Crude Oil Trading

Where Can I Open a Crude Oil Trading Account? |

There are many spread trading companies which offer thousands of international markets such as commodities, like crude oil and gold, but also indices, foreign exchange and equities.

Some firms, such as Financial Spreads, provide the usual benefits of spread trading including two way, tax free* trading with zero commissions and the option of trading outside regular market hours.

| Brent Crude Oil - Daily |

3† |

7† |

4 |

3.5 |

| Brent Crude Oil - Future |

3 |

7 |

6 |

4 |

| US Crude Oil - Daily |

3† |

4† |

4 |

3.5 |

| US Crude Oil - Future |

3 |

4 |

6 |

4 |

| Commodities - Minimum Stake |

£1 |

£1 |

£0.5 |

£1 |

Comparison Notes.

Advantages of Crude Oil Spread Trading |

There are several advantages which spread trading holds over the typical methods of trading crude oil:

- Spread trading is tax free*. You do not take possession of any assets, you are simply speculating on the future price of a barrel of oil. This means spread traders do not pay income tax, capital gains tax or stamp duty*.

- Unlike traditional methods of trading crude oil, spread trading allows you to speculate on markets to go down as well as up. This provides added flexibility and allows you to trade in whichever direction your research suggests the oil market will move.

- Most spread trading companies do not charge broker’s fees or commissions on your trades, this can help keep trading costs down.

- Financial spread trading allows investors to trade a wide range of international markets and asset classes. You can trade both Brent Crude Oil and US Crude Oil contracts but you can also trade on gold, indices including the FTSE 100 and Dax 30, stocks and shares, foreign exchange and even bonds and interest rates from a single account.

Crude Oil Spread Trading Example |

If you decide to spread trade on a market such as Brent Crude Oil then, on visiting a spread trading company's website, at the moment you would see the Brent Crude Oil (September) futures market priced at $75.18 - $75.23.

As a result, you can speculate on Brent Crude Oil settling:

- above $75.23, or

- below $75.18

On the expiry date for this market, 12-Aug-10.

As this is a futures market you should note that you can close your trade during market hours before the expiry date, however, the position will automatically close on the expiry date if it is still open.

When spread trading, investors trade on every unit the market moves up or down; with both the Brent Crude Oil and the US Crude Oil (WTI) markets a unit is 1¢ of the commodity's price movement.

For instance, you might decide to speculate £2 for every 1¢ Brent Crude Oil rises or falls.

Note that many spread trading firms also allow you to trade in Dollars or Euros, e.g. €x per 1¢.

Spread Trading on Crude Oil to Rise |

If you bought the Brent Crude Oil (September) market at $75.23 and the commodity rose then you may decide to let your trade run to expiry. If that were to happen then the market might ultimately close on 12-Aug-10 with a price of $75.98. This would result in:

Profit or Loss = (closing price of the market - initial price of the market) x stake per 1¢

Profit or Loss = ($75.98 - $75.23) x £2 per 1¢ stake

Profit or Loss = $0.75 x £2 per 1¢

Profit or Loss = 75¢ x £2 per 1¢

Profit or Loss = £150 profit

The markets can of course fall, if the market spread was to drop to $74.52 - $74.57 before the expiry date, you could choose to close your position early to limit your losses. If so, you would sell your trade at $74.52.

Therefore, with the same £2 per 1¢ stake:

Profit or Loss = (closing price of the market - initial price of the market) x stake per 1¢

Profit or Loss = ($74.52 - $75.23) x £2 per 1¢ stake

Profit or Loss = -$0.71 x £2 per 1¢

Profit or Loss = -71¢ x £2 per 1¢

Profit or Loss = -£142 loss

Spread Trading on Crude Oil to Fall |

One major advantage of spread trading is that you can sell the markets.

When we started this example, the Brent Crude Oil (September) price was $75.18 - $75.23.

If you were to sell at $75.18 and the market fell then the spread might change to $74.45 - $74.50. Assuming this was the case, you might decide to take your profits by closing your trade at $74.50 rather than letting it run to the expiry date.

Profit or Loss = (initial price of the market - closing price of the market) x stake per 1¢

Profit or Loss = ($75.18 - $74.50) x £2 per 1¢ stake

Profit or Loss = $0.68 x £2 per 1¢

Profit or Loss = 68¢ x £2 per 1¢

Profit or Loss = £136 profit

However, if the market were to rise to $75.77 - $75.82, you may decide to close your position to prevent further losses. If this were the case, you would buy at $75.82.

You would close your trade with the same £2 per 1¢ stake:

Profit or Loss = (initial price of the market - closing price of the market) x stake per 1¢

Profit or Loss = ($75.18 - $75.82) x £2 per 1¢ stake

Profit or Loss = -$0.64 x £2 per 1¢

Profit or Loss = -64¢ x £2 per 1¢

Profit or Loss = -£128 loss

Brent Crude Oil (September) market accurate as of 09-Jul-10. Expiry date for this market: 17:00 BST, 12-Aug-10.

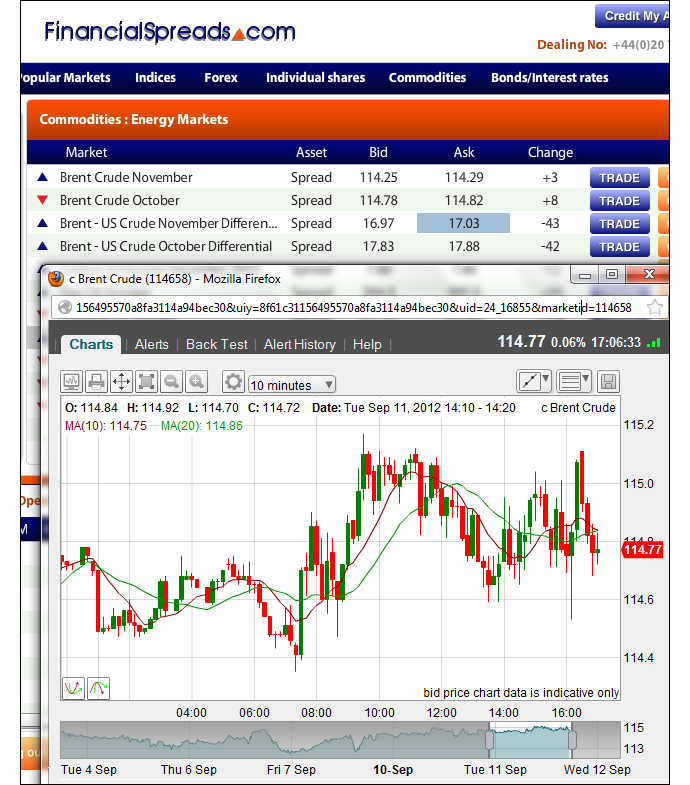

Where can I Find Crude Oil Spread Trading Charts? |

Many spread trading firms like Financial Spreads provide a variety of historical data and analysis, which includes candlestick charts, on nearly all of the financial markets they offer.

In particular you are able to make use of live crude oil spread trading charts that offer a variety of statistics including Moving Averages and Bollinger Bands.

You can typically alter these charts to show data over several time frames that range from hours or minutes to days or even weeks.

For a real-time chart see: live crude oil futures chart.

Example Crude Oil Chart

Crude Oil Trading Companies – Account Services Comparison |

The companies detailed below all provide crude oil spread trading markets and offer the usual benefits of spread trading such as a wide variety of markets, tax free trading*, no broker’s fees and two way trading.

| User Ratings |

7.6 |

6.6 |

6.7 |

7.1 |

| Web Platform |

|

|

|

|

| iPhone App |

|

|

|

|

| iPad App |

|

|

|

|

| Android Apps |

|

|

|

|

| 24 Hour Trading |

|

|

|

|

| Live Charts |

|

|

|

|

| Stop Loss Available |

|

|

|

|

| Automatic Stop Loss |

|

|

|

|

| Deposit Account |

|

|

|

|

| Credit Account |

|

|

|

|

| FCA Authorised and Regulated |

|

|

|

|

Comparison Notes.

Crude Oil Trading and Risk Management |

You can get carried away when you start investing, particularly when thinking about the amount of money you might make. And making a profit is rarely seen as a bad thing. Still, investors have to remember that they won’t profit on every trade.

The one thing I always try to stress to anyone looking at the markets is that you can lose money. Naturally, as with all investing, be it on Stocks and Shares, pensions or buying barrels of crude oil, there is a downside and with spread trading you need to be careful because you can lose more than you initially invested.

It can be useful to think about some of the other areas which the following risk notice covers, "Spread trades carry a high level of risk. Before trading, ensure that spread trading matches your investment objectives. Familiarise yourself with the risks involved. Where necessary, seek independent advice".

Having said all that, you can put limits on your trades to help limit your losses without impacting your upside. To learn more see our feature on Stop Loss Orders.

Another option for reducing your risks is simply to trade with smaller stake sizes such as £1 per point or $1 per point. This is an all too often overlooked aspect of risk management and something any investor should bear in mind.

Financial Spreads » "With FinancialSpreads.com you get all the advantages of

Spread Trading as well as commission free CFD Trading on 2,500+ markets, 24 hour trading, professional level charts and..." read

Financial Spreads review.

|

Crude Oil Trading - 11 July 2016 |

For more see our 'latest crude oil trading reports'.

'Crude Oil Trading' edited by DB, updated 11-Jul-16

For related articles also see:

Commodities Spread Betting, updated 20-May-18

The complete commodities trading guide with live prices, charts and analysis throughout the day. Plus a commodities spread betting comparison, where to trade commission-free, tax-free* and... » read guide.

Gold Spread Betting, updated 20-May-18

Guide to spread betting on gold with live prices and charts. Plus daily market analysis, a gold spread betting price comparison, tips on where to trade commission-free and tax-free* as well as... » read guide.

Crude Oil Spread Betting, updated 20-May-18

Guide to spread betting on crude oil with live prices and charts. Plus daily market analysis, crude oil spread betting price comparison, tips on where to trade commission-free and tax-free* as well as... » read guide.

Commodities Trading, updated 11-Jul-16

A look at popular commodities trading accounts, commission free trading accounts, charts, a gold and crude oil price comparison, how to trade commodities futures, market analysis and... » read guide.

Gold Trading, updated 11-Jul-16

Here we compare gold trading accounts and review how to trade the precious metal. We also have market analysis, a gold daily (spot) & futures price comparison, charts and... » read guide.

Silver Spread Betting, updated 20-May-18

Silver spread betting guide with daily analysis. Plus live Silver charts & prices, where to spread bet on commodities futures tax-free* and commission-free as well as... » read guide.

Copper Spread Betting, updated 20-May-18

Copper spread betting guide with daily analysis. Plus live Copper charts & prices, where to spread bet on commodities futures tax-free* and commission-free as well as... » read guide.

Commodities Trading News, updated 29-Jul-13

An index of commodities trading articles covering futures news, market analysis & spread betting on commodities futures. Plus trading strategies, charts, price comparisons and... » read guide.

About this page:

Crude Oil Trading

Here we compare crude oil trading accounts and review how to trade the two main oil futures markets. We also have regular analysis, a Brent (UK) and WTI (US) crude price comparison, charts and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|