A more technical look at the markets from InterTrader

With the US having avoided the fiscal cliff for the time being, the euro was among the worst performing currencies in the past week, with the bears dragging it back to the key support level at $1.30.

The EUR/USD spread betting kick started the day on a negative footing this morning and at $1.3027 at the time of writing, the bears seem to have full control of the market.

A major driver this week will be the ECB rate decision on Thursday. Previously, the euro fell by 24 points on the day of the November meeting and 98 points on the day of the December meeting.

With no policy change expected this time around, there is little hope for bullish motivation this week.

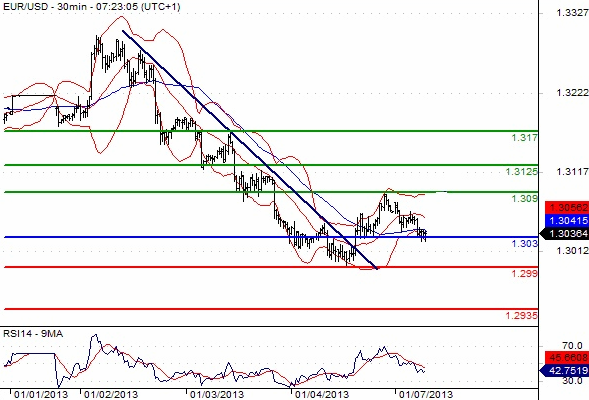

EUR/USD Chart

A concerted break below $1.303 would open the door for the next major support levels at $1.299 and $1.2935. In the alternative scenario, only the upside penetration of $1.317 could delay the downside movement.

On the economic data front, things are quiet today with a swathe of major figures being released tomorrow. Financial spread betting investors will be eyeing the German and French Merchandise Trade reports as well as the EU Unemployment Rate due for release on Tuesday.

Good luck

Dafni Sedari

(Original article written 7 January 2013).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.