A more technical look at the markets from InterTrader

In a surprising move, the EUR/USD kick started the week on a strong positive footing despite Moody’s having downgraded the ESM bailout program on Friday.

In a flurry of buying, the bulls pushed the market above $1.30 where it is currently hovering. The risk appetite that seems to have built up in the past 24 hours is likely to continue today.

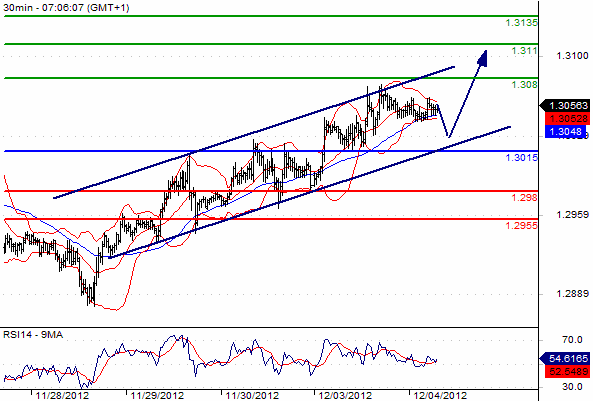

With the EUR/USD trading in a bullish channel since last Wednesday, the technical set up favours further bullishness (see below).

EUR/USD Technical Trading Chart

With the FX spread betting market hovering below October’s highs, an upside penetration of $1.311 would open the door for $1.3135, which will be a critical resistance level for the bulls to watch.

As long as the support level at $1.3015 remains intact, the market is likely to be well supported. Should the bears break below $1.3015, we could see the market re-testing $1.298.

On the economic data front, we have the EU Producer Price Index during European hours and US Redbook later in the evening.

Good luck

Dafni Sedari

(Original article written 4 December 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.