The CleanFinancial guide to Cotton spread betting.

- Where Can I Spread Bet on Cotton?

- Live Cotton Charts

- Live Cotton Prices

- Cotton Trading News and Analysis

- Where Can I Trade Cotton for Free?

- Where Can I Practice Trading Cotton?

- How to Spread Bet on Cotton?

- Commodities Spread Betting Guide

- Cotton Trading News

- Cotton Commitments of Traders Report

Live Cotton Chart & Prices

This CFDs chart provides you with a helpful view of the cotton market.The Plus 500 chart above normally uses the underlying cotton futures price.

A simple way to access live spread betting prices/charts for cotton is through a spread betting account. Opening a spreads account is subject to suitability, credit and status checks.

If your application is accepted then you can log on and look at the live prices and charts. Usually, these will be provided as part of the service.

Of course, if you do decide to trade then, before starting, you should be aware that CFDs and spread betting do carry a high level of risk to your funds and it is possible to incur losses that exceed your initial deposit.

Where Can I Spread Bet on Cotton?

At the moment, you are able to spread bet with no brokers’ fees and no commissions on Cotton, in addition to a wide variety of similar spread betting markets, with companies such as:You may also be able to take a view on Cotton with other providers.

Cotton Trading News

5 May 2018, 12:56pm, Updated Cotton No. 2 COT Report

The latest Commitments of Traders Report (COT) for Cotton No. 2 has been released by the CFTC, see our Cotton No. 2 COT report below.

We have also updated our Commodities COT Summary Report.

The latest Commitments of Traders Report (COT) for Cotton No. 2 has been released by the CFTC, see our Cotton No. 2 COT report below.

We have also updated our Commodities COT Summary Report.

5 May 2018, 8:17pm, Updated Cotton No. 2 COT Report

The latest Commitments of Traders Report (COT) for Cotton No. 2 has been released by the CFTC, see our Cotton No. 2 COT report below.

We have also updated our Commodities COT Summary Report.

The latest Commitments of Traders Report (COT) for Cotton No. 2 has been released by the CFTC, see our Cotton No. 2 COT report below.

We have also updated our Commodities COT Summary Report.

» For more see Commodities Trading News & Analysis.

This content is for information purposes only and is not intended as a recommendation to trade. Nothing on this website should be construed as investment advice.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

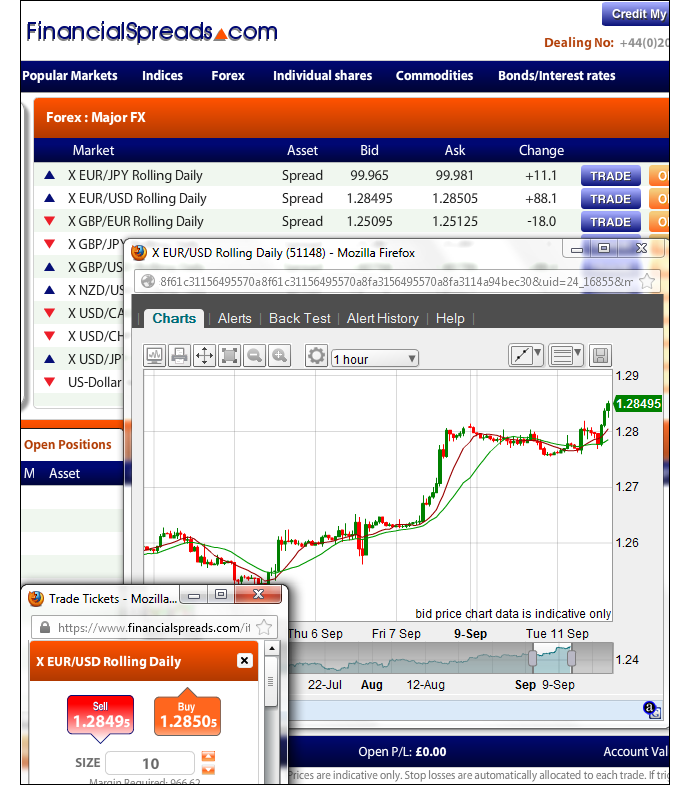

Professional Level Charts for Cotton

Although charting software and packages can vary between providers, to help you with your trading decisions, they often have user friendly features and tools, including:- A number of time intervals e.g. 2 minutes, 4 hours, 1 week and so on

- Various display options e.g. line and candle charts

- Tools for drawing and adding features e.g. trendlines, Fibonacci fans, arcs and time zones

- Overlays and technical indicators e.g. Bollinger Bands, Momentum, Williams %R and so on

- Back Testing, Analysis and Optimisation tools

- Email alerts for when your chosen market hits a given level

The financial spread betting companies in the list below give their clients access to real time trading prices/charts:

- City Index (read review)

- ETX Capital (read review)

- Financial Spreads (read review)

- Finspreads (read review)

- IG (read review)

- Inter Trader (read review)

- Spreadex (read review)

Advert:

Cotton Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Cotton with Financial Spreads.

You can spread bet on Cotton with Financial Spreads.

Where Can I Trade Cotton for Free?

By its very nature, speculating always includes a degree of risk. However, if you would like to try a completely free Test Account, which lets you look at trading charts and try out spread trading, see below for further details.When thinking about which investment option is right for you, also remember that spread betting in the UK is currently tax free*, i.e. it is exempt from capital gains tax, income tax and stamp duty.

If you are trying to find a free platform then note that investors are able to spread bet on Cotton without paying any commissions or brokers’ fees with:

Free Demo Account

Should you want to have a look at a Practice Account / Demo Account that lets users try out spread betting, including markets such as Cotton, then you can always have a look at:Each of these companies offer a risk free Test Account that lets users apply trading orders, try out strategies and check charts, such as candlestick and bar charts.

How to Spread Bet on Cotton?

As with a wide range of markets, you can spread bet on commodities, such as Cotton, to either rise or fall.Looking at the FinancialSpreads site, they are valuing the Cotton July Futures market at $91.67 – $91.90. Therefore, an investor can spread trade on Cotton:

Closing higher than $91.90, or

Closing higher than $91.90, or Closing lower than $91.67

Closing lower than $91.67On the settlement date for this ‘July’ market, 22-Jun-12.

When financial spread trading on Cotton you trade in £x per $0.01. As a result, if you chose to have a stake of £3 per $0.01 and Cotton moves $0.29 then that would make a difference to your profits (or losses) of £87. £3 per $0.01 x $0.29 = £87.

Cotton Futures – Commodity Trading Example

So, if you think about the above spread of $91.67 – $91.90 and make the assumptions:- you have analysed the commodities market, and

- it leads you to feel that the Cotton market will finish higher than $91.90 by 22-Jun-12

So, you win £2 for every $0.01 that Cotton increases above $91.90. On the other hand, it also means you will lose £2 for every $0.01 that the Cotton market moves lower than $91.90.

Looked at another way, should you ‘Buy’ a spread bet then your P&L is calculated by taking the difference between the final price of the market and the initial price you bought the spread at. You then multiply that difference in price by the stake.

Subsequently, if, on the settlement date, Cotton settled at $92.54, then:

Profits (or losses) = (Settlement Level – Initial Level) x stake

Profits (or losses) = ($92.54 – $91.90) x £2 per $0.01

Profits (or losses) = $0.64 x £2 per $0.01

Profits (or losses) = £128 profit

Speculating on commodities, whether by spread betting or otherwise, is not easy. In this example, you wanted the futures market to increase. Of course, the futures market can also go down.

If Cotton had fallen, settling lower at $91.34, then you would end up making a loss and losing on this spread bet.

Profits (or losses) = (Settlement Level – Initial Level) x stake

Profits (or losses) = ($91.34 – $91.90) x £2 per $0.01

Profits (or losses) = -$0.56 x £2 per $0.01

Profits (or losses) = -£112 loss

Note: Cotton July Futures spread betting price taken as of 26-Apr-12.

Advert:

Cotton Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Cotton with Financial Spreads.

You can spread bet on Cotton with Financial Spreads.

Cotton No. 2 Commitments of Traders Report – 15 May 2018 (i)

Futures Only Positions, ICUS, Code 33661, (Contracts of 50,000lbs) (i)| Reporting Firms (i) | Non-Reportable Positions (i) | ||||||||

| Non-Commercial (i) |

Commercial (i) | Total Reportable (i) | |||||||

| Commitments (i) | Open (i) Interest | Commitments | |||||||

| Long (i) | Short (i) | Spreads (i) | Long | Short | Long | Short | Long | Short | |

| 124,976 | 15,051 | 27,923 | 110,588 | 229,858 | 263,487 | 272,832 | 282,944 | 19,457 | 10,112 |

| Changes from 8 May 2018 (i) | Change in (i) Open Interest | Changes from | |||||||

| Long | Short | Spreads | Long | Short | Long | Short | Long | Short | |

| -6,983 | 1,455 | 2,115 | 1,146 | -8,292 | -3,722 | -4,722 | -3,457 | 265 | 1,265 |

| Percent of Open Interest for Each Category of Trader (i) | |||||||||

| Long | Short | Spreads | Long | Short | Long | Short | Long | Short | |

| 44.2% | 5.3% | 9.9% | 39.1% | 81.2% | 93.1% | 96.4% | 6.9% | 3.6% | |

| Number of Traders in Each Category (i) | Total (i) Traders | ||||||||

| Long | Short | Spreads | Long | Short | Long | Short | |||

| 171 | 41 | 71 | 60 | 76 | 258 | 166 | 310 | ||

| Long/Short Commitments Ratios (i) | Long/Short Ratio | ||||||||

| Ratio | Ratio | Ratio | Ratio | ||||||

| 8.3:1 | 1:2.1 | 1:1 | 1.9:1 | ||||||

| Net Commitment Change (i) | |||||||||

| -8,438 | |||||||||

Also see:

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.