Technical Analysis of Stock Market Direction

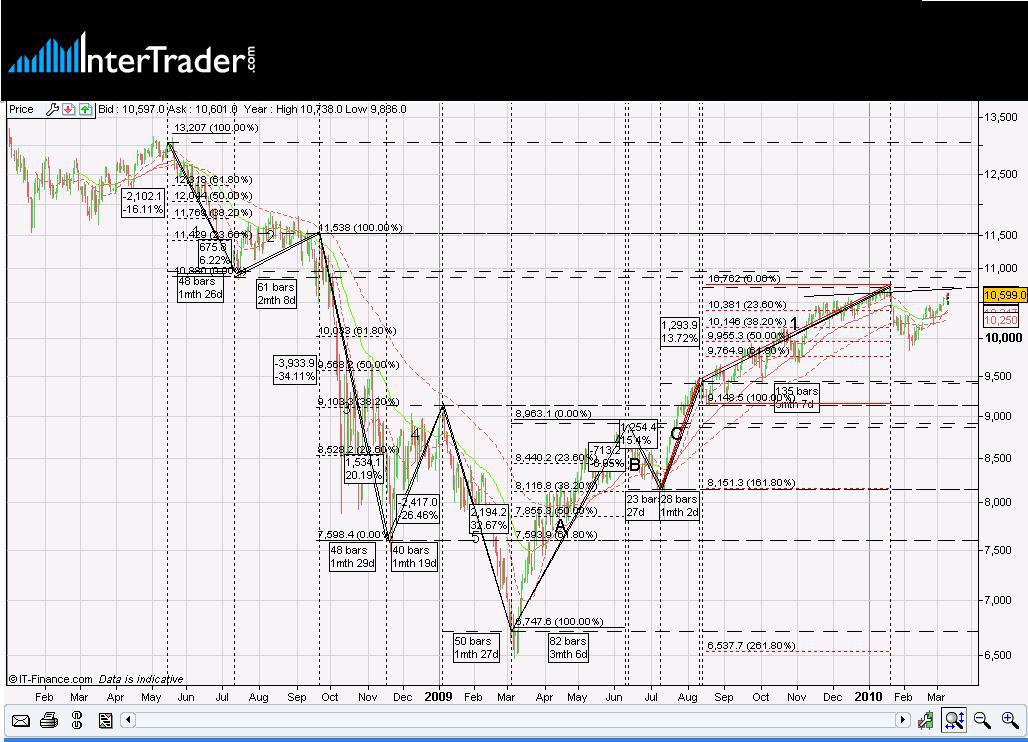

I would like to offer a view on the direction of the stock market. I will be using the Dow Jones Industrial Average (^DJI) as most indices follow its lead.In the following I tried to use the Elliot wave theory and apply it to the beginning of the 2008 crisis. In my view this was the beginning of a new primary cycle (bearish).

According to my analysis this primary cycle has now ended and we have just begun a new primary cycle which in my view is bullish.

I would advise from this point on for you also have the chart below open as I intend to reference it frequently.

Wave 1

Started on the 15th of May 2008 and completed on the 10th of July same year. The drop was 16%. At this point, most people were still under the impression that this was just a minor correction.

Wave 2

This corrective wave tells the real story. It lasts about almost 2 months until October with a perfect 23.60% Fibonacci retracement. It end abruptly is Lehman Brothers go under.

Wave 3

This was the largest wave with a 34% decline from the top of the Wave 2, with a perfect internal ABC structure, it lasts 2 for months.

Wave 4

This corrective wave gives hope that the worst may be behind us but, again a perfect Fibonacci retracement to the 38.2% line from the top of the wave and 23.60% from the beginning of the cycle. Just like the textbooks say it should be.

Wave 5

This wave appears as soon as everyone comes back from the Christmas break and there seems to be no stopping. If you recall, back then many thought the financial world was imploding. Some even claimed that capitalism was history.

It’s interesting to look at what some of the investment and trading legends of our time, Mr George Soros and Mr Warren buffet where doing. They were buying anything they could get their hands on.

In the words of the legendary investor Benjamin Graham “When others are greedy be fearful, when others are fearful be greedy”.

The Corrective Wave

March of 2009 marked the beginning of the corrective wave for the primary movement. Section A lasted March to June , Section B was from June to July and Section C from July until mid August.

This is the tricky part.

Some may say that we are still in the midst of wave C but allow me to offer an alternative solution. In late August 2009 the Index hit its 50% Fibonacci retracement line from the beginning the cycle. Even more you can observe that the angle of the rise changed. From a 71% angle to a 26% angle.

This hypothesis is supported by the flow of fundamental information typical to a bullish wave 1. Does this sound familiar in any way:

- Fundamental data is still negative

- Put options are in vogue

- Implied volatility in the options market is high

So, where are we today then?

My view is that we are now in the middle of Wave 2 in the new primary cycle. Therefore, as long as the 10,146 support level holds this should be confirmation of the trend.

My target price before re-evaluation would be around 11,000. In many ways it’s not the number that tells the story but how the market reached the target level that may reveal the next step.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.