Where Can I Find Live Prices and Charts for Google?

The real-time CFD chart and prices below provides users with a helpful guide to the Google market.

The above chart, provided by Plus 500, typically uses the underlying Google futures price (not the spot price).

To analyse live spread trading prices/charts for Google, you will generally need a spread trading account.

You can also use a spreads account to trade on shorter term spot markets. Users should note that opening an account is normally dependent on credit, status and suitability checks.

If your application is approved then you can log on to review the real-time prices and charts. These are usually provided as part of the service. The catch? You are likely to get the odd email and/or call from the spread betting provider.

If you decide to trade then, before starting, be aware that CFD trading and spread betting carry a significant level of risk and it's possible to lose more than your initial deposit.

For more details, see Advanced Google Trading Charts below.

| 03-Oct-17 |

[11:49am] Google Share Price Update:

The share price is above the 20 day MA of $939.08 and above the 50 day MA of $930.32. The share price is above the 20 day MA of $939.08 and above the 50 day MA of $930.32.- Closing Price: $978.89

1 Day Change: Up 0.92% 1 Day Change: Up 0.92% 5 Day Change: Up 2.06% 5 Day Change: Up 2.06%

Long-Term GOOG Data 52 Week High: $988.25 52 Week High: $988.25 52 Week Low: $727.54 52 Week Low: $727.54- EPS(i): $27.62

- PE Ratio(i): 35.44

- Volume / Average Volume(i): 0.001m / 1.327m

- Market Cap(i): $683,344m

- Shares Outstanding(i): 698m

Price data from Google Finance. Also see Live GOOG Share Price & Charts and About Google for more information.

Update by Jenna Cutly, Editor,

|

| 03-Feb-14 |

[2:03pm] Investors Find the Latest Google Earnings Report to Their Liking

GOOG shares closed up +4.01% to $1180.97 on Friday after the web firm reported 4Q EPS of $9.90 vs $9.02 a year ago. The results were based on consolidated revenue of $16.86bn vs $14.42bn a year ago.

The adjusted EPS was $12.01 vs $10.65 a year earlier.

Google's core web business grew by 22% YoY to post revenues of $15.72bn for the quarter.

Aggregate paid clicks were up 31% YoY and 13% QoQ.

Average CPC fell 11% YoY and 2% QoQ.

Motorola Sold

The search firm also announced that 'Motorola Mobile segment' revenues were $1.24bn, or 7% of consolidated revenues in 4Q, vs $1.51bn, or 11% of consolidated revenues last year.

Having said that, earlier in the week the company announced that it was selling Motorola to Lenovo for $3bn.

Naturally Google will be keeping the vast majority of patents it acquired when it originally bought Motorola.

Update by Jacob Wood, Editor,

|

| 15-Oct-13 |

[12:34pm] Extended Google Trading Hours

IG's new and longer trading hours for Google are: 9am to 1am (Mon to Thur) and 9am to 10pm (Fri), London time.

Update by Jacob Wood, Editor,

|

|

If you are more interested in trading using Android-based apps rather than actually trading the Google share price, please see our guide to Android spread betting and CFD apps.

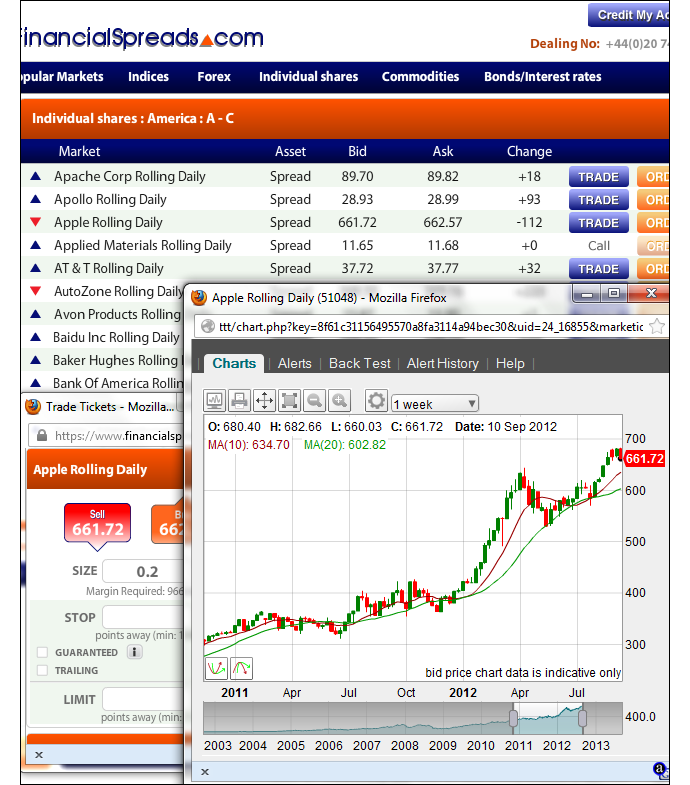

Advanced Charts for Google Shares |

Although the specific charting packages vary from provider to provider, the majority of charts come with useful tools such as:

- A broad variety of intervals, for example, 2 minutes, 1 hour, 1 month etc

- A variety of chart types, for example, line charts and candle charts

- Drawing tools and options, for example, Trendlines, Fibonacci Fans, Time Zones and Arcs

The charts provided by FinancialSpreads also offer advanced features like:

- BackTesting and Tailored Indicators

- Popular chart overlays, for example, Ichimoku Clouds, EMA, Linear Regression etc

- Secondary charts, for example, Chaikin's Money Flow, Momentum, % Price Oscillator etc

- Customised email alerts when your chosen market reaches a pre-set level

Sample FinancialSpreads trading chart

The spread trading brokers in the following list provide account holders with real time charts/prices:

Advert:

Google Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Google with

Financial Spreads.

|

Where Can I Spread Bet on Google for Free? |

Trading does involve risks. However, if you want to open an entirely free Practice Account, that lets you try out spread trading, see below for more details.

When considering which trading option might work for you, also remember that spread betting in the UK is currently tax free*, i.e. there is no stamp duty, income tax or capital gains tax.

If you're interested in a low cost spread betting website, note that investors can speculate on Google with no brokers' fees through companies such as:

If you are interested in a Test Account that allows you to try out spread betting on markets such as the Dow Jones, EUR/GBP and Google, then look into:

The above spread trading companies currently provide a Test Account that allows users to study charts, apply a host of trading orders and test new trading ideas.

How to Spread Bet on Google? |

If you are going to speculate on companies like Google then one possibility could be spread betting on the Google share price.

Looking at a website like SelftradeMarkets, you can see they have put the Google Rolling Daily market at $770.86 - $772.19. As a result, an investor can spread trade on the Google shares:

Moving above $772.19, or Moving above $772.19, or

Moving below $770.86 Moving below $770.86

Whilst spread betting on US equities you trade in £x per cent. Therefore, if you invest £4 per cent and the Google share price moves $0.38 then that would alter your profit/loss by £152. £4 per cent x $0.38 = £152.

Note that you can also spread bet on this market in Dollars or Euros, e.g. $x per cent.

Rolling Daily Shares Markets

Be aware that this is a Rolling Daily Market and so unlike a normal futures market, there is no settlement date. As a result, if your trade is still open at the end of the trading day, it will just roll over into the next day.

If your spread bet does roll over and you are speculating on the market to:

Go up - then you'll be charged a small overnight financing fee, or Go up - then you'll be charged a small overnight financing fee, or

Go down - then you'll normally receive a small credit to your account Go down - then you'll normally receive a small credit to your account

You can learn more about Rolling Daily Markets in our article Rolling Daily Spread Betting.

Google Rolling Daily - US Shares Spread Trading Example |

If we consider the above spread of $770.86 - $772.19 and make the assumptions that:

- You've done your equities research, and

- Your research leads you to think the Google share price is likely to go higher than $772.19

Then you could go long of the market at $772.19 for a stake of, for example, £0.2 per cent.

Therefore, you win £0.2 for every cent that the Google shares move above $772.19. However, it also means that you will make a loss of £0.2 for every cent that the Google market goes lower than $772.19.

Looked at another way, should you buy a spread bet then your P&L is calculated by taking the difference between the final price of the market and the initial price you bought the market at. You then multiply that difference in price by your stake.

As a result, if after a few trading sessions the stock rose then you might consider closing your position so that you can secure your profit.

Therefore, if the market moved up then the spread, determined by the spread betting company, might change to $781.26 - $782.59. To close your trade you would sell at $781.26. So, with the same £0.2 stake you would calculate your profit as:

P&L = (Settlement Price - Initial Price) x stake

P&L = ($781.26 - $772.19) x £0.2 per cent stake

P&L = $9.07 x £0.2 per cent stake

P&L = 907¢ x £0.2 per cent stake

P&L = £181.40 profit

Speculating on equities, whether by spread betting or otherwise, is not always simple. In the above example, you wanted the share price to increase. However, it can also decrease.

If the Google shares had started to drop then you could close your position to stop any further losses.

If the market dropped to $763.89 - $765.22 you would settle your spread bet by selling at $763.89. As a result, your loss would be:

P&L = (Settlement Price - Initial Price) x stake

P&L = ($763.89 - $772.19) x £0.2 per cent stake

P&L = -$8.30 x £0.2 per cent stake

P&L = -830¢ x £0.2 per cent stake

P&L = -£166.00 loss

Note - Google Rolling Daily market correct as of 06-Feb-13.

Advert:

Google Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Google with

Financial Spreads.

|

'Google Spread Betting' edited by DB, updated 03-Oct-17

For related articles also see:

Apple Spread Betting, updated 03-Oct-17

Apple spread betting and share trading guide with daily updates on the tech firm and a real-time AAPL stock chart & live prices. Where spread bet on Apple commission-free and... » read guide.

Facebook Spread Betting, updated 03-Oct-17

Facebook spread betting and share trading guide with daily updates on the tech firm and a real-time FB stock chart & live prices. Where spread bet on Facebook commission-free and... » read guide.

Adobe Spread Betting, updated 03-Oct-17

Adobe spread betting and share trading guide with daily updates on the tech firm and a real-time ADBE stock chart & live prices. Where spread bet on Adobe commission-free and... » read guide.

Amazon Spread Betting, updated 03-Oct-17

Amazon spread betting and share trading guide with daily updates on the tech firm and a real-time AMZN stock chart & live prices. Where spread bet on Amazon commission-free and... » read guide.

eBay Spread Betting, updated 03-Oct-17

eBay spread betting and share trading guide with daily updates and a real-time eBay stock chart & live prices. We review the US firm's share price, how to... » read guide.

Oracle Spread Betting, updated 03-Oct-17

Oracle spread betting and share trading guide with daily updates on the tech firm and a real-time ORCL stock chart & live prices. Where spread bet on Oracle commission-free and... » read guide.

Tripadvisor Spread Betting, updated 03-Oct-17

Tripadvisor spread betting and share trading guide with daily updates on the tech firm and a real-time TRIP stock chart & live prices. Where spread bet on Tripadvisor commission-free and... » read guide.

Netflix Spread Betting, updated 03-Oct-17

Netflix spread betting and share trading guide with daily updates on the tech firm and a real-time NFLX stock chart & live prices. Where spread bet on Netflix commission-free and... » read guide.

About this page:

Google Spread Betting

Google spread betting and share trading guide with daily updates on the search firm and a real-time GOOG stock chart & live prices. Where spread bet on Google commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|