Gas Oil Spread Betting

Where Can I Spread Bet on Gas Oil? |

You can currently trade Gas Oil, and a variety of other online markets, through providers such as:

Advert:

Gas Oil Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Gas Oil with

Financial Spreads.

|

Where Can I Spread Bet on Gas Oil for Free? |

Speculating on the markets always involves a degree of risk. Having said that, you could try a free Demo Account where you can access professional level charts and trial financial spread betting. Please see below for more details.

When deciding which trading option is right for you, also remember that, in the UK, spread betting is currently free of capital gains tax, income tax and stamp duty*.

If you're interested in using a free spread betting platform then you should note that investors can take a position on Gas Oil with no brokers' fees, and zero commissions, at:

Should you want to have a look at a virtual money Practice Account / Demo Account that allows you to try out spread betting, including trading markets like the FTSE 100, EUR/USD and Gas Oil, then you can always look into:

Each of the spread betting firms listed above currently offer a Demo Account which lets users check charts, test new trading theories and gain experience with a host of trading orders.

How to Spread Bet on Gas Oil? |

As with other energies markets, you are able to spread bet on Gas Oil to either rise or fall.

If you look at a spread trading platform like Financial Spreads, you can see they are showing the Gas Oil May Futures market at $1,013.3 - $1,014.3. This means you could spread bet on Gas Oil:

Finishing higher than $1,014.3, or Finishing higher than $1,014.3, or

Finishing lower than $1,013.3 Finishing lower than $1,013.3

On the closing date for this 'May' market, 09-May-12.

When placing a spread bet on Gas Oil you trade in £x per $0.1. As a result, if you invest £4 per $0.1 and Gas Oil moves $3.6 then that would alter your bottom line by £144. £4 per $0.1 x $3.6 = £144.

Gas Oil Futures - Spread Betting Example |

Taking the spread of $1,013.3 - $1,014.3, let's assume that:

- You've analysed the futures markets, and

- You think that the Gas Oil market will close higher than $1,014.3 by 09-May-12

If so, you could choose to go long of the market at $1,014.3 for a stake of, letís say, £2 per $0.1.

With such a bet you win £2 for every $0.1 that Gas Oil increases above $1,014.3. Having said that, you will lose £2 for every $0.1 that the Gas Oil market moves lower than $1,014.3.

In other words, should you buy a spread bet then your P&L is calculated by taking the difference between the closing price of the market and the initial price you bought the market at. You then multiply that price difference by your stake.

Subsequently, if, on the settlement date, Gas Oil finished at $1,021.9, then:

Profit = (Closing Price - Opening Price) x stake

Profit = ($1,021.9 - $1,014.3) x £2 per $0.1

Profit = $7.6 x £2 per $0.1

Profit = £152 profit

Speculating on commodity markets, by spread trading or otherwise, can work against you. With the above, you had bet that the futures market would increase. However, the futures market can also drop.

If Gas Oil prices fell and settled at $1,007.5, then you would end up making a loss and losing on this market.

Loss = (Closing Price - Opening Price) x stake

Loss = ($1,007.5 - $1,014.3) x £2 per $0.1

Loss = -$6.8 x £2 per $0.1

Loss = -£136 loss

Note - Gas Oil May Futures spread betting price taken as of 26-Apr-12.

Where Can I Find Live Prices and Charts for Gas Oil?

Should you want to look at up-to-the-minute prices and charts for Gas Oil, you might need a financial spread betting account. Users should note that all spreads accounts are normally dependent on suitability, credit and status checks.

If your application is accepted then, when you log in, you will be able to make use of the charts and prices. This is normally provided for free. Having said that, you will probably get an occasional letter, call and/or email from your spread trading firm.

If you want to spread bet then, before starting, remember that financial spread betting involves a high degree of risk to your trading capital and you may lose more than your initial investment.

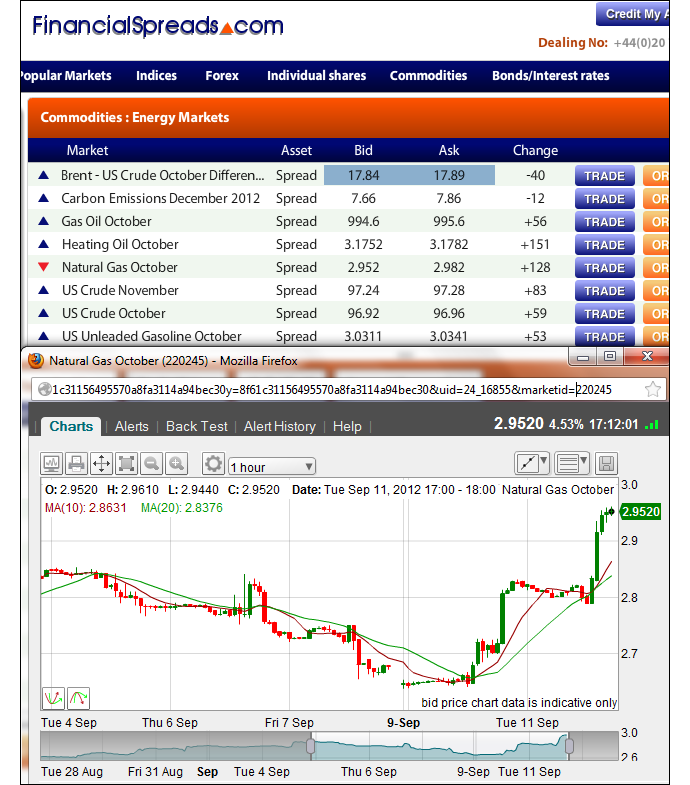

Though the charts can differ between providers, to help you with your analysis, they often have user friendly features and tools, including:

- A number of different time intervals, for example, 2 minutes, 30 minutes, 4 hours etc

- Different views, for example, candle charts and bar charts

- Tools for drawing and adding features, for example, trendlines, Fibonacci time zones, arcs and fans

- Indicators and chart overlays, for example, Bollinger Bands, Momentum Percentage, % Price Oscillator etc

The charts offered by Capital Spreads also include:

- Back Testing and Optimisation functions

- Email notifications for when the markets reach a certain price

Example commodity chart

The spread betting companies listed below offer their users real-time trading prices and charts:

Advert:

Gas Oil Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on Gas Oil with

Financial Spreads.

|

'Gas Oil Spread Betting' edited by Jacob Wood, updated 22-Feb-17

For related articles also see:

Heating Oil Spread Betting, updated 20-May-18

Heating Oil futures spread betting guide with live prices & charts. Also, where to spread bet on commodity futures like Heating Oil tax-free* and commission-free as well as ... » read guide.

Natural Gas Spread Betting, updated 20-May-18

Natural Gas spread betting guide with daily analysis. Plus live Natural Gas charts & prices, where to spread bet on commodities futures tax-free* and commission-free as well as... » read guide.

Carbon Emissions Spread Betting, updated 22-Feb-17

Carbon Emissions spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Carbon Emissions commission-free and tax-free*, how to trade and ... » read guide.

Unleaded Gasoline Spread Betting, updated 20-May-18

Unleaded Gasoline spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Unleaded Gasoline commission-free and tax-free*, how to trade and ... » read guide.

Gas Oil Spread Betting, updated 22-Feb-17

Gas Oil spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Gas Oil commission-free and tax-free*, how to trade and ... » read guide.

About this page:

Gas Oil Spread Betting

Gas Oil spread betting guide with a review of where to get live charts, where to spread bet on commodity futures like Gas Oil commission-free and tax-free*, how to trade and ... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|

|

|

|

|