Irish Stock Market Spread Betting

Where Can I Spread Bet on the Irish Stock Market? |

Investors can financial spread bet on the Irish Stock Market with:

Advert:

Irish Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Irish Stock Market with

Financial Spreads.

|

Where Can I Spread Bet on the Irish Stock Market for Free? |

Speculating on the financial markets does involve risk, but if you'd like to try a completely free Test Account, that lets you trial spread trading, then please see below.

In addition, don't forget that, in the UK, financial spread betting is currently tax free*, i.e. there is no capital gains tax, stamp duty or income tax.

Assuming you want a low cost trading platform then you should note that investors are able to trade the Irish Stock Market with zero commissions and no brokers' fees with providers such as:

Should you want to have a look at an entirely free Practice Account that lets users get a better understanding of financial spread betting, including trading markets such as the Irish Stock Market, then you can always have a look at:

Each of these spread trading companies currently offer a Demo Account that investors can use to apply a host of orders, study charts and test trading strategies.

How to Spread Bet on the Irish Stock Market? |

As with a wide variety of global markets, you are able to place a spread bet on stock market indices, such as the Irish Stock Market, to either rise or fall.

Looking at a financial spread betting platform like Tradefair, you can see they are currently valuing the Irish Stock Market Rolling Daily market at 3278 - 3284. As a result, an investor could put a spread bet on the Irish Stock Market market:

Going above 3284, or Going above 3284, or

Going below 3278 Going below 3278

Whilst spread trading on the Irish Stock Market index you trade in £x per point. Therefore, if you decide to have a stake of £5 per point and the Irish Stock Market moves 28 points then that would make a difference to your P&L of £140. £5 per point x 28 points = £140.

Rolling Daily Indices Markets

You should note that this is a 'Rolling Daily Market', therefore there is no predetermined settlement date for this market. You do not have to close your position, should it still be open at the end of the trading day, it just rolls over into the next day.

Should your position roll over, if you are speculating that the market will:

Move up - then you usually pay a small overnight financing fee, or Move up - then you usually pay a small overnight financing fee, or

Move down - then a small payment is usually credited to your account Move down - then a small payment is usually credited to your account

For a more detailed example see Rolling Daily Spread Betting.

Irish Stock Market Example |

Now, if we consider the spread of 3278 - 3284 and make the assumptions:

- You have completed your market research, and

- You think that the Irish Stock Market index will increase and move higher than 3284

Then you might buy a spread bet at 3284 and risk, for example, £2 per point.

So, you gain £2 for every point that the Irish Stock Market index moves above 3284. However, it also means that you will make a loss of £2 for every point that the Irish Stock Market market moves below 3284.

Put another way, if you were to buy a spread bet then your P&L is calculated by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that price difference by your stake.

If after a few hours the Irish stock market started to increase then you might think about closing your trade so that you can lock in your profit.

So if the market rose then the spread, set by the spread betting company, might move up to 3341 - 3347. You would close your spread bet by selling at 3341. As a result, with the same £2 stake this trade would make you a profit of:

P&L = (Closing Level - Initial Level) x stake

P&L = (3341 - 3284) x £2 per point stake

P&L = 57 x £2 per point stake

P&L = £114 profit

Financial spread trading doesn't always work out as you would have liked. In this case, you had bet that the Irish index would increase. Of course, it can also fall.

If the Irish Stock Market index had started to drop then you could close your position to limit your losses.

So if the spread fell to 3235 - 3241 you would settle your position by selling at 3235. That would mean you would make a loss of:

P&L = (Closing Level - Initial Level) x stake

P&L = (3235 - 3284) x £2 per point stake

P&L = -49 x £2 per point stake

P&L = -£98 loss

Note: Irish Stock Market Rolling Daily spread betting price accurate as of 26-Sep-12.

How to Spread Bet on the Ireland 20 (ISEQ) |

If you were to look at the InterTrader spread betting site, they are currently pricing the Ireland 20 Rolling Daily market at 526.5 - 531.2. As a result, you could spread bet on the Ireland 20 market:

- Increasing higher than 531.2, or

- Decreasing lower than 526.5

When spread trading on the Ireland 20 index you trade in £x per point. So, if you chose to invest £10 per point and the Ireland 20 moves 5.0 points then that would make a difference to your profit/loss of £50. £10 per point x 5.0 points = £50.

Ireland 20 Rolling Daily Indices Spread Trading Example

If we consider the spread of 526.5 - 531.2 and assume a) You have done your analysis of the markets, and b) your analysis leads you to feel that the Ireland 20 index will increase and go above 531.2, then you could decide that you want to go long of the market at 531.2 and invest £5 per point.

Therefore, you make a profit of £5 for every point that the Ireland 20 index pushes higher than 531.2. Conversely, however, it also means that you will lose £5 for every point that the Ireland 20 market moves below 531.2.

Put another way, if you were to ‘Buy’ a spread bet then your profits are calculated by taking the difference between the final price of the market and the initial price you bought the market at. You then multiply that difference in price by your stake.

Therefore, if after a few sessions the stock market moved higher then you might want to close your spread bet so that you can lock in your profit.

Taking this a step further, if the market rose then the spread, determined by the spread betting company, might change to 548.5 - 553.2. You would close/settle your spread bet by selling at 548.5. Therefore, with the same £5 stake your profit would be calculated as:

Profit = (Settlement Level - Opening Level) x stake

Profit = (548.5 - 531.2) x £5 per point stake

Profit = 17.3 x £5 per point stake

Profit = £86.50 profit

Spread betting on stock market indices can work against you. With this example, you had bet that the index would increase. However, the index could decrease.

If the Ireland 20 index decreased, contrary to your expectations, then you could choose to close your trade to stop any further losses.

If the spread dropped to 515.3 - 520.0 you would close your trade by selling at 515.3. If so, your loss would be calculated as:

Loss = (Settlement Level - Opening Level) x stake

Loss = (515.3 - 531.2) x £5 per point stake

Loss = -15.9 x £5 per point stake

Loss = -£79.50 loss

Note - Ireland 20 Rolling Daily spread betting market taken as of 29-Nov-10.

How to Spread Bet on Irish Shares |

If an investor is looking to invest in firms such as Ryanair then one option is to spread bet on the Ryanair share price.

Looking at a financial spread betting platform like Financial Spreads, we can see that they are currently valuing the Ryanair Rolling Daily market at €4.74 - €4.77. This means an investor could spread trade on the Ryanair share price:

Moving above €4.77, or Moving above €4.77, or

Moving below €4.74 Moving below €4.74

When financial spread betting on Irish equities you trade in £x per cent. As a result, if you decided to have a stake of £4 per cent and the Ryanair share price changes by €0.36 then that would alter your profits (or losses) by £144. £4 per cent x €0.36 = £144.

You can also invest in this market in Dollars or Euros, e.g. $x per cent.

Rolling Daily Equities Markets

One thing to note is that this is a Rolling Daily Market which means that in contrast with futures markets, there is no closing date. Should your trade be left open at the end of the trading day, it just rolls over to the next trading session.

If you do roll over a trade and you are spread betting that the market will:

Increase - then you normally pay a small overnight financing fee, or Increase - then you normally pay a small overnight financing fee, or

Decrease - then a small payment is often credited to your account Decrease - then a small payment is often credited to your account

You can learn more in our feature Rolling Daily Spread Betting.

Ryanair Rolling Daily - Irish Shares Trading Example |

If you take the above spread of €4.74 - €4.77 and make the assumptions:

- You've completed your stock market analysis, and

- Your research leads you to think the Ryanair shares are likely to move higher than €4.77

Then you could decide that you want to buy at €4.77 for a stake of £10 per cent.

Therefore, you make a profit of £10 for every cent that the Ryanair shares increase and move above €4.77. Conversely, however, it also means that you will make a loss of £10 for every cent that the Ryanair market moves below €4.77.

Looking at this from another angle, if you were to ‘Buy’ a spread bet then your profits (or losses) are calculated by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that price difference by your stake.

If after a few hours the shares started to increase then you might think about closing your spread bet to lock in your profit.

Taking this a step further, if the market did go up then the spread, determined by the spread betting company, could be adjusted to €4.91 - €4.94. To settle/close your trade you would sell at €4.91. Therefore, with the same £10 stake you would make:

Profit = (Closing Price - Initial Price) x stake

Profit = (€4.91 - €4.77) x £10 per cent stake

Profit = €0.14 x £10 per cent stake

Profit = 14c x £10 per cent stake

Profit = £140 profit

Trading equities, by spread betting or otherwise, is not always simple. In the above example, you had bet that the share price would go up. Nevertheless, the share price can also go down.

If the Ryanair stock dropped then you might decide to settle/close your position in order to restrict your losses.

So if the spread fell to €4.61 - €4.64 then you would sell back your position at €4.61. That would mean you would make a loss of:

Loss = (Closing Price - Initial Price) x stake

Loss = (€4.61 - €4.77) x £10 per cent stake

Loss = -€0.16 x £10 per cent stake

Loss = -16c x £10 per cent stake

Loss = -£160 loss

Note - Ryanair Rolling Daily market taken as of 18-Dec-12.

Simply click on the company you're interested in spread betting on and we talk you through the most popular spread betting questions on that Irish company:

- Where can I spread bet?

- Where can I get free charts?

- How to spread bet?

- Where can I trade commission free?

- Etc

Irish Stock Market Spread Betting |

If we haven't prepared a page yet on your chosen company, simply Contact Us to let us know.

If you are looking to spread bet on the Irish Stock Market please see Irish Stock Market Spread Betting.

Spread Betting on Irish Shares |

For more details on how and where to trade a specific company please click on the relevant link below:

| Company Name | Symbol | Irish Shares Spread Betting Guides » |

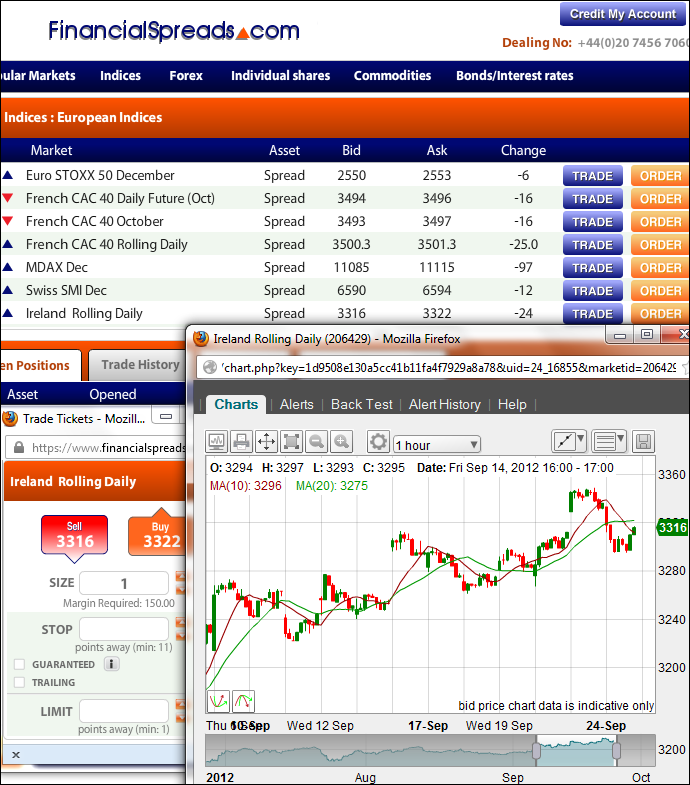

Where Can I Find Live Prices and Charts for the Irish Stock Market? |

Should you want to check up-to-the-minute charts/prices for the Irish Stock Market, you will probably require a spread betting account. Note that all spreads accounts are subject to status, suitability and credit checks.

Should your application be approved then you will be able to log on and make use of the real time prices/charts. These are usually provided for free. Having said that, you are likely to receive the occasional sales email or call from the spread betting provider.

If you do decide to trade then, before starting, remember that spread betting does involve a high degree of risk to your funds and it's possible to incur losses that exceed your initial deposit.

Although charting software/packages normally differ from provider to provider, in order to assist you with your analysis, they often come with tools such as:

- A variety of time periods e.g. 15 minutes, 4 hours, 1 day etc

- Different displays e.g. bar and candlestick charts

- Drawing options e.g. trendlines, Fibonacci time zones, fans and arcs

- Chart overlays and indicators e.g. Bollinger Bands, Parabolic SAR etc

Charts provided by Capital Spreads also come with more advanced features such as:

- Back Testing functions

- Custom alerts when your chosen market reaches a given level

Sample FinancialSpreads.com indices candle chart

The spread betting firms in the following list offer clients access to live prices and charts:

Advert:

Irish Stock Market Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Irish Stock Market with

Financial Spreads.

|

ISEQ drops below 2,000 to pre-Celtic Tiger levels |

Below, an older but interesting article from Paddypowertrader on how the Irish stock market tumbled in 2009.

Paddypowertrader has been following the movement of its client base trading Irish shares for the past number of days. Despite considerable volatility in the international markets it looks like retail investors are piling into Irish equities.

“Yesterday we were watching more and more customers putting their money into Irish equities as the Irish index hits the headlines. The market dropped to a significant low of 1981.40, down 3.3% on the open. Short bets have certainly been popular with some spread bettors.” said Davin McAnaney of paddypowertrader.

“Retail investors have been taking heed of volatile international markets and delving into financial spread betting. Since January we have seen an upsurge in subscriptions. We can see further expansion into Irish equities as market uncertainty continues.

“With the ISEQ back below 2,000 it’s like the Celtic Tiger never happened. The ISEQ index hit an all time high in May 2007 of 10,364* points so it’s been a long fall.” he continued.

“The last time that the ISEQ index was below 2,000, on July 3rd 1995, the Tiger was still a cub. Now it looks like its dead and buried. Mauled by the bears. However our clients are still able to realise gains by making short bets on a bearish market,” concluded McAnaney.

ISEQ Levels

| ISEQ Level at 10.30am on 24 February 2009:

|

1981.40

|

| ISEQ Level at close 3 July 1995:

|

1998.82

|

| ISEQ Level at close 22 May 2007:

|

10,364

|

Worst Performing Irish Shares 2008 |

Below, Paddypowertrader's annual list of Irish stock market losers, 21 Jan 2009.

Spread bettors have been diving into Irish shares since the beginning of 2008. Unfortunately the ISEQ Index has lost 66.31% of its value year to date.

Analysts have attributed the huge losses on the ISEQ and the ongoing uncertainty to the banking sector, commodities markets and generally bearish market sentiment.

“We have compiled a list of the worst performing shares in the top 25 Irish public companies over 2008. Topping the list, having lost 98.4% of its value year to date, is Anglo Irish Bank. Irish Continenta, at the bottom of the list, is the best performer of the year having only lost 14.92% of its value. It’s pretty depressing reading, with stalwarts like Ryanair down 34.56%, Kerry Group down 38.48% and Dragon Oil having lost 65.62%.

We wanted to compile a comprehensive list of performances of Irish Shares in 2008. The fact that almost all notable companies lost share value over the year was quite interesting but not unsurprising, considering the market meltdown this year.” said Davin McAnaney of paddypowertrader.

Other Irish movers attracting attention on the paddypowertrader sneak preview of 2008 are Allied Irish Banks and Elan Corporation. Elan, have dropped 70.73% while AIB Bank is currently trading at 88.51% down year to date.

“This is a developing market for paddypowertrader. We can see that trading on Irish equities is dominating our trading balance. However it is interesting to note that the top falling share prices are the four banks despite the ban on short selling financial shares still in place in Ireland,” concluded McAnaney.

ISEQ Worst Performing Companies 2008

| Company | 2008 Return | |

| Irish Continental | -14.92% | ISEQ |

| CRH | -24.53% | ISEQ 20 |

| Aer Lingus | -28.23% | ISEQ |

| Aryzta | -32.35% | ISEQ 20 |

| Ryanair | -34.56% | ISEQ 20 |

| Kerry Group | -38.48% | ISEQ 20 |

| Paddy Power | -42.37% | ISEQ 20 |

| United Drug | -43.54% | ISEQ 20 |

| DCC | -45.88% | ISEQ |

| Icon | -46.31% | ISEQ |

| Glanbia | -53.88% | ISEQ |

| Grafton Group | -55.18% | ISEQ 20 |

| C&C Group | -64.39% | ISEQ 20 |

| Dragon Oil | -65.62% | ISEQ 20 |

| FBD Holdings | -68.03% | ISEQ 20 |

| Kingspan Group | -70.71% | ISEQ 20 |

| Elan | -70.73% | ISEQ 20 |

| Fyffes | -73.40% | ISEQ |

| Greencore | -79.46% | ISEQ 20 |

| Independent News | -82.27% | ISEQ 20 |

| Smurfit Kappa | -84.01% | ISEQ 20 |

| Irish Life & Permanent | -86.71% | ISEQ 20 |

| Allied Irish Bank | -88.51% | ISEQ 20 |

| Bank of Ireland | -91.66% | ISEQ 20 |

| Anglo Irish Bank | -98.40% | ISEQ 20 |

'Irish Stock Market Spread Betting' edited by Jacob Wood, updated 13-Apr-17

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

Irish Stock Market Spread Betting

Ireland spread betting guide covering where to spread bet commission-free on shares listed on the Irish stock market as well as the main stock market index itself. How to trade... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|