Where Can I Find Live Prices and Charts for General Electric?

The CFD trading chart below provides a valuable guide to the General Electric market.

The above chart is provided by Plus 500 and usually shows the General Electric futures price.

If you'd like to study live financial spread betting prices and charts for General Electric, you will normally require a spread betting account.

You can also use a spreads account to speculate on the shorter term daily prices. Users should note that such accounts are normally dependent on status and suitability checks.

If your application is accepted then, after logging on, you will be able to review the live prices and charts. These are usually provided as part of the service, however, you are likely to receive an occasional email or letter from your spread trading broker.

Of course, if you want to trade then you must remember that spread betting and contracts for difference do involve a high level of risk and you can lose more than your initial deposit.

For more details, see Advanced General Electric Trading Charts below.

General Electric Analysis & News

|

Professional Charts for General Electric |

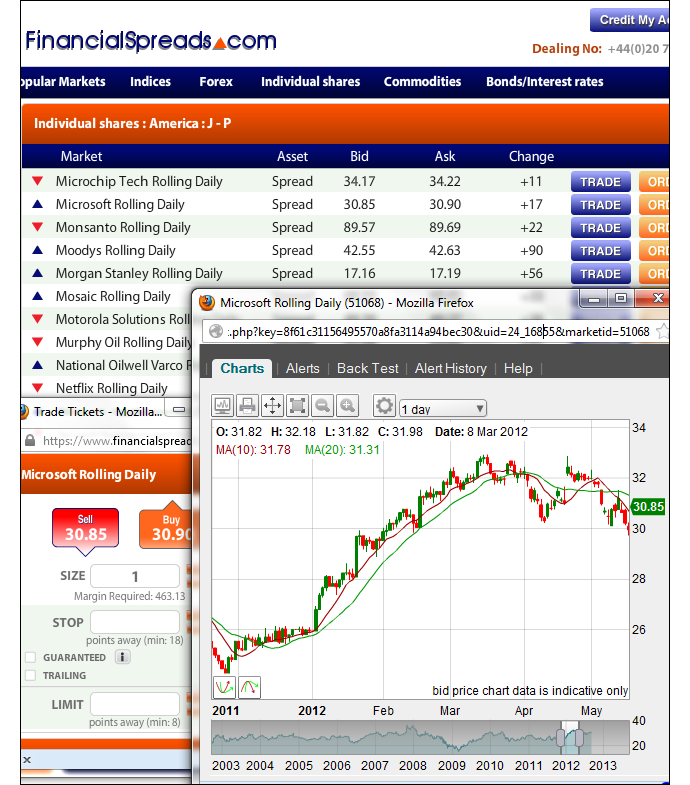

Whilst charts differ across the various firms, most charts usually have tools and features such as:

- A large range of time intervals such as 5 minutes, 1 hour, 4 hours etc.

- Different displays such as line, candlestick and OHLC charts

- Drawing tools and features such as trendlines, Fibonacci arcs, fans and time zones

Charts offered by FinancialSpreads also have other benefits, including:

- BackTesting, Custom Indicators and Analysis tools

- Helpful overlays such as Moving Averages, Bollinger Bands, Linear Regression etc.

- Technical charts such as Elder Rays, Stochastics, Linear Regression Slope etc.

- Customised email alerts when a market hits a certain level

Example chart

The financial spread betting firms in the list below offer their account holders real time charts/prices:

Advert:

General Electric Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on General Electric with

Financial Spreads.

|

Where Can I Spread Bet on General Electric for Free? |

Speculating on the financial markets always involves risk. Having said that, if you'd like to try a free Test Account, that lets you trial financial spread betting, then please see below for further details.

When considering which investment option might work for you, also remember that spread betting, in the UK, is exempt from income tax, capital gains tax and stamp duty*.

If you're interested in a free trading platform then you should note that investors can take a position on General Electric without paying any commissions or brokers' fees via companies like:

If you're looking for an entirely free Practice Account / Demo Account to try out spread betting, including markets like General Electric, then look into:

Each of these spread betting firms currently offer a risk free Practice Account which lets investors practice with a variety of orders, access charts and try out new theories.

How to Spread Bet on General Electric? |

If an investor is looking to invest in firms such as General Electric then one solution is a spread bet on the General Electric share price.

Looking at Financial Spreads, we can see they are currently offering the General Electric Rolling Daily market at $22.32 - $22.37. This means you could spread bet on the General Electric shares:

Going above $22.37, or Going above $22.37, or

Going below $22.32 Going below $22.32

When financial spread trading on US shares you trade in £x per cent. As a result, if you staked £3 per cent and the General Electric shares move $0.29 then that would change your profit/loss by £87. £3 per cent x $0.29 = £87.

You are also able to trade this market in Euros or Dollars, e.g. $x per cent.

Rolling Daily Shares Markets

One important thing to note is that this is a 'Rolling Daily Market' and therefore in contrast with futures markets, there is no closing date. Therefore, if you decide not to close your trade by the end of the day, it will roll over to the next session.

If a bet is rolled over and you are speculating on the market to:

Go up - then you'll normally be charged a small financing fee, or Go up - then you'll normally be charged a small financing fee, or

Go down - then a small payment is normally credited to your account Go down - then a small payment is normally credited to your account

For a more detailed breakdown of Rolling Daily Markets please read our article Rolling Daily Spread Betting.

General Electric Rolling Daily - US Equities Spread Betting Example |

If you consider the above spread of $22.32 - $22.37 and assume:

- You have analysed the equities market, and

- You think that the General Electric shares are likely to push higher than $22.37

Then you might choose to go long of the market at $22.37 and risk, letís say, £5 per cent.

So, you win £5 for every cent that the General Electric shares move above $22.37. Nevertheless, it also means that you will make a loss of £5 for every cent that the General Electric market goes lower than $22.37.

Looked at another way, if you buy a spread bet then your P&L is worked out by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that difference in price by the stake.

Therefore, if after a few sessions the shares started to increase then you might think about closing your trade in order to secure your profit.

Taking this a step further, if the market did go up then the spread might change to $22.62 - $22.67. You would close your trade by selling at $22.62. Therefore, with the same £5 stake you would make a profit of:

Profit = (Closing Price - Opening Price) x stake

Profit = ($22.62 - $22.37) x £5 per cent stake

Profit = $0.25 x £5 per cent stake

Profit = 25¢ x £5 per cent stake

Profit = £125 profit

Speculating on equities, whether by spread betting or not, is not always straightforward. In this case, you had bet that the share price would increase. However, the share price could go down.

If the General Electric stock weakened, against your expectations, then you could close your position to limit your losses.

If the market fell to $22.08 - $22.13 then this means you would settle your spread bet by selling at $22.08. That would mean you would make a loss of:

Loss = (Closing Price - Opening Price) x stake

Loss = ($22.08 - $22.37) x £5 per cent stake

Loss = -$0.29 x £5 per cent stake

Loss = -29¢ x £5 per cent stake

Loss = -£145 loss

Note: General Electric Rolling Daily equities market quoted as of 06-Feb-13.

Advert:

General Electric Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on General Electric with

Financial Spreads.

|

'General Electric Spread Betting' edited by DB, updated 03-Oct-17

For related articles also see:

Bank of America Spread Betting, updated 03-Oct-17

BoA spread betting and share trading guide with daily updates on the bank and a real-time BAC stock chart & live prices. Where spread bet on Bank of America commission-free and... » read guide.

Chevron Spread Betting, updated 03-Oct-17

Chevron spread betting and share trading guide with daily updates on the oil firm and a real-time CVX stock chart & live prices. Where spread bet on Chevron commission-free and... » read guide.

Exxon Mobil Spread Betting, updated 03-Oct-17

Exxon spread betting and share trading guide with daily updates on the oil firm and a real-time XOM stock chart & live prices. Where spread bet on Exxon Mobil commission-free and... » read guide.

JPMorgan Chase Spread Betting, updated 03-Oct-17

JPMorgan spread betting and share trading guide with daily updates on the bank and a real-time JPM stock chart & live prices. Where spread bet on JPMorgan Chase commission-free and... » read guide.

McDonalds Spread Betting, updated 03-Oct-17

McDonalds spread betting and share trading guide with daily updates on the fast food chain and a real-time MCD stock chart & live prices. Where spread bet on McDonalds commission-free and... » read guide.

Wal-Mart Spread Betting, updated 03-Oct-17

Wal-Mart spread betting and share trading guide with daily updates on the retailer and a real-time WMT stock chart & live prices. Where spread bet on Wal-Mart commission-free and... » read guide.

3M Spread Betting, updated 03-Oct-17

3M spread betting and share trading guide with daily updates on the US firm and a real-time MMM stock chart & live prices. Where spread bet on 3M commission-free and... » read guide.

Alcoa Spread Betting, updated 03-Oct-17

Alcoa spread betting and share trading guide with daily updates on the mining company and a real-time AA stock chart & live prices. Where spread bet on Alcoa commission-free and... » read guide.

About this page:

General Electric Spread Betting

General Electric spread betting and share trading guide with daily updates on the US firm and a real-time GE stock chart & live prices. Where spread bet on General Electric commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|