A more technical look at the markets from InterTrader

After two days of consecutive losses that saw the German benchmark pull back to the strong support area at 7140, the market has started on a negative footing this morning.

As the Obama victory euphoria fades out, index spread betting investors are now focusing on the fundamental issues on both sides of the Atlantic.

With the US facing the fiscal cliff riddle and the ECB President stating that the euro crisis is starting to hurt the German economy, it looks like there are choppy waters ahead for the DAX.

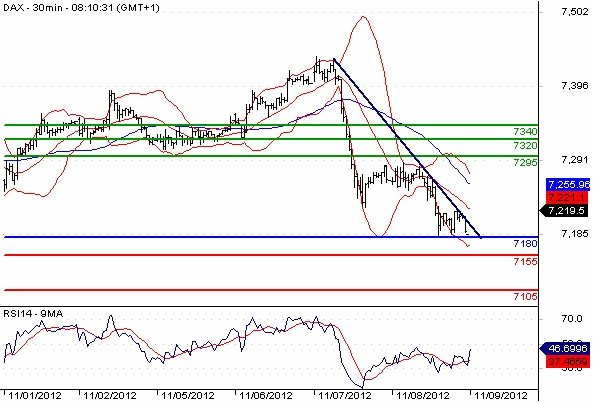

DAX Chart

On the chart above, we can see that the negative trend line is currently capping the price movement. Should this trend remain in place, the technical setup will favour short positions.

At the 7161 level, a downside penetration of 7155 would expose the index to the 7105 level.

Another quiet day on the European economic data front keeps the focus on US event risks with the US Consumer sentiment report among the most notable data set to be released.

Good luck and happy trading

Dafni Sedari, InterTrader

(Original article written 09 November 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.