A more technical look at the markets from InterTrader

The S&P 500 has been trading sideways for the past four sessions, as the market waits for the Fed conference on Wednesday.

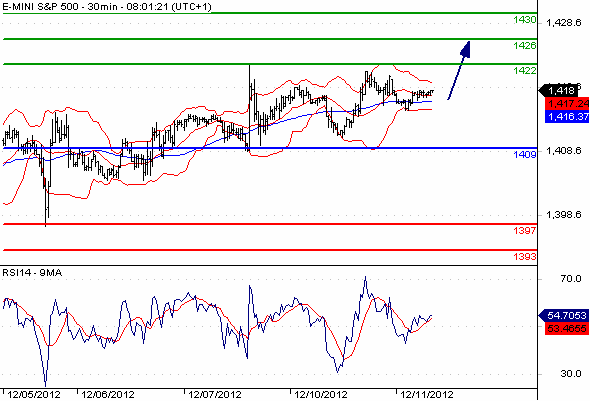

At 1418 at the time of writing, we are currently just below the strong resistance area at 1420.

The market has been ignoring bad news lately and despite the lack of progress on the fiscal cliff, a move higher appears more likely than not.

S&P 500 Candlestick Chart

Bullish spread betting investors are currently targeting the 1422 level. The upside penetration of that level would expose 1426 and 1430.

As long as the main support area at 1409 remains intact, there should be no reason for the bulls to worry.

In the alternative scenario, a break below 1409 could open the door for 1397 and 1393.

Today’s main point of focus will be the German ZEW Survey at 10.00am (GMT). Later today, eyes will be on the US International trade and the US Redbook figures.

Good luck

Dafni Sedari

(Original article written 11 December 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.