Euro Stoxx 50 Spread Betting

Where Can I Spread Bet on the Euro Stoxx 50? |

Currently, investors can speculate without paying any commissions on the Euro Stoxx 50 with an account from the following firms:

Euro Stoxx Trading Updates

|

| 23-Mar-18 |

[8:49am] Euro Stoxx 50 Daily Report- The Euro Stoxx 50 is currently trading at 3,302.

- In the last session, the market closed down -73pts (-2.15%) at 3,315.

30 Minute Indicator Analysis

The stock index is trading lower than the 20-period MA of 3,326.8 and lower than the 50-period MA of 3,360.3. The stock index is trading lower than the 20-period MA of 3,326.8 and lower than the 50-period MA of 3,360.3.

1 Day Indicator Analysis

The market is currently lower than the 20-DMA of 3,394.3 and lower than the 50-DMA of 3,467.5. The market is currently lower than the 20-DMA of 3,394.3 and lower than the 50-DMA of 3,467.5.

Update by Gordon Childs, Editor,

|

| 09-Oct-17 |

[12:15pm] Euro Stoxx 50 Daily News- The Euro Stoxx 50 is currently trading at 3,604.

- In the last session, the market closed up 2pts (0.06%) at 3,608.

30 Minute Chart Analysis

The stock market is trading below the 20-period moving average of 3,609.3 and below the 50-period moving average of 3,606.7. The stock market is trading below the 20-period moving average of 3,609.3 and below the 50-period moving average of 3,606.7.

1 Day Chart Analysis

The stock index is above the 20-day moving average of 3,567.5 and above the 50-day moving average of 3,496.3. The stock index is above the 20-day moving average of 3,567.5 and above the 50-day moving average of 3,496.3.

Update by Gordon Childs, Editor,

|

» For more see Stock Market Trading News & Analysis.

Where Can I Find Live Prices and Charts for the Euro Stoxx 50? |

The real-time CFD trading chart and prices below gives readers a helpful look at the Euro Stoxx 50 market.

The Plus 500 chart above is typically based on the near-term Euro Stoxx 50 futures market (not the spot market).

If you would like to analyse live spread trading charts/prices for the Euro Stoxx 50, you will probably require a financial spread betting account.

You can also use a spreads account to gain access to daily contracts. Accounts are subject to credit, status and suitability checks.

Should your new account be accepted then you can log in and access the real time trading charts and prices. These are usually provided as part of the service. The catch is that you might receive an occasional email or sales call from your spread trading broker.

If you want to trade then, before you start, remember that CFDs and financial spread betting involve a high level of risk to your capital and losses could exceed your initial investment.

Professional Charting Packages for the Euro Stoxx 50 |

Although the charting packages tend to vary from firm to firm, to aid your trading, the majority of charts have useful features and tools, including:

- A variety of time periods e.g. 3 minutes, 4 hours, 1 day and so on

- A variety of display options e.g. candle and line charts

- Drawing tools and options e.g. trendlines, Fibonacci arcs, fans and time zones

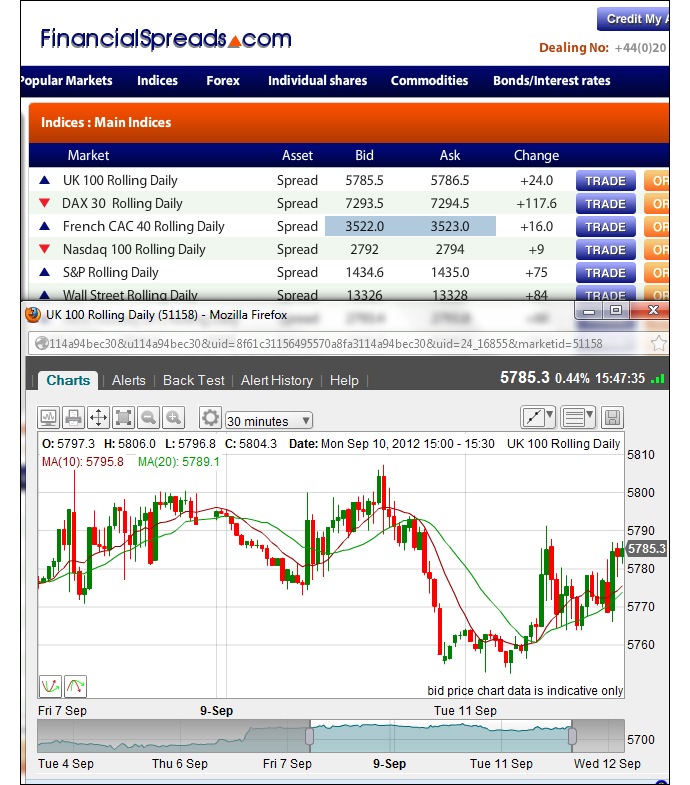

Charts with FinancialSpreads.com also have:

- Customisable Indicators and BackTesting

- Important chart overlays e.g. Bollinger Bands, Parabolic SAR, Price Channels and so on

- Secondary charts e.g. RMI, Historical Volatility, Price and Volume Trend and so on

- Custom email notifications that trigger when your chosen market reaches a particular price

Sample stock index candle chart

The spread trading firms in the list below offer clients real time trading prices/charts:

Advert:

Euro Stoxx 50 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Euro Stoxx 50 with

Financial Spreads.

|

Where Can I Spread Bet on the Euro Stoxx 50 for Free? |

Speculating on the financial markets always involves risk, but if you'd like to open a completely free Demo Account, which lets you try financial spread betting on a broad range of markets, then see below for further details.

When thinking about which investment option might work for you, don't forget that, in the UK, spread betting is currently exempt from tax*.

If you're interested in a free online trading platform, note that investors can take a position on the Euro Stoxx 50 without commissions or brokers' fees with companies like:

Should you want a Demo Account / Practice Account which lets users try financial spread betting on markets like EUR/GBP, the FTSE 100 and the Euro Stoxx 50, then you could look at:

The above spread betting firms offer a risk free Practice Account that lets investors apply an array of orders, test trading ideas and study charts.

How to Spread Bet on the Euro Stoxx 50? |

As with a range of markets, investors can speculate on stock market indices, such as the Euro Stoxx 50, to either rise or fall.

Looking at a site like FinancialSpreads, we can see they have priced the Euro Stoxx 50 March Futures market at 2500 - 2503. Therefore, an investor can spread bet on the Euro Stoxx 50 market:

Finishing higher than 2503, or Finishing higher than 2503, or

Finishing lower than 2500 Finishing lower than 2500

On the closing date for this 'March' market, 15-Mar-13.

When making a spread bet on the Euro Stoxx 50 index you trade in £x per point. Therefore, should you decide to risk £4 per point and the Euro Stoxx 50 moves 40 points then there would be a difference to your P&L of £160. £4 per point x 40 points = £160.

For short term trading on indices also see Indices Rolling Daily Spread Betting.

Euro Stoxx 50 Trading Example 1 |

Now, if we consider the above spread of 2500 - 2503 and assume:

- You've completed your analysis of the index, and

- Your analysis suggests that the Euro Stoxx 50 index will close above 2503 by 15-Mar-13

Then you could decide that you are going to go long of the market at 2503 and risk, for the sake of argument, £4 per point.

Therefore, you make a profit of £4 for every point that the Euro Stoxx 50 index rises higher than 2503. However, it also means that you will lose £4 for every point that the Euro Stoxx 50 market decreases below 2503.

Put another way, should you buy a spread bet then your P&L is worked out by taking the difference between the final price of the market and the initial price you bought the spread at. You then multiply that difference in price by your stake.

As a result, if, on the expiry date, the Euro Stoxx 50 market closed higher at 2534, then:

Profit = (Settlement Level - Initial Level) x stake

Profit = (2534 - 2503) x £4 per point stake

Profit = 31 x £4 per point stake

Profit = £124 profit

Trading stock market indices, whether by spread betting or not, is not simple. With the above, you had bet that the index would go up. However, it might go down.

If the Euro Stoxx 50 decreased and closed lower at 2475, you would end up making a loss and losing money on this market.

Loss = (Settlement Level - Initial Level) x stake

Loss = (2475 - 2503) x £4 per point stake

Loss = -28 x £4 per point stake

Loss = -£112 loss

Note: Euro Stoxx 50 March Futures spread quoted as of 26-Sep-12.

Advert:

Euro Stoxx 50 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Euro Stoxx 50 with

Financial Spreads.

|

How to Spread Bet on the EU Stocks 50 - Example 2 |

Looking at a spread trading platform like InterTrader, we can see that they are currently pricing the EU Stocks 50 September Futures market at 2495 - 2498. Therefore, an investor could put a spread bet on the EU Stocks 50 market:

Settling above 2498, or Settling above 2498, or

Settling below 2495 Settling below 2495

On the closing date for this 'September' market, 20-Sep-13.

Whilst spread betting on the EU Stocks 50 index you trade in £x per point. So, should you choose to risk £4 per point and the EU Stocks 50 moves 28 points then that would be a difference to your profits (or losses) of £112. £4 per point x 28 points = £112.

If you think about the above spread of 2495 - 2498 and make the assumptions:

- You have done your analysis of the stock market index, and

- You feel that the EU Stocks 50 index will close above 2498 by 20-Sep-13

Then you could decide that you want to buy at 2498 and invest, for example, £3 per point.

This means that you win £3 for every point that the EU Stocks 50 index moves higher than 2498. However, you will lose £3 for every point that the EU Stocks 50 market decreases lower than 2498.

Looked at another way, if you were to buy a spread bet then your P&L is found by taking the difference between the closing price of the market and the initial price you bought the spread at. You then multiply that difference in price by your stake.

With that in mind, if, on the expiry date, the EU Stocks 50 index settled at 2527, then:

Profit / loss = (Settlement Level - Initial Level) x stake

Profit / loss = (2527 - 2498) x £3 per point stake

Profit / loss = 29 x £3 per point stake

Profit / loss = £87 profit

Financial spread betting is not straightforward. With the above, you had bet that the index would go up. Of course, the index might decrease.

If the EU Stocks 50 had fallen and settled lower at 2464, then this means you would make a loss.

Profit / loss = (Settlement Level - Initial Level) x stake

Profit / loss = (2464 - 2498) x £3 per point stake

Profit / loss = -34 x £3 per point stake

Profit / loss = -£102 loss

Note: EU Stocks 50 September Futures spread betting market quoted as of 18-Apr-13.

Advert:

Euro Stoxx 50 Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on the Euro Stoxx 50 with

Financial Spreads.

|

'Euro Stoxx 50 Spread Betting' edited by Jacob Wood, updated 23-Mar-18

For related articles also see:

Stock Market Spread Betting, updated 23-Mar-18

We have stock market updates and analysis throughout the day. Our stock market guide also has live prices, charts, a spread betting comparison, tips on where to trade commission-free, tax-free* and... » read guide.

Stock Market Trading, updated 11-Jul-16

A look at popular stock market trading accounts, commission free accounts, charts, a price comparison, how to buy/sell a stock market index, regular analysis and... » read guide.

FTSE 100 Spread Betting, updated 23-Mar-18

FTSE 100 financial spread betting guide with a price comparison and daily analysis. Plus live FTSE 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Dow Jones Spread Betting, updated 20-May-18

Dow Jones financial spread betting guide with a price comparison and daily analysis. Plus live Dow Jones charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

German Stock Market Spread Betting, updated 23-Mar-18

German stock market spread betting guide with a price comparison, daily analysis, live charts & prices for the DAX 30, MDAX and German shares. Plus where to spread bet on the Frankfurt stock market commission-free and... » read guide.

S&P 500 Spread Betting, updated 20-May-18

S&P 500 financial spread betting guide with a price comparison and daily analysis. Plus live S&P 500 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

NASDAQ 100 Spread Betting, updated 23-Mar-18

Nasdaq 100 financial spread betting guide with a price comparison and daily analysis. Plus live Nasdaq 100 charts & prices, where to spread bet on the stock market index commission-free and... » read guide.

Nikkei 225 Spread Betting, updated 20-May-18

Nikkei 225 financial spread betting guide with daily analysis. Plus live Nikkei 225 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read guide.

About this page:

Euro Stoxx 50 Spread Betting

Euro Stoxx 50 financial spread betting guide with daily updates. Plus live Euro Stoxx 50 charts & prices, where to spread bet on the stock market index commission-free and tax-free* as well as... » read from top.

|

|

Q) Average Trading Results?

A) Get free trading tips, offers, price updates, important news and more!

|

|