Where Can I Find Live Prices and Charts for Royal Mail?

The live CFDs chart below offers you a handy overview of the Royal Mail share price.

Note, the Plus500 charts normally track the underlying futures contract (not the spot price).

If you want to access live financial spread betting prices and charts for Royal Mail, you will probably need a spread betting account. Note, opening such an account is normally dependent on credit, suitability and status checks.

Should your new account be accepted, you can log in and see the charts and the current prices. These are normally free. The catch is that you'll probably receive an occasional sales letter and/or email from the spread betting firm.

Of course, if you decide to trade then, before you start, you should be aware that financial spread betting involves a high level of risk and can result in you losing more than your initial investment.

See below for more on advanced Royal Mail charts.

Royal Mail Analysis & News

|

| 03-Oct-17 |

[11:49am] Royal Mail Share Price Update:

The stock is currently trading below the 20 day moving average of 380.7p and below the 50 day moving average of 389.3p. The stock is currently trading below the 20 day moving average of 380.7p and below the 50 day moving average of 389.3p.- Current Price(i): 379.7p

- Closing Price: 378.4p

1 Day Change: Up 1.50% 1 Day Change: Up 1.50% 5 Day Change: Down -1.51% 5 Day Change: Down -1.51%

Long-Term RMG.L Data 52 Week High: 501.0p 52 Week High: 501.0p 52 Week Low: 368.3p 52 Week Low: 368.3p- EPS(i): £0.27

- PE Ratio(i): 13.87

- Volume / Average Volume(i): 0.856m / 3.766m

- Market Cap(i): £3,797m

- Shares Outstanding(i): 1,000m

Price data from Google Finance. Also see Live RMG.L Share Price & Charts and About Royal Mail for more information.

Update by Jenna Cutly, Editor,

|

| 12-Nov-13 |

[11:26am] Royal Mail Continues its Recent Falls

The Royal Mail market closed yesterday at 557.3p and today they have already hit a low of 539.8p.

Whilst there has been a 10 point bounce back to trade at the current spread of 550.3p-552.7p, the market is still well off its 5 Nov high of 590.4p.

If you are trading this market, be warned, it's yet to settle and there is little new fundamental and so it's looking quite volatile.

Update by Jenna Cutly, Editor,

|

| 04-Nov-13 |

[12:13pm] Royal Mail Shares Post Yet Another High

Financial Spreads are now quoting 584.768p to 588.234p for their rolling daily market.

The Royal Mail Mar 2014 futures market is quoted at 585.9p - 589.8p

The futures market closes on 18 March 2014 but if you take a position you can opt to close your trade earlier if you want.

Futures markets normally have a slightly wider spread than the daily markets but they don't have overnight financing fees. See How to spread bet on Royal Mail shares for more details.

Update by Gordon Childs, Editor,

|

| 16-Oct-13 |

[2:15pm] In the new post on our blog, Michael Hewson of CMC Markets discusses why a lot of the talk about the Royal Mail IPO being under priced may just be hot air.

The Difficulties of Valuing Royal Mail

Update by Gordon Childs, Editor,

|

| 15-Oct-13 |

[3:31pm] Live Royal Mail Charts and Prices

We have now added live Royal Mail CFD charts and prices to this guide.

The charts and prices are based on the underlying Royal Mail share price and are therefore useful for any investors looking to speculate on the UK firm, whether they are financial spread betting, trading the physical shares or CFD trading.

See below for the live Royal Mail charts and prices.

Update by Gordon Childs, Editor,

|

| 15-Oct-13 |

[9:08am] Royal Mail Price Investigation

Vince Cable, the UK Secretary of State for Business, Innovation and Skills, is under pressure as the Royal Mail share price soars.

MPs are set to escalate their investigation into the price at which the Government sold the national postal network (full story in The Times).

Update by Gordon Childs, Editor,

|

| 15-Oct-13 |

[8:39am] The Start of Unconditional Trading

Royal Mail started unconditional trading today, this means that the IPO can no longer be undone and positions cannot be unwound.

Most spread betting and CFD markets track the underlying market. Today, the FinancialSpreads.com market opened at 478p.

So far, there has been a firm 10p move higher and the market is trading up at 487.140p - 488.860p.

Update by Gordon Childs, Editor,

|

| 14-Oct-13 |

[9:40am] Trading Update

Royal Mail closed on Friday at around 452p, this morning the FinancialSpreads market hit 474p by 8.30am.

Whilst the market is now trading a little lower, it is still 10p up on the open.

FinancialSpreads are running both spread betting and CFD markets, these are currently priced at: 462.921p - 464.580p

Note that not all firms offer as many decimal places on equity markets and it may seem confusing at first. However, the principle of the extra decimal places is to give extra price accuracy and slightly tighter spreads to investors.

In this case, it would make precious little difference to my trading but it should lower the cost of trading for larger investors and high frequency traders.

Update by Gordon Childs, Editor,

|

| 14-Oct-13 |

[9:25am] There is a new spread betting video on the CleanFinancial.com blog which discusses a range of markets including Royal Mail.

Royal Mail Surges from IPO Price Despite Lingering US Political Deadlock

Update by Gordon Childs, Editor,

|

| 11-Oct-13 |

[4:55pm] First Day of Trading

It's been a volatile first day of trading for Royal Mail shares, as you can see from the IG chart below:

Update by Gordon Childs, Editor,

|

| 11-Oct-13 |

[8:46am] Trading Royal Mail Shares

Whilst the Royal Mail shares don't enter unconditional trading until Tuesday, spread betting firms are usually a little more fleet of foot and we can already see some open markets.

For example, IG have closed their grey market, which was priced on the 'valuation' of the company.

They are now running a normal equity market where you spread bet on the price of Royal Mail shares. The spread is currently 442.38p - 443.51p but it's looking quite volatile.

If you are thinking of trading, please see the above risk warning. For worked examples, see how to spread bet on shares.

Other firms are also offering an RM market e.g. ETX Capital and Accendo.

Update by Jenna Cutly, Editor,

|

| 11-Oct-13 |

[8:01am] Royal Mail Enters 'Conditional Trading'

So the grey markets are closing / have closed and we are now entering 'conditional trading'.

What is Conditional Trading?

Though unlikely, this means that the IPO can still be stopped and, if so, positions will be unwound.

The share price started conditional trading at 330p. So, with 1bn ordinary shares, that values Royal Mail at £3.3bn.

Unconditional Trading

According to the Royal Mail pricing statement it is 'expected...that unconditional dealings in ordinary shares will commence at 8am on [Tuesday] 15 Oct 2013'.

This means investors should be able to access the market through their normal share dealing accounts on Tuesday.

If you want to trade the market before unconditional trading starts, we will post an update shortly.

Update by Gordon Childs, Editor,

|

| 11-Oct-13 |

[7:45am] Royal Mail Shares Are Now Being Traded

For a look at the privatisation and how the grey markets predicted a strong start for the postal group, see 'The Privatisation of Royal Mail'.

Update by Jenna Cutly, Editor,

|

|

The Royal Mail Group ticker code is RMG, although on some sites you will also see RMG.L, where the .L stands for London Stock Exchange.

The main homepage for investors is royalmailgroup.com/investor-centre.

Here you will find the Annual Reports and Accounts, ‘Shareholder communications’, a chart and share price (15 minute delay).

For the official London Stock Exchange page see Royal Mail Group LSE page.

Royal Mail Social Media

If you are Tweeting about Royal Mail, or searching for RM Tweets, use the cashtags, $RMG or $RMG.L.

At the moment, the former tags seems more popular.

Professional Level Charting Packages for Royal Mail |

Though the specific charting packages normally vary from firm to firm, in order to aid your technical analysis, the charts often have user friendly tools, including:

- A range of time intervals - 1 minute, 1 hour, 1 day and so on

- A variety of views - candlestick and OHLC charts

- Drawing options - trendlines, Fibonacci arcs, fans and time zones

Charts on Financial Spreads, Capital Spreads and Inter Trader also come with advanced features such as:

- Tailored Indicators and Back Testing

- Helpful overlays - Moving Averages, Ichimoku Clouds, Wilder's Smoothing and so on

- More than 30 indicators - Momentum Percentage, Williams %R, Accumulation Distribution and so on

- Automatic email alerts for when a market reaches a given level

Sample shares chart

The following financial spread betting companies provide their users with real time trading prices/charts:

Where Can I Trade Royal Mail CFDs? |

You can currently trade Royal Mail contracts for differences (CFDs) with:

This market may be available with other firms. Note that we also have a live Royal Mail CFD chart.

Where Can I Buy/Sell the Royal Mail Shares? |

If you don’t want to speculate on Royal Mail using spread betting or CFDs then you could use a traditional stock broker such as Hargreaves Lansdown or TD Direct Investing.

Advert:

Royal Mail Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Royal Mail with

Financial Spreads.

|

Where Can I Spread Bet on Royal Mail for Free? |

By its very nature, speculating always involves an element of risk. Nevertheless, if you would like to open a free Test Account, where you can try spread trading, see below for further details.

When deciding which investment option might work for you, don't forget that, in the UK, financial spread betting is currently free of capital gains tax, income tax and stamp duty*.

If you are trying to find a low cost spread trading website then you should note that you are able to trade Royal Mail without paying any stock-broker fees through providers like:

If you would like to open a completely free Demo Account that allows users to try out spread betting, and trading markets like Royal Mail, then you could consider:

The spread betting companies listed above currently provide a risk free Test Account that investors can use to analyse charts, gain experience with a variety of trading orders and try out new strategies.

How to Spread Bet on Royal Mail? |

Should you want to invest in Royal Mail then one option is spread betting on the Royal Mail share price.

Looking at FinancialSpreads, we can see that they are currently offering the Royal Mail Rolling Daily market at 436.454p - 437.797p. This means you can put a spread bet on the Royal Mail share price:

Going above 437.797p, or Going above 437.797p, or

Going below 436.454p Going below 436.454p

Whilst spread betting on UK shares you trade in £x per penny. Therefore, should you decide to invest £5 per penny and the Royal Mail share price moves 24p then that would make a difference to your P&L of £120. £5 per penny x 24p = £120.

Rolling Daily Equities Markets

Be aware that this is a Rolling Daily Market and so there is no preset settlement date for this market. You do not have to close your trade, should it still be open at the end of the trading day, it will simply roll over to the next trading day.

If your bet does roll over and you are speculating on the market to:

Increase - then you will often be charged a small financing fee, or Increase - then you will often be charged a small financing fee, or

Decrease - then you'll usually receive a small credit to your account Decrease - then you'll usually receive a small credit to your account

For a fully worked example see Rolling Daily Spread Betting.

Royal Mail Rolling Daily - Equities Trading Example |

Now, if we take the above spread of 436.454p - 437.797p and assume:

- You've completed your research, and

- Your research leads you to feel that the Royal Mail shares will move higher than 437.797p

Then you may buy at 437.797p and invest, let’s say, £5 per penny.

If so, you make a profit of £5 for every penny that the Royal Mail shares rise above 437.797p. Of course, such a bet also means that you will make a loss of £5 for every penny that the Royal Mail market moves below 437.797p.

Put another way, should you ‘Buy’ a spread bet then your profits (or losses) are worked out by taking the difference between the final price of the market and the price you bought the spread at. You then multiply that price difference by your stake.

As a result, if after a few hours the share price started to increase then you might think about closing your position in order to secure your profit.

If that happened then the spread, determined by the spread betting company, might change to 455.966p - 457.309p. You would close your trade by selling at 455.966p. So, with the same £5 stake your profit would be calculated as:

P&L = (Closing Level - Opening Level) x stake

P&L = (455.966p - 437.797p) x £5 per penny stake

P&L = 18.169p x £5 per penny stake

P&L = £90.84 profit

Speculating on shares, whether by spread betting or otherwise, is not simple. In the above example, you had bet that the share price would go up. Of course, it might fall.

If the Royal Mail shares fell then you could choose to close your spread bet to limit your losses.

If the market fell to 421.380p - 422.723p then this means you would sell back your position at 421.380p. So your loss would be calculated as:

P&L = (Closing Level - Opening Level) x stake

P&L = (421.380p - 437.797p) x £5 per penny stake

P&L = -16.417p x £5 per penny stake

P&L = -£82.09 loss

Note: Royal Mail Rolling Daily price as of 11-Oct-13.

Advert:

Royal Mail Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Royal Mail with

Financial Spreads.

|

The Privatisation of Royal Mail |

Below we take a look at the 4 months before Royal Mail was listed on the London stock exchange. We keep a particularly close eye on the grey markets that a number of firms were running prior to the listing.

| 10-Oct-13 |

[7:53pm] How is the Delivery Firm Performing?

For a look at how the share price has performed since listing on the stock market, see Royal Mail trading news and analysis.

Update by Jenna Cutly, Editor,

|

| 10-Oct-13 |

[6:53pm] IG Royal Mail Grey Market Closed

The IG Royal Mail grey market closed today, ahead of tomorrow's start of trading.

At the UK close the grey market was at 396-416.

This suggests a mid-price of 406p per share for Royal Mail.

Although according to David Jones of IG "Of course, this is just the grey market based on our client activity in recent weeks, there's no guarantee this is where trading will start".

Update by Gordon Childs, Editor,

|

| 10-Oct-13 |

[8:10am] Royal Mail Underpriced by 80%, says broker as Cable defends sale.

Hundreds of thousands of private investors will get the bare minimum of shares in Royal Mail flotation as evidence mounted that the Government has inadvertently created a stampede by selling it off too cheaply (full story in The Times).

Update by Jenna Cutly, Editor,

|

| 09-Oct-13 |

[10:13am] Applications for Royal Mail shares closed yesterday but the IPO grey markets that ETX and IG are running are still open.

The IG market hit its highest level yesterday at 4150 (£4.15bn).

The market is now back at 3825 to 4025 (£3.825bn to £4.025bn).

Market Closes on Friday

Note that this grey market closes "at the end of the first day of unconditional trading", which is expected to be this Friday (11 Oct 2013).

Alternative Market

The ETX market is running a little higher than IG, yesterday it hit 4128 (£4.28bn) but it's currently trading at 3951 to 4151 (£3.951bn to £4.151bn).

Update by Gordon Childs, Editor,

|

| 08-Oct-13 |

[5:32pm] 99.75% of Royal Mail Staff Accept Free Shares

A good story on the BBC today states that only 368 of Royal Mail's 150,000 staff have not accepted free shares as part of the IPO.

That should help reduce the risk of short-term strikes. Of course, once RM staff can offload their shares (and many will) then the risk will increase.

When RM becomes more efficient and start making staff redundant, then the risk of strike action will increase again. For now though, 99.75% of employees taking part is encouraging.

The ballot for the next strike closes on 16 October and the industrial action could begin on 23 October.

Opt Out

The BBC article notes that "Ministers deliberately opted in Royal Mail staff to the share scheme, so those wishing to reject the offer had to fill out a lengthy form."

Clever work.

Update by Jenna Cutly, Editor,

|

| 07-Oct-13 |

[2:58pm] Royal Mail IPO Deadline and Key Dates

Don't forget that the deadline for applying for shares is Tuesday 8 October.

The final price and allocations will be announced on Friday 11 October.

Shares will begin full trading on Tuesday 15 October.

The IG grey market will close at the end of the first full day of trading.

Update by Jenna Cutly, Editor,

|

| 07-Oct-13 |

[11:13am] Royal Mail Pricing Update

Since we last looked at the grey market for Royal Mail it has crossed the £4bn mark.

Grey Market IPO Valuations- IG: £3.885bn - £4.085bn

- ETX Capital: £4.078bn - £4.178bn

IG Royal Mail IPO Chart

From the chart below, it looks like IG and ETX Capital have seen an increasing number of buyers for their IPO grey markets.

Update by Gordon Childs, Editor,

|

| 27-Sep-13 |

[12:11pm] Royal Mail Grey Market Price Update

Following on from this morning's 'Order Books Open for Royal Mail' update (see below), we thought we'd have a quick look at the grey market to see where people are actually trading it.

IG and ETX are both running books on the IPO:- IG spread: £2,960m - £3,060m

- ETX Capital spread: £2,953m - £3,053m

So the grey market continues to rise.

IG price:

ETX price:

(If you are trying to find the market on ETX, it's easiest to use the search box).

Update by Gordon Childs, Editor,

|

| 27-Sep-13 |

[11:28am] Order Books Open for Royal Mail

The UK government has begun taking orders for the postal firm, offering shares at 260p to 330p. That values the firm at between £2.6bn and £3.3bn.

The government will dispose of a majority stake, with 10% of shares going to employees and 40.1% of shares to go on sale.

Dividends and Investing

Members of the public must spend at least £750 to invest.

The government is "aiming" to pay a full-year 2014 dividend of £200m, which suggests a dividend yield of 6.1-7.7%. Not a bad rate of return "if" the targets are met.

For more details there is a new Royal Mail sale article on Reuters.

Update by Gordon Childs, Editor,

|

| 26-Sep-13 |

[5:14pm] Royal Mail Worth up to £4.3bn

There's an interesting new Royal Mail valuation article on Bloomberg. According to "people briefed on the estimates" the postal firm could be worth as much as £4.3bn ($6.9bn) when it lists on the stock market.

Apparently, Royal Mail's value (excluding debt) is estimated to be £2.8bn to £4.3bn based on research from the banks preparing the IPO. This information comes from people "who asked not to be named because the talks are private".

A number of things occur to me:- Clearly the talks aren't that private

- Unless I'm missing something, I can't see the markets just 'excluding debt'

- That is a very wide spread

Having said that, if RM IPOs at £4.3bn I wouldn't be that surprised, we've already seen the Twitter IPO grey market jump a few billion dollars in the last week or so.

Update by Gordon Childs, Editor,

|

| 26-Sep-13 |

[9:46am] Royal Mail Share Price Analysis

Naturally, it is much easier to value a company that is already listed on the stock market. There's the current share price, price trends, potentially more accounts/company reports to examine, more analysts' opinions etc.

So how to price up a company before it lists on the stock market?

As part of the fundamental analysis, it is often useful to do SWOT analysis to help weigh up some of the pros and cons.

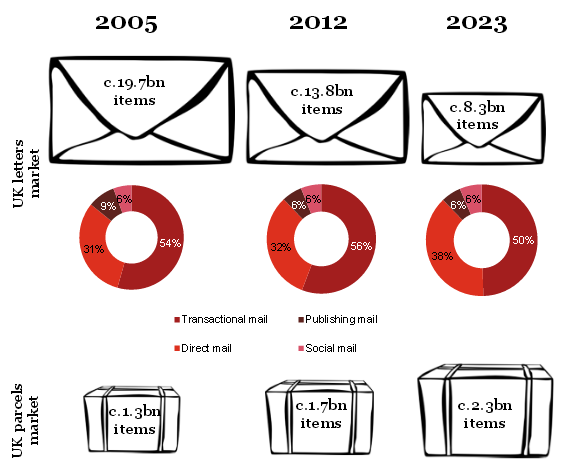

I like to look at the downside first and there are certainly some risks (weaknesses and threats): - How to work with the large, and often union-led, workforce

- Increased competition, particularly in the parcel delivery business

- The declining UK letters market

- After going public, Royal Mail will still be the UK's designated Universal Service Provider (USP). The company will still be regulated by Ofcom and will have to comply with quality of service targets set by the regulator. This includes deliveries, 6 days a week, to all urban and rural UK addresses

- As the USP, Royal Mail's prices for the Universal Postal Service will continue to be regulated to ensure that they remain affordable. This includes setting limits on 2nd class post and small parcels

Of course there are some upsides (strengths and opportunities), for example:- Cost efficiencies of reducing the workforce

- The increasing parcel business as more people shop online

- Whilst there will be increased competition in the parcel delivery business the barriers to entry are high

- For investors who prefer low levels of volatility, the Royal Mail shares could end up being seen as a utility company

- Despite being the USP (see above), Royal Mail has greater freedom to set prices for 1st class post and large parcels

The above is just a personal opinion and, whether you are buying or shorting, it is intended to highlight just a few of the risks of trading the shares. As always, this is not investment advice.

Update by Gordon Childs, Editor,

|

| 25-Sep-13 |

[4:33am] Royal Mail vs the Post Office

Investors analysing Royal Mail should note that Royal Mail and the Post Office are separate companies, with independent Boards.

Royal Mail is the firm that delivers parcels and letters.

The Post Office is "the nationwide network of branches offering a range of postal, Government and financial services".

The Post Office is not for sale (yet).

Update by Gordon Childs, Editor,

|

| 18-Sep-13 |

[4:12pm] Royal Mail IPO Grey Market Price Update

Looking at the screenshot of the IG prices below, there's doesn't seem to be much day-to-day price movement in the Royal Mail IPO market.

The lack of short-term movement in the Royal Mail market can also be seen in the chart below.

Nevertheless, you can see how the price (IPO estimate) has climbed steadily since mid-July.

Update by Gordon Childs, Editor,

|

| 18-Sep-13 |

[3:25pm] UK Postal Volumes

PricewaterhouseCoopers have prepared an interesting report for Royal Mail on future UK mail volumes.

It's fairly easy to digest and makes for a useful read if you want more background on the key deliveries market, Outlook for UK mail volumes to 2023

Naturally it comes with a lot of disclaimers but has interesting UK mail forecasts like this:

Update by Gordon Childs, Editor,

|

| 18-Sep-13 |

[2:52pm] Getting Information on the Royal Mail IPO and Buying Shares

Readers interested in the IPO grey market, and/or buying Royal Mail shares, should note that there are a few interesting reports on the Royal Mail site:

Royal Mail Group Annual Report and Accounts Documents

Via the above 'investor centre' you can also access:- [Royal Mail] Annual Report and Accounts 2012-13

- Royal Mail Group Limited accounts 2012-13

Update by Gordon Childs, Editor,

|

| 16-Sep-13 |

[12:42pm] The IG 'Royal Mail market capitalisation' grey market has now moved to £2830 - £2930m.

That's quite a move from the IG quote on 12 July when they priced the IPO at £2152.5 - £2252.5m.

Update by Gordon Childs, Editor,

|

| 12-Sep-13 |

[11:18am] Alastair McCaig from IG discusses the upcoming Royal Mail floatation and the potential issues that the company may face.

Update by Alastair McCaig, Market Analyst,

|

| 18-Jul-13 |

[3:55pm] Speculating on the Royal Mail IPO |

With the upcoming privatisation of Royal Mail, spread betting company IG has introduced a grey market for investors to speculate on the firm's market capitalisation following its IPO.

And other companies are now following in IG's footsteps and you can currently trade the grey market with:Note that as of 18 July, the ETX spread for Royal Mail was: £2.710bn - £2.810bn. That is markedly higher than the IG spread on 12 July when they were quoting: £2.1525bn - £2.2525bn.

Update by Jenna Cutly, Editor,

|

| 12-Jul-13 |

[4:16pm] IG Offer Royal Mail Grey Market

The brief video below offers a little more information on IG's Royal Mail market:

According to the IG trading platform, this market "Settles [based on] the market capitalisation of Royal Mail at the close of the 1st day of unconditional trading. All OPEN bets will be voided if there is no floatation by Dec 2014".

If you are thinking of trading this market, please remember that financial spread betting is a leveraged product and can result in losses that exceed your initial deposit. Spread betting may not be suitable for everyone, so please ensure that you fully understand the risks involved.

Update by Gordon Childs, Editor,

|

| 10-Jul-13 |

[6:56pm] UK Government to Sell Royal Mail

Estimates for the Initial Public Offering are valuing the company anywhere between £2.5-3bn.

For more information, please see Government Plans Royal Mail IPO.

Update by Gordon Childs, Editor,

|

|

|

'Royal Mail Spread Betting' edited by Jacob Wood, updated 03-Oct-17

For related articles also see:

Barclays Spread Betting, updated 03-Oct-17

Barclays spread betting and trading guide with live BARC prices and charts. Plus, daily updates, broker recommendations on Barclays, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Spread Betting on BP, updated 03-Oct-17

BP spread betting and trading guide with live LON:BP share prices and charts. Plus, daily updates, broker recommendations, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

HSBC Spread Betting, updated 03-Oct-17

HSBC spread betting and trading guide with live HSBA.L prices and charts. Plus, daily updates, broker recommendations on HSBC, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Lloyds Spread Betting, updated 03-Oct-17

Lloyds spread betting and trading guide with live LLOY prices and charts. Plus, daily updates, broker recommendations on Lloyds, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

RBS Spread Betting, updated 03-Oct-17

RBS spread betting and trading guide with live RBS prices and charts. Plus, daily updates, broker recommendations on Royal Bank Of Scotland, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Rio Tinto Spread Betting, updated 03-Oct-17

Rio Tinto spread betting and trading guide with live LON:RIO share prices and charts. Plus, daily updates, broker recommendations, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Vodafone Spread Betting, updated 03-Oct-17

Vodafone spread betting and trading guide with live VOD prices and charts. Plus, daily updates, broker recommendations on Vodafone, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Shell Spread Betting, updated 03-Oct-17

Royal Dutch Shell spread betting and trading guide with live RDSA prices and charts. Plus, daily updates, broker recommendations on Royal Dutch Shell, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

About this page:

Royal Mail Spread Betting

Royal Mail spread betting and trading guide with live RMG prices and charts. Plus, daily updates, broker recommendations on Royal Mail, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|