Where Can I Find Live Prices and Charts for Amazon?

The live CFDs chart and prices below provides users with a helpful view of the Amazon market.

The above chart from Plus 500 normally follows the near-term Amazon futures contract.

If you want to look at financial spread betting prices and live charts for Amazon, you will probably require a spread betting account.

A spreads account would also let you access daily markets. Accounts are subject to credit and status checks.

Should your new account be approved then you can log in and view the real-time prices and charts. Usually, these are provided for free. The catch is that you might receive the occasional email or letter from the spread betting provider.

If you do trade then, before you start, you should note that CFDs and financial spread betting carry a high degree of risk and you can lose more than your initial investment.

For more details, see Advanced Amazon Trading Charts below.

| 03-Oct-17 |

[11:49am] Amazon Share Price Update:

The shares are trading above the 20-DMA of $968.77 and above the 50-DMA of $971.66. The shares are trading above the 20-DMA of $968.77 and above the 50-DMA of $971.66.- Closing Price: $989.58

1 Day Change: Up 0.89% 1 Day Change: Up 0.89% 5 Day Change: Up 2.94% 5 Day Change: Up 2.94%

Long-Term AMZN Data 52 Week High: $1,083.31 52 Week High: $1,083.31 52 Week Low: $710.10 52 Week Low: $710.10- EPS(i): $3.96

- PE Ratio(i): 249.69

- Volume / Average Volume(i): 0.001m / 2.970m

- Market Cap(i): $475,374m

- Shares Outstanding(i): 480m

Price data from Google Finance. Also see Live AMZN Share Price & Charts and About Amazon for more information.

Update by Jenna Cutly, Editor,

|

| 24-Jul-14 |

[9:44am] Amazon Faces High Earnings Expectations

With the online retailer set to release its Q2 results, some analysts are suggesting a $400 price target.

Update by

|

| 03-Feb-14 |

[2:03pm] Investors Sell Amazon

The AMZN stock was caught in a fire-sale on Friday as it dropped -11% to $358.69.

The Q4 earnings report didn't contain the blockbuster numbers that investors had hoped for.

Q4 EPS was $0.51 vs $0.21 a year ago ($0.69 expected). Revenues were up 20% YoY to $25.59bn vs $26.08bn expected.

Looking ahead, the company's statement read, "Net sales are expected to be between $18.2bn and $19.9bn, or to grow between 13% and 24% compared with Q1 2013.

"Operating income (loss) is expected to be between $(200m) and $200m, compared to $181m in Q1 2013."

Update by Jacob Wood, Editor,

|

| 20-Jan-14 |

[1:57pm] Longer Trading Hours for Amazon Shares

IG have extended their opening hours for Amazon, investors can now trade the AMZN stock from 9am to 1am (Mon to Thur) and 9am to 10pm (Fri), London time.

Update by Jacob Wood, Editor,

|

|

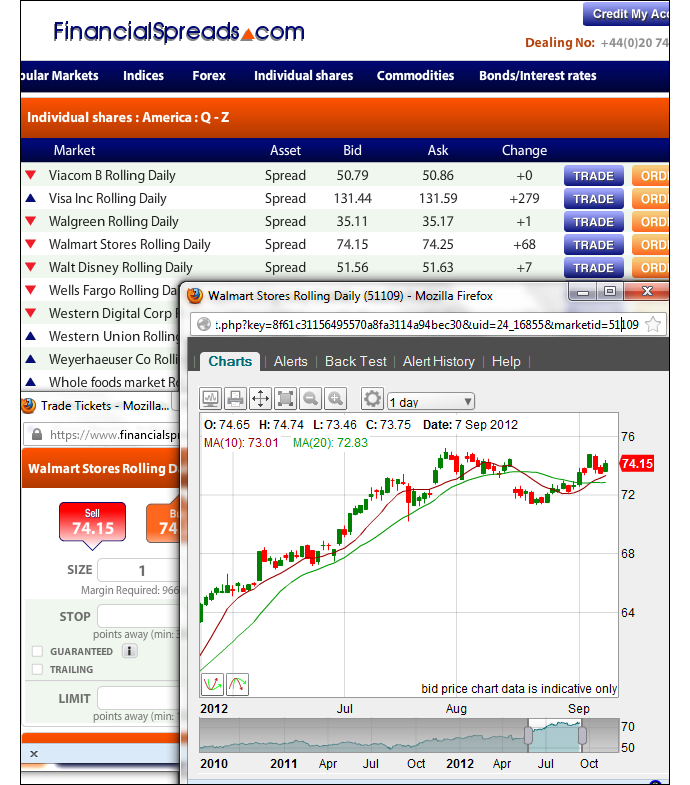

Advanced Charts for Amazon |

Whilst the charting packages vary from firm to firm, in order to help your technical analysis, most charts generally come with tools that include:

- Many different time intervals such as 1 minute, 15 minutes, 4 hours and so on

- Various chart types such as candle charts and OHLC charts

- Drawing features such as trendlines, Fibonacci time zones, arcs and fans

Charts from Financial Spreads also come with other benefits:

- BackTesting, Customisable Indicators and Optimisation tools

- Key overlays such as EMA, Ichimoku Clouds, Price Channels and so on

- Over 30 indicators such as Stochastic, Range Indicator, Projection Bands and so on

- Automatic email alerts for when a market hits a pre-set price

Sample share trading chart from Financial Spreads

The financial spread betting brokers listed below give their users real-time prices and charts:

Advert:

Amazon Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Amazon with

Financial Spreads.

|

Where Can I Spread Bet on Amazon for Free? |

Speculating on the financial markets always has risks, however, if you want to try a completely free Practice Account, that allows you to try out spread trading, then see below for further details.

When looking at which trading option is right for you, don't forget that spread trading in the UK is currently tax free*.

If you're looking for a low cost spread betting website then you should note that investors can take a view on Amazon with no commissions or brokers' fees with:

If you want to have a look at a completely free Practice Account to get to grips with online spread betting, including markets such as the FTSE 100, EUR/GBP and Amazon, then you can always have a look at:

All of the above spread betting firms currently offer a risk free Demo Account which investors can use to look at professional charts, try out new trading theories and gain experience with a range of orders, like stop losses and guaranteed stop losses.

How to Spread Bet on Amazon? |

If you decide to speculate on US companies like Amazon then one option could be to place a spread bet on the Amazon share price.

Logging into FinancialSpreads, you can see they are pricing the Amazon Rolling Daily market at $262.57 - $263.22. This means an investor can spread bet on the Amazon shares:

Going above $263.22, or Going above $263.22, or

Going below $262.57 Going below $262.57

Whilst financial spread trading on S&P 500 equities you trade in £x per cent. Therefore, if you invest £5 per cent and the Amazon share price changes by $0.33 then that would make a difference to your P&L of £165. £5 per cent x $0.33 = £165.

You are also able to invest in this market in Dollars or Euros, e.g. $x per cent.

Rolling Daily Equities Markets

One important thing to note is that this is a 'Rolling Daily Market' and therefore there is no predetermined settlement date for this market. If you decide to leave your trade open at the end of the day, it will stay open and roll over into the next day.

If a position is rolled over and you are spread betting on the market to:

Increase - then you usually pay a small overnight financing fee, or Increase - then you usually pay a small overnight financing fee, or

Decrease - then you will normally receive a small credit to your account Decrease - then you will normally receive a small credit to your account

You can find more on Rolling Daily Markets, as well as a fully worked example, in our feature Rolling Daily Spread Betting.

Amazon Rolling Daily - US Shares Spread Betting Example |

Now, if we take the above spread of $262.57 - $263.22 and make the assumptions:

- You've completed your analysis of the sector, and

- You think the Amazon share price will increase and move above $263.22

Then you might go long of the market at $263.22 for a stake of, for example, £0.5 per cent.

So, you win £0.5 for every cent that the Amazon shares increase and go higher than $263.22. Nevertheless, it also means that you will lose £0.5 for every cent that the Amazon market moves lower than $263.22.

Thinking of this in a slightly different way, if you were to buy a spread bet then your P&L is worked out by taking the difference between the settlement price of the market and the initial price you bought the market at. You then multiply that difference in price by your stake.

As a result, if after a few days the shares started to move upwards then you could choose to close your position in order to lock in your profit.

As an example, if the market increased then the spread, determined by the spread betting company, might change to $265.59 - $266.24. You would close your position by selling at $265.59. As a result, with the same £0.5 stake this trade would result in a profit of:

Profit = (Closing Price - Opening Price) x stake

Profit = ($265.59 - $263.22) x £0.5 per cent stake

Profit = $2.37 x £0.5 per cent stake

Profit = 237¢ x £0.5 per cent stake

Profit = £118.50 profit

Financial spread trading doesn't always go to plan. In this example, you had bet that the share price would go up. Of course, it might fall.

If the Amazon stock weakened, against your expectations, then you could choose to close your position to limit your losses.

Should the spread fall back to $260.52 - $261.17 then this means you would settle your position by selling at $260.52. Therefore, you would make a loss of:

Loss = (Closing Price - Opening Price) x stake

Loss = ($260.52 - $263.22) x £0.5 per cent stake

Loss = -$2.70 x £0.5 per cent stake

Loss = -270¢ x £0.5 per cent stake

Loss = -£135.00 loss

Note: Amazon Rolling Daily spread betting market quoted as of 06-Feb-13.

Advert:

Amazon Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Amazon with

Financial Spreads.

|

'Amazon Spread Betting' edited by DB, updated 03-Oct-17

For related articles also see:

Apple Spread Betting, updated 03-Oct-17

Apple spread betting and share trading guide with daily updates on the tech firm and a real-time AAPL stock chart & live prices. Where spread bet on Apple commission-free and... » read guide.

Facebook Spread Betting, updated 03-Oct-17

Facebook spread betting and share trading guide with daily updates on the tech firm and a real-time FB stock chart & live prices. Where spread bet on Facebook commission-free and... » read guide.

Google Spread Betting, updated 03-Oct-17

Google spread betting and share trading guide with daily updates on the search firm and a real-time GOOG stock chart & live prices. Where spread bet on Google commission-free and... » read guide.

Adobe Spread Betting, updated 03-Oct-17

Adobe spread betting and share trading guide with daily updates on the tech firm and a real-time ADBE stock chart & live prices. Where spread bet on Adobe commission-free and... » read guide.

eBay Spread Betting, updated 03-Oct-17

eBay spread betting and share trading guide with daily updates and a real-time eBay stock chart & live prices. We review the US firm's share price, how to... » read guide.

Oracle Spread Betting, updated 03-Oct-17

Oracle spread betting and share trading guide with daily updates on the tech firm and a real-time ORCL stock chart & live prices. Where spread bet on Oracle commission-free and... » read guide.

Tripadvisor Spread Betting, updated 03-Oct-17

Tripadvisor spread betting and share trading guide with daily updates on the tech firm and a real-time TRIP stock chart & live prices. Where spread bet on Tripadvisor commission-free and... » read guide.

Netflix Spread Betting, updated 03-Oct-17

Netflix spread betting and share trading guide with daily updates on the tech firm and a real-time NFLX stock chart & live prices. Where spread bet on Netflix commission-free and... » read guide.

About this page:

Amazon Spread Betting

Amazon spread betting and share trading guide with daily updates on the tech firm and a real-time AMZN stock chart & live prices. Where spread bet on Amazon commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|