House Price Spread Betting

Where to Spread Bet on House Prices |

At the moment IG is offering a spread betting market on UK House Prices. Other firms may offer a housing market but most firms don't.

Spread Betting on House Prices |

If you want to speculate on house prices, you are probably asking yourself, where next for the housing markets?

According to a recent Financial Spreads report**, the latest UK data has shown that house prices have fallen to their lowest level for eight months.

"It's not a surprise that prices are decreasing if buyers cannot get the mortgages they could over three years ago.

"In 2007, a buy-to-let investor could pick up flats and houses with a 10% deposit. Now the buyer will need something closer to the 30-40% mark."

"This means that either house prices need to fall in order to make them more affordable, or mortgage lenders will need to be more flexible. With the latter looking unlikely, the former will probably continue."

If you're interested in spread betting on house prices, or perhaps looking for a hedge against rising or falling house prices, you can trade with IG Index.

Of course, as with all investments, such as trading shares, funds, pensions etc you can lose money. With spread betting you can lose more than your initial investment.

** Financial Spreads report: 28-Oct-2010

Why Spread Bet on the Housing Market? |

So why choose spread betting? Spread betting can be beneficial on a number of fronts:

- Spread betting in the UK is tax free*. You are not buying or selling any assets, rights or stocks; you are merely speculating on the future price of a financial market. There's no capital gains tax, no stamp duty and no income tax.

- A key advantage is that spread betting offers a wide variety of markets on which you can speculate. As mentioned, you can speculate on the housing market, but you can also spread bet on the commodities, indices, foreign exchange and equities markets.

- Also, an investor can either go long or short with a spread bet. This means you can speculate on markets to either rise or fall. If you think house prices will rise, you can speculate on that, however you can also speculate on house prices to fall.

- Another key benefit is the lack of fees and commissions. When you trade stocks and shares you normally incur brokers' fees and/or commission charges. With spread betting there are no such fees. Note that if you trade on a:

- 'Rolling Daily' spread betting market, and you roll a trade over to the next trading day you will probably be charged a small fee.

- 'Futures' spread betting market, there is no overnight financing fee.

- Risk management options. Investing does have its risks, nevertheless, there are things you can do in order to reduce the potential drawbacks. Adding a 'guaranteed stop loss order' to your spread bet helps to reduce your risks. If you start to lose on a trade, and the market reaches your pre-determined stop loss level, then your order will close the trade and you won't lose any more capital.

IG Index » "With IG Index you get all the normal advantages of

Spread Betting plus 8000 markets, narrow spreads, advanced charting,

24 hour spread betting ..." » read

IG Index review.

|

Spread Betting on the UK Housing Market |

According to the press the US housing market was in freefall and the UK housing market had/has the potential to follow it.

A market that only moves in one direction clearly offers investors opportunities. But how to trade house prices? One of the easiest ways to gain exposure is through spread betting where some companies now let you speculate on the average UK house price.

Economies thrive on confidence and one of the pillars of confidence in the UK is the value of property. If the whole market grinds to a halt through lack of liquidity then there would be only one direction for it to go. Down.

In a market bereft of buyers, the prices must fall.

With fewer and fewer people able to 'gear up' to pay the current prices, I fear that this will be the scenario towards which we are heading. A major problem is that once a trend gets set it is very difficult to halt its momentum (witness the property situation in the US).

Buyers shrink from putting themselves in hock when they fear that next week / month / year the house they have, so painfully paid for, will have dropped in value. And so stagnation follows.

If the housing market locks up then many retailers who thrive on sales to 'new owners' will also fail and so on down a long line that ends with recession. At the moment, growth is just enough to keep the tills turning over but without some aid from our central bank I fear that this will not be the case for long.

If I was looking to buy a house now I would just knock 25% off the asking price on the basis that this is where forecasters expect the market to be in a years time.

Presumably, I would be paying a Mortgage (probably around 7.5%) during that time, have paid 2-5% stamp duty on the deal plus numerous other house purchase related fees.

If the market did indeed drop as expected, a purchaser at current levels could easily be looking at an overall negative cash/asset position of some 30-35% by next year once you include all of the costs. That does not sound too good.

For those people who are certain that the markets are in freefall, or for those who feel the UK is different to the US and less affected by sub prime fallout, the spread betting companies have come up with an interesting type of speculation. See how to spread bet on House Prices.

Article by Anthony Grech, Market Strategist, IG, Originally written in 2008.

How to Spread Bet on House Prices |

Looking at IG Index they make their spreads based on "the Halifax House Price Survey, the premier and most widely publicised indicator of the UK housing market.

So, whether you want to profit from predicted market shifts or hedge against the value of property you already own, you can back your judgment against nationally recognised figures".

Prices are given in points per £1,000. You simply 'buy' if you think the average price is set to rise or 'sell' if you think it will fall.

The current spread of the:

- "Average London House Price (December)" market is 258.1 to 264.1 points.

- "Average UK House Price (December)" market is 163.1 to 166.7 points

(Both December markets expire on 31 December).

House Price Spread Betting Example

So focusing on London, that spread is basically saying you can bet on London house prices being higher than £264,100 or lower than £258,100 on 31 December.

With house price spread betting you bet in £x per point, where a point is £1,000 of the house price. So if you are trading £15 per point and the average house price moves £5,000 (5 points) your profit / loss would change by £15 per point x 5 points = £75.

Taking the above London spread, let's say you think the prices will continue to fall. You could therefore Sell £20 per point at 258.1 points.

If the market does fall to 249.5 points (ie £249,500) then, because you sold the market:

P&L = (Opening Price - Closing Price) x Stake

P&L = (258.1 points - 249.5 points) x £20 per point

P&L = 8.6 points x £20 per point

P&L = £172 profit.

But if the market has a correction or simply stops falling, or if London is more resilient to the current mortgage malaise, then the average London house price could be £265,200 on 31 December.

Therefore if the market closes at, let's say, 265.2 points then:

P&L = (Opening Price - Closing Price) x Stake

P&L = (258.1 points - 265.2 points) x £20 per point

P&L = -7.1 points x £20 per point

P&L = £142 loss

Of course, as the example above shows, as with all spread betting, care is needed.

Notes: IG prices quoted as of 18-Aug-08. IG may have stopped offering a 'London' market.

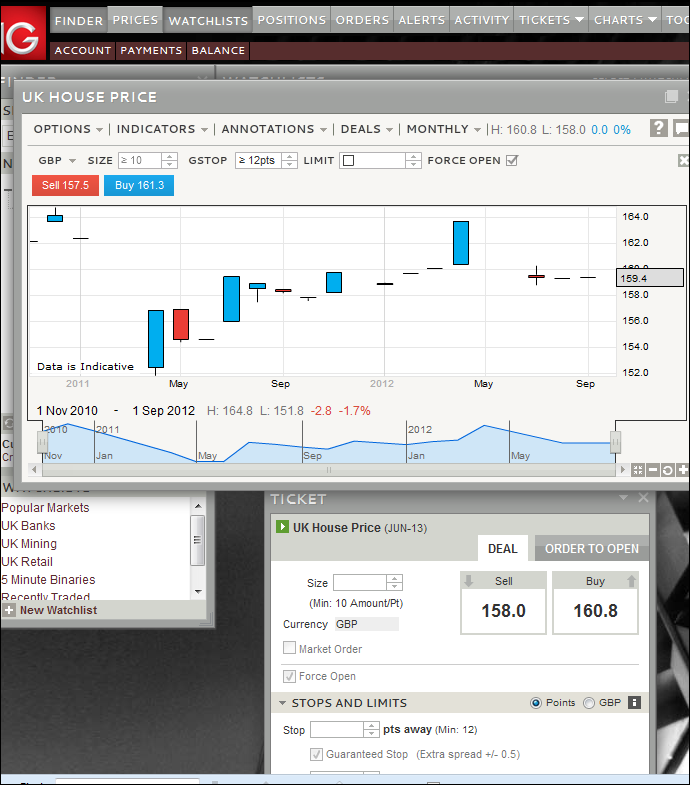

Where Can I Find Live Prices and Charts for House Prices?

IG offer both live house prices and charts.

As mentioned above, other firms might offer financial spread betting on UK house prices but its not the most popular market and so most firms don't offer it.

The housing price market is not the most efficient and therefore, as you can see from the chart below, the prices can "gap".

House Price spread betting chart on the IG platform:

Risk Warning:

Spread betting, CFDs and margined forex trading are leveraged products which carry a high level of risk to your capital. You can lose more than your initial deposit so you should ensure spread betting, CFDs and margined forex meet your investment objectives and, if necessary, seek independent advice.

IG Index » "With IG Index you get all the normal advantages of

Spread Betting plus 8000 markets, narrow spreads, advanced charting,

24 hour spread betting ..." » read

IG Index review.

|

Under no circumstances are the comments and the information provided herein to be considered an offer or solicitation to invest and nothing herein should be construed as investment advice. The information provided is believed to be accurate at the date the information is produced.

'House Price Spread Betting' edited by Jenna Cutly, updated 03-Jan-17

For related articles also see:

Litecoin Spread Betting and CFD Trading Guide, updated 09-Oct-17

The Litecoin CFD and spread betting markets are limited but this live chart & prices show regular trading. Our Litecoin trading guide takes a look at Bitcoin's little brother and... » read guide.

Bitcoin Spread Betting, CFD and Binary Trading Guide, updated 09-Oct-17

In-depth Bitcoin trading guide with live charts and prices. We cover Bitcoin CFDs, spread betting & binaries, we also review the digital currency's spread sizes, volatility and... » read guide.

Chinese Renminbi Spread Betting & Trading the Yuan, updated 09-Oct-17

Chinese Renminbi trading guide with daily market updates, live USD/CNH prices & charts. Plus where to trade CNH, RMB and CNY markets, the basics of Chinese Yuan, worked examples and... » read guide.

US Dollar Index Spread Betting, updated 20-May-18

A quick guide to the US Dollar Index with a look at what it is, where you can trade it and where to get live charts. We also have analysis case studies and... » read guide.

Turkish Lira Spread Betting and Trading, updated 09-Oct-17

Turkish Lira spread betting guide with daily market updates. Plus live USD/TRY charts & prices, where to spread bet on Lira-based forex markets tax-free* and commission-free as well as how to trade and... » read guide.

Russian Ruble Spread Betting and Trading, updated 20-May-18

Russian Ruble spread betting guide with daily updates and COT reports. Plus, where to trade USD/RUB tax-free* and commission-free, worked examples... » read guide.

Nonfarm Payroll Spread Betting, updated 18-Mar-15

Investors can now spread bet on the US nonfarm payrolls release. A number of firms have opened an NFP market so you can speculate on the key US employment figure... » read guide.

Political Spread Betting, updated 08-Jun-17

This guide to political spread betting reviews how to trade on the outcome of the UK General Election, which firms offer election spread betting markets, plus the latest news for... » read guide.

About this page:

House Price Spread Betting

The complete guide to spread getting on the housing market. Here we look where to spread bet on house prices, where to get live charts and prices, how to trade the UK market and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|

|

|

|

|