Unleaded Gasoline Spread Betting

Where Can I Spread Bet on Unleaded Gasoline? |

Currently, investors can spread bet on Unleaded Gasoline, plus a wide variety of other online markets, through companies like:

| 20-May-18 |

[12:56pm] Updated Gasoline COT Report

The latest Commitments of Traders Report (COT) for Gasoline has been released by the CFTC, see our Gasoline COT report below.

We have also updated our Commodities COT Summary Report.

Update by Gordon Childs, Editor,

|

» For more see Commodities Trading News & Analysis.

Advert:

Unleaded Gasoline Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Unleaded Gasoline with

Financial Spreads.

|

Where Can I Spread Bet on Unleaded Gasoline for Free? |

Trading commodities futures is never a risk free process. However, if you would like to try a free Practice Account, where you can try out spread betting and make use of trading charts, see below.

When deciding which investment option might work for you, don't forget that in the UK, spread betting is free of capital gains tax, stamp duty and income tax*.

If you are interested in a free spread betting website, keep in mind that investors can take a position on Unleaded Gasoline with no brokers' fees, and zero commissions, with firms such as:

If you want a completely free Test Account / Demo Account that lets users get a better feel for financial spread betting, and speculating on markets such as Unleaded Gasoline, then you could always look into:

Each of the above spread trading firms offer a Test Account that lets investors study charts, apply a variety of orders and try out new theories.

How to Spread Bet on Unleaded Gasoline? |

As with a wide variety of global markets, you can speculate on commodity markets, like Unleaded Gasoline, to go up or down.

If you were to look at the Inter Trader platform, they are giving the Unleaded Gasoline June Futures market at $3.1220 - $3.1250. As a result, you can spread trade on Unleaded Gasoline:

Settling above $3.1250, or Settling above $3.1250, or

Settling below $3.1220 Settling below $3.1220

On the closing date for this 'June' market, 30-May-12.

When spread betting on Unleaded Gasoline you trade in £x per $0.0001. Therefore, if you invested £3 per $0.0001 and Unleaded Gasoline moves $0.0023 then there would be a difference to your profit/loss of £69. £3 per $0.0001 x $0.0023 = £69.

Unleaded Gasoline Futures - Commodity Spread Betting Example |

Now, if we consider the above spread of $3.1220 - $3.1250 and make the assumptions:

- you've done your analysis of the futures market, and

- you feel that the Unleaded Gasoline market will settle higher than $3.1250 by 30-May-12

then you might go long of the market at $3.1250 and risk, for example, £2 per $0.0001.

With such a spread bet you win £2 for every $0.0001 that Unleaded Gasoline pushes above $3.1250. However, it also means that you will lose £2 for every $0.0001 that the Unleaded Gasoline market falls lower than $3.1250.

Thinking of this in a slightly different way, if you buy a spread bet then your profits (or losses) are worked out by taking the difference between the final price of the market and the price you bought the spread at. You then multiply that price difference by the stake.

With that in mind, if, on the expiry date, Unleaded Gasoline settled at $3.1328, then:

Profit / loss = (Final Price - Initial Price) x stake

Profit / loss = ($3.1328 - $3.1250) x £2 per $0.0001

Profit / loss = $0.0078 x £2 per $0.0001

Profit / loss = £156 profit

Spread betting on commodity markets is not always easy. In this example, you had bet that the futures market would increase. Of course, the commodity could go down.

If Unleaded Gasoline fell, closing at $3.1180, then this means you would end up losing this spread bet.

Profit / loss = (Final Price - Initial Price) x stake

Profit / loss = ($3.1180 - $3.1250) x £2 per $0.0001

Profit / loss = -$0.0070 x £2 per $0.0001

Profit / loss = -£140 loss

Note: Unleaded Gasoline June Futures market correct as of 26-Apr-12.

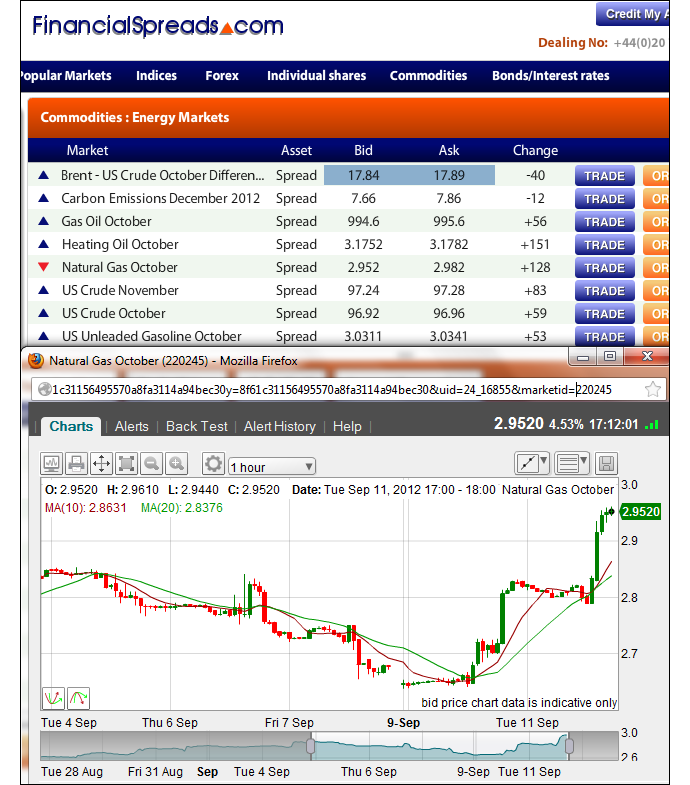

Where Can I Find Live Prices and Charts for Unleaded Gasoline?

If you'd like to view the prices/charts for Unleaded Gasoline, you could use a financial spread betting account. Please note that all spreads accounts are normally dependent on status, suitability and credit checks.

If your application is approved then you can log in and look at the up-to-the-minute prices/charts. Usually, this is provided as part of the service. The catch is that you're likely to receive an occasional letter, email and/or call from your spread betting provider.

Of course, if you want to spread bet then you must remember that financial spread betting does carry a significant level of risk to your capital and you can incur losses that exceed your initial deposit.

Although the specific charting packages vary from firm to firm, to help you with your analysis, they generally have useful tools and features such as:

- A range of time periods such as 1 minute, 1 hour, 1 day etc.

- Different views such as candle charts and bar charts

- Drawing options and tools such as Fibonacci time zones, fans and arcs

- Technical indicators and overlays such as MACD, Relative Strength Index (RSI), Williams %R etc.

Charts provided by Capital Spreads also come with other benefits such as:

- BackTesting and Analysis functions

- Automatic email notifications when a market hits a certain level

Example commodities chart

The following online spread betting firms offer account holders prices and live charts:

Advert:

Unleaded Gasoline Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Unleaded Gasoline with

Financial Spreads.

|

Gasoline (RBOB) Commitments of Traders Report - 15 May 2018 (i) |

Futures Only Positions, NYME, Code 111659, (Contracts of 42,000 US gallons) (i)

| Reporting Firms (i)

|

|

Non-Reportable Positions (i) |

Non-Commercial (i)

|

Commercial (i) |

Total Reportable (i) |

| |

| Commitments (i) |

Open (i) Interest |

Commitments |

| Long (i) |

Short (i) |

Spreads (i) |

Long |

Short |

Long |

Short |

Long |

Short |

| 191,041 |

95,122 |

75,490 |

182,157 |

290,609 |

448,688 |

461,221 |

477,684 |

28,996 |

16,463 |

| |

| Changes from 8 May 2018 (i) |

Change in (i) Open Interest |

Changes from |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

Long |

Short |

| 10,248 |

-918 |

389 |

-3,364 |

10,583 |

7,273 |

10,054 |

8,969 |

1,696 |

-1,085 |

| |

| Percent of Open Interest for Each Category of Trader (i) |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

Long |

Short |

| 40.0% |

19.9% |

15.8% |

38.1% |

60.8% |

93.9% |

96.6% |

|

6.1% |

3.4% |

| |

| Number of Traders in Each Category (i) |

Total (i) Traders |

|

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

|

| 120 |

52 |

100 |

93 |

105 |

261 |

222 |

310 |

|

|

| |

| Long/Short Commitments Ratios (i) |

|

Long/Short Ratio |

| Ratio |

|

Ratio |

Ratio |

|

Ratio |

| 2:1 |

|

1:1.6 |

1:1 |

|

1.8:1 |

| |

| Net Commitment Change (i) |

|

| 11,166 |

|

Also see:

'Unleaded Gasoline Spread Betting' edited by Jacob Wood, updated 20-May-18

For related articles also see:

Heating Oil Spread Betting, updated 20-May-18

Heating Oil futures spread betting guide with live prices & charts. Also, where to spread bet on commodity futures like Heating Oil tax-free* and commission-free as well as ... » read guide.

Natural Gas Spread Betting, updated 20-May-18

Natural Gas spread betting guide with daily analysis. Plus live Natural Gas charts & prices, where to spread bet on commodities futures tax-free* and commission-free as well as... » read guide.

Carbon Emissions Spread Betting, updated 22-Feb-17

Carbon Emissions spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Carbon Emissions commission-free and tax-free*, how to trade and ... » read guide.

Gas Oil Spread Betting, updated 22-Feb-17

Gas Oil spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Gas Oil commission-free and tax-free*, how to trade and ... » read guide.

Gas Oil Spread Betting, updated 22-Feb-17

Gas Oil spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Gas Oil commission-free and tax-free*, how to trade and ... » read guide.

About this page:

Unleaded Gasoline Spread Betting

Unleaded Gasoline spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Unleaded Gasoline commission-free and tax-free*, how to trade and ... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|

|

|

|

|