Life After Capital Spreads

Please note that as of March 2016, the Capital Spreads platform is no longer available.However, if you liked your Capital Spreads account, or were interested in opening a Capital Spreads account, then the FinancialSpreads.com is a very similar alternative.

FinancialSpreads.com uses a platform with a similar layout, similar or better prices, they offer 1,000+ markets etc.

Likewise, InterTrader also offers a similar platform.

What Happened to Capital Spreads?

In 2016 Capital Spreads was merged into ‘LCG Trader’, a new and somewhat different platform.Given that LCG Trader is a new platform we don’t have enough views to give ‘LCG Trader’ the thumbs up / thumbs down. Any feedback is welcome.

New Spread Betting, CFD and Forex Account?

As well as the above, please also see our see our spread betting, CFD and forex offers and spread betting comparison.Note that the Capital Spreads information below is no longer accurate, it is maintained purely as part of the CleanFinancial Website Archive.

Capital Spreads Review

Capital Spreads Account Review

With CapitalSpreads.com you get all the normal advantages of spread betting:- Tax Free Investments*

- No Capital Gains Tax

- No Income Tax

- No Stamp Duty

- You can buy or sell stock market indices, shares, forex, commodities, interest rates and bonds

- No commission fees

- No stock brokers’ fees

- A wide range of markets – also see Capital Spreads markets

Plus with Capital Spreads you get:

Plus with Capital Spreads you get:- 24 Hour Spread Betting – Spread bet on popular markets like the FTSE 100, EUR/USD, GBP/USD, gold and crude oil 24 hours a day from Sunday evening to Friday evening

- Tight Spreads – Capital Spreads aim to provide value for money plus top quality service. They say “you’ll find our spread quotes far better value than most of our competitors. In some cases, you will find that our spreads are extremely competitive in relation to the live, underlying market quotes.”

- More than 2,500 markets – Capital Spreads offer more than 2,500 markets including prices on UK, European and US shares, stock indices, commodities, forex markets, bonds and STIRS via ‘Rolling Daily’ spread bets and/or ‘Futures’ spread bets. For more details see Capital Spreads prices and markets

- Risk Management – There is an automated stop-loss facility which encourages you to understand and control your risk. Be aware that stop losses are not guaranteed. Your stop-loss is set according to the funds available on your account up to a maximum computer-generated level. You can alter your stop loss. Note that whilst they offer compulsory stop-losses, it is possible for you to lose more than your initial deposit

- Guaranteed Stops – For extra security you can add Guaranteed Stops to your trades for a small fee

- Mobile Trading – For more details see Capital Spreads Mobile below

- CFD Trading – For more details see Capital Spreads CFDs below

- A Choice of Currency – You can trade in one of three currencies (Sterling, Euros or US Dollars), which means you do not have to bother with costly exchange rates

Capital Spreads Mobile

The Capital Spreads platform has been optimised for both the Android and iPhone based smartphones. The mobile financial spread betting software has been created to give clients the same flexibility as the current web-based platform. Capital Spreads account holders can:- Open and close trades

- Access live prices

- Review the charts

- Set and amend trading orders including: Guaranteed Stops, Stop Losses, Limits, OCO and If Done orders

- Check and amend their portfolio

Capital Spreads – Award Winning Service

Capital Spreads have won a number of the more prestigious industry awards.Some of the more recent awards include:

- 2013 Money AM Award for Best Mobile/Tablet Application

- 2012 Money AM Award for Best Mobile Trading Platform

- 2012 Money AM Award for Best Online Trading Platform

- 2011 Investors Chronicle Investment Awards – CFD Provider of the Year

- 2011 Trade2Win Members Choice ‘Silver’ Award for Best CFD Broker

User Ratings & Comments on Capital Spreads

Add Your View – please add any user comments and/or questions on Capital Spreads here.Readers can leave comments by logging in securely to their Facebook, Twitter or Intense Debate accounts (CleanFinancial does not see, or keep a record of, your login details).

Capital Spreads Account:

An overview of the Capital Spreads account:Capital Spreads Services |  |

| Average User Rating | 6.8 |

| New Account Offer |  |

| 24 Hour Trading |  |

| Live Charts |  |

| iPhone App |  |

| iPad App |  |

| Android Apps |  |

| Web Platform |  |

| Stop Loss Available |  |

| Automatic Stop Loss |  |

| Credit Account |  |

| Deposit Account |  |

| FCA Authorised and Regulated |  |

Capital Spreads CFDs

In addition to a comprehensive financial spread betting service, Capital Spreads offers contracts for difference (CFDs) on shares, forex, indices and commodities.Like spread betting, CFD trading is leveraged, so an investor does not take a stake in the underlying market and they do not put up the full value of the shares that they are buying or selling.

With CFD trading the primary trading costs are normally the commission and the spread, i.e. the difference between the sell and buy price. As such it normally costs more to trade with companies that have wide spreads and high commission levels.

If you trade CFDs with Capital Spreads there are no commissions. They also offer some of the tightest spreads in the market place. E.g. the spread applied to FTSE 100 shares is just 0.05% per side of the underlying market.

With Capital Spreads, investors trading CFDs can also benefit from:

- No stamp duty*

- Trading an exact quantity of shares or lot sizes

- Low minimum margin rates

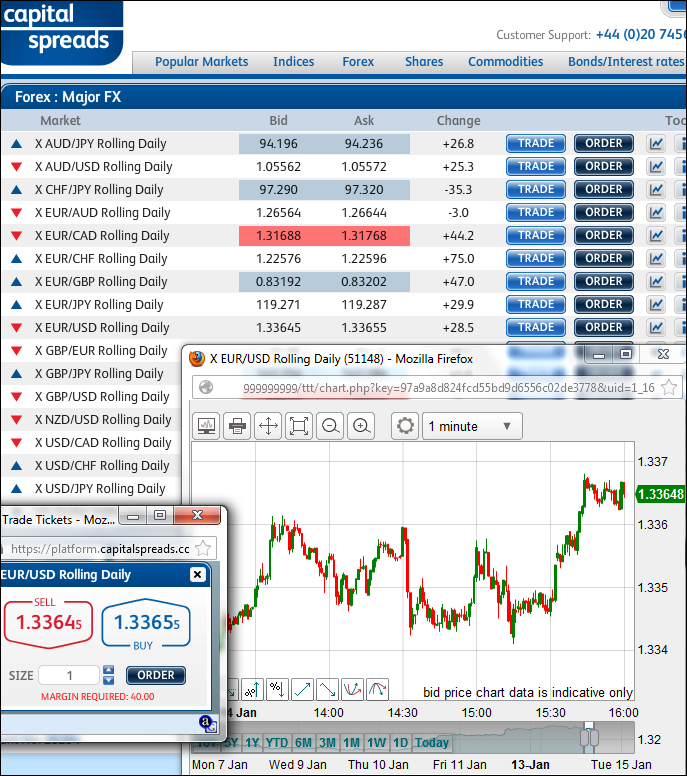

Capital Spreads Charts

Capital Spreads provide their clients with live charts for every market that they offer. As you can expect with most spread betting companies, the charts come with:- A variety of intervals, e.g. tick, 1 minute, 2 minute, 10 minute, 1 hour, 4 hour, 1 day, 1 week, etc.

- Different displays, e.g. candlestick charts and line charts

- Tools for adding features e.g. Fibonacci arcs, time zones and fans

- Important chart overlays e.g. EMA, MA, Ichimoku Kinko Hyo, Price Channels etc.

- 30+ indicator charts e.g. Historical Volatility, Money Flow, Forecast Oscillator, Range Indicator, Price & Volume Trend, etc.

- Customisable Indicators, BackTesting and Optimisation functions

- Custom email alerts which trigger when a market reaches a pre-determined level

Sample Capital Spreads Charts

Capital Spreads Markets

Below, readers will find a sample of the markets offered by Capital Spreads along with their typical in-hours spread size and the minimum stake for that market. See the Capital Spreads website for full details.Swiss SMI, Indian Nifty 50 etc.

Natural Gas Futures, Silver Futures, Copper Futures, Coffee Futures etc.

Typical In-Hours Forex Spread Sizes with Capital Spreads |  |

| EUR / USD Daily | 1 |

| GBP / USD Daily | 1.8 |

| EUR / GBP Daily | 0.8 |

| USD / JPY Daily | 0.8 |

| Forex minimum stake | £1 |

Also see comparison / company spreads notes.

About Capital Spreads

Here’s what they say:“CapitalSpreads.com is an exciting contender in the financial spread betting market-place and we hope it will be embraced by both experienced customers and newcomers to the spread betting world.

“We have built our business with the sole purpose of introducing competitive pricing and a customer friendly trading environment.

“Our unique account management system ensures that you can trade with confidence and the knowledge that all your positions are protected by our automated stop loss facility which can help to limit the risk on your spread betting account (stop-losses are not guaranteed).

“This client protection policy underlines everything that makes us the choice for many private investors and professionals alike. We are truly aiming for every CapitalSpreads.com trade to be as stress and error free as is possible.

“We are committed to quoting amongst the best prices in the industry and feel certain that this, coupled with our customer service policy, will keep you coming back for more.

“Our customers are our most valuable asset and consequently we want your experience with us to be as harmonious as possible.”

Capital Spreads is a division of London Capital Group (LCG). LCG is a company registered in England and Wales under registered number: 3218125.

London Capital Group Ltd, a wholly owned trading subsidiary of LCGH plc, is regulated and authorised by the Financial Conduct Authority. It has a European passport and is a member of the London Stock Exchange. London Capital Group Ltd also has access to international markets through its global clearing relationships.

Registered address: 2nd floor, 6 Devonshire Square, London, EC2M 4AB.

Losses can exceed deposits

Capital Spreads Video Guide to Spread Betting

We find the Capital Spreads platform to be fairly intuitive. However, below, we have also added a series of videos focused on the platform to help those less familiar with financial spread betting and/or the Capital Spreads platform.The following video looks at how spread betting works, the types of markets and the margin requirements as well as rolling contracts and futures contracts.

Video Guide to the Capital Spreads Platform

The following video looks at the tight spreads, low margins, limited risk orders, stop loss orders, demo accounts and educational tools available on the platform.Video Guide to the Capital Spreads Account

The video below reviews the markets available, 24 hour trading, leveraged trading, tax-free* trading, commission-free trading, no brokerage fees, trading falling markets, segregated funds and of course, the risk to your capital.Other Financial Spread Betting Companies?

If want a spread betting account, CleanFinancial.com offers a range of spread betting company reviews and comparisons:- City Index Review

- CMC Markets Review

- ETX Capital Review

- Financial Spreads Review

- Finspreads Review

- IG Index Review

- InterTrader Review

- Spreadex Review

- Tradefair Review

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.