A more technical look at the markets from InterTrader

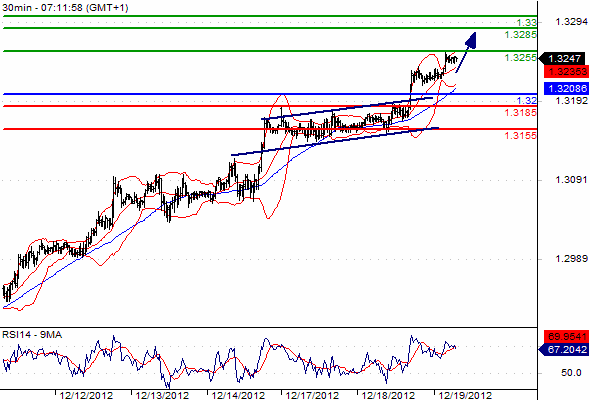

The EUR/USD spread betting market pushed above $1.32 on Tuesday, as investors appeared happy to move away from the safe haven dollar and take on more risk.

With the Federal Reserve willing to expand its balance sheet, it looks like the current rally will continue until the ECB steps in and starts talking about printing euros.

At $1.3234, at the time of writing, the bulls are targeting at $1.3285 and $1.33.

EUR/USD Chart

The upside penetration of the $1.33 level could open the door for the recapture of $1.34, but we do expect choppy price action and a bit of noise on the way up.

$1.3155 remains the main support area for the bulls to watch. A break below that area could open the way to $1.309, although this scenario is hard to imagine at the moment.

In terms of economic data, today, financial spread betting investors will be focusing on the German IFO Survey at 09.00 (GMT). Later in the session, eyes will be on the US Housing Starts report.

Good luck

Dafni Sedari

(Original article written 19 December 2012).

Spread betting and CFD trading carry a high level of risk to your capital and you may lose more than your initial investment. Spread betting and CFD trading may not be suitable for all investors. Only speculate with money that you can afford to lose. Please ensure you fully understand the risks involved and seek independent financial advice where necessary.