A more technical look at the markets from InterTrader.

This article analyses the current status of the UK economy and tries to find some indication of where it is heading and how it might affect the UK spread betting markets.

UK Gross Domestic Product

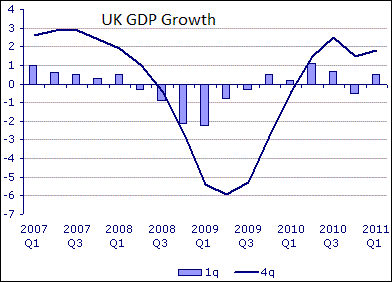

If we look at the chart below, it is clear that the country went through a period of negative economic growth, or economic decline, from the second quarter of 2008 to the third quarter of 2009.Between the fourth quarter of 2009 and the third quarter of 2010, there was a relatively small economic recovery with positive growth rates measured for four quarters in a row.

The last quarter of 2010 once again saw a decline in GDP figures, something that surprised many economists since it did not correspond to expectations raised by levels of business confidence. However, the first quarter of 2011 saw a return to positive growth figures.

The year-on-year growth continues to remains lower than 2% at this stage and this is unlikely to aid Sterling on the forex spread betting markets.

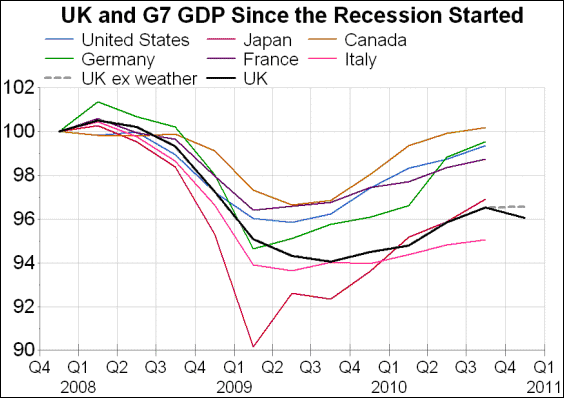

Relative to other G7 countries, the UK economy is currently underperforming and this is immediately clear if we look at the chart below.

Right now, only the Italian economy is fairing worse than the UK.

UK Unemployment and Job Creation

At first glance, the unemployment figures for the first part of 2011 seem to indicate strong economic recovery.In the period to April unemployment fell by 88,000 people and official employment figures also confirm this, showing that 80,000 jobs were created.

However, some economists warn that the UK economy might have undergone structural changes during the recession and that the jobs that are created now are different in nature from the ones that were lost in the recession, thus requiring different skills.

UK Economic Indicators

Let us briefly analyse what some important economic indicators are telling us about the state of the UK economy.UK Housing Sales and Prices

With the exception of a few areas, such as prime areas in London, the UK housing market has been declining for several quarters in a row.House prices are now significantly lower than at the beginning of the recession and there is no reason to believe things will change in the short term.

UK Car Sales

The sales of new cars in April 2011 were 7.42% down on the figures for April 2010. If we look at the figures for January to April this year compared to January to April 2010, there was a decline of 8.45%.The sales of durable goods, such as new cars, are usually first to suffer in a recession and last to recover when things pick up again.

UK Retail Sales

Retail sales paint a similar picture. While the figure for April was up by 1.1%, May saw a return to the negative trend with sales down by 1.4%.Since food and fuel now form more than half of all consumer spending, economists argue that April’s figures were inflated by the Royal Wedding and the many bank holidays.

UK Economy – Summary

Although there are some signs of recovery on the financial spread betting markets, the UK economy is still sluggish and it might take years to return to what most of us perceive as ‘normal’.However, some things may never return to how they were in the past; surveys show that a whole generation of young people now accept they will never be able to own a home of their own.

Good luck and happy trading

Shai Heffetz, InterTrader

(Original article written 21 June 2011).

The contents of this report are for information purposes only. It is not intended as a recommendation to trade. Neither InterTrader nor CleanFinancial.com accept any responsibility for any use that may be made of the above or for the correctness or accuracy of the information provided.

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.