Losses can exceed deposits

Here at Clean Financial we want you to select the trading option that is right for you. One option worth considering is Finspreads.

Important: note that “Financial Spreads” (FinancialSpreads.com) and “Finspreads” (Finspreads.com) are different brands (both a regulated by the FCA).

The following review just relates to Finspreads.

Finspreads Review Quick Links:

Finspreads Review

With Finspreads you get all the normal advantages of financial spread betting:- Tax Free Investments*, i.e. no capital gains tax, income tax or stamp duty

- You can buy or sell indices, shares, forex, commodities, interest rates and bonds

- No commission fees

- No brokers fees

- A wide range of markets is offered – also see – Finspreads markets

And With Finspreads You Also Get:

- An Advanced Trading Platform – One click trading, interactive charts, customisable platform layouts etc.

- Mobile Trading Apps – See the Finspreads mobile trading section below for more details.

- 24-Hour Markets – Finspreads offer 24-hour prices on over 12,000 financial markets. 24 hour trading is available from Sunday evening to Friday evening.

- Low Stakes from 10p per Point – ‘Beginner Account’ holders can trade from just 10p per point on a range of markets including stock indices, forex and commodities markets.

- 3 Account Types – These are aimed at offering investors an account that is best suited to their trading needs. The table below compares the 3 account types:

Could Do Better

- The homepage says “FX spreads from just 0.5pts. Spread bet on EUR/USD and USD/JPY from just 0.5pts, GBP/USD from just 0.8pts.”

Reality check – as quoted elsewhere on the Finspreads website in December 2017, they quote 3 weeks of trading in November 2016, when the EUR/USD DFT is average spread was 0.72pts, USD/JPY was 0.89 and GBP/USD was 1.36pts.

Let’s assume the average spread is closer to 1pt, 1pt and 1.5pts… then please print these spreads! It feels like the above headline is misleading – something many of the spread betting companies are guilty of. And 1pt, 1pt and 1.5pts isn’t that bad…It won’t make a big difference to most investors’ P&L - The site is a little dated and it feels like the owners (Gain Capital) concentrate on their other brands like City Index… we could be wrong on this! If so, just let us know.

- No CFD account available

- No MT4 account available

Finspreads Account

A quick rundown of the ‘Standard’ account.Finspreads Services |  |

| Average User Rating | 5.2 |

| New Account Offer |  |

| 24 Hour Trading |  |

| Live Charts |  |

| iPhone App |  |

| iPad App |  |

| Android Apps |  |

| Web Platform |  |

| Stop Loss Available |  |

| Automatic Stop Loss |  |

| Credit Account |  |

| Deposit Account |  |

| FCA Authorised and Regulated |  |

Plus…

- Risk Management Tools – e.g. Stop orders, Limit orders and Guaranteed Stop Loss orders.

- Market Profiles – These help clients keep up to speed with the prices and volumes of a selected market. Also, users can view the day’s most active shares and as well as the top gainers and losers (feature not available for Beginner accounts).

- Streaming News – i.e. a live Dow Jones news feed.

- Education and Training – There is a range of tools and training seminars. Both account and non-account holders can attend seminars for free.

User Ratings & Comments on Finspreads

Add Your View – please add any user comments and/or questions on Finspreads here.Readers can leave comments by logging in securely to their Facebook, Twitter or Intense Debate accounts (CleanFinancial does not see, or keep a record of, your login details).

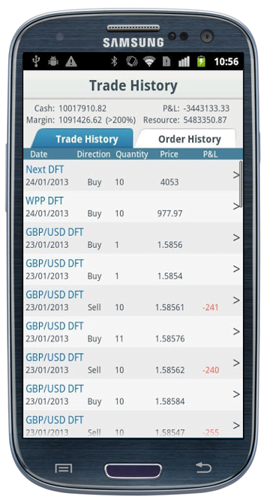

Finspreads Mobile Trading

- Trade thousands of markets 24 hours a day (5 days a week)

- Access live interactive charts

- Apply risk management orders such as stop, limit and guaranteed stop loss orders as well as ‘if done’ and OCO orders

- Check and update personalised market Watchlists

Finspreads Markets

Below you will find a sample of the spread betting markets offered by Finspreads along with their typical in-hours spread size and the minimum stake for that market.Note – the following applies to the ‘Standard’ account, see Finspreads for full details.

Typical In-Hours Forex Spread Sizes with Finspreads |  |

| EUR / USD Daily | 1 |

| GBP / USD Daily | 2 |

| EUR / GBP Daily | 2 |

| USD / JPY Daily | 2 |

| Forex minimum stake | £0.5 |

- Metals markets: eg palladium and silver

- Softs / Agriculture markets: eg coffee, soybeans, wheat and more

Typical In-Hours Interest Rate Spread Sizes with Finspreads |  |

| Euribor | 3 |

| Euroswiss | – |

| Short Sterling | 3 |

| Treasuries minimum stake | £1 |

Typical In-Hours Bonds Spread Sizes with Finspreads |  |

| BOBL | 2 |

| Bund | 3 |

| Gilt | – |

| Schatz | 2 |

| US T Bond 10 Year | 3 |

| US T Bond 30 Year | 3 |

| Treasuries minimum stake | £1 |

Finspreads also provides trading on other market including UK equities sectors. Also see, Company Prices – Notes and Comments

About Finspreads

Losses can exceed deposits

In 1999, Finspreads became the UK’s first company to offer real-time spread betting through a web-browser. The company grew to become one of the UK’s largest spread betting providers and in 2006 it was acquired by City Index Ltd.

In 2011, Finspreads created its first iPhone spread betting app. In 2012, the company underwent a major rebrand and launched its current website and the choice of three different account types.

With regards to ‘Client Money Protection’, according to the Finspreads website, they operate in strict accordance with the Financial Service Authority’s rules on ‘Client Money’, which helps to ensure that your funds are protected. All Client Money is held in a segregated account and Finspreads only use their own funds for hedging.

Finspreads is a trading name of City Index Ltd which is authorised and regulated by the Financial Conduct Authority. Address, City Index Ltd, Park House, 16 Finsbury Circus, London, EC2M 7EB.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.