The CleanFinancial guide to Coffee spread betting.

- Where Can I Spread Bet on Coffee?

- Live Coffee Charts

- Live Coffee Prices

- Coffee Trading News and Analysis

- Where Can I Trade Coffee for Free?

- Where Can I Practice Trading Coffee?

- How to Spread Bet on Coffee?

- Commodities Spread Betting Guide

- Coffee Commitments of Traders Report

- Coffee Trading Guide

- Coffee Trading Case Study

Live Coffee Chart & Prices

The CFD chart below offers a useful overview of the coffee market.The chart above is from Plus 500 and is normally based on the Arabica Coffee futures price, also known as Coffee ‘C’.

Should you want to analyse live spread betting charts and prices for coffee, you will need a spread betting account. Opening such an account is normally dependent on status and suitability checks.

Should you apply for a new account and it is approved then, after logging on, you will be able to analyse the up-to-the-minute charts and prices. On most platforms, these are provided for free, however, the catch is that you could receive an occasional sales letter and/or boring email from your chosen company.

If you decide to trade then, before starting, you should be aware that CFDs and spread trading involve a high degree of risk and it’s possible to incur losses that exceed your initial deposit.

Where Can I Spread Bet on Coffee?

You can currently speculate on coffee futures, and a range of other commodity markets, through companies such as:Please note that you may also be able to spread bet on coffee via other websites.

Coffee Market Trading News

5 May 2018, 12:56pm, Updated Coffee COT Report

The latest Commitments of Traders Report (COT) for Coffee has been released by the CFTC, see our Coffee COT report below.

We have also updated our Commodities COT Summary Report.

The latest Commitments of Traders Report (COT) for Coffee has been released by the CFTC, see our Coffee COT report below.

We have also updated our Commodities COT Summary Report.

5 May 2018, 8:17pm, Updated Coffee COT Report

The latest Commitments of Traders Report (COT) for Coffee has been released by the CFTC, see our Coffee COT report below.

We have also updated our Commodities COT Summary Report.

The latest Commitments of Traders Report (COT) for Coffee has been released by the CFTC, see our Coffee COT report below.

We have also updated our Commodities COT Summary Report.

This content is for information purposes only and is not intended as a recommendation to trade. Nothing on this website should be construed as investment advice.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Advert:

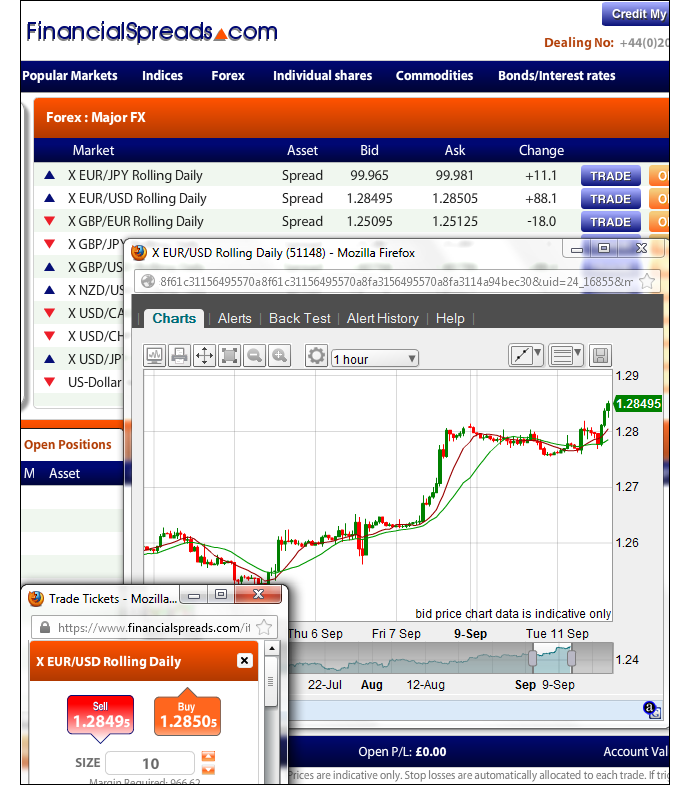

Coffee Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Coffee with Financial Spreads.

You can spread bet on Coffee with Financial Spreads.

Technical Charting Packages for Coffee

Even though charting software and packages vary between platforms, to aid your technical analysis, the charts often come with valuable features such as:- A number of time intervals, for example, 1 minute, 30 minutes, 1 day etc

- A variety of chart types, for example, candlestick charts and bar charts

- Drawing tools and options, for example, Fibonacci Arcs, Fans and Time Zones

- Indicators, for example, Moving Average, Relative Strength Index (RSI) etc

- Back Testing

- Custom email notifications for when the markets reach a given price

The financial spread betting companies in the list below offer clients access to real-time trading charts/prices:

- City Index (read review)

- ETX Capital (read review)

- Financial Spreads (read review)

- Finspreads (read review)

- IG (read review)

- Inter Trader (read review)

- Spreadex (read review)

Coffee Trading Guide

Anthony Grech, Market Strategist at IG Index, offers a useful guide for trading the Coffee market.

Coffee Trading Guide

- The two main types of coffee that are traded are Robusta and Arabica

- Robusta is generally traded on the London International Financial Futures and Options Exchange (LIFFE)

- Arabica is generally traded on the Intercontinental Exchange (ICE)

- Robusta is generally traded on the London International Financial Futures and Options Exchange (LIFFE)

- Arabica Facts

- Arabica is also known as Coffea Arabica or Coffee ‘C’ when referring to coffee futures

- When Arabica coffee cherries ripen they fall to the ground and spoil

- Arabica accounted for around 60% of world coffee production. Brazil and Colombia produce the majority of the world’s Arabica supply

- Arabica is also known as Coffea Arabica or Coffee ‘C’ when referring to coffee futures

- Robusta Facts

- Robusta is also known as Coffea canephora and Conillon

- It is considered to be of a lower grade than Arabica. It has twice the caffeine and produces an inferior taste

- The Robusta plant is easier to take care of and has lower production costs. When its coffee cherries ripen they remain on the plant

- The Robusta plant is less susceptible to disease than Arabica

- The Robusta plant can grow in areas where Arabica cannot

- Robusta accounts for approximately 40% of global coffee production. Vietnam and Indonesia produce 50% of the world’s Robusta

- Robusta is also known as Coffea canephora and Conillon

- According to the International Coffee Organisation (ICO), last year saw coffee production down 7% to 118,000 million bags

- Coffee is measured in 60kg bags

- As Anthony Grech of IG Index recently reported “It is also important to note that the production of both coffee types, as with any agricultural commodity, is primarily dependent on weather conditions, harvesting practices and disease. Therefore monitoring these variables, particularly in the major coffee producing countries, will provide an understanding of coffee supply and its intrinsic value, when compared with demand”

- Key players in the market are Procter and Gamble, Kraft, Nestle and Sara Lee. Together this ‘Big Four’ buys most of the world’s raw coffee. Therefore monitoring the buying habits of these companies would help provide a better understanding of coffee demand. From a micro perspective, marketing and profit margins and also play an important role in driving demand

- You can spread bet on Coffee with spread betting companies like Financial Spreads and IG Index

- Note that coffee is traded in US dollars. That means one of the biggest factors affecting the price is the exchange rate, just like Crude Oil and Gold. Because coffee is traded in US Dollars then, all things being equal, Coffee will tend to follows the dollar exchange rates. If the Dollar goes down against the Euro, the price of Coffee should go up and vice versa

- It is also worth noting that demand for coffee is considered to be price inelastic. This means that when coffee prices increase, individuals do not proportionally reduce their coffee consumption, and when coffee prices decline, consumer demand for coffee does not proportionally rise to any great extent

- Finally, it is often useful to keep up-to-date with the latest coffee technical analysis and commodities news to help you understand how the market is currently moving

Coffee C (Arabica) Commitments of Traders Report – 15 May 2018 (i)

Futures Only Positions, ICUS, Code 83731, (Contracts of 37,500lbs) (i)| Reporting Firms (i) | Non-Reportable Positions (i) | ||||||||

| Non-Commercial (i) |

Commercial (i) | Total Reportable (i) | |||||||

| Commitments (i) | Open (i) Interest | Commitments | |||||||

| Long (i) | Short (i) | Spreads (i) | Long | Short | Long | Short | Long | Short | |

| 59,858 | 94,376 | 56,861 | 124,983 | 98,567 | 241,702 | 249,804 | 257,849 | 16,147 | 8,045 |

| Changes from 8 May 2018 (i) | Change in (i) Open Interest | Changes from | |||||||

| Long | Short | Spreads | Long | Short | Long | Short | Long | Short | |

| 1,260 | 7,814 | 6,623 | 5,893 | 850 | 13,776 | 15,287 | 15,419 | 1,643 | 132 |

| Percent of Open Interest for Each Category of Trader (i) | |||||||||

| Long | Short | Spreads | Long | Short | Long | Short | Long | Short | |

| 23.2% | 36.6% | 22.1% | 48.5% | 38.2% | 93.7% | 96.9% | 6.3% | 3.1% | |

| Number of Traders in Each Category (i) | Total (i) Traders | ||||||||

| Long | Short | Spreads | Long | Short | Long | Short | |||

| 163 | 144 | 118 | 151 | 124 | 383 | 340 | 500 | ||

| Long/Short Commitments Ratios (i) | Long/Short Ratio | ||||||||

| Ratio | Ratio | Ratio | Ratio | ||||||

| 1:1.6 | 1.3:1 | 1:1 | 2:1 | ||||||

| Net Commitment Change (i) | |||||||||

| -6,554 | |||||||||

Also see:

Where Can I Trade Coffee for Free?

Investing isn’t without risk, however, if you would like to open an entirely free Test Account, that lets you get more familiar with financial spread betting, then please see below for further details.When deciding which investment option might work for you, also remember that spread trading, in the UK, is tax free*, i.e. it is exempt from stamp duty, income tax and capital gains tax.

If you want to try a free financial spread betting platform then you should keep in mind that you are able to speculate on US Coffee futures without paying any commissions with providers like:

Free Demo Account

If you’d like to open a Practice Account / Demo Account where you can try trading markets like Coffee then you could always look into:Each of these companies currently provide a Demo Account which lets investors look at professional level charts, test theories and practice with a range of trading orders, like stop losses and guaranteed stops.

How to Spread Bet on Coffee?

As with many global financial markets, investors can place a spread bet on commodities futures, like Coffee, to go up or down.Looking at the CapitalSpreads website, we can see that they are currently offering the Coffee December Futures market at $177.75 – $178.00. This means an investor can spread bet on Coffee:

Settling higher than $178.00, or

Settling higher than $178.00, or Settling lower than $177.75

Settling lower than $177.75On the expiry date for this ‘December’ market, 12-Nov-12.

If you spread bet on Coffee you trade in £x per $0.01. Therefore, if you decide to risk £3 per $0.01 and Coffee moves $0.39 then there would be a difference to your profits (or losses) of £117. £3 per $0.01 x $0.39 = £117.

Coffee Futures Trading Example

If we continue with the above spread of $177.75 – $178.00 and assume:- You’ve analysed the commodities futures markets, and

- It leads you to think that the Coffee market will close above $178.00 by 12-Nov-12

With this spread bet you win £3 for every $0.01 that Coffee moves higher than $178.00. Nevertheless, you will lose £3 for every $0.01 that the Coffee market falls lower than $178.00.

Considering this from another angle, should you ‘Buy’ a spread bet then your profit/loss is worked out by taking the difference between the final price of the trade and the initial price you bought the spread at. You then multiply that difference in price by your stake.

As a result, if, on the closing date, your Coffee trade closed at $178.53, then:

Profit / loss = (Closing Price – Opening Price) x stake

Profit / loss = ($178.53 – $178.00) x £3 per $0.01

Profit / loss = $0.53 x £3 per $0.01

Profit / loss = £159 profit

Speculating on futures, by spread betting or otherwise, is not always straightforward. In this case, you had bet that the commodity would rise. However, there may have been a good Coffee harvest and so the price of Coffee might fall.

If Coffee fell, settling at $177.52, you would end up making a loss.

Profit / loss = (Closing Price – Opening Price) x stake

Profit / loss = ($177.52 – $178.00) x £3 per $0.01

Profit / loss = -$0.48 x £3 per $0.01

Profit / loss = -£144 loss

Note: Coffee December Futures market taken as of 18-Sep-12.

Applying Technical Analysis to Coffee Futures

Below, an older but nevertheless useful case study on coffee futures market by Shai Heffetz, InterTrader, 10-Jan-2012.To appreciate a long term view of the coffee market we will first consider the daily chart below, which covers the period from September 2010 to January 2012.

From this, it becomes clear that between the beginning of October 2010 and the beginning of May 2011 the price of coffee soared from about $170 to more than $308.

It peaked at $308.03 on the 3rd of May last year and then started a long decline that brought it to the current price of $217.93.

For a more detailed view of the recent price movements of coffee, we have to look at the shorter term daily chart below.

Here we can clearly see that towards the end of August 2011 we had a mini bull run, which peaked at $290.58 on the 1st of September 2011.

However, it failed to match the previous high of $308.03 and since then we have seen a steady decline in the price.

Daily Coffee Candlestick Chart

Right now, we are faced with a price that is well below the Ichimoku Kinko Hyo cloud. Both the red Tenkan Sen and the blue Kijun Sen lines are also below the cloud.

The green Chinkou Span line is also well below the price of 26 periods ago and the price has dropped below both the Chinkou Span and the Kijun Span.

As a result, the commodities analysis suggests that we are currently in a bear phase.

A long trade at this stage would be extremely optimistic. Spread bettors should at least wait for the price to clear the cloud in an upward direction again before buying the market.

On the one-hour coffee chart below, we can see that the price is also well below the cloud, so even day trading investors might consider good entry points for a short trade.

Hourly Coffee Candlestick Chart

Advert:

Coffee Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Coffee with Financial Spreads.

You can spread bet on Coffee with Financial Spreads.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.