Life After SelfTrade Markets

Important – ‘SelfTrade’ is still running and offering Share Dealing and SIPPS, see SelfTrade.co.uk.The article below is about ‘SelfTrade Markets’.

‘SelfTrade Markets’ was another of the many spread betting and CFD platforms run by London Capital Group.

Importantly, when SelfTrade Markets closed, clients were simply moved across to the Capital Spreads brand (no clients lost any money as a result of the closure).

According to the FCA register ‘SelfTrade Markets’ was delisted as a Trading Name of London Capital Group on 23-Sep-14.

If you liked the SelfTrade Markets platform then FinancialSpreads.com is a viable alternative (with a similar platform).

Note that the deal ticket is slightly different and Financial Spreads only offer 1,000+ markets compared to the 2,500+ with ‘SelfTrade Markets’.

Having said that, the spreads are more competitive on Financial Spreads (i.e, same or better, particularly for popular markets).

See the Financial Spreads review.

A more obvious suggestion might be Capital Spreads, another user-friendly platform.

However, in March 2016, that platform was merged into ‘LCG Trader’.

Our query here is that LCG Trader is a relatively new platform. For our own trading we prefer to use a tried-and-tested platform.

For further viable alternatives, see our spread betting company comparison.

The information below is being kept for archive purposes but, with ‘SelfTrade Markets’ no longer online, it should not be relied upon.

Selftrade Markets Review

- Selftrade Markets Mobile Trading

- Selftrade Markets Account

- User Ratings on Selftrade Markets

- User Comments on Selftrade Markets

- Selftrade Markets CFDs

- Spread Betting Markets

- About Selftrade Markets

- Tax Free Trading*

- No Capital Gains Tax

- No Income Tax

- No Stamp Duty

- Investors can buy or sell stock market indices, equities, forex, commodities, interest rates and bonds

- There are thousands of global markets

- There are no stockbroker’s fees and no commissions

Selftrade Markets

With a Selftrade Markets account you also get:- Mobile Trading: Trade on your iPhone or iPad, see mobile trading below for details.

- Contracts for Difference: Speculate on over 2,500 CFD markets, see CFD trading below for details.

- 24 Hour Trading: Many popular markets can be traded 24 hours a day, from Sunday evening to Friday evening.

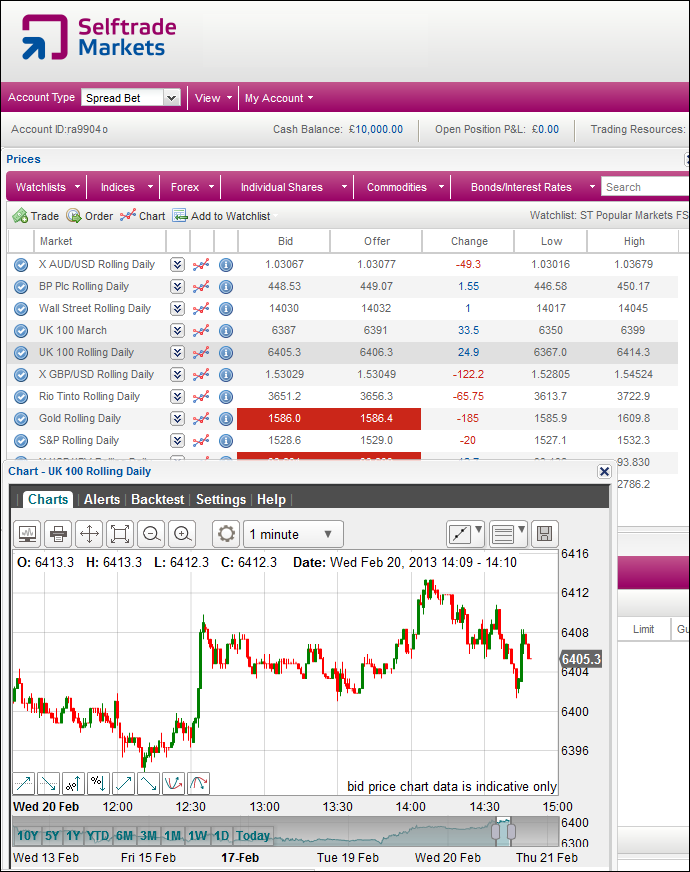

- Advanced Charting: Access live charts for every market as well as pre-set and customisable technical indicators.

- Different Account Options: Choose from Individual, Investment Club and Corporate accounts.

- Market Squawk: Listen to live audio news and commentary on the forex markets.

- Research and Analysis: Clients can access a comprehensive research portal which comes with broker recommendations, director deals, heat maps, charts, stock screener etc.

- Tight Spreads: The service was launched “with the intention of providing all customers with the best service and some of the best value spreads in the market”. For example spreads, see Selftrade spread betting markets below.

- Low Margins: There are low margin requirements across all markets.

- Automatic Stop Losses: To help with risk management, every opening trade comes with an automatic stop loss (readers should note that Stop Losses are not guaranteed).

- Risk Management Tools: As well as automatic stop loss orders, investors can use trading orders such as Trailing Stops and, for a small premium, Guaranteed Stops.

- Small Minimum Stakes: Trade from as little as £1 per point.

- Demo Accounts: Practice your trading using the free demo account.

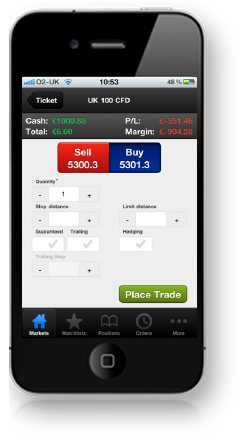

Selftrade Markets Mobile Trading

The Selftrade Markets mobile trading application has been optimised for both the iPhone and iPad.Using the mobile trading platform, investors can:

- Open and close trades

- Place new, and amend existing, trading orders

- Access live charts

- Monitor your account

- Check your watchlists

Selftrade Markets Account

A review of the Selftrade Markets account:Selftrade Markets Services |  |

| Average User Rating | 4 |

| New Account Offer |  |

| 24 Hour Trading |  |

| Live Charts |  |

| iPhone App |  |

| iPad App |  |

| Android Apps |  |

| Web Platform |  |

| Stop Loss Available |  |

| Automatic Stop Loss |  |

| Credit Account |  |

| Deposit Account |  |

| FCA Authorised and Regulated |  |

The Selftrade Markets platform

User Rating & Comments on Selftrade Markets

Add Your View – you have any comments or questions on Selftrade, feel free to add them here:Readers can leave comments by logging in securely to their Facebook, Twitter or Intense Debate accounts (CleanFinancial does not see, or keep a record of, your login details).

Selftrade Markets CFDs

As well as the comprehensive spread betting service, Selftrade Markets offers contracts for difference (CFDs) on over 2,500 global markets.With CFD trading, the primary trading costs are normally the commission and the spread (i.e. the difference between the sell and buy price). Therefore, it costs more to trade through brokers that have high commission levels and wide spreads.

This CFD service is commission-free and comes with some of the tightest spreads in the market place, e.g. the spread on FTSE 100 shares is 0.05% per side of the underlying market.

CFD trading is leveraged and so whilst any profits are amplified, losses are also amplified. Therefore, like spread betting, CFD trading carries a high level of risk to your capital and it is possible to lose more than your initial investment.

Selftrade Markets – Spread Betting Market Review

Below we have noted some of the markets available on the Selftrade Markets platform along with their typical in-hours spread size and the minimum stake. See SelftradeMarkets.com for full details and live prices.Selftrade Markets offers spread bets on a range of other Stock Market Indices including; AEX, Euro Stoxx 50, MDAX, Sweden 30, Swiss SMI, Taiwan 50, Australia 200, Chinese stock market, Hang Seng, Indian Nifty 50 and South Africa 40.

Selftrade Markets also offers spread bets on a range of other forex markets including Australian Dollar/US Dollar, Swiss Franc/Yen, Euro/Australian Dollar, Euro/Canadian Dollar, Euro/Swiss Franc, Sterling/Yen and US Dollar/Swiss Franc.

Further ‘Minor’ and ‘Exotic’ forex markets are available, these include; Sterling/Swiss Franc, US Dollar/South African Rand, Dollar/Polish Zloty, Dollar/Mexican Peso and Dollar/Czech Koruna.

Selftrade Markets offers spread bets on other commodities such as copper, silver, carbon emissions, heating oil, natural gas, cocoa, coffee, cotton, orange juice, soybean, sugar and wheat.

About Selftrade Markets

Selftrade Markets has closed.According to the FCA register ‘SelfTrade Markets’ was delisted as a Trading Name of London Capital Group on 23-Sep-14.

Selftrade have been at the forefront of execution-only broking for over 12 years and provide an extensive range of investment services.

Selftrade Markets is a trading name of London Capital Group Ltd (LCG). LCG is a company registered in England and Wales under registered number: 3218125. London Capital Group Ltd, a wholly owned trading subsidiary of LCGH plc, is regulated and authorised by the Financial Conduct Authority.

Registered Address: 2nd floor, 6 Devonshire Square, London, EC2M 4AB.

Spread Betting Companies

If you are looking to open a new spread betting account, CleanFinancial.com offers a range of spread betting company reviews and comparisons:- City Index Review

- CMC Markets Review

- ETX Capital Review

- Financial Spreads Review

- Finspreads Review

- IG Index Review

- InterTrader Review

- Spreadex Review

- Tradefair Review

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.