Losses can exceed deposits

Let’s look at InterTrader…

At Clean Financial we want to help you select the spread betting / CFD platform that is right for you and One option is InterTrader.Quick Links

- InterTrader Trading Offers

- InterTrader – TradeBack

- InterTrader Review

- InterTrader Account

- InterTrader Mobile Trading

- User Ratings on InterTrader

- User Comments on InterTrader

- InterTrader CFDs

- InterTrader Charts

- InterTrader Markets

- About InterTrader

- Video Guide – Charts on InterTrader

10% First Deposit Trading Credit

InterTrader are currently running two offers:

10% First Deposit Trading Credit

£50 – £10,000 trading credit available

Your trading credit is 10% of your first deposit over £500 (within six months of opening your account), i.e. from £50 to a £10,000 maximum.

In order to convert the credit to cash and withdraw the funds you need to place trade with a total stake of at least double the trading credit amount (and therefore your risk considerably more than the credit amount)

Single share trades do not count. Offer applies to new clients on the web-based platform and excludes MT4 accounts. InterTrader recommends you read the full terms and conditions.

InterTrader ‘TradeBack’ Loyalty Programme

InterTrader run a rebate loyalty programme called TradeBack. They will give you a rebate at the end of every month based on the volume of your trading.

As long as you have paid combined spread fees during the month of over £500, regardless of how much you have earned from your trading, you will receive an automatic rebate on your trading costs.

Depending on the volume you trade, the rebate rises from 5% to 10% of your trading costs.

Accounts are subject to status. See site for full Terms and Conditions.

Losses can exceed deposits

Spread betting and CFD trading are leveraged products and as such carry a high level of risk to your capital which can result in losses greater than your initial deposit. These products may not be suitable for all investors. CFDs are not suitable for pension building and income. Ensure you fully understand all risks involved and seek independent advice if necessary.

InterTrader is a trading name of InterTrader Limited which is owned and controlled by GVC Holdings PLC. InterTrader Limited is authorised and regulated by the Gibraltar Financial Services Commission and registered with the Financial Conduct Authority in the UK, ref 597312. Registered address: Suite 6, Atlantic Suites, Europort Avenue, Gibraltar.

InterTrader Account Review

With InterTrader you get all the normal advantages of spread betting:- Tax Free Investments* with no capital gains tax, stamp duty or income tax

- You can buy or sell stock market indices, shares, FX, commodities, interest rates and bonds

- There no are stockbroker’s fees and no commissions

- You can trade thousands of markets and instruments, for more details see InterTrader Markets

You Also Get:

- MetaTrader 4: MT4 is one of the most popular trading terminals, it combines sophisticated analytics and trading tools with a simple interface. It was independently developed as an integrated forex trading platform. Through InterTrader you can use MT4 to trade forex, stock market indices, commodities and treasuries.

- Mobile Trading Apps: see InterTrader Mobile Trading.

- Advanced Charts: including the power to run complex backtesting strategies, see the charting section below.

- CFD Trading: see InterTrader CFDs.

- 24 Hour Trading: the dealing desk operates 24 hours a day for major markets like the FTSE 100, EUR/USD, crude oil and gold (Monday – Friday).

Dealing spreads may be wider in out-of-hours trading, however, this added flexibility offers you the ability to get both in-and-out of positions as the markets change throughout the day and night. You no longer need to wait for the opening bell. - Live Squawk: the text and audio commentary lets clients stay in touch with market headlines throughout the day. Users can also access research and video summaries through the Live Squawk service.

- Technical Analysis and Trading Signals: daily analysis covers target levels, and stop levels, for a wide range of stock market indices, commodities, forex, shares and treasuries markets.

- Heatmaps: colour-coded-at-a-glance guides to market hotspots.

- Low Margins: the spread betting company offers consistently low margin rates and this provides you with a trading advantage. Low margins allow you to commit less capital for each position you take.

As an example, you can place a £1 per point FTSE 100 Rolling Daily spread bet with an initial deposit of just £30. Deposits start from just 3% for FTSE 100 shares and from 5% for FTSE 250 and US shares. - Trailing Stops & Guaranteed Stops: investors can apply trailing stops to all markets. A trailing stop is an order that is designed to limit your risk whilst helping to lock in your potential profits.

There is no fee to use a trailing stop, however, they are a form of stop-loss and stop-loss orders are not guaranteed.

For a small premium users can opt to add Guaranteed Stops to their trades in order to protect them from any market ‘gaps’.

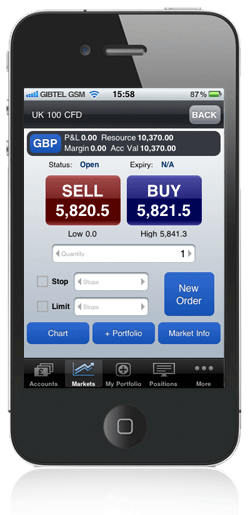

InterTrader Mobile Trading

InterTrader offer free apps for the iPhone, iPad and Android based smartphones. Using these applications investors can:- Trade thousands of spread betting markets

- Trade CFDs

- Access live charts

- Use a range of trading orders

- Review their account

InterTrader – TradeBack

As long as you have paid combined spread fees during the month of over £500, regardless of how much you have earned from your trading, you will receive an automatic rebate on your trading costs.The rebate rises from 5% to 10% of your trading costs, depending on volume:

| Loyalty Tier | Monthly Spread Fees | TradeBack Rebate |

| Silver | £500 – £1999 | 5% |

| Gold | £2000 – £4999 | 7.50% |

| Platinum | £5000+ | 10% |

The TradeBack loyalty programme is available to anyone with an InterTrader account.

There’s no need to enrol in the scheme, once your InterTrader account is live you will automatically enjoy TradeBack rebates, see InterTrader.com for full details.

TradeBack – Spread Betting Loyalty Programme Example

Looking at an example, let’s say an investor called Mr Spreads traded the following with InterTrader over the course of a month:| Instrument | Number of Trades | Typical Spread | Average Stake per Point |

| FTSE 100 | 50 | 1 | £10 |

| GBP/USD | 40 | 2 | £5 |

| Crude Oil | 30 | 5 | £10 |

| Gold | 50 | 5 | £20 |

(50x1x10) +

(40x2x5) +

(30x5x10) +

(50x5x20) = 7,400 X 10% = £740 rebate.

Therefore, during the first week of the following month, Mr Spreads would receive £740 directly into his trading account, no strings attached.

User Ratings & Comments on InterTrader

Add Your View – if you have any comments or questions on InterTrader, feel free to add them here.Readers can leave comments by logging in securely to their Facebook, Twitter or Intense Debate accounts (CleanFinancial does not see, or keep a record of, your login details).

InterTrader CFDs

As well as a comprehensive financial spread betting service, InterTrader offers contracts for difference (CFDs) on more than 2,500 markets.Like spread betting, CFD trading is leveraged, so an investor does not buy the physical shares / take a stake in the underlying market, and they do not put up the full value of the shares that they are trading.

With CFDs the main trading costs are normally the commission and the spread (the difference between the sell and buy price). Naturally, this means it costs more to trade with brokers that have wide spreads and high commission levels.

The CFD service is commission-free and they also offer some of the tightest spreads in the market place. E.g. the spread on FTSE 100 shares is 0.05% per side of the underlying market.

With InterTrader, investors trading CFDs can also benefit from:

- No stamp duty*

- Trading an exact quantity of shares or lot sizes

- Low minimum margin rates

InterTrader Charts

As you can expect with most financial spread betting companies, the charts come with:- Different displays e.g. candlestick charts and line charts

- Tools for adding features e.g. Fibonacci arcs, time zones and fans

- Numerous intervals e.g. by the tick, 1 minute, 5 minute, 10 minute, 30 minute, 1 hour, 2 hour, 1 day, 1 week etc.

- Customisable Indicators e.g. BackTesting and Optimisation functions

- Important pre-set overlays e.g. Moving Averages, Ichimoku Clouds, Envelopes, Bollinger Bands etc.

- Over 30 indicator charts e.g. MACD, Historical Volatility, Chaikin Money Flow, Forecast Oscillator, Volume Index, Range Indicator, Commodity Channel Index etc.

- Customisable alerts i.e. email alerts which trigger when your chosen market reaches a pre-determined level

InterTrader now offers clients free access to advanced charts. The new charts are fully integrated into the InterTrader platform and are available to all live account holders for free.

Clients simply have to click the icon next to any market listing to bring up a live chart for that market.

The new charts are in addition to the existing chart package which is also still available on the platform. This means that clients now get free access to both basic and advanced charts.

InterTrader is one of very few brokers to offer IT-Finance Advanced Charts free to all its clients, without charging minimum trading volumes or other usage requirements.

InterTrader Charts

IT-Finance Advanced Charts contain over 70 preset technical indicators, enabling complex technical trading analysis of historical price data.Any of these indicators can be modified and users can create their own indicators with the simple ProBuilder language.

With the indicators in place, investors can set price alerts which are triggered by single or multiple criteria and monitor the current status of all your alerts.

This package also gives investors the power to conduct sophisticated backtesting against historical data. After setting any combination of trigger conditions and defining money management rules, investors can run a full simulation showing virtual orders and trades and a full breakdown of the return on virtual capital.

The advanced charting package is ideal for traders who rely on detailed technical analysis, and who want to tailor their tools to their exact needs.

Sample InterTrader Chart

InterTrader Spread Betting/CFD Account

A quick run-down of the main InterTrader account.InterTrader Services |  |

| Average User Rating | 7 |

| New Account Offer |  |

| 24 Hour Trading |  |

| Live Charts |  |

| iPhone App |  |

| iPad App |  |

| Android Apps |  |

| Web Platform |  |

| Stop Loss Available |  |

| Automatic Stop Loss |  |

| Credit Account |  |

| Deposit Account |  |

| FCA Authorised and Regulated |  |

InterTrader Markets and Spreads

Below, we look at some of the most popular spread betting markets available with InterTrader along with their typical in-market-hours spread size and the minimum stake for that market.See above for InterTrader prices.

- European Indices: AEX, Euro Stoxx 50, MDAX 50, Sweden 30, Swiss SMI

- US Indices: Russ 2K

- World Indices: Australia 200, China Enterprise, Hong Kong Index, Indian Nifty 50, Johannesburg Index

Typical In-Hours Forex Spread Sizes with InterTrader |  |

| EUR / USD Daily | 1 |

| GBP / USD Daily | 1.8 |

| EUR / GBP Daily | 0.8 |

| USD / JPY Daily | 0.8 |

| Forex minimum stake | £1 |

- Majors: Australian Dollar/Yen, Australian Dollar/US Dollar, Swiss Franc/Yen, Euro/Australian Dollar, Euro/Canadian Dollar, Euro/Swiss Franc, Pound/Yen, US Dollar/Swiss Franc.

- Minors: Australian Dollar/Canadian Dollar, Australian Dollar/New Zealand Dollar, Euro/New Zealand Dollar, Pound/Swiss Franc, Pound/South African Rand, New Zealand Dollar/Yen, US Dollar/Danish Krone, US Dollar/Swedish Krona, US Dollar/South African Rand.

- Exotics: Dollar/Polish Zloty, Dollar/Mexican Peso, Dollar/Czech Koruna

- Metals: Copper, Silver

- Energies: Carbon Emissions, Heating Oil, Natural Gas

- Softs: Cocoa, Coffee, Cotton, Orange Juice, Soybean, Sugar, Wheat

Typical In-Hours Interest Rate Spread Sizes with InterTrader |  |

| Euribor | 2 |

| Euroswiss | 2 |

| Short Sterling | 2 |

| Treasuries minimum stake | £1 |

Typical In-Hours Bonds Spread Sizes with InterTrader |  |

| BOBL | 2 |

| Bund | 3 |

| Gilt | 3 |

| Schatz | 2 |

| US T Bond 10 Year | 4 |

| US T Bond 30 Year | 6 |

| Treasuries minimum stake | £1 |

About InterTrader

Losses can exceed deposits

InterTrader.com is part of the bwin.party family. bwin.party is listed on the London Stock Exchange under the ticker BPTY and is a FTSE 250 company.

InterTrader.com is a trading name of London Capital Group Ltd which is authorised and regulated by the Financial Conduct Authority (FCA).

Your funds are ring-fenced i.e. any funds that are either deposited and/or are the result of trading profits, are held in a segregated client money account in accordance with the FCA’s client money rules.

According to the InterTrader website, they are “committed to giving you the tools to profit from market moves and the resources to become a more informed trader. With low margin rates and tight spreads, you can make the most of your capital in the global markets”.

Video Guide to Charts on the InterTrader Platform

This video guide looks at the charts on the platform:

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.