Not Risk Free Though…

FinancialSpreads now offer a limited risk spread betting account.

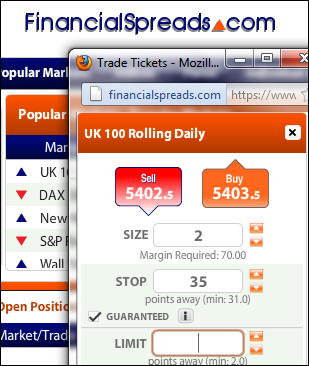

The new limited risk spread betting account offers tax-free* trading, the same number of markets, the same charts etc as the standard account. However, it is designed to help investors by attaching a Guaranteed Stop order to every new spread bet. In short, every trade has a limited risk.

Limited Risk Spread Betting Account – No Limit on Profits

Whilst adding a Guaranteed Stop to each trade puts a limit on how much you can lose it doesn’t put a limit on how much you can win.Limited Risk Spread Betting Account

As with any trading, risk management is important, particularly in the current highly volatile markets. The new limited risk account will help clients minimise their risks. Every time a client places a new trade, a Guaranteed Stop is automatically added to the trade. Therefore, if their trade should move against them, it is guaranteed to close at a pre-set level. Knowing the absolute risks will help a range of spread bettors”.

At Financial Spreads we take risk management seriously. Even our standard spread betting account automatically attaches Stop Loss orders to every new spread bet, although stop loss orders are not guaranteed.

Illiquid markets and volatile markets can often ‘gap’, i.e. jump between different price levels. The markets do not always move smoothly. When the markets gap they can jump straight through a Stop Loss level and when that happens a normal Stop Loss order will close the losing trade at the next best traded level.

Guaranteed Stops are a way of insuring against the market gapping and, as such, they come at a small cost. Of course, when clients have gained sufficient experience with the limited risk spread betting account, they can of course upgrade to a standard account. The standard accounts still have mandatory Stop Losses however clients can, on a trade-by-trade-basis, opt to add a Guaranteed Stop instead” concluded Jepsen.

Spread Betting Account Risk

With any type of spread betting account investors should:- Appreciate that financial spread betting is a leveraged form of investment, it carries a high level of risk to your funds

- Be aware that unless they use a Guaranteed Stop order the losses on a trade can exceed their deposit / initial investment

- Ensure spread betting fits their trading requirements (it might not be appropriate for all investors)

- Fully appreciate the risk

- Only speculate with capital that they can afford to lose

- Seek independent advice where necessary

Limited Risk Spread Betting Account Features

Financial Spreads offers tight spreads on a wide range of global markets including forex, stock market indices and shares listed in the UK, US, Germany, France, Holland, India, South Africa etc. They also offer commodities, treasuries and differential spread betting markets. For more details about the markets and spreads see the Financial Spreads prices.With Financial Spreads spread bet are tax-free*, commission-free and there are no brokers’ fees.

Key markets like the FTSE 100, DAX 30, EUR/USD, GBP/USD, gold, and oil can be traded 24 hours a day (5 days a week), for more details see 24 hour spread betting.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.