Where Can I Find Live Prices and Charts for Aviva?

The following CFD trading chart offers a nice look at the Aviva share price.

The Plus 500 chart that we use above is typically based on the underlying Aviva futures contract.

Should you want to access real time spread trading prices/charts for Aviva, you generally require a financial spread betting account.

In addition, a spreads account would let you speculate on shorter term spot markets. Readers should note that opening any such account is subject to status, suitability and credit checks.

If your account application is approved, you will be able to log in and see the up-to-the-minute charts/prices. On most platforms, these are provided as part of the service. The catch? You're likely to get the occasional call or email from your chosen spread trading broker.

If you do decide to trade then you should note that financial spread betting and CFD trading involve a high degree of risk to your funds and it's possible to lose more than your initial investment.

See below for more on advanced Aviva charts.

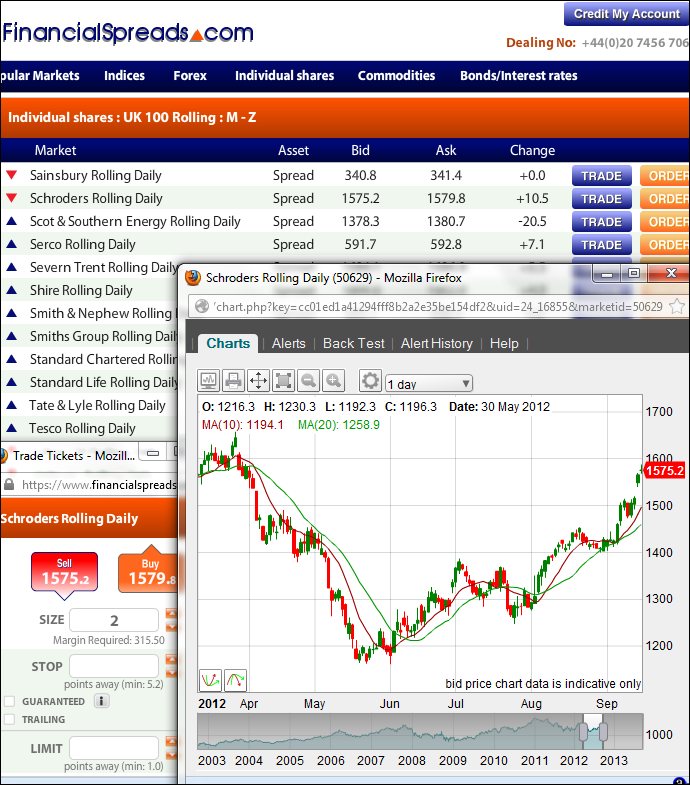

Professional Level Charts for Aviva Shares |

Although the charts normally differ across the various platforms, to aid your analysis, the charts generally have useful features, including:

- An array of time periods e.g. 5 minutes, 1 hour, 2 hours etc.

- A variety of chart types e.g. candlestick and OHLC charts

- Drawing options and tools e.g. Fibonacci arcs, fans and time zones

Charts from Selftrade Markets also include more advanced aspects:

- Back Testing and Custom Indicators

- Key chart overlays e.g. Ichimoku Clouds, Exponential Moving Average, Envelopes etc.

- Indicators e.g. Elder Rays, TSI, Linear Regression Slope etc.

- Custom email notifications when a market hits a particular price

Example Financial Spreads equities trading chart

The spread trading companies in the following list give account holders live prices/charts:

Where Can I Spread Bet on Aviva for Free? |

Trading always involves risk. Nevertheless, if you would like to try a (free) Test Account, where you can try financial spread betting, see below for further details.

When looking at which trading option is right for you, don't forget that spread trading, in the UK, is tax free*, i.e. it is exempt from stamp duty, income tax and capital gains tax.

If you're interested in a low cost spread trading platform, you should keep in mind that investors are able to trade Aviva without having to pay any brokers' fees or commissions with providers like:

If you're interested in a completely free Practice Account so you can try spread betting on markets such as GBP/USD, the Dow Jones, crude oil and Aviva, then you can always have a look at:

Each of the companies listed above provide a Test Account which investors can use to try out ideas, access professional charts and practice with an array of trading orders, like guaranteed stops and trailing stops.

How to Spread Bet on Aviva? |

If you want to speculate on firms like Aviva then one solution could be spread betting on the Aviva share price.

Looking at a spread trading website like Selftrade Markets, we can see that they are showing the Aviva Rolling Daily market at 341.5p - 342.1p. This means you can put a spread bet on the Aviva share price:

Going higher than 342.1p, or Going higher than 342.1p, or

Going lower than 341.5p Going lower than 341.5p

When spread betting on UK equities you trade in £x per penny. As a result, should you decide to risk £4 per penny and the Aviva share price changes by 30p then that would alter your profits (or losses) by £120. £4 per penny x 30p = £120.

Rolling Daily Shares Markets

One important thing to note is that this is a 'Rolling Daily Market' and therefore there is no preset closing date for this market. If you leave your trade open at the end of the day, it simply rolls over to the next session.

If a bet is rolled over and you are speculating on the market to:

Increase - then you'll be charged a small overnight financing fee, or Increase - then you'll be charged a small overnight financing fee, or

Decrease - then you will often receive a small payment to your account Decrease - then you will often receive a small payment to your account

To learn more about Rolling Daily Markets please see Rolling Daily Spread Betting.

Aviva Rolling Daily - Equities Spread Betting Example |

If we consider the spread of 341.5p - 342.1p and make the assumptions:

- You have completed your analysis of the sector, and

- Your research leads you to think that the Aviva share price is likely to increase and move above 342.1p

Then you could decide that you want to go long of the market at 342.1p for a stake of, for the sake of argument, £10 per penny.

So, you make a profit of £10 for every penny that the Aviva shares increase and go higher than 342.1p. However, such a bet also means that you will lose £10 for every penny that the Aviva market moves lower than 342.1p.

Looked at another way, should you buy a spread bet then your P&L is worked out by taking the difference between the settlement price of the market and the initial price you bought the spread at. You then multiply that difference in price by your stake.

As a result, if after a few trading sessions the stock rose then you might consider closing your position to secure your profit.

As an example, should the market rise, the spread, set by the spread betting company, could change to 354.1p - 354.7p. To close your trade you would sell at 354.1p. Therefore, with the same £10 stake your profit would come to:

P&L = (Final Price - Opening Price) x stake

P&L = (354.1p - 342.1p) x £10 per penny stake

P&L = 12.0p x £10 per penny stake

P&L = £120.00 profit

Financial spread betting is not always simple. In this example, you had bet that the share price would increase. Nevertheless, the share price might go down.

If the Aviva share price had fallen then you could choose to close your spread bet to stop any further losses.

Should the spread drop to 331.8p - 332.4p you would settle/close your trade by selling at 331.8p. If so, that would mean you would lose:

P&L = (Final Price - Opening Price) x stake

P&L = (331.8p - 342.1p) x £10 per penny stake

P&L = -10.3p x £10 per penny stake

P&L = -£103.00 loss

Note - Aviva Rolling Daily spread betting price accurate as of 17-May-13.

Advert:

Aviva Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Aviva with

Financial Spreads.

|

'Aviva Spread Betting' edited by Jenna Cutly, updated 03-Oct-17

For related articles also see:

Barclays Spread Betting, updated 03-Oct-17

Barclays spread betting and trading guide with live BARC prices and charts. Plus, daily updates, broker recommendations on Barclays, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Spread Betting on BP, updated 03-Oct-17

BP spread betting and trading guide with live LON:BP share prices and charts. Plus, daily updates, broker recommendations, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

HSBC Spread Betting, updated 03-Oct-17

HSBC spread betting and trading guide with live HSBA.L prices and charts. Plus, daily updates, broker recommendations on HSBC, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Royal Mail Spread Betting, updated 03-Oct-17

Royal Mail spread betting and trading guide with live RMG prices and charts. Plus, daily updates, broker recommendations on Royal Mail, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Lloyds Spread Betting, updated 03-Oct-17

Lloyds spread betting and trading guide with live LLOY prices and charts. Plus, daily updates, broker recommendations on Lloyds, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

RBS Spread Betting, updated 03-Oct-17

RBS spread betting and trading guide with live RBS prices and charts. Plus, daily updates, broker recommendations on Royal Bank Of Scotland, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Rio Tinto Spread Betting, updated 03-Oct-17

Rio Tinto spread betting and trading guide with live LON:RIO share prices and charts. Plus, daily updates, broker recommendations, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

Vodafone Spread Betting, updated 03-Oct-17

Vodafone spread betting and trading guide with live VOD prices and charts. Plus, daily updates, broker recommendations on Vodafone, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read guide.

About this page:

Aviva Spread Betting

Aviva spread betting and trading guide with live AV prices and charts. Plus, daily updates, broker recommendations on Aviva, where to spread bet on the UK shares tax-free* and commission-free, how to trade... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|