The CleanFinancial guide to USD/ZAR spread betting.

- Where Can I Spread Bet on USD/ZAR?

- Live USD/ZAR Charts

- Live USD/ZAR Prices

- USD/ZAR Trading News and Analysis

- Where Can I Trade USD/ZAR for Free?

- Where Can I Practice Trading USD/ZAR?

- How to Spread Bet on USD/ZAR?

- Forex Spread Betting Guide

Live USD/ZAR Chart & Prices

The live CFD chart and prices below gives readers a handy view of the USD/ZAR currency market.The chart above is provided by Plus500 and usually follows the near-term USD/ZAR futures market.

Should you want to access real-time financial spread betting charts and prices for USD/ZAR, you will generally need a financial spread betting account.

Also, a spreads account will let you have access to the short term daily prices. Note: Such accounts are subject to status.

Should your new account be accepted, you can log on to study the charts and the current prices. On most platforms, these are free. The catch? You could receive the odd sales call or email from your chosen financial spread betting broker.

If you do decide to trade then, before starting, remember that CFDs and financial spread trading do carry a high level of risk to your funds and it’s possible to lose more than your initial deposit.

Where Can I Spread Bet on USD/ZAR?

You can spread bet on USD/ZAR, EUR/ZAR and GBP/ZAR with:Note: You may be able to spread bet on ZAR-based markets with other brokers.

USD/ZAR Market Analysis and Trading News

3 March 2018, 9:19am,

The forex market is currently below the 20-period MA of R 11.83651 and below the 50-period MA of R 11.83108.

The forex market is currently below the 20-period MA of R 11.83651 and below the 50-period MA of R 11.83108.

1 Day Chart Analysis

The forex market is below the 20-DMA of R 11.86752 and below the 50-DMA of R 11.84441.

The forex market is below the 20-DMA of R 11.86752 and below the 50-DMA of R 11.84441.

USD/ZAR Daily Trading Report

- USD/ZAR is currently trading at R 11.79500.

- Overnight, the market closed R 0.05695 (0.48%) higher at R 11.87425.

1 Day Chart Analysis

10 October 2017, 12:48pm,

The forex pair is currently higher than the 20-period MA of R 13.75368 and higher than the 50-period MA of R 13.74132.

The forex pair is currently higher than the 20-period MA of R 13.75368 and higher than the 50-period MA of R 13.74132.

1 Day Chart Analysis

The forex market is higher than the 20-day MA of R 13.47259 and higher than the 50-day MA of R 13.23114.

The forex market is higher than the 20-day MA of R 13.47259 and higher than the 50-day MA of R 13.23114.

USD/ZAR Daily Report

- USD/ZAR is currently trading at R 13.78874.

- At the end of the last session, the market closed R 0.05888 (0.43%) higher at R 13.76599.

1 Day Chart Analysis

» More forex trading views and analysis.

This content is for information purposes only and is not intended as a recommendation to trade. Nothing on this website should be construed as investment advice.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

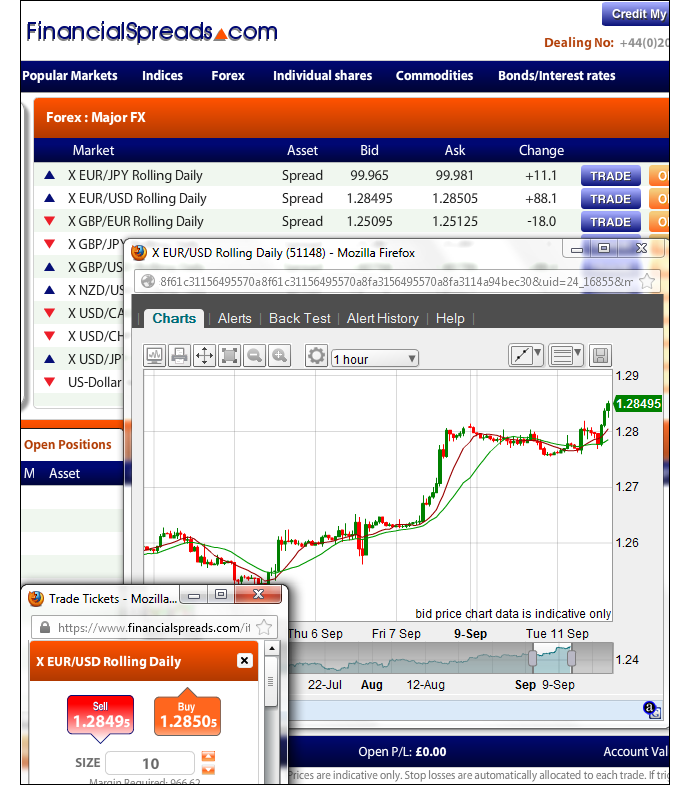

Sample FinancialSpreads.com forex rate trading chart

The following online spread betting companies offer users access to prices and live charts:

- City Index (read review)

- ETX Capital (read review)

- Financial Spreads (read review)

- Finspreads (read review)

- IG (read review)

- Inter Trader (read review)

- Spreadex (read review)

Advert:

USD/ZAR Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on USD/ZAR with Financial Spreads.

You can spread bet on USD/ZAR with Financial Spreads.

Where Can I Trade USD/ZAR for Free?

Trading the markets always has risks. However, if you would like to open a completely free Test Account, that lets you try out spread betting on a large range of markets, see below for more details.When thinking about which investment option is right for you, don’t forget that in the UK, financial spread betting is exempt from income tax, capital gains tax and stamp duty*.

If you’re looking for a low cost spread trading platform then you should keep in mind that you are able to financial spread bet on USD/ZAR with no brokers’ fees, and zero commissions, with providers such as:

Free Demo Account

If you want a Practice Account / Test Account in order to try out financial spread betting, including markets such as USD/ZAR, then you could always consider:The spread betting firms listed above offer a Test Account that lets investors try out theories, access charts and gain experience with an array of orders, e.g. guaranteed stop losses and trailing stop losses.

How to Spread Bet on USD/ZAR?

As with most key financial markets, you are able to speculate on FX pairs, like USD/ZAR, to go up or down.Looking at a site like Selftrade Markets, we can see they are valuing the USD/ZAR Rolling Daily market at R 8.1345 – R 8.1495. Therefore, you could spread bet on the USD/ZAR pair:

Increasing above R 8.1495, or

Increasing above R 8.1495, or Decreasing below R 8.1345

Decreasing below R 8.1345When placing a spread bet on USD/ZAR you trade in £x per point where a point is R 0.0010 of the pairs movement. Therefore, if you invested £2 per point and USD/ZAR moves 20.0 points then that would change your P&L by £40. £2 per point x R 0.0200 = £2 per point x 20.0 points = £40.

Rolling Daily Foreign Exchange Markets

You should note that this is a Rolling Daily Market which means that unlike a futures market, there is no settlement date. If you decide to leave your trade open at the end of the day, it just rolls over to the next day.If you do let your FX trade roll over then you would normally pay a small financing fee. For a fully worked example see Rolling Daily Spread Betting.

How to Spread Bet on the South African Rand: USD/ZAR Example

If you continue with the above spread of R 8.1345 – R 8.1495 and make the assumptions that:- You’ve done your research, and

- Your research leads you to think that the USD/ZAR market will push above R 8.1495

So, you win £3 for every point (R 0.0010) that the USD/ZAR rate increases higher than R 8.1495. Conversely, however, it also means that you will lose £3 for every point that the USD/ZAR market falls lower than R 8.1495.

Looking at this from another angle, should you buy a spread bet then your profit/loss is found by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that difference in price by your stake.

As a result, if the FX rate started to increase then you might think about closing your spread bet so that you can secure your profit.

So if the market rose then the spread, set by the spread trading firm, might move up to R 8.1854 – R 8.2004. In order to close your trade you would sell at R 8.1854. Therefore, with the same £3 stake you would make a profit of:

Profit / loss = (Final Level – Opening Level) x stake

Profit / loss = (R 8.1854 – R 8.1495) x £3 per point stake

Profit / loss = R 0.0359 x £3 per point stake

Profit / loss = 35.9 points x £3 per point stake

Profit / loss = £107.70 profit

Trading forex, by spread betting or otherwise, won’t always go to plan. With the above, you wanted the forex rate to rise. Of course, the FX rate might decrease.

If the USD/ZAR rate decreased, contrary to your expectations, then you could close your spread bet to stop any further losses.

If the market fell to R 8.1189 – R 8.1339 then you would sell back your position at R 8.1189. This would result in a loss of:

Profit / loss = (Final Level – Opening Level) x stake

Profit / loss = (R 8.1189 – R 8.1495) x £3 per point stake

Profit / loss = R -0.0306 x £3 per point stake

Profit / loss = -30.6 points x £3 per point stake

Profit / loss = -£91.80 loss

Note: USD/ZAR Rolling Daily market accurate as of 11-Sep-12.

Advert:

USD/ZAR Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on USD/ZAR with Financial Spreads.

You can spread bet on USD/ZAR with Financial Spreads.

How to Spread Bet on the South African Rand: EUR/ZAR Example

Looking at a site like FinancialSpreads, you can see they have put the Euro – South African Rand Rolling Daily market at R 10.7463 – R 10.7663. As a result, an investor can spread trade on the Euro – South African Rand rate: Moving higher than R 10.7663, or

Moving higher than R 10.7663, or Moving lower than R 10.7463

Moving lower than R 10.7463When spread trading on Euro – South African Rand you trade in £x per point where a point is R 0.0010 of the pairs movement. So, if you decided to have a stake of £4 per point and Euro – South African Rand moves 21.0 points then that would change your bottom line by £84. £4 per point x R 0.0210 = £4 per point x 21.0 points = £84.

So, if you consider the spread of R 10.7463 – R 10.7663 and make the assumptions that:

- You have completed your market analysis, and

- You feel that the Euro – South African Rand rate will move higher than R 10.7663

So, you make a profit of £2 for every point (R 0.0010) that the Euro – South African Rand pair pushes above R 10.7663. Of course, you will make a loss of £2 for every point that the Euro – South African Rand market goes lower than R 10.7663.

Considering this from another angle, should you buy a spread bet then your profits (or losses) are found by taking the difference between the final price of the market and the initial price you bought the spread at. You then multiply that difference in price by your stake.

Therefore, if after a few hours the FX rate rose then you might want to close your position so that you can secure your profit.

Taking this a step further, if the market rose then the spread, set by the spread betting company, might move up to R 10.8470 – R 10.8670. To settle/close your trade you would sell at R 10.8470. Therefore, with the same £2 stake this trade would result in a profit of:

Profit = (Settlement Value – Initial Value) x stake

Profit = (R 10.8470 – R 10.7663) x £2 per point stake

Profit = R 0.0807 x £2 per point stake

Profit = 80.7 points x £2 per point stake

Profit = £161.40 profit

Trading forex, whether by spread trading or otherwise, is not simple. With the above, you had bet that the FX pair would rise. Naturally, the FX rate could decrease.

If the Euro – South African Rand market had fallen then you could choose to close your spread bet in order to limit your losses.

So if the market fell to R 10.6936 – R 10.7136 you would settle your spread bet by selling at R 10.6936. That would mean you would make a loss of:

Loss = (Settlement Value – Initial Value) x stake

Loss = (R 10.6936 – R 10.7663) x £2 per point stake

Loss = R -0.0727 x £2 per point stake

Loss = -72.7 points x £2 per point stake

Loss = -£145.40 loss

Note: Euro – South African Rand Rolling Daily spread betting price accurate as of 18-Sep-12.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.