Gold Trading

Where Can I Open a Gold Spread Trading Account? |

Many spread trading accounts offer access to thousands of financial markets including commodities, like gold and crude oil, but also stock market indices, forex and individual shares.

Spread trading provides a tax free* investment option, two way trading and no commissions, however, some spread trading companies, like Financial Spreads, also offer easy access with 24 hour trading and state-of-the-art platforms.

| Gold Daily |

4 |

3 |

4 |

4 |

| Gold Future |

4† |

6 |

6 |

5 |

| Commodities - Minimum Stake |

£1 |

£1 |

£0.5 |

£1 |

Comparison Notes.

Advantages of Gold Spread Trading |

Gold spread trading has several important advantages over more traditional investment options:

- Spread trading is tax free*. You do not pay income tax, capital gains tax or stamp duty on any of your trades.

- When spread trading, you deal directly with a spread trading firm and so your trades are normally commission free with no broker’s fees. This can help to keep your trading costs down.

- A single spread trading account can offer a wide range of financial markets from commodities, like gold, crude oil and copper, to stock market indices, currencies, shares, bonds and even interest rates.

- When spread trading, you are merely speculating on the future price of the market and so you can trade on the gold to go down as well as up. This is in contrast with traditional investment formats which limit investors into trading on markets to rise.

Gold Spread Trading Example |

If you are going to spread trade on a commodity such as Gold then, on visiting a spread trading site like Financial Spreads, you would currently see the Gold Rolling Daily market priced at $1,208.7 - $1,209.2.

This means you can speculate on Gold moving higher than $1,209.2 or moving lower than $1,208.7.

With financial spread trading, investors trade on every unit the market moves up or down; with Gold spread trading markets a unit is $0.1 of the commodity's price movement.

As an example, you might decide to trade £2 for every $0.1 the price of Gold goes up or down.

Note that you can also spread trade on Gold in Dollars or Euros, i.e. €x per $0.1.

You should note that this example considers a 'Rolling Daily Market' and so there is no predetermined settlement date for this market. As a result, if the trade is still open at the end of the trading day, it simply rolls over to the next trading day.

If your trade does roll over and you are speculating on the market to:

- Rise - then you would normally pay a small financing fee, or

- Fall - then a small payment is often credited to your account

To learn more about Rolling Daily Markets please see Rolling Daily Spread Trading.

Spread Trading on Gold to Go Up |

If you were to go long of Gold at $1,209.2 and the commodity went up then the spread might change to $1,215.2 - $1,215.7. If that happened, you might decide to close your trade for a profit at $1,215.2.

Profits (or Losses) = (final level of the market - opening level of the market) x stake per $0.1

Profits (or Losses) = ($1,215.2 - $1,209.2) x £2 per $0.1 stake

Profits (or Losses) = $6.0 x £2 per $0.1

Profits (or Losses) = £120 profit

Financial markets also move down, if the price of Gold was to drop to $1,203.5 - $1,204.0, you could decide to close your position to limit your losses. In that case, you would sell at $1,203.5.

With the same £2 per $0.1 stake:

Profits (or Losses) = (final level of the market - opening level of the market) x stake per $0.1

Profits (or Losses) = ($1,203.5 - $1,209.2) x £2 per $0.1 stake

Profits (or Losses) = -$5.7 x £2 per $0.1

Profits (or Losses) = -£114 loss

Spread Trading on Gold to Go Down |

An important benefit of spread trading is that you can short the markets.

At the beginning of this example, the spread was $1,208.7 - $1,209.2.

If you were to sell Gold at $1,208.7 and the market fell then the spread might become $1,201.6 - $1,202.1. If so, you could close your trade for a profit by buying at $1,202.1.

Profits (or Losses) = (opening level of the market - final level of the market) x stake per $0.1

Profits (or Losses) = ($1,208.7 - $1,202.1) x £2 per $0.1 stake

Profits (or Losses) = $6.6 x £2 per $0.1

Profits (or Losses) = £132 profit

The markets can of course rise, if the gold market had moved up to, for example, $1,214.5 - $1,215.0, you may want to close your trade in order to limit your losses. If that were to happen, you would buy at $1,215.0.

You would do this with the same £2 per $0.1 stake:

Profits (or Losses) = (opening level of the market - final level of the market) x stake per $0.1

Profits (or Losses) = ($1,208.7 - $1,215.0) x £2 per $0.1 stake

Profits (or Losses) = -$6.3 x £2 per $0.1

Profits (or Losses) = -£126 loss

Gold Rolling Daily market quoted as of 09-Jul-10.

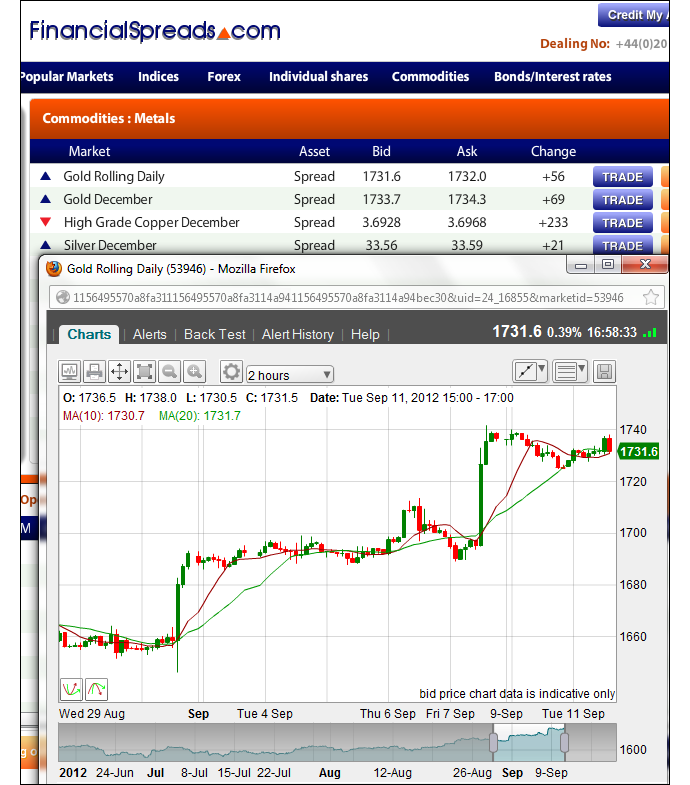

Where Can I Find Gold Trading Charts? |

Many spread trading companies offer candlestick charts on the majority of their financial markets, as well as a wide range of historical data and analysis.

For example, you can make use of gold spread trading charts with a variety of Moving Averages and other statistics such as Bollinger Bands.

The charts can also show data over a variety of time scales, ranging from minutes to hours, days or even weeks depending on your personal investment strategy.

For a real-time chart see: live gold futures chart.

Example Gold Chart

Gold Trading Companies – Account Services Comparison |

The companies detailed below all offer gold spread trading markets as well as all the usual benefits of spread trading such as tax free*, commission free trading, a wide range of financial markets and two way trading.

| User Ratings |

7.6 |

6.6 |

6.7 |

7.1 |

| Web Platform |

|

|

|

|

| iPhone App |

|

|

|

|

| iPad App |

|

|

|

|

| Android Apps |

|

|

|

|

| 24 Hour Trading |

|

|

|

|

| Live Charts |

|

|

|

|

| Stop Loss Available |

|

|

|

|

| Automatic Stop Loss |

|

|

|

|

| Deposit Account |

|

|

|

|

| Credit Account |

|

|

|

|

| FCA Authorised and Regulated |

|

|

|

|

Comparison Notes.

Gold Trading and Risk Management |

Investing in the gold spread trading markets can be exciting, particularly when thinking about the amount of money you might make. Profits are rarely seen as a bad thing. Nevertheless, we should all understand that we can lose money as well.

Naturally, as with all investing, be it on shares, pensions or CFDs, there is a downside and with spread trading you need to be careful because you can lose more than you initially invested.

The following risk warning also provides you with some other points to think about, "Spread trading does carry a high level of risk to your capital. Before trading, ensure that spread trading matches your investment objectives. Familiarise yourself with the risks involved. Seek independent advice where necessary".

At the same time though, you are able to put limits on your trades to help reduce your potential losses without impacting your upside, for more information see Stop Loss Orders.

Another important aspect of risk management to consider is using smaller stake sizes such as £1 per point or $1 per point. This is an all too often overlooked method for reducing your risks and is something that any investor should bear in mind.

Financial Spreads » "With FinancialSpreads.com you get all the advantages of

Spread Trading as well as commission free CFD Trading on 2,500+ markets, 24 hour trading, professional level charts and..." read

Financial Spreads review.

|

Gold Trading - 11 July 2016 |

For more see our 'latest gold trading reports'.

'Gold Trading' edited by DB, updated 11-Jul-16

For related articles also see:

Commodities Spread Betting, updated 20-May-18

The complete commodities trading guide with live prices, charts and analysis throughout the day. Plus a commodities spread betting comparison, where to trade commission-free, tax-free* and... » read guide.

Gold Spread Betting, updated 20-May-18

Guide to spread betting on gold with live prices and charts. Plus daily market analysis, a gold spread betting price comparison, tips on where to trade commission-free and tax-free* as well as... » read guide.

Crude Oil Spread Betting, updated 20-May-18

Guide to spread betting on crude oil with live prices and charts. Plus daily market analysis, crude oil spread betting price comparison, tips on where to trade commission-free and tax-free* as well as... » read guide.

Commodities Trading, updated 11-Jul-16

A look at popular commodities trading accounts, commission free trading accounts, charts, a gold and crude oil price comparison, how to trade commodities futures, market analysis and... » read guide.

Crude Oil Trading, updated 11-Jul-16

Here we compare crude oil trading accounts and review how to trade the two main oil futures markets. We also have regular analysis, a Brent (UK) and WTI (US) crude price comparison, charts and... » read guide.

Silver Spread Betting, updated 20-May-18

Silver spread betting guide with daily analysis. Plus live Silver charts & prices, where to spread bet on commodities futures tax-free* and commission-free as well as... » read guide.

Copper Spread Betting, updated 20-May-18

Copper spread betting guide with daily analysis. Plus live Copper charts & prices, where to spread bet on commodities futures tax-free* and commission-free as well as... » read guide.

Commodities Trading News, updated 29-Jul-13

An index of commodities trading articles covering futures news, market analysis & spread betting on commodities futures. Plus trading strategies, charts, price comparisons and... » read guide.

About this page:

Gold Trading

Here we compare gold trading accounts and review how to trade the precious metal. We also have market analysis, a gold daily (spot) & futures price comparison, charts and... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|