Where Can I Find Live Prices and Charts for Chevron?

The real-time CFD trading chart below provides users with a handy overview of the Chevron market.

The above Plus 500 chart normally uses the Chevron futures price (not the spot market).

To review spread trading charts and the current pricing for Chevron, you will need to apply for a spread betting account.

Also, a spreads account would let you trade on the shorter term daily markets. Note that all accounts are normally dependent on credit, suitability and status checks.

If your application is accepted then you will be able to log in and view the prices and charts. These are normally provided for free. The catch? You're likely to get the odd newsletter or call from your financial spread betting firm.

Of course, if you want to trade, be aware that spread betting and CFDs involve a high degree of risk to your funds and it's possible to lose more than your initial investment.

For more details, see Advanced Chevron Trading Charts below.

| 03-Oct-17 |

[11:49am] Chevron Share Price Update:

The US equity is higher than the 20-DMA of $116.32 and higher than the 50-DMA of $111.79. The US equity is higher than the 20-DMA of $116.32 and higher than the 50-DMA of $111.79.- Closing Price: $117.03

1 Day Change: Down -1.31% 1 Day Change: Down -1.31% 5 Day Change: Down -0.40% 5 Day Change: Down -0.40%

Long-Term CVX Data 52 Week High: $119.00 52 Week High: $119.00 52 Week Low: $99.61 52 Week Low: $99.61- EPS(i): $3.08

- PE Ratio(i): 37.96

- Volume / Average Volume(i): 0.000m / 5.008m

- Market Cap(i): $221,772m

- Shares Outstanding(i): 1,895m

Price data from Google Finance. Also see Live CVX Share Price & Charts and About Chevron for more information.

Update by Jenna Cutly, Editor,

|

| 26-Feb-14 |

[11:41am] Chevron Explores Sale Options

CVX shares are trading slightly higher after the oil and gas giant said it was reviewing the option of selling some, or all, of its US midstream business.

Update by Jacob Wood, Editor,

|

| 03-Feb-14 |

[2:03pm] Chevron Stock Slips

The CVX stock closed down -4.14% to $111.63bn on Friday after the petroleum giant reported Q4 earnings of $4.9bn or $2.57 per 'diluted share'.

The numbers compared poorly with $7.2bn, or $3.70 per diluted share, in Q4 2012.

Update by Jacob Wood, Editor,

|

|

Professional Level Charting Packages for Chevron |

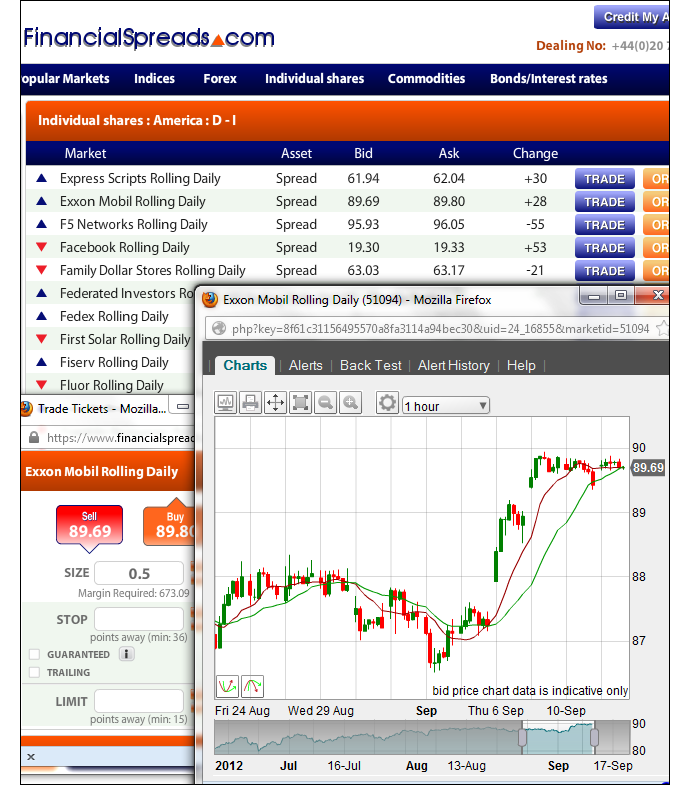

Even though the charts tend to vary from firm to firm, in order to help your trading, most charts have tools such as:

- Many different time intervals such as 30 minutes, 4 hours, 1 month etc.

- Various chart types such as candle charts and line charts

- Drawing tools and options such as trendlines, Fibonacci time zones, arcs and fans

Charts from Capital Spreads also have more advanced features like:

- BackTesting, Custom Indicators and Optimisation functions

- Numerous overlays such as Ichimoku Kinko Hyo, Parabolic SAR, Wilder's Smoothing etc.

- More than 30 indicator charts such as Range Indicator, RMI, Qstick etc.

- Custom email notifications that trigger when your chosen market hits a given level

FinancialSpreads equities trading chart

The financial spread betting firms listed below offer clients real time charts and prices:

Advert:

Chevron Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Chevron with

Financial Spreads.

|

Where Can I Spread Bet on Chevron for Free? |

By its very nature, speculating does involve risk, but if you would like to open a Practice Account, that allows you to try out financial spread betting and check candlestick charts, then see below for further details.

When considering which investment option might work for you, also remember that spread betting in the UK is tax free*, i.e. it is exempt from capital gains tax, stamp duty and income tax.

If you're interested in a low cost spread betting site then you should note that you can take a position on Chevron commission free and with no brokers' fees with:

If you would like to open a Test Account / Practice Account where users can try out online spread betting, and markets like the Dow Jones, gold, EUR/USD and Chevron, then you can always have a look at:

Each of these spread betting firms currently provide a Practice Account which lets users try out trading ideas, gain experience with a variety of orders and look at charts, such as line and candlestick charts.

How to Spread Bet on Chevron? |

If an investor is looking to invest in companies such as Chevron then one possibility could be to place a spread bet on the Chevron share price.

Looking at a financial spread betting site like InterTrader, you can see they have priced the Chevron Rolling Daily market at $115.22 - $115.36. This means an investor can spread bet on the Chevron share price:

Moving higher than $115.36, or Moving higher than $115.36, or

Moving lower than $115.22 Moving lower than $115.22

Whilst making a spread bet on S&P 500 shares you trade in £x per cent. Therefore, if you chose to risk £4 per cent and the Chevron share price moves $0.39 then that would alter your profit/loss by £156. £4 per cent x $0.39 = £156.

Note that you can also spread bet on this market in Dollars or Euros, e.g. €x per cent.

Rolling Daily Shares Markets

One important thing to note is that this is a 'Rolling Daily Market' and therefore it does not have a settlement date. If you leave your position open at the end of the day, it just rolls over into the next session.

If your trade does roll over and you are speculating on the market to:

Increase - then you are usually charged a small overnight financing fee, or Increase - then you are usually charged a small overnight financing fee, or

Decrease - then you'll normally receive a small credit to your account Decrease - then you'll normally receive a small credit to your account

You can learn more about Rolling Daily Markets in our article Rolling Daily Spread Betting.

Chevron Rolling Daily - US Equities Spread Trading Example |

Now, if we consider the above spread of $115.22 - $115.36 and make the assumptions:

- You have done your analysis of the company, and

- Your research suggests that the Chevron shares are likely to increase and move above $115.36

Then you could decide to go long of the market at $115.36 and invest, for example, £2 per cent.

This means that you win £2 for every cent that the Chevron shares push higher than $115.36. However, it also means that you will lose £2 for every cent that the Chevron market goes below $115.36.

Put another way, if you buy a spread bet then your profit/loss is worked out by taking the difference between the closing price of the market and the price you bought the market at. You then multiply that price difference by the stake.

With this in mind, if after a few trading sessions the share price started to increase then you might want to close your trade and therefore guarantee your profits.

As an example, should the market rise, the spread, set by the spread betting company, could change to $116.05 - $116.19. To close your position you would sell at $116.05. Therefore, with the same £2 stake you would make:

Profits (or losses) = (Closing Price - Opening Price) x stake

Profits (or losses) = ($116.05 - $115.36) x £2 per cent stake

Profits (or losses) = $0.69 x £2 per cent stake

Profits (or losses) = 69¢ x £2 per cent stake

Profits (or losses) = £138 profit

Speculating on shares, by spread trading or otherwise, doesn't always work out as you would have liked. In the above example, you had bet that the share price would rise. Nevertheless, the share price can also fall.

If the Chevron shares had started to fall then you could choose to close your spread bet to stop any further losses.

If the market dropped to $114.61 - $114.75 you would close your spread bet by selling at $114.61. Therefore, you would make a loss of:

Profits (or losses) = (Closing Price - Opening Price) x stake

Profits (or losses) = ($114.61 - $115.36) x £2 per cent stake

Profits (or losses) = -$0.75 x £2 per cent stake

Profits (or losses) = -75¢ x £2 per cent stake

Profits (or losses) = -£150 loss

Note - Chevron Rolling Daily spread betting market quoted as of 06-Feb-13.

Advert:

Chevron Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Chevron with

Financial Spreads.

|

'Chevron Spread Betting' edited by Jenna Cutly, updated 03-Oct-17

For related articles also see:

Bank of America Spread Betting, updated 03-Oct-17

BoA spread betting and share trading guide with daily updates on the bank and a real-time BAC stock chart & live prices. Where spread bet on Bank of America commission-free and... » read guide.

Exxon Mobil Spread Betting, updated 03-Oct-17

Exxon spread betting and share trading guide with daily updates on the oil firm and a real-time XOM stock chart & live prices. Where spread bet on Exxon Mobil commission-free and... » read guide.

General Electric Spread Betting, updated 03-Oct-17

General Electric spread betting and share trading guide with daily updates on the US firm and a real-time GE stock chart & live prices. Where spread bet on General Electric commission-free and... » read guide.

JPMorgan Chase Spread Betting, updated 03-Oct-17

JPMorgan spread betting and share trading guide with daily updates on the bank and a real-time JPM stock chart & live prices. Where spread bet on JPMorgan Chase commission-free and... » read guide.

McDonalds Spread Betting, updated 03-Oct-17

McDonalds spread betting and share trading guide with daily updates on the fast food chain and a real-time MCD stock chart & live prices. Where spread bet on McDonalds commission-free and... » read guide.

Wal-Mart Spread Betting, updated 03-Oct-17

Wal-Mart spread betting and share trading guide with daily updates on the retailer and a real-time WMT stock chart & live prices. Where spread bet on Wal-Mart commission-free and... » read guide.

3M Spread Betting, updated 03-Oct-17

3M spread betting and share trading guide with daily updates on the US firm and a real-time MMM stock chart & live prices. Where spread bet on 3M commission-free and... » read guide.

Alcoa Spread Betting, updated 03-Oct-17

Alcoa spread betting and share trading guide with daily updates on the mining company and a real-time AA stock chart & live prices. Where spread bet on Alcoa commission-free and... » read guide.

About this page:

Chevron Spread Betting

Chevron spread betting and share trading guide with daily updates on the oil firm and a real-time CVX stock chart & live prices. Where spread bet on Chevron commission-free and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|