Bonds Spread Betting

A spread/price comparison table covering the popular bond markets:

| BOBL |

- |

2 |

2 |

2 |

| Bund |

- |

2 |

2 |

3 |

| Gilt |

- |

3 |

2 |

2 |

| Schatz |

- |

2 |

4 |

2 |

| US T Bond 10 Yr |

- |

4 |

4 |

3 |

| US T Bond 30 Yr |

- |

2 |

4 |

3 |

| Treasuries Minimum Stake |

- |

£0.5 |

£0.5 |

£1 |

Comparison Notes.

This table is not meant to be inclusive, bonds spread betting may be available through other brokers.

Where Can I Spread Bet on Bonds? |

You can currently spread bet on Government bonds with:

Where Can I Spread Bet on Canadian / French / Italian Bonds? |

IG offer spread betting on:

Bonds Market Analysis and Trading News

|

| 20-May-18 |

[12:56pm] New US Bonds COT Reports

The latest Commitments of Traders Report (COT) has been published by the US Commodity Futures Trading Commission and so we have produced a new Bonds COT Summary Report.

You can also click on the individual links below to access our 'easier-to-read' COT report for the relevant treasuries market:

Note that the Bonds COT Summary Report also looks at US Long Term Bonds.

Update by Gordon Childs, Editor,

|

| 13-May-18 |

[8:17pm] New US Bonds COT Reports

The latest Commitments of Traders Report (COT) has been published by the US Commodity Futures Trading Commission and so we have produced a new Bonds COT Summary Report.

You can also click on the individual links below to access our 'easier-to-read' COT report for the relevant treasuries market:

Note that the Bonds COT Summary Report also looks at US Long Term Bonds.

Update by Gordon Childs, Editor,

|

| 07-May-18 |

[1:06pm] New US Bonds COT Reports

The latest Commitments of Traders Report (COT) has been published by the US Commodity Futures Trading Commission and so we have produced a new Bonds COT Summary Report.

You can also click on the individual links below to access our 'easier-to-read' COT report for the relevant treasuries market:

Note that the Bonds COT Summary Report also looks at US Long Term Bonds.

Update by Gordon Childs, Editor,

|

» For more see Stock Market Trading News & Analysis.

Where Can I Trade Bonds for Free? |

It depends upon what you mean by free.

If you are looking for a free Demo Account where you can practice trading, see below.

If you want tax efficient trading, don't forget that in the UK, spread betting is tax free*.

If you want to keep your trading costs down then note that you can spread bet on Gilts, the BOBL, the Bund and other bonds commission-free and with no brokers’ fees at:

If you are looking for a free Test Account where you can give spread betting a go, and practice trading bonds then you can always try:

Each of the above currently offers a free demo account where you can hone your financial spread betting skills.

US Bonds Commitments of Traders Reports |

When studying the CFTC COT reports investors often concentrate on the Non-Commercial commitments and the Change in Open Interest. Therefore, we publish the following ‘Summary Non-Commercial and Open Interest COT Report’ each week.

For the full COT report for a particular treasuries market, just click on the relevant link in the summary table below.

Unfortunately, we don’t currently produce an individual COT report for the US Long Bond, but it is still covered in the table below.

Also see our guide to understanding Commitments of Traders (COT) reports.

Summary Bonds Non-Commercial and Open Interest COT Report - 15 May 2018 |

| Bonds |

Net Non-Commercial Commitments (i) (Futures Only) |

Open Interest (i) |

Change in Open Interest (i) |

| Long:Short Ratio (i) |

15 May 2018 |

8 May 2018 |

Weekly Change |

| US 2yr Bonds |

1:1.1 |

-31,029 |

-54,256 |

23,227 |

2,230,275 |

142,851 |

| US 10yr Bonds |

1:1.5 |

-381,922 |

-408,629 |

26,707 |

3,862,526 |

109,886 |

| US Long Term Bonds |

1:3.2 |

-187,904 |

-177,437 |

-10,467 |

1,035,496 |

23,697 |

US 10yr Bonds Commitments of Traders Report - 15 May 2018 (i) |

Futures Only Positions, CBT , Code 43602, (Contracts of $100,000 face value) (i)

| Reporting Firms (i)

|

|

Non-Reportable Positions (i) |

Non-Commercial (i)

|

Commercial (i) |

Total Reportable (i) |

| |

| Commitments (i) |

Open (i) Interest |

Commitments |

| Long (i) |

Short (i) |

Spreads (i) |

Long |

Short |

Long |

Short |

Long |

Short |

| 706,685 |

1,088,607 |

173,477 |

2,602,621 |

1,985,638 |

3,482,783 |

3,247,722 |

3,862,526 |

379,743 |

614,804 |

| |

| Changes from 8 May 2018 (i) |

Change in (i) Open Interest |

Changes from |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

Long |

Short |

| 9,007 |

-17,700 |

27,460 |

41,215 |

64,084 |

77,682 |

73,844 |

109,886 |

32,204 |

36,042 |

| |

| Percent of Open Interest for Each Category of Trader (i) |

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

Long |

Short |

| 18.3% |

28.2% |

4.5% |

67.4% |

51.4% |

90.2% |

84.1% |

|

9.8% |

15.9% |

| |

| Number of Traders in Each Category (i) |

Total (i) Traders |

|

| Long |

Short |

Spreads |

Long |

Short |

Long |

Short |

|

|

| 79 |

110 |

68 |

176 |

204 |

289 |

348 |

447 |

|

|

| |

| Long/Short Commitments Ratios (i) |

|

Long/Short Ratio |

| Ratio |

|

Ratio |

Ratio |

|

Ratio |

| 1:1.5 |

|

1.3:1 |

1.1:1 |

|

1:1.6 |

| |

| Net Commitment Change (i) |

|

| 26,707 |

|

Advert:

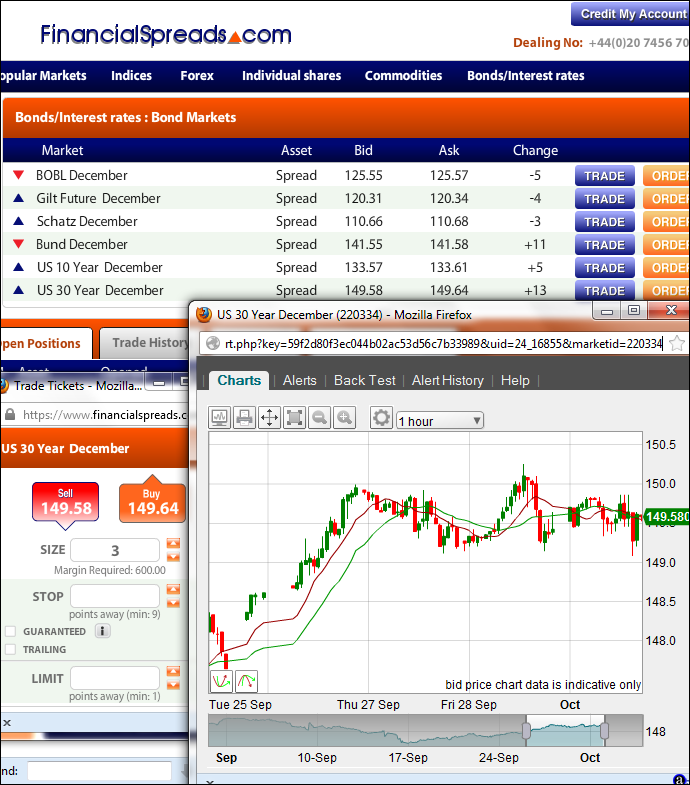

Bonds Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Bonds with

Financial Spreads.

|

If you just want to access live market data, then you could do worse than opening an account with a firm like FinancialSpreads or Capital Spreads.

Also, you don't have to trade with them, if you just open an account (which is free to do) then their data is free. The catch? You'll get the odd email or letter from them. As you can see from the screenshot below, the free FinancialSpreads charts are also useful.

If you do open an account with FinancialSpreads, Capital Spreads, or any other spread betting company, remember that financial spread betting carries a high level of risk to your funds. With financial spread betting you can lose more than your initial deposit so only speculate with money that you can afford to lose.

There are also live prices available at:

Live Bonds Spread Betting Charts? |

As mentioned above, you can get free charts with spread betting companies like Financial Spreads.

You can alter the charts to see market data by the minute, by the day, by the week etc. There are also many other settings to help you analyse the Government bond markets.

The chart below is interesting because it shows how the markets are not perfect and how you can expect them to "gap".

Bonds spread betting chart:

Government Bonds and the European Debt Crisis |

Below, a quick look at European government bonds by Shai Heffetz, InterTrader, 14-Sep-2011.

We recently heard that two major French banks, Societe Generale and Credit Agricole, were downgraded by credit rating agency Moody’s because of their exposure to potentially bad government debt.

This is the latest development in the rapidly escalating disaster we know as the European debt crisis. When exactly did this start and why? Who will be the major losers if Greece, Italy, or Spain should go under?

European Debt Crisis Explained

It can be very difficult to explain what exactly is happening in the major European economies at the moment, given that most economists seem unable to do so.

Things started going wrong towards the end of 2009 and, by the beginning of 2010, it was clear that certain European countries are going to have serious problems meeting their debt commitments.

These included Greece, Ireland, Spain, and Portugal, but the list has since grown to include Italy and the ripple effect is starting to effect even countries like France.

The core of the problem was most likely irresponsible lending by banks around the world. A credit bubble was created through banks lending out money to individuals and businesses to acquire assets that proved to be worth significantly less than the amount of the loans.

This was especially true in the real estate sector, something we also saw happening in the United States.

When these banks got into trouble because of bad loan practices, the government had to bail them out using public funds. This happened in the United States and was repeated in Greece and throughout other European countries.

Bond Markets

Governments of course have no money of their own; they have to raise it either through either taxes or loans. Since tax money is normally used to finance the current budget expenditure, a large amount of the money to bail out banks had to come from loans.

What happened therefore is that the US, Greece and subsequently other European governments issued government bonds to finance these bailouts.

The problem with government bonds is that you have to pay interest on them and, when the bond markets start doubting your ability to repay the loan, the interest rate will become higher and higher.

In the end it is a downward spiral. The government has to take up more loans to roll over existing ones, but the interest rates keep on getting higher and higher.

The next step in this spiral is that countries, who actually managed their finances perfectly well, such as Spain, are also caught up in the web. This is because they invested in the government bonds of the ‘rotten apples’ such as Greece.

This is exactly what happened to the two French banks in question. They are both heavily invested in Greek government bonds which might soon prove to be worthless if the Greek government should default on its debt payments.

What it all means is that we have an interconnected web of debtors and creditors here and if one goes down, they might very well take down the rest with them.

Italy, for example, owes France $550 billion, which is nearly 20% of the French GDP. If Italy goes down, one can understand how badly it will hurt France.

Spain owes France, Germany, and Britain more than $500 billion, so all of them are rightly scared of a collapse in Spain.

France undoubtedly has the most to lose from a Spanish or Italian collapse: these two countries combined owe the country more than $700 billion.

'Bonds Spread Betting' edited by Jenna Cutly, updated 20-May-18

For related articles also see:

Interest Rates Spread Betting, updated 22-Feb-17

Interest rates spread betting guide with regular market updates and a price comparison. Plus where to spread bet on STIRS tax-free*, how to access live interest rates charts & prices as well as... » read guide.

Treasuries Spread Betting, updated 20-May-18

An introductory guide to spread betting on treasuries. We cover the bonds and interest rates markets available, which firms offer treasuries, how and why to trade. We also... » read guide.

Treasuries Spread Betting, updated 20-May-18

An introductory guide to spread betting on treasuries. We cover the bonds and interest rates markets available, which firms offer treasuries, how and why to trade. We also... » read guide.

About this page:

Bonds Spread Betting

Bonds spread betting guide with regular market updates and a price comparison. Plus where to spread bet on government bonds tax-free*, how to access live futures charts & prices as well as... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|