Where Can I Find Live Prices and Charts for Adobe?

This CFD chart gives you a handy guide to the Adobe share price.

The chart above is from Plus500 and typically tracks the underlying Adobe futures market (not the daily market).

If you'd like to study spread betting charts and live prices for Adobe, one option is to use a spread trading account.

A spreads account also gives you access to the shorter-term daily markets. Users should note that accounts are subject to status and suitability checks.

If your account application is approved then, once logged on, you will be able to analyse the real-time trading prices and charts. Usually, these will be provided for free. So what's the catch? You'll probably receive an occasional sales letter or email from the relevant spread trading broker.

If you want to trade, remember that CFDs and financial spread betting do involve a high level of risk to your capital and it is possible to incur losses that exceed your initial investment.

For more details, see Advanced Adobe Trading Charts below.

Professional Level Charting Packages for Adobe |

Although charts differ from provider to provider, in order to assist you with your trading decisions, they often come with useful tools and features that include:

- A large range of time periods e.g. 30 minutes, 4 hours, 1 month and so on

- Various views e.g. line and candle charts

- Drawing options e.g. Fibonacci time zones, arcs and fans

The charts with Inter Trader also have more advanced aspects:

- Custom Indicators, BackTesting and Analysis tools

- Overlays e.g. Exponential Moving Average, Bollinger Bands, Wilder's Smoothing and so on

- A selection of secondary charts e.g. Range Indicator, RMI, Mass Index and so on

- Automatic email alerts for when a market reaches a specific level

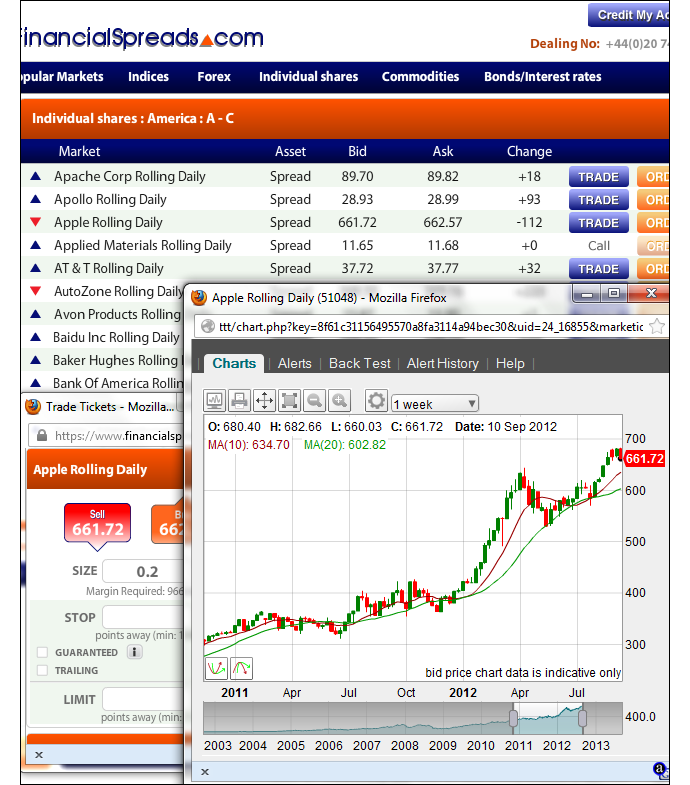

Example trading chart

The spread betting companies in the following list offer clients access to real-time charts and prices:

Advert:

Adobe Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Adobe with

Financial Spreads.

|

Where Can I Spread Bet on Adobe for Free? |

Trading the markets involves a degree of risk. Nevertheless, if you want to try a Demo Account (free), that lets you try out financial spread betting, then please see below.

When thinking about which trading option is right for you, also remember that spread trading in the UK is tax free*, i.e. there is no income tax, capital gains tax or stamp duty.

If you're trying to find a low cost trading platform, note that you can spread bet on Adobe without paying any brokers' fees or commissions via:

If you want to have a look at a free Demo Account / Practice Account where you can try out online spread betting, including trading markets such as Adobe, then look into:

Each of the above spread betting companies currently provide a risk free Demo Account that allows investors to gain experience with an array of orders, try out new theories and study charts.

How to Spread Bet on Adobe? |

Should an investor decide to invest in firms such as Adobe then one solution could be to spread trade on the Adobe share price.

Logging onto Financial Spreads, you can see they have put the Adobe Rolling Daily market at $38.52 - $38.57. As a result, you can put a spread bet on the Adobe shares:

Rising above $38.57, or Rising above $38.57, or

Falling below $38.52 Falling below $38.52

Whilst financial spread trading on US shares you trade in £x per cent. So, if you invest £2 per cent and the Adobe share price changes by $0.26 then that would make a difference to your P&L of £52. £2 per cent x $0.26 = £52.

Note that you are also able to spread bet on this market in Euros or Dollars, e.g. $x per cent.

Rolling Daily Shares Markets

It is important to note that this is a Rolling Daily Market and so unlike a normal spread betting futures market, there is no closing date. You do not have to close your position, should it still be open at the end of the trading day, it will simply roll over to the next session.

Should your trade roll over, if you are speculating that the market will:

Go up - then you'll often be charged a small financing fee, or Go up - then you'll often be charged a small financing fee, or

Go down - then you will often receive a small payment to your account Go down - then you will often receive a small payment to your account

For a worked example please see Rolling Daily Spread Betting.

Adobe Rolling Daily - US Shares Spread Trading Example |

So, if we consider the above spread of $38.52 - $38.57 and make the assumptions that:

- You have completed your analysis of the markets, and

- You think the Adobe shares will increase and go above $38.57

Then you might choose to buy a spread bet at $38.57 and risk, let’s say, £3 per cent.

This means that you win £3 for every cent that the Adobe shares rise higher than $38.57. On the other hand, it also means you will make a loss of £3 for every cent that the Adobe market moves lower than $38.57.

Thinking of this in a slightly different way, if you ‘Buy’ a spread bet then your profits (or losses) are worked out by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that price difference by the stake.

With this in mind, if after a few hours the shares started to increase then you might think about closing your trade and therefore lock in your profits.

So if the market rose then the spread might change to $38.97 - $39.02. You would settle your position by selling at $38.97. So, with the same £3 stake you would calculate your profit as:

Profit = (Final Price - Opening Price) x stake

Profit = ($38.97 - $38.57) x £3 per cent stake

Profit = $0.40 x £3 per cent stake

Profit = 40¢ x £3 per cent stake

Profit = £120 profit

Financial spread betting on shares doesn't always work out as you would have liked. In this example, you had bet that the share price would increase. Nevertheless, the share price could decrease.

If the Adobe share price decreased, contrary to your expectations, then you could close your spread bet to stop any further losses.

So if the spread pulled back to $38.11 - $38.16 then this means you would settle your trade by selling at $38.11. If so, your loss would be calculated as:

Loss = (Final Price - Opening Price) x stake

Loss = ($38.11 - $38.57) x £3 per cent stake

Loss = -$0.46 x £3 per cent stake

Loss = -46¢ x £3 per cent stake

Loss = -£138 loss

Note: Adobe Rolling Daily spread betting price taken as of 06-Feb-13.

Advert:

Adobe Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Adobe with

Financial Spreads.

|

'Adobe Spread Betting' edited by DB, updated 03-Oct-17

For related articles also see:

Apple Spread Betting, updated 03-Oct-17

Apple spread betting and share trading guide with daily updates on the tech firm and a real-time AAPL stock chart & live prices. Where spread bet on Apple commission-free and... » read guide.

Facebook Spread Betting, updated 03-Oct-17

Facebook spread betting and share trading guide with daily updates on the tech firm and a real-time FB stock chart & live prices. Where spread bet on Facebook commission-free and... » read guide.

Google Spread Betting, updated 03-Oct-17

Google spread betting and share trading guide with daily updates on the search firm and a real-time GOOG stock chart & live prices. Where spread bet on Google commission-free and... » read guide.

Amazon Spread Betting, updated 03-Oct-17

Amazon spread betting and share trading guide with daily updates on the tech firm and a real-time AMZN stock chart & live prices. Where spread bet on Amazon commission-free and... » read guide.

eBay Spread Betting, updated 03-Oct-17

eBay spread betting and share trading guide with daily updates and a real-time eBay stock chart & live prices. We review the US firm's share price, how to... » read guide.

Oracle Spread Betting, updated 03-Oct-17

Oracle spread betting and share trading guide with daily updates on the tech firm and a real-time ORCL stock chart & live prices. Where spread bet on Oracle commission-free and... » read guide.

Tripadvisor Spread Betting, updated 03-Oct-17

Tripadvisor spread betting and share trading guide with daily updates on the tech firm and a real-time TRIP stock chart & live prices. Where spread bet on Tripadvisor commission-free and... » read guide.

Netflix Spread Betting, updated 03-Oct-17

Netflix spread betting and share trading guide with daily updates on the tech firm and a real-time NFLX stock chart & live prices. Where spread bet on Netflix commission-free and... » read guide.

About this page:

Adobe Spread Betting

Adobe spread betting and share trading guide with daily updates on the tech firm and a real-time ADBE stock chart & live prices. Where spread bet on Adobe commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|