- Where to Trade the Banking Sector

- Banking Sector Constituents

- Pricing and Valuing Bank Shares

- Banking Sector Analysis

Where Can I Trade the Banking Sector?

You can currently spread bet on the banking sector with:You may be able to trade the banking sector with other firms.

Banking Sector Constituents

As of 19 Dec 2017, the following banks make up the FTSE 350 Banking Sector:- Aldermore, L.ALD

- Bank of Georgia, L.BGEO

- Barclays, L.BARC

- Close Brothers, L.CBG

- CYBG, L.CYBG

- HSBC, L.HSBA

- Lloyds, L.LLOY

- Metro Bank, L.MTRO

- RBS, L.RBS

- Standard Chartered, L.STAN

- TBC Bank, L.TBCG

- Virgin Money, L.VM.

For more detail on a particular bank, just click on the relevant link above.

In most cases we have added the latest broker recommendations, live charts and prices as well as details on how to speculate on the individual bank.

Trading Sectors

Pricing and Valuing Bank Shares

Below, an interesting article on how to value a bank by Anthony Grech, IG Index, 7-Oct-2008.Share prices react to news and information, but price alone is not always an accurate reflection of a company’s value in the short-term.

Information gaps, market sentiment and rumours can cause the price to deviate from a company’s intrinsic value. In the long term, share price and value should align, at least in theory.

Value is a direct function of risk and return. Market participants have a different risk/return profile, which means that a company’s equity may not be attractive to everyone at certain price levels.

In a downturn, however, strong support may start to appear as the risk/return trade-off of a particular security or sector starts to appeal to a greater number of investors.

Therefore, identifying a period of strong fundamental support may help traders identify the bottom of a cycle.

One way of looking at support is by identifying fundamental ratios and comparing them with the previous 2000-2002 banking sector downturn.

Two ways of looking at banking share fundamentals are from a price to earnings (P/E) and price to book (P/B) ratio perspective.

For the sake of brevity this analysis does not observe other fundamental data such as cost to income, advances to deposits and liquidity ratios and does not consider holdings of mortgage backed securities.

The P/E multiple:

This compares a bank’s share price with its latest annual earnings per share.

A high ratio may mean that a company is overvalued or could reflect investors’ willingness to pay a premium on every unit of earnings, whereas a low P/E may indicate that a company is relatively undervalued.

However, a low P/E does not necessarily mean that a stock is a good buying opportunity; it may in some circumstances suggest that a company is close to bankruptcy.

In the case for banks, low P/E’s reflect the reduced earnings prospects originating from further writedowns and credits losses.

The P/B multiple:

This compares a company’s share price with its book value of equity, also referred to as ‘shareholders funds’ (total assets less total liabilities).

A high P/B ratio may mean that a company is overvalued or that investors are willing to pay a premium over a company’s ‘accounting book value’.

Unlike the P/E (which reflects a company’s ability to generate profits), the P/B multiple reflects a company’s ability to grow its net asset base and generate higher returns on equity.

A P/B ratio below 1 indicates that the market believes that a company is not worth the value of its net assets (as is the case with most banks at the moment).

Banks are predominantly trading at low P/B multiples because investors are concerned with the quality of their loan books.

The sub-prime crisis and slowdown in the real estate market have exposed banks to rising bad debts. Banks also hold structured securities, which are extremely complex to value (hence they are classed as off-balance sheet items) and carry an element of leverage.

Because of the leverage, small adverse movements (depending on exposure levels) could result in huge chunks of a bank’s book value being eroded and could even cause collapse.

Investors are aware of these potential dangers and this is the reason why most banks are trading at significant discounts to their book value.

Banking Sector Analysis

Below, we have listed a series of articles which speculate on the banking sector.Most of the markets will have moved on since the analysis was written and the fundamental arguments may no longer apply.

However we feel the analysis is still useful if you are new to trading this sector because it talks through many of the factors that positively and negatively impact the UK banks.

Banking Sector in Focus After Relaxation of Basel 3 Rules

Below, a banking vs regulation article by Michael Hewson, CMC Markets, 24-Jan-2013.The gains seen in the banking sector over the past few weeks and months have been driven largely by reduced tensions in Europe with respect to fragmentation of the European banking system.

ECB President Draghi’s dramatic intervention last summer to do “whatever it takes” to save the euro along with the introduction of the OMT program has assuaged investor concerns that the European banking sector could have fallen apart.

Be that as it may, banks still remain reluctant to lend given pressure for them to rebuild their capital buffers which is why the recent relaxation of Basel 3 capital rules has helped in giving the sector an extra boost.

This decision has prompted a widespread reassessment of the UK banking sector in general. A raft of upgrades on the sector have helped push the share price values of Lloyds Banking Group, Royal Bank of Scotland and Barclays to their highest levels in months.

The end of the month will see the latest earnings releases for UK banks. However, the main question being asked by spread betting investors is how much upside is left given that the share prices of each of the banks up over 70% on a six month time frame.

Concerns are rising that with interest rates as low as they are, the scope for better bank profitability is likely to remain difficult, especially given the outlook for growth remains difficult. In fact Barclays is up 84%, Lloyds Banking Group, up 82% and RBS up 77%.

The key levels to observe are the 2011 highs which sit at 339.45p for Barclays, 69.85p for Lloyds and 49.5p for Royal Bank of Scotland.

Banking Sector Set to Remain Risky

Below, an article highlighting the risks of trading the sector by Michael Hewson, CMC Markets, 3-Jul-2012.Many commentators are saying now is the time to buy into banking stocks.

In the following article, Michael Hewson from CMC Markets believes the charts do not support this ‘buy’ message and urges investors to consider the uncertainty that will remain in the banking sector moving forward.

Concerns about Europe and exposure to the amount of bad debt on European banks balance sheets are quite enough for the banking sector to think about.

The current furore surrounding the LIBOR fixing scandal isn’t likely to change public perception of mistrust with respect to the problems facing a sector that has endured a torrid five years.

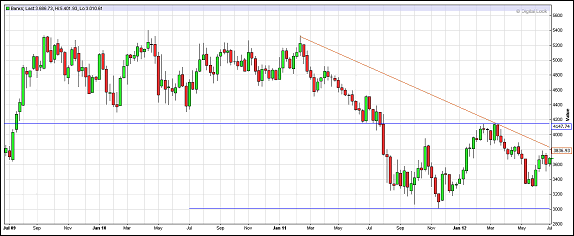

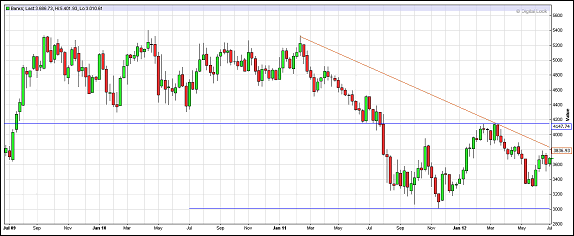

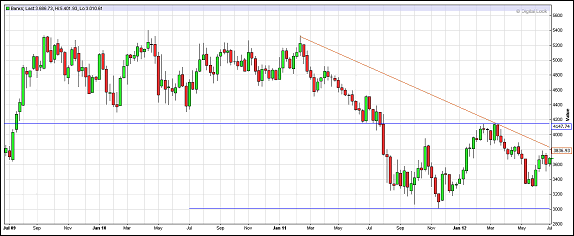

In mid-2007 the UK banking sector had a combined market value of over 11,000. It now trades at a mere 33% of that at 3,800.

Since the lows seen in 2009 at 1,877 the sector managed to recover to highs of 5,400 in 2010 and the beginning of 2011.

However, since then, the sector has remained under pressure largely as a result of events in Europe and the sectors exposure to potential sovereign insolvencies and insolvent banks in Europe.

Banking sector: 5 year chart

Public Perception

Public perception about the banking sector had already been fairly low after the events of the last few years, which in turn has prompted calls for much tougher regulation of the banking industry and the ‘too big to fail’ culture.Certainly there has been a lot of criticism of the Vickers Report on banking with the watering down of some of the more controversial aspects of the report, including the separation of the investment banking and retail arms.

Regulatory Spotlight

Recent events with respect to the behaviour of banks in the UK over PPI mis-selling, interest rate swap mis-selling and now LIBOR fixing is likely to increase calls for much more regulatory oversight from regulators.Calls would not only be for here in the UK, but also worldwide as public anger demands action from politicians anxious not to be seen to be pandering to banks vested interests and big business.

If you add to that, the controversy over the JP Morgan ‘London Whale’ trading losses which are expected to exceed $5bn, then you have a very toxic operating environment for banks in general.

This increases the risks of the sector being used as a political football by politicians anxious to deflect attention from their own shortcomings, inadequacies and policy failings.

You only have to look at Europe’s politicians and the proposed implementation of a financial transaction tax to see how much in denial these policymakers are with respect to their roles in the current European crisis.

Tuesday’s resignation of Barclay’s CEO Bob Diamond, while likely to draw a line under his role in the Libor fixing saga, is unlikely to be the end of the story for the banking sector.

There also remains the question of how much central bankers knew of what was going on and whether a blind eye was turned to the practice.

Regulators globally are now likely to focus their attention to the involvement of other banks and the likelihood of litigation as a result of any findings is likely to increase.

Any increased regulatory oversight is likely to increase the costs to the business models of banks and could also prompt much tougher steps to separate the business units of bigger banks, and even break some business units up altogether.

Barclays – Where to from Here?

Barclays spread betting market has certainly shown some resilience after its sharp falls last week and while some analysts are starting to break cover and tip the shares to move higher, the charts don’t support that view in the short term.

Barclays: 1 year chart

Since April, the price action has been firmly to the downside and while it remains in the downward channel from the March highs as well as the 200 day MA, the trend remains lower.

A move back above the 200p level could well stabilise in the short term.

As for the nationalised banks of Royal Bank of Scotland and Lloyds Banking Group, the risk remains that they too become embroiled in the LIBOR scandal with all the risks that entails for further share price gains.

The ironic thing is that any fines, if levied, will end up being paid for by the UK tax payer.

Future Profitability of the Banking Sector

The main downside to all of this is that any future profitability of these banks is likely to be mitigated by stronger regulation as the banks riskier activities get pared back.It therefore seems unlikely that, given the current environment, tax payers will see any return on their investment in either of these banks.

Royal Bank of Scotland

Royal Bank of Scotland: 2 year chart

Royal Bank of Scotland’s share price needs to get back to 550p to even get close to break even, which is more than double its current value of 218p.

A break above the 300p level would certainly help in stabilising the share price, but for now the range seems to be 175p, the 2011 lows, and the multiple highs this year around 299p.

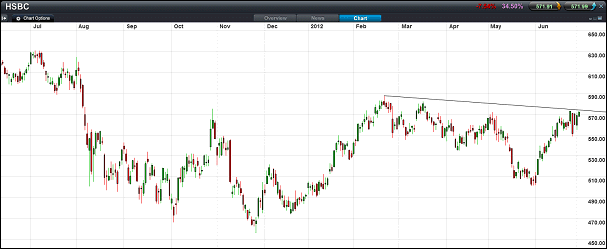

HSBC

HSBC: 1 year chart

Even HSBC, which has found itself fairly insulated from the travails of the banking sector over the past few months, has struggled to make much in the way of gains above the highs seen this year at 588p.

If the current enquiries into other banks activities see the bank dragged into the LIBOR enquiry, further share price volatility in the sector seems likely.

The upshot is that the banking sector is likely to remain a fairly high risk sector going forward; with the likelihood of further regulation, possible litigation and further write downs of bad debt as economic conditions deteriorate in Europe.

According to BIS data, as of the end of 2011, UK bank exposure to Spain and Italy is estimated to be in the region of £90bn.

This raises the likelihood of significant losses especially if there is a restructuring of the Spanish banking sector further down the line, if economic conditions in the country continue to deteriorate.

Banking Sector Outperforms Despite a Year of Shame

Below, an interesting article on the UK banking sector by Michael Hewson, CMC Markets, 21-Dec-2012.At the beginning of 2012 the main worries surrounding the UK banking sector where the effects of the Vickers report, Basel 3 requirements, and a further deterioration in the European sovereign debt crisis.

We’d just seen the ECB launch the first of two LTRO’s in an attempt to breathe some life and unlock the European banking credit channels. Unfortunately, all these did were reinforce the negative feedback loop between banks and sovereigns as largely insolvent banks were forced to buy the bonds of their increasingly insolvent sovereigns.

While I believed we had probably seen the lows as far as share price valuations were concerned, I felt that upside was probably going to remain fairly limited against a backdrop of a weak economic outlook and persistently sticky inflation.

As it turns out, after an initially rocky six months for the banks, we have seen some stabilisation in share price values. However, as far as news flow goes, it has been a year of shame and a very bumpy road with lots of negative publicity as the banks bring their own annus horribilis to a close.

Virtually every major bank worldwide has been caught up in a range of scandals from mis-selling PPI insurance, Libor rate manipulation, money laundering and energy market manipulation, as banks fall foul of regulators at every turn.

Even after all this, the banking sector has had a fairly positive few months since August. These followed the announcement by the ECB of the new OMT bond buying program, the Spanish banking bailout, and moves towards a European banking union.

To all intents and purposes, these appear to have removed the short term risks of a messy disintegration of the euro, and collapse of the European banking system.

Concerns remain around the sector though, especially given the warning in November by the Bank of England in its Financial Stability report. The document stated that UK banks face a potential £60bn black hole in 2013 as a result of further bad debt provisions, customer compensation and further regulatory fines.

This could well see further asset disposals over the coming months as well as other capital raising measures including job losses and the paring back of investment banking activities.

The sector started 2012 at 3,335 and is currently trading near 4,400, up over 30% and the highs for this year, however it still remains well below the highs of 2011.

While the short-term risks appear contained, the outlook remains full of potential pitfalls with further regulatory fines in the pipeline for all four of the big UK banks as regulators dig through the activities of the past few years.

The findings of the UK parliamentary commission could also add an extra layer of uncertainty over a sector still reeling from the fall-out of this year’s scandals.

The report urges the government to put in place safeguards to ensure that banks don’t try and circumvent the ring fence around the retail activities. This would be achieved by putting in place a form of electrified partition which would give regulators the means to split up banks that are found in material breach of the rules.

This report therefore increases the risk of the government coming under pressure to break up some of the larger banks. This is increasingly likely if we see further fines on large institutions over the Libor scandal in the wake of the recent fine on UBS and Royal Bank of Scotland negotiating another fine ahead of next year’s quarterly results.

Continued balance sheet rebuilding is likely to continue apace as banks wrestle with higher capital adequacy requirements, while facing pressures to lend by governments desperately trying to kick start their debt strapped economies.

There also remains the risk of continued uncertainty in the euro area in 2013, which could see bank share prices remain choppy if economic conditions remain difficult, particularly in Spain and Italy.

One thing seems certain given the tight funding problems set to face sovereigns as well as banks in 2012, it remains likely that financials will continue to remain unpredictable, with shares trading markets prices remaining volatile.

Europe is likely to act as a cloud, while a recovery in Asia is more likely to help HSBC and Standard Chartered than the others, further regulatory scandals notwithstanding.

Royal Bank of Scotland

The state owned bank has endured a turbulent year but nonetheless has managed to make some healthy gains in the wake of significant negative news flow, with the shares up over 50% on the year.The direction of travel with respect to its profitability continues to go in the right direction, mis-selling costs notwithstanding, with hopes high that the bank will return to profitability in 2013.

The bank will also be hoping to rebuild a new deal to sell the branches it was set to sell to Santander until the deal fell through a couple of months ago.

Barclays

A volatile year for the bank has seen the departure of its Chairman, CEO and COO over a host of scandals including PPI mis-selling, Libor and other market manipulation.The shares opened the year around the 180p level and initially pushed to a high of 260p in March before crashing back to earth in August to hit a low of 148p. Stocks have since bounced back strongly, and are once again approaching the March highs at 260p.

This comes despite concerns about further fines from US regulators over alleged energy market price manipulation.

A move above 260p could well be the precursor to further gains towards the highs seen in 2011, above 330p. However, given the bank’s exposure to Spain and Italy, further shocks can’t be ruled out in 2013, with a break below 235p potentially triggering further losses.

HSBC

Opening the year at 492p HSBC had, by and large, navigated the worst of the financial crisis with some ease. However, the bank fell foul of US regulators this year as it became implicated in a Mexican money laundering scandal that would ultimately cost it $1.9bn to settle US regulatory concerns.The bank has also set aside £1.2bn to set aside PPI mis-selling claims.

Trading just below its highest levels this year, the share price still remains below its 2011 highs at 739p.

The sustained up trend that has been in place since the end of July currently has support at the 620p level, and any pullbacks need to hold above this trend line for upward momentum to be sustained.

Lloyds Banking Group

The best performer this year has also outperformed in the last few months as the situation in Europe has stabilised, after opening the year above 25.70p, its 2011 close.Like its UK peers, the bank has continued to set aside provisions for PPI mis-selling and potentially other regulatory surprises.

With the bank less exposed than its peers to the problems in Europe, the potential for further upside remains much higher. This has been reflected in the share price movement in the last few months, breaking above its March highs and hitting its highest levels since July 2011.

The current uptrend should remain in place while trend line support from the August lows remains intact at 44.75p.

Standard Chartered Bank

Standard Chartered has been the underperformer of the year in the UK banking sector. A large part of this can be put down this summer’s broadside by the New York regulator on the bank accusing it of being a rogue institution.Since those sharp falls at the back end of the summer the share price has recovered somewhat and should remain well positioned for any recovery in its core Asia markets.

It has struggled to recover its highest levels of this year, however if growth prospects continue to show signs of stabilisation, we could see the share price recover back to these levels.

Conclusion

The past twelve months have been extremely positive for the UK’s banks and as long as economic conditions don’t deteriorate much further in Europe and elsewhere, the share price performance over the past months could well be sustained.We have to add an enormous caveat though in that there remains a great deal of opaqueness with respect to the bad loans on the books of the banking sector in Europe.

While the UK’s banks have taken great strides in paring down their exposure to the peripheral economies in Europe, the fact remains that Barclays in particular has some significant exposure to Spain and Italy. Further deterioration there could well impact on the quality of their loan book.

The recent decision by Barclays to take a small stake in the Spanish bad bank also seems rather questionable given the continued deterioration in the Spanish banking sector and the rising nature of bad loans, now at 11.2%, a record high.

Should We Buy into the Banking Sector?

Below, this could be read as part II of the above ‘Pricing and Valuing Bank Shares‘ article by Anthony Grech, IG Index, 7-Oct-2008.Banks are currently struggling due to turbulent economic conditions, but how does their current value compare to that of the 2000-2002 downturn? Should we be buying into the sector?

Looking at the lowest P/E and P/B ratios of the previous banking sector downturn which occurred between 2000-2002…most of the FTSE 100 listed banks are already trading at lower P/E and P/B multiples.

The fact that most of the banks are trading below comparable multiples shows an absence of fundamental support levels and indicates that investors are not giving as much weight to these multiples as they did in the past.

That is possibly because the market has been reacting negatively to any news concerning writedowns and a slowdown in the economy.

Investors may also be discounting these multiples on the basis that the systematic (sector wide) and unsystematic (company specific) risks inherent to this banking sector downturn are unique and much greater than the risks in previous downturns.

The latest credit market blowout and the introduction of securitised leveraged products have made it a more dangerous playground as the risks present in this downturn have become harder to quantify.

Liquidity constraints in the secondary market have raised doubts or concerns on a number of issues including the alternative valuation methods used to price complex securitised products, the level of write-offs incurred so far and the possibility of future write-downs.

In turn, this has also tainted the accuracy of future earnings forecasts.

All these factors may help explain why we are entering a period where P/E and P/B multiples are at historic lows.

Therefore, an absence of a fundamental support and the likelihood of increased systematic and unsystematic risks occurring as a result of a more pronounced downturn in the UK housing market, leads me to believe that the sector has not reached a bottom yet.

Balance sheet restructuring and risk management are among the most important functions for a bank at this juncture.

As a result, I believe that cost controls, the sale of non-core assets, a bank’s ability to attract funds and a reduction in the exposure of certain asset backed securities will all play an important role in helping liquidity and will be key issues going forward.

Time to Buy the Banks?

According to Anthony Grech’s 2008 Banking Report “those banks that successfully manage to survive this downturn will ultimately prove to be excellent investment opportunities within the next 5 years.

“Speculators interested in the sector’s upside prospects could start to allocate very small amounts of their wealth during dips.

“However, I must caution that I also believe that further sub-prime news and economic deterioration in the UK and US will drag on the sector and that better entry levels could be achieved at a later stage”.

Banking Crisis?

For more also read our Diary of the 2008 UK Banking Crisis.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.