Nikkei 225 Spread Betting

Indicative Nikkei 225 Prices |

Where Can I Spread Bet on the Nikkei 225? |

You can speculate on the Nikkei 225 with these firms:

Japanese Stock Market Analysis and Trading News

|

| 20-May-18 |

[12:56pm] Updated Nikkei 225 (Yen Denominated) COT Report

The latest COT Report (Commitments of Traders) for the Nikkei 225 futures market has been released by the CFTC, please see our Nikkei 225 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 13-May-18 |

[8:17pm] Updated Nikkei 225 (Yen Denominated) COT Report

The latest COT Report (Commitments of Traders) for the Nikkei 225 futures market has been released by the CFTC, please see our Nikkei 225 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 07-May-18 |

[1:06pm] Updated Nikkei 225 (Yen Denominated) COT Report

The latest COT Report (Commitments of Traders) for the Nikkei 225 futures market has been released by the CFTC, please see our Nikkei 225 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 29-Apr-18 |

[11:28am] Updated Nikkei 225 (Yen Denominated) COT Report

The latest COT Report (Commitments of Traders) for the Nikkei 225 futures market has been released by the CFTC, please see our Nikkei 225 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

| 09-Apr-18 |

[11:27am] Updated Nikkei 225 (Yen Denominated) COT Report

The latest COT Report (Commitments of Traders) for the Nikkei 225 futures market has been released by the CFTC, please see our Nikkei 225 COT report below.

Readers should note that we have also updated our Stock Market COT Summary Report.

Update by Gordon Childs, Editor,

|

» For more see Stock Market Trading News & Analysis.

Where Can I Find Live Prices and Charts for the Nikkei 225? |

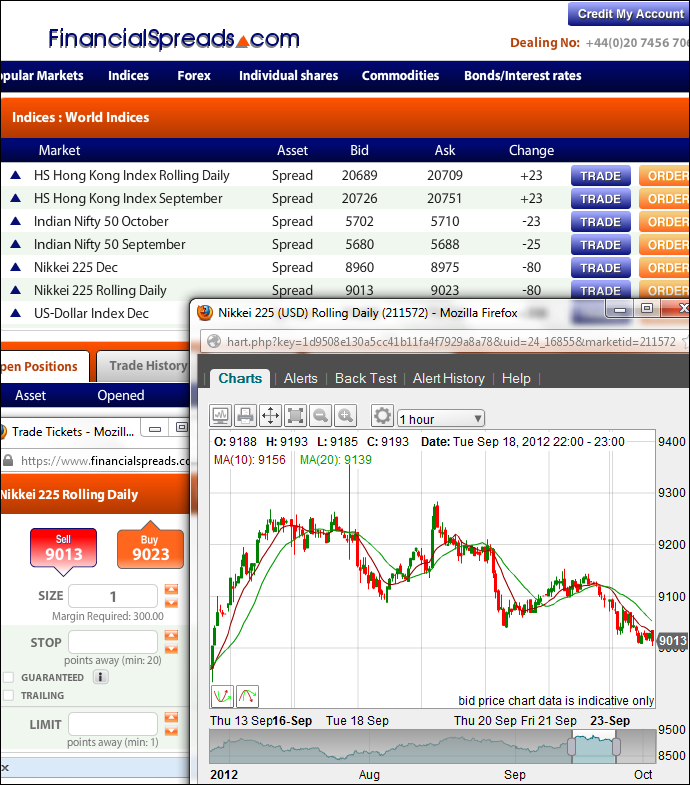

We show readers some pretty accurate Nikkei 225 spread betting prices - see above.

The live CFD chart below also provides you with a good overview of the Japanese stock market.

The chart above is provided by Plus500 and is typically based on the Nikkei 225 futures price.

Should you want to look at real-time spread betting charts and prices for the Nikkei 225, you will normally require a spread betting account.

A spreads account would also let you access the shorter-term spot markets. Note that such accounts are subject to suitability, credit and status checks.

Should your account application be accepted then, when you log on, you will be able to analyse the charts and the current pricing. On most platforms, these will be free.

If you were to trade then, before starting, remember that spread trading and CFD trading involve a significant level of risk to your funds and it's possible to lose more than your initial investment.

Professional Charting Packages for the Nikkei 225 |

Whilst charts can differ across the industry, to help your stock market analysis, most charts usually come with useful tools and features such as:

- A range of intervals e.g. 2 minutes, 5 minutes, 10 minutes, 30 minutes, 2 hours, 4 hours etc.

- Tools for drawing/adding features e.g. Trendlines, Fibonacci Arcs, Time Zones and Fans

- Different displays e.g. line charts and candle charts

Charts from Tradefair also offer more advanced aspects like:

- BackTesting, Tailored Indicators and Optimisation functions

- Useful chart overlays e.g. Ichimoku Kinko Hyo Clouds, MAs, EMAs, Bollinger Bands, Envelopes, Linear Regression etc.

- A choice of indicators e.g. Momentum Percentage, Williams %R, Chaikin Volatility, Volume Index, Klinger Oscillator etc.

- Customised alerts when the markets hit a certain level

Sample Nikkei 225 chart on FinancialSpreads.com

The spread betting firms in the following list give their users real-time prices and charts:

If you want to spread bet, or trade CFDs, on individual Japanese shares then CMC Markets is a good starting point.

In the past IG offered a number of Japanese stocks but they don’t seem to be on the IG site anymore.

Likewise, most of the other reputable firms have a good offering when it comes to UK, Eurozone and US shares but they fall down when it comes to Japanese stocks.

Advert:

Nikkei 225 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Nikkei 225 with

Financial Spreads.

|

Where Can I Spread Bet on the Nikkei 225 for Free? |

Trading the stock market is not without risk. Having said that, if you want to open a free Practice Account, that lets you trial spread betting, then please see below for more details.

When considering which trading option is right for you, don't forget that in the UK, financial spread betting is currently tax free*, i.e. it is exempt from income tax, stamp duty and capital gains tax.

If you're looking for a low cost trading platform, keep in mind that you can trade the Nikkei 225 commission free through these platforms:

If you want to have a go with a free Test Account that allows users to get to grips with online spread betting, and speculating on markets like the Nikkei 225 index, then you could take a look at:

Each of these spread betting companies offer a risk free Practice Account that lets investors practice with a range of trading orders and test new ideas.

How to Spread Bet on the Nikkei 225? |

As with a lot of markets, you can speculate on stock market indices, such as the Nikkei 225, to go up or down.

If we go to a spread betting site like Financial Spreads, we can see they are currently offering the Nikkei 225 Rolling Daily market at 8818 - 8828. As a result, you can spread bet on the Nikkei 225 index:

Rising above 8828, or Rising above 8828, or

Falling below 8818 Falling below 8818

Whilst spread betting on the Nikkei 225 index you trade in £x per point, where a point is one point of the index itself. Therefore, if you risked £4 per point and the Nikkei 225 moves 21 points then that would make a difference to your profit/loss of £84. £4 per point x 21 points = £84.

Rolling Daily Index Markets

This is a Rolling Daily Market and so, unlike a normal futures market, there is no settlement date. If your position is still open at the end of the day, it just rolls over into the next session.

If you allow your trade to roll over and are spread betting on the market to:

Move up - then you'll normally be charged a small financing fee, or Move up - then you'll normally be charged a small financing fee, or

Move down - then a small payment is usually credited to your account Move down - then a small payment is usually credited to your account

For more information see Rolling Daily Spread Betting.

Nikkei 225 Trading Example 1 |

If we take the above spread of 8818 - 8828 and assume that:

- You have done your market analysis, and

- You to think that the Japanese index will move higher than 8828

Then you might go long of the market at 8828 for a stake of £2 per point.

With this spread bet you make a profit of £2 for every point that the Nikkei 225 index pushes above 8828. Having said that, this trade also means that you will make a loss of £2 for every point that the Nikkei 225 market moves below 8828.

Thinking of this in a slightly different way, if you buy a spread bet then your profits (or losses) are found by taking the difference between the final price of the market and the price you bought the market at. You then multiply that difference in price by your stake.

With this in mind, if after a few days the Japanese stock market started to move up then you could choose to close your trade so that you can lock in your profit.

So if the stock market rose then the spread, set by the spread trading firm, might move up to 8890 - 8900. You would close your spread bet by selling at 8890. Therefore, with the same £2 stake your profit would be:

Profit = (Closing Level - Initial Level) x stake

Profit = (8890 - 8828) x £2 per point stake

Profit = 62 x £2 per point stake

Profit = £124 profit

Speculating on the Japanese stock market, whether by spread betting or otherwise, doesn't always lead to a profit. With the above, you wanted the index to increase. However, the stock market can fall.

If the Nikkei 225 had fallen then you could close your trade in order to restrict your losses.

Should the spread pull back to 8757 - 8767 then you would settle your position by selling at 8757. Therefore, you would make a loss of:

Loss = (Closing Level - Initial Level) x stake

Loss = (8757 - 8828) x £2 per point stake

Loss = -71 x £2 per point stake

Loss = -£142 loss

Note: Nikkei 225 Rolling Daily index market accurate as of 15-Nov-12.

Advert:

Nikkei 225 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Nikkei 225 with

Financial Spreads.

|

How to Spread Bet on the Japan 225 - Example 2 |

Logging onto Tradefair, you can see that they are offering the Japan 225 Rolling Daily market at 8860 - 8870. As a result, you can put a spread bet on the Japan 225 market:

Increasing higher than 8870, or Increasing higher than 8870, or

Decreasing lower than 8860 Decreasing lower than 8860

Whilst financial spread betting on the Japan 225 index you trade in £x per point. As a result, if you staked £2 per point and the Japan 225 moves 37 points then that would make a difference to your bottom line of £74. £2 per point x 37 points = £74.

If you consider the spread of 8860 - 8870 and make the assumptions:

- You have analysed the stock market, and

- Your analysis leads you to feel that the Japan 225 index will increase and go higher than 8870

Then you might decide that you want to go long of the market at 8870 for a stake of, let’s say, £3 per point.

So, you gain £3 for every point that the Japan 225 index increases above 8870. Having said that, you will lose £3 for every point that the Japan 225 market goes below 8870.

Looked at another way, if you were to ‘Buy’ a spread bet then your P&L is found by taking the difference between the final price of the market and the price you bought the spread at. You then multiply that price difference by your stake.

With this in mind, if after a few sessions the Japanese stock market moved higher then you could consider closing your spread bet so that you can secure your profit.

As an example, if the market increased then the spread, determined by the spread betting company, could be adjusted to 8914 - 8924. To close your position you would sell at 8914. Accordingly, with the same £3 stake your profit would be:

Profits (or losses) = (Settlement Price - Initial Price) x stake

Profits (or losses) = (8914 - 8870) x £3 per point stake

Profits (or losses) = 44 x £3 per point stake

Profits (or losses) = £132 profit

Speculating on stock market indices is not always easy. In this case, you had bet that the index would go up. Of course, the Japanese index could fall.

If the Japan 225 index had started to fall then you could choose to close your position to stop any further losses.

So if the market dropped to 8830 - 8840 then you would sell back your position at 8830. If so, this would result in a loss of:

Profits (or losses) = (Settlement Price - Initial Price) x stake

Profits (or losses) = (8830 - 8870) x £3 per point stake

Profits (or losses) = -40 x £3 per point stake

Profits (or losses) = -£120 loss

Note: Japan 225 Rolling Daily spread betting price taken as of 19-Oct-12.

Advert:

Nikkei 225 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Nikkei 225 with

Financial Spreads.

|

Nikkei 225 Index (Yen Denom) Commitments of Traders Report - 15 May 2018 (i) |

Futures Only Positions, CME , Code 240743, (Nikkei Index x ¥500) (i)

| Reporting Firms (i)

|

|

Non-Reportable Positions (i) |

Non-Commercial (i)

|

Commercial (i) |

Total Reportable (i) |

| |

| Commitments (i) |

Open (i) Interest |

Commitments |

| Long (i) |

Short (i) |

Spreads (i) |

Long |

Short |

Long |

Short |

Long |

Short |

| 12,583 |

15,628 |

841 |

39,349 |

26,215 |

52,773 |

42,684 |

61,995 |

9,222 |

19,311 |

| |

| Changes from 8 May 2018 (i) |

Change in (i) Open Interest |

Changes from |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

Long |

Short |

| -526 |

-605 |

-144 |

-3,467 |

-3,553 |

-4,137 |

-4,302 |

-4,935 |

-798 |

-633 |

| |

| Percent of Open Interest for Each Category of Trader (i) |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

Long |

Short |

| 20.3% |

25.2% |

1.4% |

63.5% |

42.3% |

85.1% |

68.9% |

|

14.9% |

31.1% |

| |

| Number of Traders in Each Category (i) |

Total (i) Traders |

|

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

|

| 14 |

18 |

6 |

27 |

15 |

45 |

35 |

66 |

|

|

| |

| Long/Short Commitments Ratios (i) |

|

Long/Short Ratio |

| Ratio |

|

Ratio |

Ratio |

|

Ratio |

| 1:1.2 |

|

1.5:1 |

1.2:1 |

|

1:2.1 |

| |

| Net Commitment Change (i) |

|

| 79 |

|

The above is the 'Nikkei 225 Index yen denominated COT report' which is different from the 'Nikkei 225 Index dollar denominated COT report'. For the dollar denominated report see Nikkei 225 COT (USD Denom).

Also see:

The Nikkei 225 refers to the price-weighted average of 225 stocks of the first section of the Tokyo Stock Exchange.

For more details visit the official Nikkei Website: http://www.tse.or.jp/english/.

For the latest view on the stock market see Daily Market Review.

'Nikkei 225 Spread Betting' edited by Jacob Wood, updated 20-May-18

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Hang Seng Spread Betting, updated 13-Apr-17

Hang Seng financial spread betting guide with daily updates. Plus live Hang Seng charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

Nikkei 225 Spread Betting

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|