loss = 74 x £2 per point stake

Profit / loss = £148 profit

Of course trading the American stock market futures is rarely that straightforward. In the above example, you wanted the Dow to rise. Of course, the stock market index could fall.

If the futures had fallen and settled at 13334 on the expiry date, then you would end up losing this trade.

Profit / loss = (Closing Value - Opening Value) x stake

Profit / loss = (13334 - 13414) x £2 per point stake

Profit / loss = -80 x £2 per point stake

Profit / loss = -£160 loss

Note - Dow Jones December Futures market taken as of 27-Sep-12.

Risk Management: Spread Betting on the US Stock Market with a Stop Loss |

You can put a limit on the size of your position to help reduce your potential losses without impacting your upside. You can also employ smaller stake sizes such as £1 per point or $1 per point.

Letís say you spread bet on the Dow to go up, with a £1 per point stake and attach a Stop Loss order to your trade. If the US stock market goes up by 120 points then you would make 120 points x £1 per point = £120.

You are also able to trade the markets in Euros and Dollars. If you want to trade in dollars then 120 points x $1 per point = $120.

Of course if the market went against you, dropping by say 90 points, then with a £1 stake you would lose 90 points x £1 per point = £90.

Obviously this would be a fairly poor start. However, with firms like Financial Spreads you can add a Stop Loss at let's say, 30 points.

If you were trading the Dow this would mean that your position would be closed if the US index moved against you by 30 points. Therefore, instead of losing £90, you'd only lose 30 points x £1 per point = £30.

However, assuming you correctly predicted the direction of the market, your upside would still be £120.

Note that Stop Losses are not guaranteed, if a market slips then your Stop Loss is closed out at the next traded price. If you donít want that risk then you can use a Guaranteed Stop Loss, these are guaranteed to close your trade even if the underlying market slips (gaps).

A number of firms like Financial Spreads, InterTrader and Capital Spreads automatically apply a Stop Loss to every trade. You can upgrade to a Guaranteed Stop Loss but that normally comes at a small premium (normally a wider spread).

Advert:

Dow Jones Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Dow Jones with

Financial Spreads.

|

'Dow Jones Spread Betting' edited by Jacob Wood, updated 20-May-18

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

Hang Seng Spread Betting, updated 13-Apr-17

Hang Seng financial spread betting guide with daily updates. Plus live Hang Seng charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

Dow Jones Spread Betting

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|