LSE Spread Betting

Where Can I Spread Bet on LSE? |

At the moment, investors are able to take a view on LSE, and a wide variety of other spread trading markets, with companies like:

|

| Broker Ratings - Sponsored by IG |

A look at the latest LSE broker ratings:

| 15-Mar-16 |  | Neutral | Macquarie | 2893 | 2460 | -15.00% | | 10-Mar-16 |  | Add | AlphaValue | 2847 | 3354 | 17.80% | | 08-Mar-16 |  | Hold | Numis | 2815 | 2700 | -4.10% | | 07-Mar-16 |  | Outperform | Exane BNP Paribas | 2821 | 3000 | 6.30% | | 24-Feb-16 |  | Outperform | Keefe, Bruyette & Woods | 2642 | 2875 | 8.80% | | 23-Feb-16 |  | Hold | HSBC | 2297 | 2500 | 8.80% | | 16-Feb-16 |  | Overweight | Barclays | 2331 | 2840 | 21.80% | | 10-Feb-16 |  | Neutral | Macquarie | 2171 | 2468 | 13.70% | | 04-Feb-16 |  | Buy | AlphaValue | 2393 | 3126 | 30.60% | | 25-Jan-16 |  | Outperform | RBC Capital Markets | 2465 | 3000 | 21.70% | | 15-Jan-16 |  | Neutral | Macquarie | 2478 | 2468 | -0.40% | | 07-Jan-16 |  | Buy | AlphaValue | 2503 | 3158 | 26.20% | | 31-Dec-15 |  | Buy | AlphaValue | 2753 | 3191 | 15.90% | | 24-Dec-15 |  | Buy | AlphaValue | 2721 | 3167 | 16.40% | | 18-Nov-15 |  | Overweight | Barclays | 2542 | 2840 | 11.70% | | 10-Nov-15 |  | Hold | HSBC | 2572 | 2700 | 5.00% | | 28-Oct-15 |  | Hold | Societe Generale | 2557 | 2600 | 1.70% | | 22-Oct-15 |  | Overwt/In-Line | Morgan Stanley | 2440 | 2885 | 18.20% | | 20-Oct-15 |  | Hold | Numis | 2439 | 2450 | 0.50% | | 16-Oct-15 |  | Hold | HSBC | 2480 | 2500 | 0.80% | | 09-Oct-15 |  | Outperform | Credit Suisse | 2443 | 2900 | 18.70% | | 24-Sep-15 |  | Neutral | Macquarie | 2393 | 2468 | 3.10% | | 15-Sep-15 |  | Outperform | RBC Capital Markets | 2454 | 2900 | 18.20% | | 26-Aug-15 |  | Outperform | RBC Capital Markets | 2504 | 2900 | 15.80% | | 19-Aug-15 |  | Overweight | Barclays | 2594 | 2840 | 9.50% |

For the latest UK broker ratings see Daily Trading Tips.

|

Where Can I Find Live Prices and Charts for LSE?

The real time CFD trading chart below will give you a handy look at the LSE share price.

The Plus500 chart that we use above normally uses the underlying LSE futures market (not the daily market).

Should you want to access real time spread betting prices and charts for LSE, you could use a spread trading account.

A spreads account also lets you access short term daily markets. Users should note that accounts are normally dependent on suitability, credit and status checks.

Should your new account be accepted, you will be able to log on and access the up-to-the-minute trading charts/prices. These are usually free. What's the catch? You might receive an occasional call and/or letter from your financial spread betting provider.

Of course, if you do decide to trade then you should be aware that CFDs and spread trading carry a high level of risk and it is possible to incur losses that exceed your initial investment.

See below for more on advanced LSE charts.

London Stock Exchange Analysis & News

|

|

About London Stock Exchange |

Professional Level Charts for LSE |

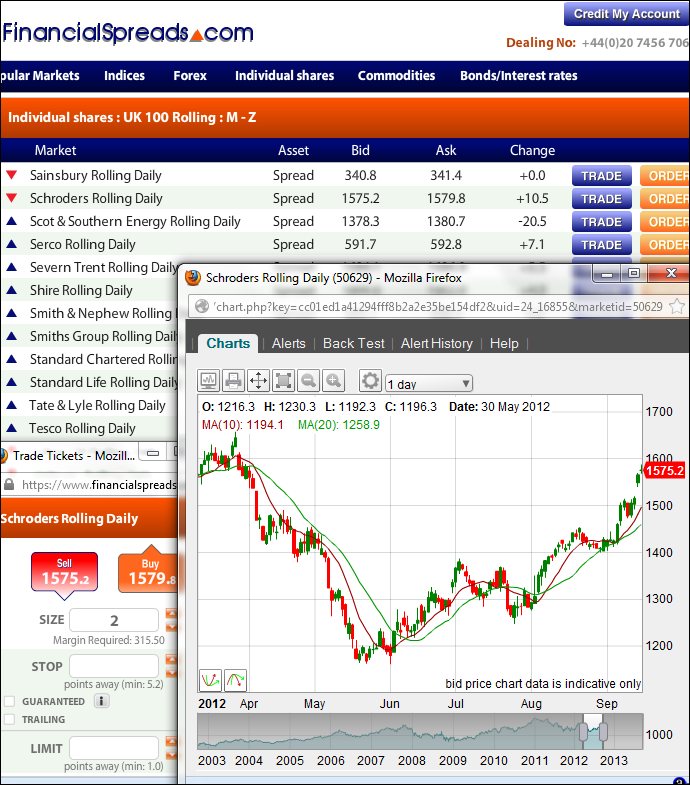

Even though the specific charting packages differ from firm to firm, to help you with your trading decisions, they generally have valuable tools such as:

- A broad range of time intervals, for example, 5 minutes, 15 minutes, 1 day and so on

- A variety of chart types, for example, OHLC, candlestick and line charts

- Tools for drawing and adding features, for example, trendlines, Fibonacci arcs, fans and time zones

Charts with CapitalSpreads also come with:

- Tailored Indicators, BackTesting and Optimisation tools

- Numerous overlays, for example, Parabolic SAR, Ichimoku Cloud, Chande Kroll Stop and so on

- Over 30 indicators, for example, RMI, Williams %R, Price and Volume Trend and so on

- Automatic alerts when the markets hit a pre-set level

Example FinancialSpreads.com equities chart

The spread betting firms in the list below give their clients real time charts/prices:

Where Can I Spread Bet on LSE for Free? |

Investing in the financial markets is not without risk. Having said that, if you'd like to open an entirely free Practice Account, which lets you try out financial spread betting on a wide variety of markets, then see below for more details.

When thinking about which investment option might work for you, also remember that, in the UK, financial spread betting is currently tax free*, i.e. it is exempt from capital gains tax, income tax and stamp duty.

If you are interested in a free financial spread betting site, note that investors can speculate on LSE commission free and with no brokers' fees with firms like:

Should you want to have a look at a completely free Practice Account / Test Account that allows you to try spread betting, and markets such as EUR/GBP, the Dow Jones, gold and LSE, then you can always consider:

Each of these spread trading firms currently offer a Demo Account that investors can use to try out trading ideas, review professional level charts and gain experience with an array of trading orders.

How to Spread Bet on LSE? |

If you decide to invest in UK companies like LSE then one option could be spread betting on the LSE share price.

Looking at a spread trading website like InterTrader, we can see they have priced the LSE Rolling Daily market at 982.2p - 985.3p. Therefore, an investor can spread trade on the LSE share price:

Increasing above 985.3p, or Increasing above 985.3p, or

Decreasing below 982.2p Decreasing below 982.2p

When financial spread trading on UK equities you trade in £x per penny. So, if you risked £3 per penny and the LSE shares move 39p then there would be a difference to your profit/loss of £117. £3 per penny x 39p = £117.

Rolling Daily Shares Markets

This is a Rolling Daily Market which means that there is no preset settlement date for this market. If you decide to leave your trade open at the end of the day, it simply rolls over to the next session.

If you allow your position to roll over and are spread betting on the market to:

Rise - then you are normally charged a small financing fee, or Rise - then you are normally charged a small financing fee, or

Fall - then you will normally receive a small credit to your account Fall - then you will normally receive a small credit to your account

You can learn more about Rolling Daily Markets in our article Rolling Daily Spread Betting.

LSE Rolling Daily - Shares Trading Example |

If we continue with the spread of 982.2p - 985.3p and assume that:

- You've done your analysis of the equities market, and

- Your analysis leads you to feel that the LSE shares are likely to rise above 985.3p

Then you might choose to buy a spread bet at 985.3p and invest, letís say, £3 per penny.

Therefore, you make a profit of £3 for every penny that the LSE shares go higher than 985.3p. However, such a bet also means that you will lose £3 for every penny that the LSE market moves below 985.3p.

Put another way, if you were to buy a spread bet then your P&L is worked out by taking the difference between the closing price of the market and the price you bought the market at. You then multiply that difference in price by the stake.

As a result, if after a few sessions the shares moved higher then you could consider closing your spread bet so that you can secure your profit.

Taking this a step further, if the market rose then the spread, set by the spread trading firm, might move up to 1019.8p - 1022.9p. In order to close/settle your position you would sell at 1019.8p. Accordingly, with the same £3 stake you would make:

Profits (or losses) = (Closing Level - Opening Level) x stake

Profits (or losses) = (1019.8p - 985.3p) x £3 per penny stake

Profits (or losses) = 34.5p x £3 per penny stake

Profits (or losses) = £103.50 profit

Speculating on shares, by spread betting or otherwise, is not always simple. In this example, you wanted the share price to increase. Naturally, it might decrease.

If the LSE share price began to drop then you could choose to close your spread bet in order to limit your losses.

If the market dropped to 944.9p - 948.0p you would close your spread bet by selling at 944.9p. So your loss would be calculated as:

Profits (or losses) = (Closing Level - Opening Level) x stake

Profits (or losses) = (944.9p - 985.3p) x £3 per penny stake

Profits (or losses) = -40.4p x £3 per penny stake

Profits (or losses) = -£121.20 loss

Note: LSE Rolling Daily spread betting market correct as of 31-Oct-12.

Advert:

LSE Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on LSE with

Financial Spreads.

|

'LSE Spread Betting' edited by DB, updated 03-Oct-17

For related articles also see:

Barclays Spread Betting, updated 03-Oct-17

Barclays spread betting and trading guide with live BARC prices and charts. Plus, daily updates, broker recommendations on Barclays, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Spread Betting on BP, updated 03-Oct-17

BP spread betting and trading guide with live LON:BP share prices and charts. Plus, daily updates, broker recommendations, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

HSBC Spread Betting, updated 03-Oct-17

HSBC spread betting and trading guide with live HSBA.L prices and charts. Plus, daily updates, broker recommendations on HSBC, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Royal Mail Spread Betting, updated 03-Oct-17

Royal Mail spread betting and trading guide with live RMG prices and charts. Plus, daily updates, broker recommendations on Royal Mail, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Lloyds Spread Betting, updated 03-Oct-17

Lloyds spread betting and trading guide with live LLOY prices and charts. Plus, daily updates, broker recommendations on Lloyds, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

RBS Spread Betting, updated 03-Oct-17

RBS spread betting and trading guide with live RBS prices and charts. Plus, daily updates, broker recommendations on Royal Bank Of Scotland, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Rio Tinto Spread Betting, updated 03-Oct-17

Rio Tinto spread betting and trading guide with live LON:RIO share prices and charts. Plus, daily updates, broker recommendations, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Vodafone Spread Betting, updated 03-Oct-17

Vodafone spread betting and trading guide with live VOD prices and charts. Plus, daily updates, broker recommendations on Vodafone, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

About this page:

LSE Spread Betting

LSE spread betting and trading guide with live LSE.L prices and charts. Plus, daily updates, broker recommendations on London Stock Exchange, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|

|

|

|

|