Pairs Trading Concept: To make a net profit from two opposite spread betting positions on a pair of related markets.

- The Basics of Pairs Trading

- The Pros and Cons of Pairs Trading

- Market Neutrality When Trading Pairs

- Where to Look for Suitable Pairs

- Differential Spread Betting

- Pairs Trading Data

- Pairs Trading Example 1

- Pairs Trading Example 2

- Trading Synthetic Forex Pairs

- Advantages of Synthetic Pairs

- Disadvantages of Synthetic Pairs

We all know that to predict the movement of an individual share, currency or commodity is more a work of art than science.

Sure, you can use the tools of the trade such as technical indicators and fundamental indicators. You can have expensive charting software and state of the art trading software, but in the end, you can never predict future price movements with a 100% level of certainty.

Then pairs trading came along. During the 1980s, a group of quantitative analysts working for Morgan Stanley discovered this strategy and ever since many hedge funds and institutional investors have used the strategy with greater or lesser degrees of success.

The Basics of Pairs Trading – What is Pairs Trading?

The name sounds rather involved and before the advent of the Internet, most private traders did not fully appreciate how pairs trading worked.

The system entails finding two trading instruments, e.g. a pair of shares, commodities or currencies, which normally show a very strong price correlation. For example, if you are looking at shares, this could mean two companies that are in the same industry, but that is not necessarily the case.

Your next step should be to study the correlation between their prices over a period of time. Make sure that what you thought to be a strong correlation was not simply a temporary convergence of prices.

You should notice that from time to time the prices of the two instruments will diverge, only to return to convergence levels after a certain period of time.

Once you have satisfied yourself that a) their prices normally run together, b) they sometimes move apart for a while and c) they then come together again, you are ready to act.

The next time their prices diverge you buy the one that is ‘undervalued’ at the time and you sell the one that is ‘overvalued’. That is all; for many the beauty of pair trading lies in its simplicity.

The Pros and Cons of Pairs Trading

The reason you do this is that you trust that the prices of the instruments will eventually converge again, i.e. move back to the ‘normal’ difference between them.This is how you make money with pair trading and this is also its weakest point. You are in effect spread betting that the prices of the instruments will move closer again.

The trick is to time your entry right. If it happens that the day after you place your trade the prices of these two instruments do not start converging, but rather start moving further and further apart, you are heading for trouble.

In such a case, you should have very strict money management rules. Once the trade reaches a certain level, you have to cut your losses and get out.

Hedge funds have closed down because the instruments they expected to converge have kept moving further apart, sometimes only to converge again after the fund had gone bankrupt.

Market Neutrality When Trading Pairs

Pairs trading is different from ordinary trading in the sense that it is market neutral. In other words, you can make money whether the market goes up, goes down, or moves sideways.When the market goes down for example, you will lose money on the instrument that you bought, but you will make money on the instrument on which you went short. The reverse is true when the market goes up.

You are, however, not protected against the scenario discussed under the previous heading above. If the two instruments move further and further apart, you will lose money and lots of it.

Where to Look for Suitable Pairs

As we explained earlier, with shares you will normally find suitable pairs by studying companies in the same sector.For example, Wal-Mart and Target Corporation are two shares that have historically showed strong price correlation, as are Dell and Hewlett Packard.

In the UK, Royal Bank of Scotland and Alliance and Leicester used to show strong correlation, although the recent economic downturn did not affect the two companies in the same way. If you had a long-term pair trade involving the two companies’ shares, you might not be a very happy trader right now.

It is also worth bearing in mind that you can of course pair trade using stock market indices. Traditionally the S&P 500 and the Dow Jones have shown remarkable levels of correlation.

Differential Spread Betting

Another way of trading on the difference between two markets is by speculating on a differential market.E.g. the “Brent crude oil vs US crude oil differential“.

For more information please see Differential Spread Betting.

A Different View of Pairs Trading

Below, Dominic Picarda, on behalf of Tradefair Spreads, takes a further look at pairs tradingPairs Trading Example 1

BP and Shell are the two biggest oil companies on the London stock market. As two businesses in the same industry, their share prices might typically follow a similar path over time.Every so often, though, BP’s price might go up by much more than Shell’s, or vice versa. When this happens, you could speculate that the two shares will move back into line with each other. This is called a “pairs trade.”

To do a pairs trade, you simply buy the low-priced half of the Pairs and short-sell the high-price half.

So, if BP’s price has become high compared to Shell’s, you simultaneously do a “sell” trade on BP and a “buy” trade on Shell.

If the ratio between the two prices then decreases, you make a profit. This can happen either by Shell rising by more than BP, or by Shell falling by less than BP.

Pairs Trading Data

The best way to look for potential pairs-trading opportunities is by using charts. You can easily display the ratio of one price to another with a charting software-package. Or you can download the prices for free from Yahoo Finance and then use a spreadsheet to plot a graph.The accompanying chart shows BP’s share price divided by Shell’s over the last decade. When the blue line is at the top of its range, you know that BP is high relative to Shell by past standards.

When researching pair trades, it is vital to look for two assets that genuinely are a pair. As well as finding prices that have had a consistent relationship over time, you should also consider the reasons behind it.

Also, just because a price relationship has got out of kilter, that doesn’t mean it cannot get even more so. For this reason, choose your stop-loss levels carefully when doing a pairs trade.

Pairs Trading Example 2

Below, City Index add a further exampleImagine that a spread bettor specialises in the financial sector. To engage in pairs trading, that spread bettor would need to find two stocks with a correlation; a strong tendency to move in line with each other on a day-to-day basis. For the purposes of the example, let’s say that Bank X and Bank Y represent a relationship like this and are therefore a suitable pair.

Next, the spread bettor needs to decide if one of the two stocks is under- or overvalued in comparison to the other. If the trader believed that Bank X was undervalued relative to Bank Y, they would go long (open a ‘buying’ position) on Bank X whilst simultaneously going short (taking an equivalent ‘selling’ position) on Bank Y.

These two opposing financial spread bets need be worth roughly the same amount, for example Bank X: 300 price x £8 stake = £2400, Bank Y: 1200 price x £2 stake = £2400. The reason for this is that if they are not, then the spread bettor is merely reducing the risk of the larger trade rather than creating a situation in which they can profit from the pair regardless of whether the overall markets move higher or lower.

If the overall market was now to move upwards, the Bank X spread bet, the undervalued stock, would in theory close the gap and enter a profit greater than the loss incurred by the ‘short’ Bank Y spread bet.

Similarly, if the market was to dip, Bank X’s stock would presumably not dip as far as Bank Y’s stock, therefore putting the Bank Y spread bet into a profit that outweighed the Bank X loss.

In this respect, pairs trading is similar to hedging in financial spread betting, as it can create an equilibrium where one half of the pair becomes profitable when the other half loses money.

Forex Pairs Trading

It also follows the same principle as forex spread betting, where every spread bet you make is actually two spread bets. For example, in the case of a GBP/USD trade, one bet would go long on Sterling whilst one would go short on the Dollar.Trading Synthetic Forex Pairs

Below, an article by Shai Heffetz, InterTrader, 8-May-13.Sometimes a trader may want to trade a specific currency pair but his spread betting company’s platform does not offer the ability to trade that pair, often because there is not sufficient liquidity in that particular market.

Let us for example say that you would like to trade the British Pound (GBP) against the Japanese Yen (JPY) because you believe that there are going to be significant price movements in the near future.

In reality, many spread betting companies do offer the GBP/JPY pair, however, for this example let’s assume that your chosen spread betting platform does not directly offer this market. In that case, how would one go about to executing such a trade?

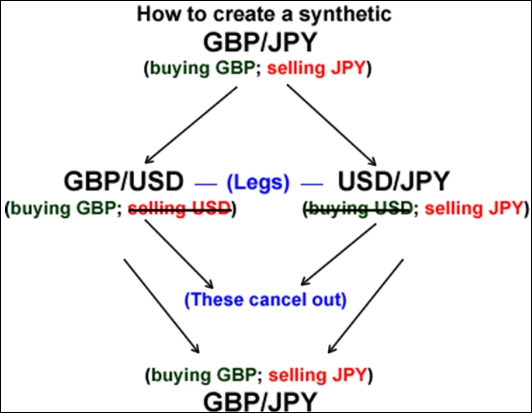

One solution is to find two currency pairs, one that gives the value of the GBP in terms of a third currency (e.g. the USD) and another that gives the value of the JPY in terms of the same currency.

An example of two such pairs would be the GBP/USD and the USD/JPY. If you trade in both pairs simultaneously, it can effectively mean that the third currency, USD in this case, will be cancelled out. As a result, you will indirectly be trading the GBP versus the JPY and will have created a so-called ‘synthetic pair’.

A word of caution: You should take note that to go long on the GBP; you have to spread bet on the GBP/USD to rise. To go short on the Yen on the other hand, you have to buy the USD/JPY forex pair not sell it. When you buy USD/JPY, you are effectively going long on the Dollar and short on the Yen.

As a result, to go long on the GBP/JPY synthetic pair, you would have to buy the GBP/USD market and also buy the USD/JPY pair.

Alternatively, if the USD/JPY currency pair was quoted the other way round, i.e. JPY/USD, it would be a different matter; you would buy GBP/USD and sell JPY/USD.

In addition, you also have to make a calculation to ensure that you are buying and/or selling the same amount of your chosen currencies when calculated in your third currency, Dollars in this case.

Advantages of Trading Synthetic Pairs

Why would anyone go to the trouble of spread betting on synthetic currency pairs?As mentioned above, you might have access to information indicating a pending price move in such a currency pair. If your spread betting account does not allow you to trade the forex pair directly, one way around this is to create your own synthetic pair.

Another reason why traders often engage in trading synthetic currency pairs is that movements on less popular markets can be more exaggerated than when you trade with more stable currency pairs such as the EUR/CHF.

For example, some smaller world currencies can go through violent movements in a relatively short period of time, offering potentially larger profit opportunities.

Unfortunately, it has to be kept in mind that the reverse is also true: if such a currency should move against you, your losses could be much larger than if you were trading more stable currencies.

Even if your stockbroker’s trading platform does offer the opportunity to trade in a particular currency pair, there might sometimes be an arbitrage opportunity hidden away here.

Let us assume the GBP is trading at $2 against the USD and the EUR is trading at $1.5 against the same currency.

The laws of mathematics would suggest that the GBP should be trading at €1.3333 against the EUR. If it is trading lower or higher then there may exist an arbitrage opportunity by either going long or short on the GBP/EUR.

Disadvantages of Trading Synthetic Pairs

There are various disadvantages associated with trading synthetic currency pairs. In the first place, you have to make two separate trades.That means you have to pay commission on two trades in the form of the spread. You will therefore have to make a higher profit to cover the additional trading cost.

Therefore, if your spread betting company’s trading platform already offers the opportunity to trade in a particular currency pair, as mentioned with the GBP/JPY earlier, no benefit can be derived from creating your own synthetic pair. In fact you will simply be paying more in commissions.

Another significant disadvantage is that a much larger amount of your trading funds will be tied up with a synthetic pairs trade.

This is because of the margin requirements; you will have two different trades, which means double the normal margin.

As mentioned earlier, it is also more complicated to do a synthetic pairs trade, especially when the currencies involved are not quoted in the same way.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.