Introduction

The Ichimoku Kinko Hyo is a highly versatile trading indicator. In fact it is a set of indicators that gives traders a complete overview of the market.

It was developed in the previous century by a Japanese journalist by the name of Goichi Hosada. He worked on it for more than two decades to further refine it and later published his findings in a 1959 book.

It is still not widely known in the West, although its popularity is on the rise. In Japan it’s hard to find a trading room without an Ichimoku Kinko Hyo chart somewhere on a screen or against a wall.

This stock market index trading strategy uses the Ichimoku chart below. The reason for this is that the spread betting strategy is very much based on trend following, which is what the Ichimoku was developed for in the first place.

Also see guide to Ichimoku Clouds.

Stock Index Spread Betting Strategy

If you are looking at buying an index, such as the FTSE 100, Dow Jones, DAX 30 etc, then according to this strategy there are a series of requirements that need to be fulfilled.-

Requirement 1 – The price must be above the Ichimoku Kinko Hyo cloud before a bull market is indicated.

-

Requirement 2 – The green Chinkou Span line must be above the price 26 periods ago. The Chinkou Span is the current price plotted 26 days in the past.

Since the Ichimoku is in the first instance a trend indicator, this is simply a visual way of immediately showing us that the current price is higher than the price 26 days ago, indicating a bull market.

-

Requirement 3 – The price must be above the red Tenkan-Sen line. The Tenkan-Sen depicts the average of the high and low prices for the past 9 periods and, as such, is similar to a short-term average.

If the price moves above this line, it simply indicates that the longer-term bull run is confirmed by a short-term upturn in the price.

-

Requirement 4 – The red Tenkan-Sen line must be above the blue Kijun-Sen line. The Kijun-Sen is the average of the highest high and the lowest low for the past 26 periods. It is therefore a longer-term average.

For a short position, the requirements should of course be reversed: the price has to be below the cloud, the Chinkou Span must be below the price 26 periods ago, the price must be below the red Tenkan-Sen, and the Tenkan-Sen must be below the Kijun-Sen.

Strategy Case Study

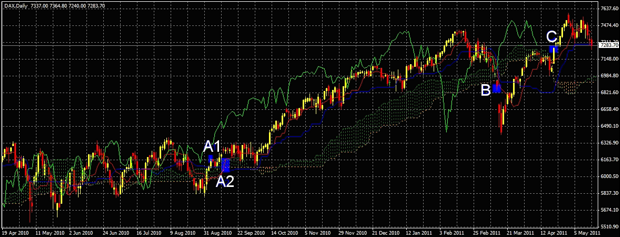

The chart below shows a graph of the daily price of the DAX 30 index spread betting market from April 2010 until May 2011. During this period the price moved gradually upwards, then went through a major correction but still closed more than 1,000 points above its original closing price.If we had followed the simple trading strategy above, we would have captured most of the upswing and made a very nice profit.

Strategy Application

Returning to the chart, we see that at point A1 the first three requirements are met. The price has just moved out of the cloud, the green Chinkou Span line is above the price 26 periods ago and the price is also above the red Tenkan-Sen short-term average.The last requirement, that the red Tenkan-Sen line must be above the blue Kijun-Sen, has not been met yet. In this particular case it would have worked out well if you did not wait for this to happen, however, it could easily have gone the other way.

When the red Tenkan-Sen line moves above the blue Kijun-Sen at point A2 on the chart, we have received another short-term confirmation of the longer term bull market.

Going long at this point would have given us a nice profit of several hundred points, depending on what we used as a stop loss point.

Strategy – Stop Loss

Using the red Tenkan-Sen Line as a stop loss is very conservative and would have kicked you out of an otherwise profitable trade several times.The blue Kijun-Sen would have been a better option. It would have kicked you out of the trade on the 30th of November and again on the 10th of January, only to enter again when the price returned above the level of the Tenkan-Sen.

Eventually this strategy would have become erratic towards the end of February/beginning of March, with several false exits and entries before the price finally dropped back into the cloud.

The best option would have been to use the cloud itself as an exit strategy. In other words, exit the trade the moment the price drops back into the cloud. This would have given us the biggest profit and the lowest number of false entries/exits.

Stock Market Index Spread Betting Strategy – Conclusion

At point B all four requirements above were again met but this time for a short trade. Unfortunately, there wasn’t much profit in that particular trade due to an early exit, e.g. the red Tenkan-Sen, would have worked best in this instance.At point C all four requirements for a bull market were once again met. The price subsequently moved up just over 200 points, but then retracted to a level below both the Kijun-Sen and the Tenkan-Sen.

At this point, a cautious trader would wait for a continuation signal, such as the price moving above the red Tenkan-Sen again, before entering a long position.

If, on the other hand, the price were to move down further and enter the cloud, a cautious trader would wait for the requirements of a short position set out above to be met before making a trade.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.