The CleanFinancial guide to EUR/NOK spread betting.

- Where Can I Spread Bet on EUR/NOK?

- Live EUR/NOK Charts

- Live EUR/NOK Prices

- EUR/NOK Trading News and Analysis

- Where Can I Trade EUR/NOK for Free?

- Where Can I Practice Trading EUR/NOK?

- How to Spread Bet on EUR/NOK?

- Forex Spread Betting Guide

Live EUR/NOK Chart & Prices

The real time CFD chart below offers a good guide to the EUR/NOK FX rate.The above Plus 500 chart is usually based on the near-term EUR/NOK futures price (not the daily market).

If you want to check live financial spread betting prices and charts for EUR/NOK, one option is to use a spread trading account.

In addition, a spreads account would let you speculate on short-term daily markets. Note that such accounts are normally dependent on status, credit and suitability checks.

Should your application be approved then, after logging on, you will be able to analyse the charts and live prices. Usually, these will be free. The catch? You might get the occasional newsletter or call from the company.

Of course, if you do decide to trade then you must remember that contracts for difference and financial spread trading do carry a significant level of risk to your capital and can result in you losing more than your initial investment.

Where Can I Spread Bet on EUR/NOK?

Investors are able to trade EUR/NOK, and a wide variety of similar spread betting markets, via companies like:Note that you may also be able to speculate on EUR/NOK using other providers.

EUR/NOK Market Analysis and Trading News

3 March 2018, 9:19am,

The forex market is trading higher than the 20 period MA of kr 9.54764 and higher than the 50 period MA of kr 9.53474.

The forex market is trading higher than the 20 period MA of kr 9.54764 and higher than the 50 period MA of kr 9.53474.

1 Day Chart Analysis

The currency pair is higher than the 20 day MA of kr 9.56644 and lower than the 50 day MA of kr 9.61565.

The currency pair is higher than the 20 day MA of kr 9.56644 and lower than the 50 day MA of kr 9.61565.

EUR/NOK Daily Market Report

- EUR/NOK is currently trading at kr 9.58295.

- Overnight, the market closed kr 0.04663 (0.49%) higher at kr 9.53805.

1 Day Chart Analysis

10 October 2017, 12:48pm,

The forex pair is trading above the 20-period MA of kr 9.37897 and below the 50-period MA of kr 9.38107.

The forex pair is trading above the 20-period MA of kr 9.37897 and below the 50-period MA of kr 9.38107.

1 Day Chart Analysis

The forex pair is trading above the 20-DMA of kr 9.35389 and above the 50-DMA of kr 9.32574.

The forex pair is trading above the 20-DMA of kr 9.35389 and above the 50-DMA of kr 9.32574.

EUR/NOK Daily Market Analysis

- EUR/NOK is currently trading at kr 9.37914.

- In the last session, the market closed kr 0.00536 (0.06%) higher at kr 9.38088.

1 Day Chart Analysis

» More forex trading views and analysis.

This content is for information purposes only and is not intended as a recommendation to trade. Nothing on this website should be construed as investment advice.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Unless stated otherwise, the above time is based on when we receive the data (London time). All reasonable efforts have been made to present accurate information. The above is not meant to form an exhaustive guide. Neither CleanFinancial.com nor any contributing company/author accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

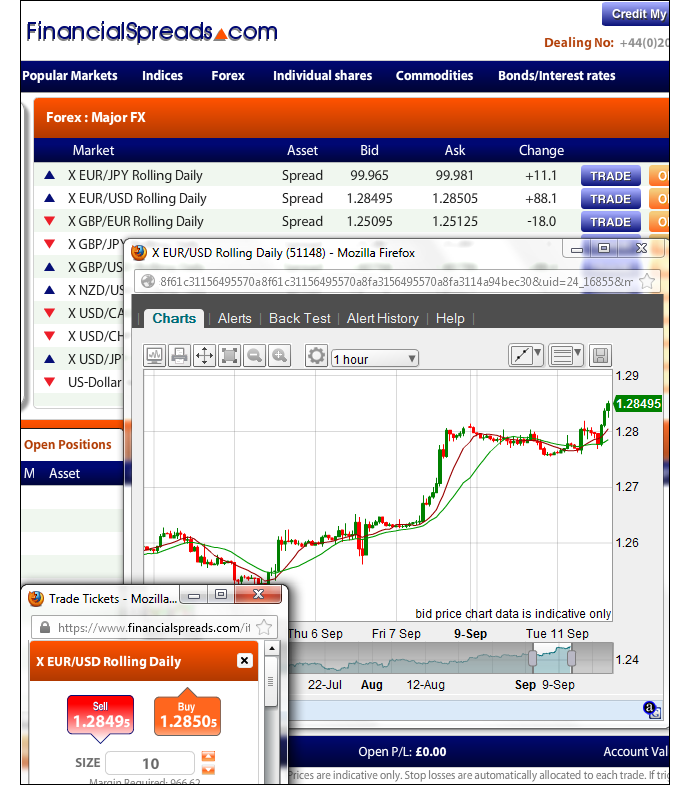

Sample Financial Spreads FX market candlestick chart

The spread trading firms in the following list offer users access to real-time trading charts and prices:

- City Index (read review)

- ETX Capital (read review)

- Financial Spreads (read review)

- Finspreads (read review)

- IG (read review)

- Inter Trader (read review)

- Spreadex (read review)

Advert:

EUR/NOK Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on EUR/NOK with Financial Spreads.

You can spread bet on EUR/NOK with Financial Spreads.

Where Can I Trade EUR/NOK for Free?

By its very nature, speculating always involves a degree of risk. Nevertheless, if you’d like to try a free Test Account, that allows you to try out spread trading on a large variety of markets, see below for more details.When looking at which investment option is right for you, don’t forget that spread trading, in the UK, is currently free of capital gains tax, stamp duty and income tax*.

Assuming you want a free spread trading website, you should note that investors can take a position on EUR/NOK with no brokers’ fees with companies like:

Free Demo Account

Should you want a Test Account / Demo Account where you are able to get to grips with financial spread betting, and trading markets such as the Dow Jones, crude oil, GBP/USD and EUR/NOK, then have a closer look at:The spread betting companies listed above currently provide a free Practice Account that lets investors review professional level charts, test ideas and practice with an array of trading orders, e.g. OCO and GFD orders.

How to Spread Bet on EUR/NOK?

As with a lot of markets, investors can place a spread bet on foreign exchange pairs, such as EUR/NOK, to either rise or fall.Looking at a financial spread betting site like Financial Spreads, you can see that they are pricing the EUR/NOK Rolling Daily market at kr 7.41041 – kr 7.41541. As a result, an investor could spread trade on the EUR/NOK pair:

Rising higher than kr 7.41541, or

Rising higher than kr 7.41541, or Falling lower than kr 7.41041

Falling lower than kr 7.41041When making a spread bet on EUR/NOK you trade in £x per point where a point is kr 0.00010 of the pairs movement. As a result, if you decide to risk £2 per point and EUR/NOK moves 26.0 points then that would change your bottom line by £52. £2 per point x kr 0.00260 = £2 per point x 26.0 points = £52.

Rolling Daily Foreign Exchange Markets

It’s important to note that this is a Rolling Daily Market and so it does not have a settlement date. If a trade is still open when the markets close at the end of the day, it will roll over to the next trading day.If you do let your FX position roll over then you are usually charged a small overnight financing fee. If you would like a fully worked example then see Rolling Daily Spread Betting.

EUR/NOK Trading Example 1

So, if you think about the spread of kr 7.41041 – kr 7.41541 and assume that:- You’ve done your FX market analysis, and

- Your research suggests the EUR/NOK rate will increase and go higher than kr 7.41541

With such a bet you win £2 for every point (kr 0.00010) that the EUR/NOK rate moves above kr 7.41541. However, you will lose £2 for every point that the EUR/NOK market goes below kr 7.41541.

Looking at this from another angle, should you ‘Buy’ a spread bet then your profit/loss is found by taking the difference between the settlement price of the market and the initial price you bought the market at. You then multiply that difference in price by your stake.

With this in mind, if after a few hours the forex rate moved higher then you could consider closing your spread bet to secure your profit.

If that happened then the spread, determined by the spread betting firm, could change to kr 7.42357 – kr 7.42857. In order to close/settle your position you would sell at kr 7.42357. As a result, with the same £2 stake this trade would result in a profit of:

Profit = (Final Price – Initial Price) x stake

Profit = (kr 7.42357 – kr 7.41541) x £2 per point stake

Profit = kr 0.00816 x £2 per point stake

Profit = 81.6 points x £2 per point stake

Profit = £163.20 profit

Financial spread trading on forex doesn’t always go to plan. With the above, you had bet that the currency pair would increase. Of course, it might decrease.

If the EUR/NOK market decreased, contrary to your expectations, then you could choose to close your position to limit your losses.

Should the spread pull back to kr 7.40651 – kr 7.41151 then you would sell back your position at kr 7.40651. This would result in a loss of:

Loss = (Final Price – Initial Price) x stake

Loss = (kr 7.40651 – kr 7.41541) x £2 per point stake

Loss = -kr 0.00890 x £2 per point stake

Loss = -89.0 points x £2 per point stake

Loss = -£178.00 loss

Note – EUR/NOK Rolling Daily FX market quoted as of 11-Sep-12.

Advert:

EUR/NOK Spread Betting, sponsored by FinancialSpreads.com.

You can spread bet on EUR/NOK with Financial Spreads.

You can spread bet on EUR/NOK with Financial Spreads.

How to Spread Bet on Euro – Norwegian Krone – Example 2

Looking at a website like Tradefair, you can see that they have put the Euro – Norwegian Krone Rolling Daily market at kr 7.45677 – kr 7.46177. As a result, you can put a spread bet on the Euro – Norwegian Krone pair: Going above kr 7.46177, or

Going above kr 7.46177, or Going below kr 7.45677

Going below kr 7.45677Whilst financial spread trading on Euro – Norwegian Krone you trade in £x per point where a point is kr 0.00010 of the pairs movement. So, if you decided to risk £3 per point and Euro – Norwegian Krone moves 23.0 points then that would make a difference to your bottom line of £69. £3 per point x kr 0.00230 = £3 per point x 23.0 points = £69.

So, if we think about the above spread of kr 7.45677 – kr 7.46177 and make the assumptions:

- You have completed your FX market research, and

- Your analysis leads you to feel that the Euro – Norwegian Krone rate will move above kr 7.46177

Therefore, you make a profit of £2 for every point (kr 0.00010) that the Euro – Norwegian Krone rate moves higher than kr 7.46177. Nevertheless, such a bet also means that you will lose £2 for every point that the Euro – Norwegian Krone market falls below kr 7.46177.

Thinking of this in a slightly different way, if you ‘Buy’ a spread bet then your profit/loss is found by taking the difference between the settlement price of the market and the initial price you bought the spread at. You then multiply that price difference by the stake.

Therefore, if after a few sessions the foreign exchange rate rose then you might want to close your spread bet and therefore lock in your profits.

As an example, if the market increased then the spread, set by the spread trading firm, might move up to kr 7.47035 – kr 7.47535. In order to close/settle your position you would sell at kr 7.47035. Accordingly, with the same £2 stake you would calculate your profit as:

Profits (or losses) = (Closing Price – Opening Price) x stake

Profits (or losses) = (kr 7.47035 – kr 7.46177) x £2 per point stake

Profits (or losses) = kr 0.00858 x £2 per point stake

Profits (or losses) = 85.8 points x £2 per point stake

Profits (or losses) = £171.60 profit

Speculating on forex, whether by spread betting or not, is not always simple. With the above, you had bet that the forex pair would go up. However, the forex rate can also decrease.

If the Euro – Norwegian Krone market weakened, against your expectations, then you might choose to close your trade in order to limit your losses.

Should the market pull back to kr 7.45244 – kr 7.45744 then this means you would settle your trade by selling at kr 7.45244. Accordingly, your loss would be:

Profits (or losses) = (Closing Price – Opening Price) x stake

Profits (or losses) = (kr 7.45244 – kr 7.46177) x £2 per point stake

Profits (or losses) = -kr 0.00933 x £2 per point stake

Profits (or losses) = -93.3 points x £2 per point stake

Profits (or losses) = -£186.60 loss

Note: Euro – Norwegian Krone Rolling Daily spread accurate as of 18-Sep-12.

EUR/NOK Weakens Despite Norwegian Bubble Concerns

Below, an older but interesting article analysing the Norwegian krone by Michael Hewson, CMC Markets, 18 Jan 2012.A few months back the Swiss National Bank instituted a peg for the Swiss franc against the single currency due to the currency inflows pushing the Swiss currency to record highs.

This action had FX spread betting investors searching for alternatives with the Norwegian krone being an obvious candidate.

There are a lot of immediate attractions given that Norway runs a current account surplus due to being entirely self-sufficient in its energy requirements, through hydroelectric power.

Furthermore all of the North Sea oil produced is exported, making the economy less prone to the energy cycle inflation that most developed economies are prone to.

It does however make their economy more susceptible to the economic cycle as demand ebbs and flows according to global growth. This shouldn’t be too much of a problem in the short term, given the current tensions in the Middle East.

Oil demand isn’t likely to slip that much, and the North Sea is free from geo-political worries, which would mean that if there were problems in the Middle East the taps would be kept open.

Since September last year the yield on 10 year Norwegian bonds has dropped from 2.4% to lows earlier this month of 1.81%, almost trading on a par with German bunds at one stage.

They have since rallied back sharply towards 2.13% today, after a report suggested that Norway’s economy would grow at a slower rate in 2012, due to concerns about a blow through effect from Europe. Consumer confidence has also dropped to a 2 and a half year low.

The effect on the krone has been different though, with the Norwegian currency only showing gains against the single currency and the Swiss franc in the last six months.

This may have more to do with the fact that the Norwegian Central Bank has cut rates sharply to deter capital inflows, as last month’s 50 basis point cut to 1.75% illustrates.

These fairly low interest rates, as well as low unemployment rates, with potential for lots of infrastructure projects, has seen the Norwegian economy avoid the worst of the slowdown in Europe. As of the end of the third quarter, Norway has an annual growth rate of 3.8%.

Now that Europe has two less triple “A” sovereigns, and even fewer with a stable outlook, some investors have been looking at alternative government bonds with stable fundamentals and the Scandinavian bloc appears to tick all the boxes.

The problem with the Norwegian krone is that it isn’t that liquid and, even if it is near its highs against the euro, the lack of liquidity could be a hindrance.

There is a worry though that in their attempts to try and deter too much in the way of capital inflows with lower rates that an asset bubble could well be forming in the housing market.

With lack of capacity and high demand, asking prices are rising quite rapidly; house prices rose by 8.5% in December according to Norway’s Real Estate Brokers.

With household debt also surging to 204% of disposable incomes, according to Norges Bank estimates, there is a worry that Norway could be heading for a similar type of housing bubble seen in the UK and Ireland.

Denmark saw a similar asset bubble in 2007 and banks need to be careful about overstretching themselves in the event of a price crash.

If the lessons of the UK are any gauge, banks need to think about raising the loan to deposit ratio to take the heat of the market and keep a cap on prices so that when adjustment comes it is more gradual.

Otherwise those investors who bought into Norway in the belief it could be a safe haven from indebted European governments could find themselves crushed in the stampede for the exits in a thinly traded market.

The EUR/NOK spread betting market has moved in a range between kr 7.60/7.80 in the last few months with a fairly strong support around kr 7.6500.

With euro rallies continuing to fall short, there is a concern that irrespective of the measures taken by the Norges Bank, the Norwegian krone may see further strength could, especially if the Euro drops below the support at kr 7.65.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.