Constructing a Channel Strategy

Trading channels is a well known and often used trading technique.It’s based on the observed tendency of many financial instruments to set a direction and then maintain it for a period of time. A change of such a paradigm is often well connected with planned and unplanned macro economic events.

A recent example would be the sovereign debt crisis in EU, lead by Greece. Once the information emerged many instruments shifted and reversed some of their existing underline trends.

A channel is defined when an instrument’s price is confined between 2 upper and lower parallel bands. The lower line is considered support and the upper line considered as resistance.

In order to claim a channel has formed we must have at least 4 touch points, 2 on the supporting band and 2 on the resistance band. The more points connected without material breakout, the stronger the channel will be considered.

As you may already guessed we have 3 types of channels:

- Ascending – When the price action exhibits a positive slope with rising tops and rising bottoms.

- Descending – When the price exhibits a negative slope with falling tops and falling bottoms.

-

Sideways – When the price does not exhibit a particular slope. This is combined with a mix of rising and falling tops and bottoms. Sideways movement can also be broken down again into categories:

- Diverging Sideways – This is best described with a combination of rising tops and falling bottoms, such that the price action diverges, yet the overall pivot line remains roughly the same.

- Horizontal – When support and resistance bands are parallel with each other but with minimal or no visible slope.

- Consolidation – A combination of falling tops and rising bottoms, such that the price action converges towards the pivot. Equilibrium may be achieved momentarily.

- Diverging Sideways – This is best described with a combination of rising tops and falling bottoms, such that the price action diverges, yet the overall pivot line remains roughly the same.

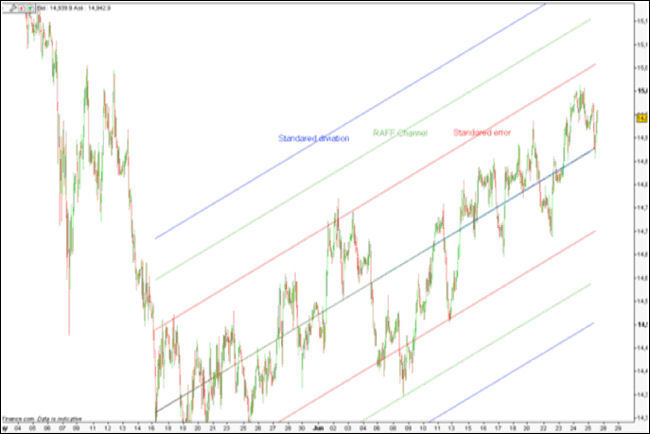

Channel Trading Example Chart – GBP/USD Forex Market

Plotting a Channel

There are many ways of drawing a channel. The first, and most common, is drawing parallel lines, using the naked eye, which try to connect as many touch points as possible according to the principles outlined above.

A more scientific method would be to use linear regression to plot the pivot line and build the channel around it. There are three main methods of channel building that are based on linear regression:

- Standard Deviation Channel – Two lines can form a standard deviation channel if they are parallel to the linear regression trend line. These are usually set two standard deviations either side of the regression line.

- Standard Error Channel – The standard error can also be used, in place of the standard deviation. This is preferred by some investors. It is the standard deviation divided by the square root of the sample size.

- RAFF Channel – The distance between the channel lines and the regression line is the greatest distance that any one closing price is from the regression line.

Building your Channel Trading Strategy

There are countless ‘off the shelf’ strategies for channel trading but this article will provide all the ingredients for building your own custom channel trading strategy.

From each section below you should pick the method that you find most suitable for your own trading style. Once you have determined which methods to use, you will have a comprehensive strategy that covers all the necessary aspects of channel trading.

It is highly recommended with any trading strategy, be it channel trading or otherwise, that you back test your strategy using automatic tools such as E-signal or Ninja. This may demonstrate a potential flaw before you risk your own trading capital.

Entering the Trade

As mentioned, there are several methods for entering into a trade; you can decide to either trade with the trend, against the trend or even trade both.

Trading with the trend is considered the safest method as it mostly enjoys a higher accuracy rate. In fact even when a channel is broken, breakdowns do have a tendency to recover at least to the bottom of the channel which can be an exit point for either breaking even or with a small profit.

Another option is to decide to trade both ways; SHORT on a breakout from the upper band and LONG on breakdowns from the bottom band.

The greatest benefit of trading both sides is that one may get lucky and hit a material reversal, i.e. it could be a catching the top of an uptrend channel switching to a downtrend or vice versa. These are the rare occasions when out of scale profits can be made.

The third method would be trending only against the trend. Some traders see the sense in this but, personally, I don’t.

One thing to note is that with a spread betting account investors can gain quick access to a range of financial markets and you are able to trade in both directions, i.e. trade either long or short.

Exiting the Trade

Many traders take the view that getting out of a trade is as important, if not even more important, than getting into it. When trading channel breakouts you have several important decision points.

The first one is channel recovery, when the price either falls or climbs back into the channel. One should pay careful attention to the patterns developing around the boundaries and decide if this is the time to close the trade.

The second important decision point would be the pivot line; pay extra attention to this point especially when trading against the trend as counter trend movement sometimes breaks around the pivot line.

The third and last decision point would be the opposite boundary. If you have reached this point you should be deep in profit so it’s probably the time to play it right and secure the majority of it as realized profit.

Entry and Exit Style

The simplest way to enter and exit trades is to decide in advance how much you are willing to risk on a specific trade and work out the desired stake size. Yet, there are also more sophisticated ways to trade:

-

Scaling In – When using this method you would usually divide your overall investment into 3 batches. A third is to be placed when opening the trade. The second third would usually go in after price recovered back into the channel and the final third would be added once the price crossed the pivot line and the direction of the current movement is confirmed. When the price target has been reached the whole position will be closed.

This method allows the trader to increase their stake only when price action is going their way and by trailing the stops, the risk factor may remain the same despite increasing the overall stake.

- Scaling Out – When using this method a trader would place the entire stake when opening the trade and reduce his exposure as price action moves his way, locking in more and more profit.

Capital Management

One important trading rule that many investors follow is ‘refraining from risking more than 1-2% of trading capital’ on a single trade.

Aside from this, it is also advisable to build a well diversified portfolio where some of the contracts act as a hedge on others. This is to reduce the risk of all your holdings running against you simultaneously as the result of an unforeseen event.

For example, let’s assume one decides to open various long positions on the US Dollar against the Japanese Yen and the British Pound.

Both Britain and Japan are net importers of commodities and, therefore, are susceptible to changes in commodity prices. A natural hedge against these would be to take short positions on the Australian and Canadian Dollars as these two countries are net exporters and will enjoy increased commodity prices.

This is especially necessary when trading the FX markets as positions can be very volatile. In addition, remember that the markets are well connected and you should always try to quantify your real net exposure. This can be done by summing the LONG and SHORT trades you may have in multiple positions.

Hedging and Net Exposure Example:

| Instrument | Direction | Size | Open | Stop loss | Distance |

| EUR/USD | SHORT | $100,000 | 1.255 | 1.28 | 250 |

| GBP/USD | SHORT | $100,000 | 1.502 | 1.52 | 180 |

| USD/CHF | SHORT | $50,000 | 1.0675 | 1.08 | 125 |

| AUD/USD | LONG | $100,000 | 0.8413 | 0.835 | 83 |

| USD/CAD | LONG | $50,000 | 1.066 | 1.06 | 66 |

| EUR/GBP | SHORT | $50,000 | 0.82 | 0.826 | 60 |

Net exposure:

| Instrument | Exposure | Overall Risk (Pips) |

| USD | 100,000 | 412 |

| EUR | -150,000 | 250 |

| GBP | -50,000 | 120 |

| CHF | -50,000 | 125 |

| AUD | 100,000 | 83 |

| CAD | 50,000 | 60 |

You may observe that the positions which are placed to hedge any un-favourable movement have stop losses which are placed much tighter than the ‘main’ positions.

This is so that once the market moves in the ‘correct’ direction we will be looking to remove the hedge, allowing us to enjoy the most of the current swing in the market. It is always important to revaluate your risk once some of the positions are closed.

Stops and Limits

Stop losses should basically be placed very near to the closest high for short trades and next to the closest low for long trades. In essence you need to pin point a price level where the view that a reversal is imminent invalidates.

In the chart below we can easily see how the GBP/USD was range bound in a very clear channel.

When a trade is going well there are two key points where investors should consider trailing stops.

The first is once the market has regained the channel and completed a corrective movement, many traders choose to trail the stop close to the peak, for short trades, or bottom, for longs, of the movement.

The second trail should come into effect once the price has pierced through the top of the channel. This is where a trader must carefully control his stops and limits in order to optimize his exit from the trade.

Unlike stop losses, which are strongly advised in any position, limit orders are something that many traders find they can do without.

This doesn’t mean that targets should not be set, yet when the price is getting closer to the target area it becomes important to make judgment calls according to emerging patterns, momentum and overall market sentiment.

Please note that not all stop losses are guaranteed.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.