Among the many stock market clichés, the ‘January effect’ is one of the most well-known.

The premise is that the stock market often rises in January, as investors that had sold out of their holdings in December, to book profits and offset losses, buy back into the market. This creates a wave of buying pressure.

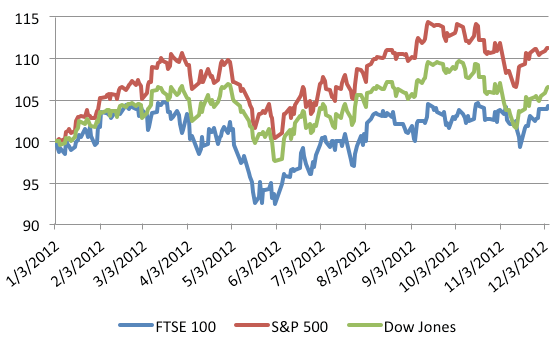

This held true in 2012, as the chart below shows, with the FTSE 100, S&P 500 and Dow Jones all starting out well in the first month and then going on to end the year higher:

We took a look at data for the three indices to see if this old statement still held true.

The data does show that markets have risen in January in a majority of the years from 1984 to 2012 and, furthermore, overall gains for the year were stronger when January had been positive.

The January Effect: New Year Optimism

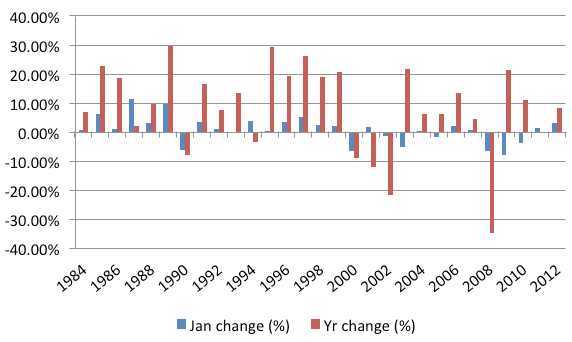

To test the hypothesis, we collected data spanning the period 1984 to 2012.1984 was the year that saw the introduction of the FTSE 100 in the UK, replacing the FTSE 30 as the premier index on the London stock market. This gave us 29 years of data to examine.

Out of those 29 years, 17 saw a positive start to the year. This equates to a 58.6% chance that the first month of each year would see a gain for the FTSE 100.

In the US, the potential for a positive first month was even greater. During the same period, the S&P 500 and the Dow Jones rose 19 out of 29 times, or 65.5% of the time.

The average yearly gain over the whole 29 year period is 1.13% for the S&P 500 and 1.07% for the Dow Jones.

The January Effect: The Rest of the Year

There is, of course, no ‘sure thing’ in the financial markets, and the above data should not be taken to mean that the stock market will always rise during the month of January. This is not true.However, there is another, more interesting, possibility that arises from our look at returns during the month of January.

The following table shows the average return for the FTSE 100, S&P 500 and Dow Jones in the period 1984 – 2012:

| Index | Average Annual Return, 1984-2012 |

| FTSE 100 | 7.43% |

| S&P 500 | 8.85% |

| Dow Jones | 9.34% |

However, in those years that enjoyed a positive January, the average return for the year was much better:

| Index | Average Annual Return, 1984-2012 |

| FTSE 100 | 11.94% |

| S&P 500 | 13.88% |

| Dow Jones | 13.99% |

The graph below is an average of the movements of the three indices, showing that years with positive Januaries often enjoy better gains:

As with any rule of thumb, there are exceptions. There were some years during our sample that saw a positive January but still resulted in the spread betting market finishing the year lower.

For the FTSE 100, these years were 1994 and 2001, while for the S&P 500 and Dow Jones 2001 was also a bad year.

This was likely due to the impact of the September 2001 terrorist attacks, which resulted in the temporary closure of US markets and a loss of confidence among investors.

It is also the case that a poor January can mean a more difficult year, as occurred in 1990, 2000 and 2008, but we would suggest caution about drawing too much of a conclusion from this observation.

January 2009 and 2010 are classic examples; both saw losses for the first month but then the rest of the year saw excellent gains, with the three indices gaining an average of 21.45% and 10.93% respectively.

The January Effect: 2013

No one, of course, has a crystal ball. But it must be said that, while the outlook for global markets doesn’t look great, there is still the possibility that 2013 will start well.There is still plenty to be concerned about, including the US fiscal cliff, slowing Chinese growth and the Eurozone crisis.

However, the end of 2011 looked equally unpromising, and yet January 2012 saw the three indices gain an average of 3.24%.

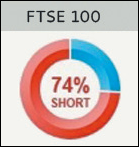

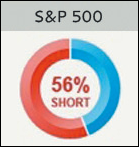

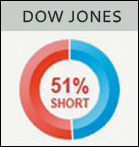

At the time of writing (December 2012), IG client sentiment on the three indices was as below:

|

|

|

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.