S&P 500 Spread Betting

Note: Rather than being called the S&P 500 or just S&P, in spread betting and CFD trading, the index is often called 'SPX', 'US 500' or 'USA 500'.

Indicative S&P 500 Prices |

Stock Market Index Comparison |

A stock market index comparison table covering the S&P 500 and other popular markets:

| FTSE 100 (UK 100) Daily |

0.8 |

1 |

1 |

2 |

| Dow Jones (Wall St) Daily |

1 |

1 |

1 |

1.4 |

| DAX 30 (Germany 30) Daily |

1 |

1 |

1 |

1 |

| S&P 500 (SPX 500) Daily |

3 |

4 |

5 |

5 |

| NASDAQ 100 (US Tech 100) Daily |

5 |

4-10 |

3 |

1 |

| CAC 40 (France 40) Daily |

0.8 |

1 |

1 |

1 |

| ASX 200 (Australia 200) Daily |

1 |

5 |

3 |

1 |

| Japan 225 Daily |

8 |

8 |

13 |

5 |

| Hong Kong Daily |

8 |

10 |

20 |

7 |

| Stock Indices - Minimum Stake |

£1 |

£1 |

£0.5 |

£1 |

Comparison Notes.

Where Can I Spread Bet on the S&P 500? |

Investors can spread bet on the S&P 500 through an account with any of these spread betting firms:

S&P 500 Stock Market Analysis and Trading News

|

| 20-May-18 |

[12:56pm] Updated S&P 500 COT Report

The latest COT Report (Commitments of Traders) for the S&P 500 futures market has been released by the CFTC, please see our S&P 500 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 13-May-18 |

[8:17pm] Updated S&P 500 COT Report

The latest COT Report (Commitments of Traders) for the S&P 500 futures market has been released by the CFTC, please see our S&P 500 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 07-May-18 |

[1:06pm] Updated S&P 500 COT Report

The latest COT Report (Commitments of Traders) for the S&P 500 futures market has been released by the CFTC, please see our S&P 500 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 29-Apr-18 |

[11:28am] Updated S&P 500 COT Report

The latest COT Report (Commitments of Traders) for the S&P 500 futures market has been released by the CFTC, please see our S&P 500 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 09-Apr-18 |

[11:27am] Updated S&P 500 COT Report

The latest COT Report (Commitments of Traders) for the S&P 500 futures market has been released by the CFTC, please see our S&P 500 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 03-Apr-18 |

[8:48pm] Updated S&P 500 COT Report

The latest COT Report (Commitments of Traders) for the S&P 500 futures market has been released by the CFTC, please see our S&P 500 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 29-Mar-18 |

[1:53pm] Updated S&P 500 COT Report

The latest COT Report (Commitments of Traders) for the S&P 500 futures market has been released by the CFTC, please see our S&P 500 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

For more stock market updates see:

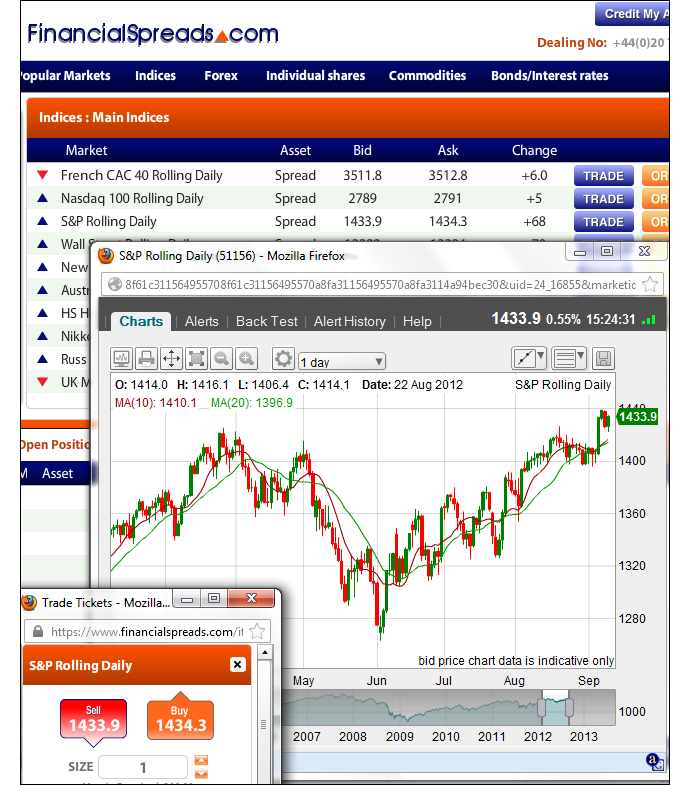

Where Can I Find Live Prices and Charts for the S&P 500? |

We do show readers pretty accurate S&P 500 prices, please see above.

The live chart below will also give readers a useful insight into the American stock market index.

The contracts for difference chart above usually tracks the underlying S&P 500 futures market (not the daily market).

To analyse live financial spread betting charts/prices for the S&P 500, you might require a spread trading account.

You can also use a spreads account to access the shorter term spot markets. Readers should note that accounts are normally dependent on status, credit and suitability checks.

If your new account is accepted, you will be able to log on and view the live charts and prices. On most platforms, these are free. Having said that, you could get the occasional email or sales call from the relevant firm.

Of course, if you decide to trade then, before starting, you should note that CFD trading and financial spread betting carry a significant level of risk to your funds and losses can exceed your initial deposit.

Technical Charting Packages for the S&P 500 |

Though charts normally vary across the industry, to help your technical analysis of the S&P 500, the majority of charts usually come with valuable tools, including:

- Drawing features, for example, trendlines, Fibonacci fans, time zones and arcs

- Different chart types, for example, candle and bar charts

- An array of intervals, for example, 1 minute, 5 minute, 15 minute, 1 hour, 2 hour etc

Charts on Tradefair Spreads also include more advanced aspects:

- BackTesting, Customisable Indicators and Optimisation tools

- Custom email alerts for when a market hits a specific price

- Numerous chart overlays, for example, Parabolic SAR, Ichimoku Clouds, Linear Regression etc

- More than 30 secondary charts, for example, Money Flow, Momentum, Projection Bands, Historical Volatility etc

Example S&P 500 chart from the Financial Spreads platform

The financial spread betting firms listed below offer clients real time trading charts and prices:

Advert:

S&P 500 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the S&P 500 with

Financial Spreads.

|

Where Can I Spread Bet on the S&P 500 for Free? |

Investing always involves a degree of risk. However, if you'd like to try a completely free Demo Account, where you can look at spread betting charts and practice trading, please see below.

When deciding which investment option might work for you, also remember that spread trading in the UK is tax free*, i.e. it is exempt from capital gains tax, stamp duty and income tax.

If you're trying to find a free spread betting platform then note that you can financial spread bet on the S&P 500 with no brokers' fees, and zero commissions, via providers like:

If you are interested in a completely free Test Account which allows you to practice spread betting, and trading markets like the S&P 500, then you could always look at:

Each of the above firms provide a 'Demo Account' that gives users the opportunity to try spread betting, test new ideas, practice with an array of orders and use charts.

How to Spread Bet on the S&P 500? |

As with most key markets, you can spread bet on indices, like the S&P 500, to either rise or fall.

If we log on to a platform like Tradefair, we can see that they are currently pricing the S&P 500 Rolling Daily market at 1435.9 - 1436.3. As a result, you can put a spread bet on the S&P 500 index:

Going higher than 1436.3, or Going higher than 1436.3, or

Going lower than 1435.9 Going lower than 1435.9

When you spread bet on the S&P 500 index you trade in £x per 0.1 points. So if you have a trade of £4 per 0.1 points and the S&P 500 moves 2.2 points then there would be a difference to your P&L of £88. £4 per 0.1 points x 2.2 points = £88.

Rolling Daily Indices Markets

Be aware that this is a Rolling Daily Market and so unlike a normal futures market, there is no settlement date. As a result, if your trade is still open at the end of the trading day, it simply rolls over to the next session.

If you allow your bet to roll over and are spread betting on the market to:

Go up - then you'll pay a small overnight financing fee, or Go up - then you'll pay a small overnight financing fee, or

Go down - then a small payment will usually be credited to your account Go down - then a small payment will usually be credited to your account

To learn more please read Rolling Daily Spread Betting.

S&P 500 Trading Example (Daily) |

If we continue with the spread of 1435.9 - 1436.3 and assume:

- You have analysed the US stock market, and

- You think that the S&P 500 index will increase and go higher than 1436.3

Then you may decide to go long of the index at 1436.3 and risk, for example, £3 per 0.1 points.

This trade means that you win £3 for every 0.1 points that the S&P 500 index rises above 1436.3. Nevertheless, such a trade also means that you will make a loss of £3 for every 0.1 points that the S&P 500 market decreases below 1436.3.

Put another way, if you ‘Buy’ a spread bet then your profits (or losses) are found by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that difference in price by your stake.

As a result, if after a few sessions the US stock market moved higher then you might want to close your position so that you can secure your profit.

So if the stock market increased then the spread, set by the spread trading company, might change to 1441.1 - 1441.5. In order to close your spread bet you would sell at 1441.1. Therefore, with the same £3 stake you would make a profit of:

Profit / loss = (Closing Price - Opening Price) x stake

Profit / loss = (1441.1 - 1436.3) x £3 per 0.1 points stake

Profit / loss = 4.8 x £3 per 0.1 points stake

Profit / loss = £144 profit

Speculating on the American stock market, whether by spread betting or otherwise, does not always go to plan. In the above example, you wanted the index to rise. However, it can also fall.

If the S&P 500 market weakened, against your expectations, then you might decide to settle your spread bet to stop any further losses.

So if the market pulled back to 1431.0 - 1431.4 you would settle your spread bet by selling at 1431.0. This would result in a loss of:

Profit / loss = (Closing Price - Opening Price) x stake

Profit / loss = (1431.0 - 1436.3) x £3 per 0.1 points stake

Profit / loss = -5.3 x £3 per 0.1 points stake

Profit / loss = -£159 loss

Note: S&P 500 Rolling Daily spread betting market taken as of 21-Dec-12.

Advert:

S&P 500 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the S&P 500 with

Financial Spreads.

|

How to Trade S&P 500 Futures |

If we go to Financial Spreads, we can see they are pricing the S&P 500 March Futures market at 1427.2 - 1428.0. This means that you can speculate on the S&P 500:

Settling higher than 1428.0, or Settling higher than 1428.0, or

Settling lower than 1427.2 Settling lower than 1427.2

On the settlement date for this 'March' market, 15-Mar-13.

Again, if you speculate on the S&P 500 index you trade in £x per 0.1 points. As a result, should you decide to risk £3 per 0.1 points and the S&P 500 moves 2.2 points then that would make a difference to your profit/loss of £66. £3 per 0.1 points x 2.2 points = £66.

S&P 500 Futures Trading Example |

So, if we take the above spread of 1427.2 - 1428.0 and make the assumptions that:

- You've analysed the American stock market, and

- Your analysis suggests the S&P 500 index will close above 1428.0 by 15-Mar-13

Then you might decide to go long of the US market at 1428.0 with a stake of, for the sake of argument, £3 per 0.1 points.

With this contract, you gain £3 for every 0.1 points that the S&P 500 index pushes higher than 1428.0. However, such a contract also means that you will lose £3 for every 0.1 points that the S&P 500 falls below 1428.0.

In other words, with spread trading, when buy a contract, your P&L is calculated by taking the difference between the price the market expires and the price you bought the market at. You then multiply that difference in price by your stake.

So if, on the closing date, the S&P 500 index expired at 1432.6, then you would make a profit:

P&L = (Expiry Price - Opening Price) x stake

P&L = (1432.6 - 1428.0) x £3 per 0.1 points stake

P&L = 4.6 x £3 per 0.1 points stake

P&L = £138 profit

Having said that, trading American stock market futures doesn't always go to plan. In the above example, you wanted the US index to rise. Of course, the index could drop.

If the S&P 500 fell and closed lower at 1424.0, then you would end up making a loss on this contract.

P&L = (Expiry Price - Opening Price) x stake

P&L = (1424.0 - 1428.0) x £3 per 0.1 points stake

P&L = -4.0 x £3 per 0.1 points stake

P&L = -£120 loss

Note - S&P 500 March Futures taken as of 27-Sep-12.

Advert:

S&P 500 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the S&P 500 with

Financial Spreads.

|

S&P 500 Index Commitments of Traders Report - 15 May 2018 (i) |

Futures Only Positions, CME , Code 138741, (S&P 500 Index x $250) (i)

| Reporting Firms (i)

|

|

Non-Reportable Positions (i) |

Non-Commercial (i)

|

Commercial (i) |

Total Reportable (i) |

| |

| Commitments (i) |

Open (i) Interest |

Commitments |

| Long (i) |

Short (i) |

Spreads (i) |

Long |

Short |

Long |

Short |

Long |

Short |

| 10,636 |

8,212 |

127 |

70,726 |

24,805 |

81,489 |

33,144 |

99,871 |

18,382 |

66,727 |

| |

| Changes from 8 May 2018 (i) |

Change in (i) Open Interest |

Changes from |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

Long |

Short |

| 556 |

-682 |

-32 |

266 |

-593 |

790 |

-1,307 |

1,255 |

465 |

2,562 |

| |

| Percent of Open Interest for Each Category of Trader (i) |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

Long |

Short |

| 10.6% |

8.2% |

0.1% |

70.8% |

24.8% |

81.6% |

33.2% |

|

18.4% |

66.8% |

| |

| Number of Traders in Each Category (i) |

Total (i) Traders |

|

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

|

| 5 |

13 |

3 |

27 |

8 |

34 |

22 |

51 |

|

|

| |

| Long/Short Commitments Ratios (i) |

|

Long/Short Ratio |

| Ratio |

|

Ratio |

Ratio |

|

Ratio |

| 1.3:1 |

|

2.9:1 |

2.5:1 |

|

1:3.6 |

| |

| Net Commitment Change (i) |

|

| 1,238 |

|

Also see:

Spread Betting on S&P 500 Companies |

Simply click on the company you're interested in spread betting on and we talk you through the most popular spread betting questions on that S&P 500 company:

- Where can I spread bet on S&P 500 Companies?

- How to spread bet on American shares?

- Where can I trade commission free?

- Etc

Most of these guides also have indicative prices and charts:

Individual Shares Spread Betting Guides |

For more individual equities guides, also see:

Rather than being called the S&P or S&P 500, in financial spread betting and CFD trading, the American index is often called 'US 500', 'USA 500' or 'SPX'.

The S&P 500 defines the broader US equities market. An index tracking the performance of the top 500 US companies.

S&P indices have over $1.53 trillion in indexed assets. The history of the S&P 500 dates back to 1923. It expanded to 500 companies in 1957.

S&P 500 Index Constituent's Characteristics:

- Market Coverage: approximately 75% of the US equities market

- Weighting: Market capitalisation

- Market Capitalization: minimum of $5bn

- Public Float: at least 50%

- Reconstitution: as needed basis

S&P Index Governance and Policy

This index is maintained by the S&P Index Committee which includes Standard & Poor's economists and index analysts.

For more details visit the official Standard and Poor's Website: standardandpoors.com

For the latest view on the stock market see Daily Market Review.

Applying Technical Analysis to the S&P 500 |

Below, an older but still useful case study on the US stock market by Shai Heffetz, InterTrader, 29-Jun-2011.

The S&P 500 has been widely used as a bellwether for the US economy ever since it was published for the first time in 1957.

It is an index of the top 500 companies in terms of market capitalisation trading on the NASDAQ and New York stock exchanges.

The index has been in a relatively strong bull market since September 2010. This started to lose momentum at the beginning of March and since then the market has moved mostly sideways.

On 3 June 2011, it closed below the Ichimoku cloud for the first time in quite a while, indicating that the bull run has finally been broken. On 6 June the S&P 500 formed a new low of 1285.90 and continued to trade generally downwards, forming a new low of 1264.90 on the 15th of June.

Currently the market is somewhat directionless, as can be seen by the fact that the blue Kijun Sen line in the chart below has turned flat.

The big picture on the technical analysis remains bearish, however. The green Chinkou Span line is well below the price of 26 periods ago and the price is below the green Ichimoku cloud, whilst the red Tenkan Sen line is also below the blue Kijun Sen. All this adds up to a clear indication of a short-term downturn in the price.

Some analysts believe the price is forming a double bottom before heading up again. This will only be confirmed if the price breaks upwards through the Ichimoku cloud in the near future, which is currently quite far away at 1332.95.

Any move below the recent low of 1257.90 will be a clear indication that the bearish sentiment is winning on the S&P 500 market and we could soon see new lows.

'S&P 500 Spread Betting' edited by Jacob Wood, updated 20-May-18

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

Hang Seng Spread Betting, updated 13-Apr-17

Hang Seng financial spread betting guide with daily updates. Plus live Hang Seng charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

S&P 500 Spread Betting

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|